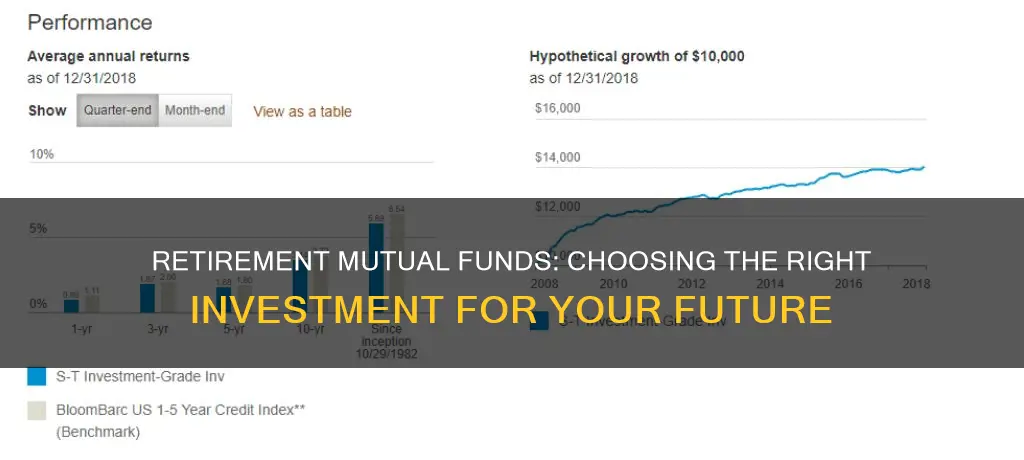

Retirement is a time to relax and enjoy the fruits of your labour. However, achieving a comfortable retirement requires smart planning and strategic investment decisions. One such investment vehicle is a mutual fund. Mutual funds are professionally managed and offer diversification across various assets such as stocks, bonds, precious metals, commodities, and alternative investments. When considering mutual funds for retirement, it's essential to remember that not all funds are suitable. Some may be too concentrated in a specific sector, while others may be too volatile for long-term investment.

The best mutual funds for retirement tend to share two key traits: high diversification and low fees. These factors help mitigate controllable risks and play a significant role in determining long-term outcomes. Additionally, retirement income funds, which prioritise asset preservation, income, and growth, are worth considering. These funds aim to achieve positive returns, provide returns above inflation, and preserve assets.

When investing in mutual funds for retirement, it's crucial to assess your personal circumstances, risk tolerance, and time horizon. A balanced approach, combining stocks, bonds, and other assets, can help strike a balance between growth and stability.

- Vanguard Target Retirement 2025 Fund (VTTVX)

- Vanguard LifeStrategy Conservative Growth Fund (VSCGX)

- iShares Core Moderate Allocation ETF (AOM)

- iShares TIPS Bond ETF (TIP)

- iShares 0-3 Month Treasury Bond ETF (SGOV)

- Vanguard Wellesley Income Fund Investor Shares (VWINX)

- Vanguard Wellington Fund (VWELX)

| Characteristics | Values |

|---|---|

| Mutual fund companies | Vanguard, iShares, Fidelity, T. Rowe Price, JPMorgan, Dodge & Cox, American Funds |

| Mutual fund names | Target Retirement 2025 Fund, LifeStrategy Conservative Growth Fund, Core Moderate Allocation ETF, TIPS Bond ETF, 0-3 Month Treasury Bond ETF, Wellesley Income Fund Investor Shares, Wellington Fund |

| Diversification | Thousands of U.S. and international stocks and bonds |

| Asset mix | Gradual shift from stocks to bonds as retirement approaches |

| Rebalancing | Automatic |

| Minimum investment | $1,000 |

| Expense ratio | 0.08% |

| Risk profile | Conservative, moderate, aggressive |

| Returns | 4% annually |

| Inflation | 3% |

| Investment types | Stocks, bonds, cash, dividend-paying stocks, fixed-income funds, money market funds, certificates of deposit |

| Initial purchase | $3,000 |

What You'll Learn

How to calculate risk tolerance

Risk tolerance is the degree of risk that an investor is willing to take on, given the volatility in the value of an investment. It is an important component of investing and often determines the type and amount of investments that an individual chooses.

There are three types of risk tolerance: aggressive, moderate, and conservative. An aggressive investor has a higher risk tolerance and is willing to risk losing money to get potentially better results. Their investments emphasize capital appreciation rather than income or preserving their principal investment. This investor's asset allocation commonly includes stocks and little or no allocation to bonds or cash. A conservative investor, on the other hand, has a lower risk tolerance and seeks investments with guaranteed returns. They target vehicles that are guaranteed and highly liquid, such as bank certificates of deposit, money markets, or U.S. Treasuries. A moderate investor falls between these two categories and aims to grow their money without losing too much. Their portfolio commonly includes a mixture of stocks and bonds.

When determining your risk tolerance, it is important to consider factors such as age, investment goals, income, net worth, investment experience, and risk capital. Age is a factor, as younger people tend to have a longer time horizon and can be more risk-tolerant. However, it is not the only factor, and people are living longer, so it is important to consider other aspects as well. For example, those with a higher net worth and more liquid capital to spend can generally afford to have a greater risk tolerance. Additionally, an investor's future earning capacity and the presence of other assets, such as a home, pension, or Social Security, can affect their risk tolerance.

It is also important to note that risk tolerance can change over time, depending on market and economic conditions or life events. Therefore, it is essential to periodically reassess your risk tolerance to ensure that your investment strategy aligns with your current situation and goals.

Retirement Mutual Funds: Where to Invest for a Secure Future

You may want to see also

Mutual funds vs individual stocks and bonds

When it comes to investing for retirement, there are a few options to consider, including individual stocks, bonds, and mutual funds. Each has its own advantages and disadvantages, so it's important to understand the differences before making any decisions.

Mutual funds are a type of investment fund that pools money from multiple investors to purchase a diversified portfolio of assets, such as stocks, bonds, and other securities. They are managed by professional fund managers, who make investment decisions on behalf of the investors. Mutual funds offer instant diversification, as they invest in a wide range of industries and asset types. This diversification helps to reduce risk and provide a more stable investment option, especially for those who may not have the time or expertise to monitor individual stocks. Additionally, mutual funds have relatively low costs, as the fees are spread across all investors.

On the other hand, individual stocks and bonds offer more control over your investments, as you decide exactly where your money goes. Stocks can provide the potential for large gains if a company performs well, but they also come with higher risks and potential for large losses. Bonds, on the other hand, are generally considered safer investments, especially those backed by governments, but they often provide lower returns compared to stocks.

When deciding between mutual funds and individual stocks/bonds for retirement, it's important to consider your financial goals, risk tolerance, and time horizon. Mutual funds are often a good choice for long-term retirement portfolios, as they provide diversification and reduced risk. Individual stocks can boost returns but come with more volatility, so they may be more suitable for those with a higher risk tolerance.

Examples of Mutual Funds for Retirement

- Vanguard Target Retirement Income Fund (VTINX)

- Fidelity Freedom Income Fund (FFFAX)

- Vanguard LifeStrategy Conservative Growth Fund (VSCGX)

- IShares Core Moderate Allocation ETF (AOM)

- IShares TIPS Bond ETF (TIP)

- Vanguard Wellesley Income Fund Investor Shares (VWINX)

- Vanguard Wellington Fund (VWELX)

In summary, mutual funds offer a convenient, diversified, and relatively low-cost investment option for retirement, while individual stocks and bonds provide more control but may require more time and expertise. It's important to carefully consider your financial goals and risk tolerance before making any investment decisions.

Semi-Short-Term House Fund: Where to Invest?

You may want to see also

Mutual fund diversification

Diversification is a key part of investing for retirement. It's a strategy that reduces risk by spreading your money across different types of investments while still allowing your money to grow.

When it comes to mutual funds, diversification can be achieved in several ways:

- Different types of mutual funds: Invest in a mix of growth and income, growth, aggressive growth, and international mutual funds. These funds correspond to different cap sizes, or the size of the companies within the fund. Growth and income funds, for example, invest in large and established companies and are considered large-cap funds, while aggressive growth funds focus on smaller companies with high growth potential.

- Asset classes: Diversify across various asset classes such as stocks, bonds, and cash. This can include investing in dividend-paying stocks, fixed-income funds, money market funds, and certificates of deposit (CDs).

- Geographic regions: Invest in international funds or exchange-traded funds (ETFs) to reduce your dependency on domestic market conditions.

- Index funds: Index funds offer a cost-effective way to gain exposure to a diverse range of companies within a specific market segment.

- Systematic Investment Plans (SIPs): Utilize SIPs to invest regular amounts in mutual funds, smoothing out the impact of market volatility.

- Gold and money market securities: Allocating a portion of your portfolio to gold and money market instruments can provide stability and liquidity.

- Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation and ensure it remains aligned with your risk tolerance and financial goals.

Remember, the key to successful investing is to find the right balance between risk and reward. Diversification helps reduce the impact of market volatility and can protect your portfolio from significant losses. However, it's important to note that diversification does not guarantee profit or prevent losses. It's also essential to consider your time horizon and risk tolerance when creating your investment plan.

Consulting a financial advisor can be beneficial, especially for those new to investing. They can help you tailor a diversification strategy that aligns with your specific circumstances, risk tolerance, and financial goals.

Understanding Federal Funds Rates, Dividends, and CODs

You may want to see also

Mutual fund fees

When it comes to investing for retirement, there are a lot of fees to look out for. Here's a breakdown of the fees you may encounter and how they can impact your investment strategy.

Types of Mutual Fund Fees

Shareholder fees, on the other hand, are sales commissions and other one-time costs when you buy or sell mutual fund shares. Examples include sales loads (commissions paid when buying or selling shares), redemption fees (charged when you sell shares shortly after purchasing them), exchange fees (charged when you transfer shares to another fund within the same investment company), account fees, and purchase fees.

Load Funds vs. No-Load Funds

When investing in mutual funds, you may encounter load funds and no-load funds. Load funds impose sales loads or commissions, which can be either front-end (paid when you buy shares) or back-end (paid when you sell shares). No-load funds, on the other hand, do not charge sales commissions. However, no-load funds may have higher annual fees and may not offer the same level of advice and support as load funds.

Impact of Fees on Investment Performance

Even small differences in fees can have a significant impact on your investment returns over time. For example, a 1% difference in fees on a $25,000 investment with an 11% average annual rate of return could result in a difference of over $60,000 after 30 years. Therefore, it's important to consider the long-term impact of fees when selecting mutual funds for your retirement portfolio.

Tips for Evaluating Mutual Fund Fees

When evaluating mutual fund fees, consider the following:

- Look for value: Don't get too caught up in finding the lowest fees. Instead, focus on funds with a reasonable expense ratio, a strong track record of returns, and good management.

- Focus on the long term: Prefer funds with lower ongoing fees, as they are more suitable for long-term investments.

- Understand your overall cost: Ask your investment advisor to break down the fees into percentages and dollar amounts to get a clear picture of where your money is going.

HOA Reserve Fund Investment Strategies: Where to Invest for Growth

You may want to see also

Mutual fund vs robo-advisors

When it comes to investing for retirement, there are a variety of options to consider, such as mutual funds and robo-advisors. Both have their own advantages and disadvantages, so it's important to understand how they work and how they can help you achieve your financial goals.

Mutual Funds

Mutual funds are a type of investment vehicle where money from many different investors is pooled together and managed by professional fund managers. These funds typically invest in a diverse range of assets, such as stocks, bonds, and other securities, and are designed to provide investors with a balanced and less risky approach to investing. Mutual funds are often chosen for retirement savings due to their ability to provide diversification and professional management. When investing in mutual funds, it's important to consider the fees associated with them, as they can impact your overall returns. Additionally, the performance of mutual funds depends on the expertise and decisions of the fund managers, who may be subject to emotional reactions that could influence their investment choices.

Robo-Advisors

On the other hand, robo-advisors are digital platforms that provide automated investment advice and portfolio management services. These platforms use algorithms and artificial intelligence to create and manage investment portfolios based on an individual's financial goals, risk tolerance, and time horizon. Robo-advisors offer a hands-off approach to investing, making them attractive to those who prefer a more passive investment strategy. They are also typically low-cost, with lower fees than traditional financial advisors, making them accessible to a wider range of investors. However, robo-advisors may lack the personalized touch and expertise of human advisors, and they are relatively new, so there is less performance history to evaluate.

Mutual Funds vs. Robo-Advisors

When deciding between mutual funds and robo-advisors for retirement investing, there are several factors to consider:

- Level of Involvement: Mutual funds are generally more hands-off, as the fund managers make the investment decisions. With robo-advisors, you have more control over the specific funds chosen and the overall composition of your portfolio.

- Costs: Robo-advisors typically have lower fees than mutual funds, which can result in significant savings over time.

- Performance and Track Record: Mutual funds have a longer history to evaluate, while robo-advisors are newer and have a shorter performance record.

- Personalization: Mutual funds offer more flexibility in terms of sector-specific funds and customization based on individual preferences. Robo-advisors provide personalized advice based on algorithms and your financial situation.

- Expertise: Mutual funds are managed by experienced professionals, while robo-advisors rely on pre-set algorithms. Mutual fund managers may be susceptible to emotional reactions, whereas robo-advisors make decisions based solely on data and models.

In conclusion, both mutual funds and robo-advisors can be effective tools for retirement investing. The best option for you will depend on your financial goals, risk tolerance, desired level of involvement, and need for personalized advice. It's important to carefully consider these factors before making a decision, as they can have a significant impact on your retirement savings and overall investment experience.

Where Fund Managers Put Their Own Money

You may want to see also

Frequently asked questions

Some of the best mutual funds for retirement are Vanguard Target Retirement 2025 Fund (VTTVX), Vanguard LifeStrategy Conservative Growth Fund (VSCGX), iShares Core Moderate Allocation ETF (AOM), iShares TIPS Bond ETF (TIP), and Vanguard Wellington Fund (VWELX).

Mutual funds are professionally managed and can provide diversified exposure to a variety of assets such as stocks, bonds, precious metals, commodities, and alternative investments. They are also versatile and can be tailored to your specific financial circumstances, risk tolerance, and time horizon.

When choosing mutual funds for your retirement portfolio, consider your financial goals, risk tolerance, and time horizon. It is generally recommended to have a mix of assets that provide both growth and income, with a focus on minimizing risk and preserving capital. Diversification and low fees are also important factors to consider when selecting mutual funds for retirement.

Here are some tips for investing in mutual funds for retirement:

- Determine your asset allocation: Decide how you want to allocate your investments across different asset classes, such as stocks, bonds, and cash.

- Assess your risk tolerance: Consider your time horizon and ability to tolerate risk. You can use rules of thumb, such as subtracting your age from 100 or 110 to determine the percentage of your portfolio allocated to stocks.

- Consider mutual funds or ETFs: Instead of investing in individual stocks and bonds, consider mutual funds or ETFs for better diversification and long-term results.

- Explore target-date funds and robo-advisors: If you don't want to actively manage your investments, consider target-date funds that automatically adjust your asset allocation over time or robo-advisors that provide low-cost portfolio management services.