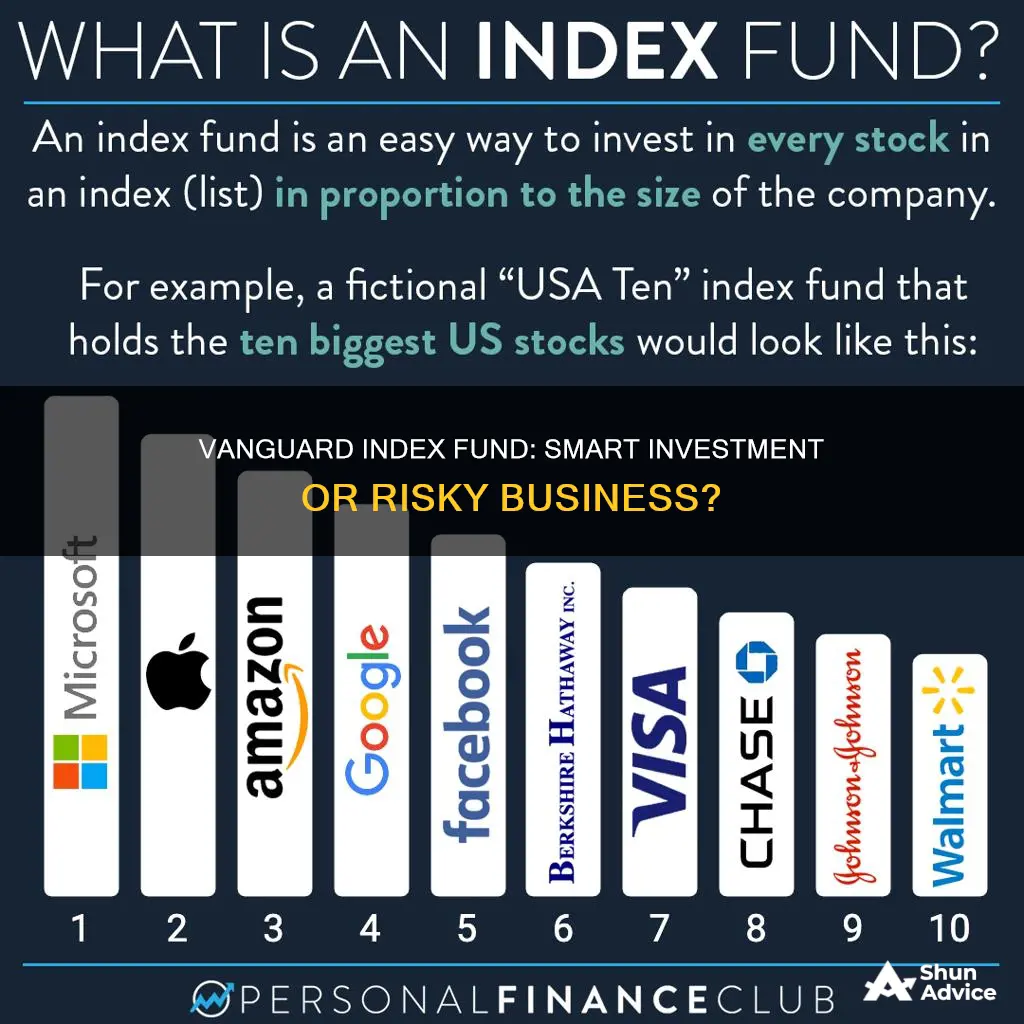

Vanguard index funds are a popular investment option. They are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500. When you buy shares of a Vanguard index fund, your money is invested in a diversified portfolio of assets that mirror the index's performance. Vanguard index funds are known for their low costs, instant diversification, and long-term returns. The company has over 40 years of experience, and its funds have consistently outperformed their peers. With a unique structure where the funds own the company, Vanguard is able to pass on more savings to investors. Vanguard offers a wide range of index funds, including U.S. stock and bond funds, international stock and bond funds, and sector and specialty funds. When considering investing in Vanguard index funds, it's important to evaluate factors such as the type of index, fees, long-run performance, and investment minimums.

| Characteristics | Values |

|---|---|

| Initial Investment | $1,000 to $3,000 |

| Expense Ratio Range | 0.04% to 1.8% |

| Average Mutual Fund Expense Ratio | 0.10% |

| Annual Costs | Expense ratio based on a small percentage of your cash invested in the fund |

| Investment Options | U.S. bond funds, U.S. stock funds, balanced funds, international stock funds, international bond funds, sector and specialty funds |

| Performance | 83% of Vanguard's index mutual funds and ETFs have performed better than their peer-group averages over the last 10 years |

| Investment Style | Passive |

What You'll Learn

Vanguard's performance and fees

Vanguard's performance has been strong over the years, with the company claiming that 84% of its index funds have outperformed their peer-group averages over the past decade. Vanguard's index funds are designed to harness market trends by capturing entire market gains for investors, rather than actively investing in individual stocks. This passive approach to investing has proven to be more profitable for the average investor over time, as markets tend to rise, and index funds charge lower fees.

Vanguard's average mutual fund expense ratio was 0.10% as of 31 December 2019, and the company offers a range of funds with varying expense ratios and fees. Some of Vanguard's funds are available at the Admiral Shares level, which requires a minimum investment of $3,000. Vanguard's funds also have different investment strategies, with some investing in large-cap companies, while others focus on small-cap or mid-cap companies. Some funds also target specific sectors or industries, such as energy, healthcare, and real estate.

Vanguard's fees are generally low, and there are no-load mutual funds available, meaning there are no sales fees when buying or selling fund shares. The company also does not charge commissions. However, there are some fees associated with Vanguard's funds, such as an account fee of 0.10% per annum on the value of holdings in ASX direct shares within a Vanguard Personal Account. There is also a flat brokerage fee of $9 for Vanguard ETF sales and all buy or sell ASX direct-share trades. Additionally, managed funds and ETFs incur investment management fees, which cover the administration and management of those products.

Vanguard also offers a range of other accounts and services, such as Vanguard Cash Accounts, which do not charge an account fee on any cash held. However, an Indirect Cash Management Fee ranging from 0% to 1.50% per annum may apply. It is important to carefully review the Product Disclosure Statement or other disclosure documents for detailed information on fees and costs associated with specific Vanguard funds.

Dividend Funds: A Smart Investment Strategy for Long-Term Gains

You may want to see also

Vanguard's investment options

Vanguard is a popular choice for investors due to its low costs, reliable strategies, and well-diversified portfolios. The company offers a range of investment options, including mutual funds and exchange-traded funds (ETFs), that track various market indexes. Here are the key investment options available through Vanguard:

U.S. Bond Funds

Vanguard's U.S. bond funds invest in U.S. corporate bonds, U.S. Treasuries, and Treasury-backed securities. These funds help balance the risks associated with stock funds by providing more stable and fixed-income investments.

U.S. Stock Funds

Vanguard's U.S. stock funds focus on investing in domestic companies across different market capitalizations, including large-cap, mid-cap, and small-cap companies. This provides exposure to a wide range of U.S. businesses and industries.

Balanced Funds

Balanced funds, also known as target-date funds, invest in a mix of stocks and bonds. They offer a balanced approach by providing both income and growth opportunities. These funds are particularly popular among retirement investors.

International Stock Funds

Vanguard's international stock funds invest in companies based outside of the U.S., allowing investors to diversify their portfolios globally. This option provides exposure to non-U.S. markets and businesses.

International Bond Funds

International bond funds offer further diversification by investing in government and corporate bonds issued outside the U.S. These funds add a global perspective to fixed-income investments.

Sector and Specialty Funds

Sector and specialty funds allow investors to focus on specific industries or sectors, such as energy, healthcare, or real estate. These funds may be suitable for investors who are comfortable with additional volatility and have a particular interest in certain sectors.

Vanguard also offers various index funds that track popular market indexes, such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. These funds provide instant diversification and are known for their low costs. Some of the notable Vanguard index funds include:

- Vanguard 500 Index Fund Admiral Shares (VFIAX)

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- Vanguard Growth Index Fund Admiral Shares (VIGAX)

- Vanguard Small-Cap Index Fund Admiral Shares (VSMAX)

- Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

- Vanguard Balanced Index Fund Admiral Shares (VBIAX)

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

Investing in Ultra Short Term Debt Funds: A Quick Guide

You may want to see also

How to choose a Vanguard index fund

When it comes to choosing a Vanguard index fund, there are several factors to consider. Here are some guidelines to help you make an informed decision:

Identify Your Investment Goals and Risk Tolerance:

Before selecting a Vanguard index fund, it's important to define your investment goals and risk tolerance. Are you investing for retirement, saving for a specific goal, or looking for capital appreciation? Different funds cater to different objectives, so understanding your goals will help narrow down your choices. Additionally, consider your risk tolerance. Vanguard index funds vary in risk levels, so choose one that aligns with your comfort level.

Evaluate the Type of Index and Underlying Assets:

Vanguard index funds track various indexes, such as the S&P 500, Dow Jones Industrial Average, or Nasdaq Composite. Choose an index that aligns with your investment strategy. Also, consider the underlying assets of the fund. Vanguard offers funds that invest in U.S. stocks, international stocks, bonds, or a combination of these asset classes. Diversifying your portfolio across different asset classes can help manage risk.

Compare Fees and Expense Ratios:

Vanguard index funds are known for their low costs, but it's essential to compare fees and expense ratios among different funds. Expense ratios represent the annual fees charged by the fund, expressed as a percentage of your investment. Lower expense ratios mean more of your money goes towards your investment rather than fees. Additionally, some funds may have purchase and redemption fees, so be sure to factor those into your decision.

Assess Historical Performance and Turnover:

While past performance doesn't guarantee future results, it can give you an idea of how the fund has fared over time. Compare the historical returns of different Vanguard index funds, but remember to evaluate them over a similar time period. Additionally, consider the portfolio turnover rate. Funds with lower turnover rates tend to be more tax-efficient and may result in lower transaction costs.

Consider Your Investment Horizon:

Your investment horizon refers to how long you plan to invest for. If you're investing for the long term, a buy-and-hold strategy with a broad-market index fund might be suitable. On the other hand, if you're investing for a shorter period, you may want to consider funds with a more targeted approach or different asset allocation.

Research Specific Fund Details:

Once you've narrowed down your options, delve into the specifics of each fund. Consider the fund's asset class, expense ratio, historical performance, and top holdings. Evaluate if the fund aligns with your investment goals and risk tolerance. Additionally, review the fund's prospectus, which provides essential information about the fund's investment objectives, risks, and fees.

Choose the Right Account Type:

Vanguard offers various account types, such as traditional IRA, Roth IRA, self-employed IRA, or a taxable brokerage account. The account type you choose will depend on your savings goals and tax preferences. Be sure to understand the tax implications and contribution limits associated with each account type.

Monitor and Review Your Investment:

Finally, remember that investing is a dynamic process. Regularly review the performance of your chosen Vanguard index fund and make adjustments as necessary. Stay informed about market conditions and consider rebalancing your portfolio periodically to ensure it remains aligned with your investment strategy and goals.

Remember, investing carries inherent risks, and past performance does not guarantee future results. Diversification and long-term investing are generally considered prudent strategies, but it's essential to do your research and consult with a financial advisor to make informed decisions that align with your specific circumstances.

Real Estate Fund Investing: What You Need to Know

You may want to see also

How to invest in a Vanguard index fund

Investing in a Vanguard index fund can be a great way to diversify your portfolio and reduce fees. Here's a step-by-step guide on how to invest in a Vanguard index fund:

Step 1: Understand Vanguard Index Funds

Vanguard index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500. When you buy shares of a Vanguard index fund, your money is invested in a diversified portfolio of assets that match the index's performance. Vanguard index funds are known for their low costs and strong long-term returns.

Step 2: Choose the Right Vanguard Index Fund

When deciding which Vanguard index fund to invest in, consider your investment goals, risk tolerance, and financial objectives. Vanguard offers a wide range of index funds, including U.S. stock funds, bond funds, international stock funds, and sector-specific funds. Compare the fees and costs associated with different funds that track the same index.

Step 3: Open an Account

You can open an account with Vanguard online in just a few minutes. Decide on the type of account you need, such as a traditional IRA, Roth IRA, or taxable brokerage account, depending on your savings goals. Link your bank account information, including your checking account number and routing number. Vanguard will verify your account by making a small deposit.

Step 4: Buy Shares

Once your bank account has been verified, you can start buying and trading shares. Log in to your Vanguard account, click on the "Buy and Sell" link, and enter the name of the Vanguard index fund you want to purchase.

Step 5: Monitor and Manage Your Investment

After purchasing shares, you can monitor the performance of your Vanguard index fund through your account. Vanguard also offers professional management for its funds, and you can set up automatic investments or withdrawals. Remember that all investments carry risk, and past performance does not guarantee future results.

Investing Trust Funds for Children: A Secure Future

You may want to see also

Vanguard's history and structure

Vanguard is an American registered investment advisor founded on 1 May 1975 and based in Malvern, Pennsylvania. The company traces its roots to its first mutual fund, the Wellington Fund, introduced in 1929. Vanguard was founded by John C. Bogle, who is credited with creating the first index fund available to individual investors. Vanguard has a distinctive investor-owned corporate structure, meaning it is owned by the funds managed by the company and, therefore, by its customers.

Vanguard has had four chief executive officers since its founding: John C. Bogle (1975-1995), John J. Brennan (1996-2008), F. William McNabb III (2008-2017), and Mortimer J. Buckley (2018-2024). The company has expanded globally and now has offices in several US states, Canada, Mexico, China, and multiple European countries.

Vanguard offers two classes of most of its funds: investor shares and admiral shares. Admiral shares require a higher minimum investment, often between $3,000 and $100,000 per fund, but they have slightly lower expense ratios. Vanguard's average mutual fund expense ratio was 0.10% as of 31 December 2019.

The company offers a wide range of funds, including US bond funds, US stock funds, balanced funds, international stock funds, international bond funds, and sector and specialty funds. Vanguard is known for its low-cost investment options, and its funds have delivered consistent long-term returns.

Money Market Funds: When to Invest for Maximum Returns

You may want to see also

Frequently asked questions

When you buy shares of a Vanguard Index Fund, your money is invested in a diversified portfolio of assets that track an underlying market index. Vanguard founder Jack Bogle invented the index fund when it launched the Vanguard 500 (VFINX) in 1976.

When you invest in a Vanguard Index Fund, you’re investing in hundreds or even thousands of securities at once. If some securities perform poorly, the other investments held by the Vanguard Index Fund can help mitigate the risk, protecting your investment.

Vanguard Index Funds are professionally managed, provide instant diversification and low costs, and don't require a lot of work on your part. They are also very cost-effective investments, with Vanguard's average mutual fund expense ratio being 0.10% as of 31 December 2019.

First, decide which kind of account you will use. If you’d like to use Vanguard Index Funds to save for retirement, you can open a traditional IRA, Roth IRA or self-employed IRA. If you’d like to invest your money for other goals, you can also open a taxable brokerage account. Next, link your bank information. Then, once your bank account has been verified, your account is ready and you can begin buying and trading shares.