Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. Each fund is designed to manage risk while helping to grow your retirement savings. Vanguard offers target-date retirement funds to suit the needs of investors of various ages. A target-date fund is a mutual fund that automatically adjusts the asset mix and allocation over a time period based on your age and when you want to retire. The minimum investment per Target Retirement Fund is $1,000.

| Characteristics | Values |

|---|---|

| Minimum investment | $1,000 |

| Average expense ratio | 0.08% |

| Industry average expense ratio | 0.44% |

| Investment style | Buy-and-hold |

| Investment approach | One-fund |

| Investment type | Stocks, bonds, short-term reserves |

| Risk | Low |

What You'll Learn

Vanguard's low fees

Vanguard's low-cost approach is a core part of its business model, ensuring that investors benefit from reduced fees. For example, there are no trading commissions when buying and selling Vanguard mutual funds or ETFs online, and investors can trade thousands of ETFs and mutual funds from Vanguard and other companies commission-free.

Vanguard Target Retirement Funds offer a simple, diversified portfolio for investors, with a low-cost mix of stocks and bonds that gradually becomes more conservative as the investor approaches retirement. The funds are self-adjusting, with investment professionals at Vanguard managing each fund to ensure a gradual shift to fewer stocks and more bonds over time.

The low fees at Vanguard also extend to account and service fees. While there is a $25 annual fee for brokerage and mutual-fund-only accounts, this can be waived for clients with a certain level of assets or those who sign up for e-delivery of statements and other documents.

Overall, Vanguard's low fees are a significant benefit for investors, allowing them to maximize their returns and keep more of their savings.

Senior Living Fund: A Smart Investment for Your Future

You may want to see also

Instant diversification

Vanguard Target Retirement Funds are a simple, one-stop solution for investors who want a diversified portfolio that adjusts its risk profile over time. These funds are designed to be a "set it and forget it" investment approach, where you pick the target retirement date closest to your planned retirement year, and the fund handles the rest.

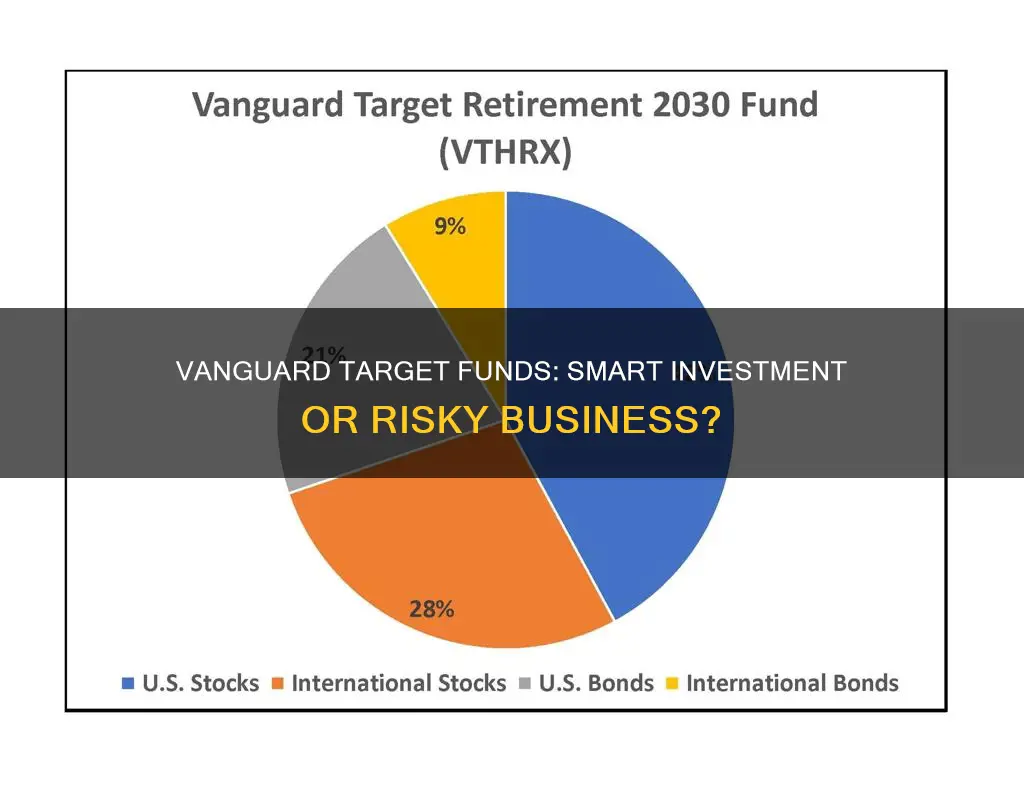

Each Target Retirement Fund is a "fund of funds", meaning it invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. The funds start with an allocation that favours stocks, with approximately 90% stocks and 10% bonds. As the target retirement date approaches, Vanguard gradually rebalances the fund's asset allocation towards less risky securities, such as bonds and short-term reserves. This self-adjusting mix helps manage risk while aiming to grow your retirement savings.

The benefit of this approach is that it provides instant diversification across thousands of U.S. and international stocks and bonds through a single fund. Vanguard's broad range of underlying funds gives you access to a diverse mix of asset classes, sectors, and geographic regions. This diversification helps to lower risk by spreading your investments across various areas, reducing the impact of any one security or market on your portfolio.

The Vanguard Target Retirement Funds also offer a simple way to maintain your desired asset allocation over time. As you get closer to retirement, the fund's managers gradually shift the asset allocation to become more conservative, freeing you from the hassle of ongoing rebalancing. This automatic rebalancing ensures your portfolio stays aligned with your risk tolerance and investment goals, without requiring constant monitoring and adjustments.

The instant diversification and automatic rebalancing of Vanguard Target Retirement Funds make them a compelling choice for investors seeking a straightforward, all-in-one investment solution for their retirement planning.

Raising Private Funds: Real Estate Investing Strategies

You may want to see also

Automatic rebalancing

Vanguard Target Retirement Funds are a "set it and forget it" retirement savings option. They are designed to age with you by automatically rebalancing your portfolio from growth investments towards more conservative ones as retirement nears. The funds' managers maintain the current target mix, so you don't have to worry about ongoing rebalancing.

As you get older, a target retirement fund will typically shed some of its stock positions in favour of bond holdings. For example, a 2020 target retirement fund typically allocates between 40% and 50% in stocks. The closer you are to retirement, the more conservative a fund's investment mix will be.

The automatic rebalancing feature of Vanguard Target Retirement Funds offers a number of benefits. It simplifies retirement investing by rebalancing asset allocations over time to allow for less risk. It also ensures that your portfolio remains appropriately invested even if you ignore it for years. Additionally, it helps to protect your nest egg by gradually shifting towards more conservative investments as you age.

Overall, automatic rebalancing is a valuable feature of Vanguard Target Retirement Funds that can help to make retirement investing easier and less risky.

Setting Up an Investment Fund in Singapore: A Guide

You may want to see also

Long-term investing

Diversification and Risk Management

Vanguard Target Retirement Funds provide access to a diversified portfolio of thousands of U.S. and international stocks and bonds through their investment in Vanguard's broadest index funds. This diversification helps to lower risk and gives investors exposure to a wide range of assets. As you get closer to retirement, the fund managers gradually shift the asset allocation to fewer stocks and more bonds, making the fund more conservative. This dynamic asset allocation ensures that your portfolio remains aligned with your risk tolerance and investment goals over time.

Hands-off and Convenient Approach

These funds are ideal for investors who prefer a hands-off, convenient approach to investing. They offer the benefit of automatic asset allocation rebalancing, so you don't have to actively manage your portfolio. Vanguard's investment professionals handle the research, selection, and rebalancing of securities, making it a truly passive investment strategy. This feature is especially attractive for those who want to focus on their careers or other aspects of their lives without constantly worrying about their investment portfolios.

Low Expense Ratios

Vanguard Target Retirement Funds have an average expense ratio of 0.08%, which is significantly lower than the industry average of 0.44% to 0.48%. Lower expense ratios mean that more of your money stays invested and working for you over the long term, potentially resulting in higher returns. This cost advantage can make a significant difference in your overall investment returns, especially when compounded over several years.

Long-Term Focus

Vanguard Target Retirement Funds are designed for long-term investing, as evident by their target dates ranging from 2020 to 2070. These funds are meant to be held for the long haul, and their asset allocation becomes more conservative as you approach retirement. This long-term focus aligns with the buy-and-hold strategy, which has proven effective in generating market-beating returns over extended periods. By investing in these funds for the long term, you benefit from the power of compound interest and the potential for higher returns.

Simplicity and Flexibility

These funds offer a simple, one-fund investing approach, providing a complete, diversified retirement portfolio in a single investment. You choose the fund with a target date closest to your planned retirement year, and Vanguard handles the rest. However, you also have the flexibility to choose a fund with an earlier or later target date based on your risk tolerance and investment goals. This flexibility allows you to customize your portfolio to a certain extent while still maintaining the simplicity of a one-fund solution.

Mutual Funds: US Market Investment Options for Indians

You may want to see also

Choosing the right fund

When choosing a Vanguard Target Retirement Fund, it's important to consider your risk tolerance and investment goals. Here are some factors to keep in mind when selecting the right fund for you:

- Time horizon: The first step is to identify the target retirement fund with the closest target date to your planned retirement year. Vanguard offers funds with target dates ranging from 2020 to 2070. Selecting the fund with the closest target date will give you a mix of stocks and bonds appropriate for your time horizon.

- Risk tolerance: If you have a higher risk tolerance and are comfortable with a more aggressive investment strategy, you may choose a fund with a later target date to increase your stock allocation. On the other hand, if you prefer a more conservative approach, you can opt for a fund with an earlier target date, which will result in a higher allocation of bonds and other lower-risk investments.

- Diversification: Vanguard Target Retirement Funds provide instant diversification by investing in a broad range of Vanguard funds, including stocks, bonds, and short-term reserves. This diversification helps to manage risk and maximise the potential for growth.

- Expense ratios: While all Vanguard Target Retirement Funds offer low expense ratios compared to the industry average, there are slight differences among them. Be sure to review the expense ratios of the funds you're considering to ensure you're comfortable with the ongoing fees.

- Performance: Consider the historical performance of the funds you're evaluating. Look at metrics such as 10-year returns to get a sense of how the funds have fared over the long term.

- Minimum investment: Vanguard Target Retirement Funds have a minimum investment requirement of $1,000. Ensure that you're comfortable with the minimum investment amount when selecting a fund.

- Rebalancing: One of the key advantages of Vanguard Target Retirement Funds is automatic rebalancing. The fund managers gradually adjust the investment mix over time, reducing the number of stocks and increasing bonds as you get closer to retirement. This ensures your portfolio remains aligned with your changing risk tolerance.

It's important to review your asset mix periodically to ensure it aligns with your investment goals and risk tolerance. Additionally, remember that all investments carry risks, and past performance does not guarantee future results.

Mutual Funds: NRIs' Smart Investment Choice

You may want to see also