Investing in venture capital is a risky endeavour that should only be undertaken with money that investors can afford to lose. However, it can be a way to add diversification to a typical stock and bond investment portfolio.

Venture capital funds pool money from investors to finance early-stage startup companies with high long-term growth potential. These funds often focus on companies in a particular industry sector, business type, or geographic region where there is substantial growth potential. Due to the high number of startup ventures that will inevitably fail, venture funds tend to place modest amounts of capital with a large number of companies.

Venture capitalists (VCs) are known for making large bets in new start-up companies, hoping to hit a home run on a future billion-dollar company. They have a set of criteria that they evaluate before making an investment, including the management team, business concept and plan, market opportunity, and risk judgement.

What You'll Learn

What are the risks of investing in venture capital?

Investing in venture capital is a risky business. The failure rate of new companies is high, and the risk of losing your entire investment is real. Venture capital investments are typically unsecured loans provided to start-up companies that cannot get traditional loans.

Venture capitalists look for companies with high growth potential, but this is based on projections and assumptions about the future of a product or service, and the market's acceptance of it. Market trends can impact the growth of a company, and outside factors can determine the fate of a new company.

The success of a company often depends on its management team, and venture capitalists cannot always predict how human beings will behave. There is a risk that a management team won't deliver on their promises or stick around.

There is also a risk that the company won't be able to pull off its exit strategy. The planned exit strategy may fail, and venture capitalists may have to cut their losses or take a more active role in the company's management.

Other risks include government regulations, economic factors, and corporate theft of intellectual property or patent infringements.

Venture capital investments should only be undertaken with money that investors can afford to lose. There is limited liquidity, and investors may need to wait several years to receive their principal investment. In some cases, with failed startups, the investment return might be zero.

Millennium Hedge Fund: A Guide to Investing Wisely

You may want to see also

What are the benefits of investing in venture capital?

Investing in venture capital can be beneficial for start-ups with high initial costs and limited operating history. Here are some advantages that venture capital offers:

Opportunity for Expansion

Unlike bank loans, venture capital provides an opportunity for expansion without the need for collateral. Investors are willing to take on the risk as they believe in the company's long-term success. This makes it ideal for start-ups that require large amounts of capital upfront.

Valuable Guidance and Expertise

Venture capital firms not only provide financial support but also valuable business advice and guidance. They offer expertise in various areas such as financial management, human resource management, and operational scaling. Their experience in building and expanding start-ups can be instrumental in making better decisions and navigating risks.

Enhanced Networking and Connections

Venture capitalists have extensive networks and connections within the business community. These connections can be advantageous for start-ups, helping them forge new partnerships, build a client base, and access potential future investment partners.

No Obligation for Repayment

Unlike bank loans, there is no obligation to repay venture capitalists if the start-up fails or shuts down. This reduces the burden on the start-up as they don't have to worry about debt repayment.

Trustworthy and Regulated

Venture capitalists are strictly regulated by regulatory bodies, ensuring transparency and reducing the likelihood of unscrupulous activities. Their involvement also adds credibility to start-ups, making them more attractive to potential employees, customers, and other investors.

While there are benefits to investing in venture capital, it's important to consider potential drawbacks, such as the loss of ownership and control, lengthy processes, and high expectations for growth.

A Guide to Mutual Fund Investment in Nigeria

You may want to see also

How do you invest in venture capital?

How to Invest in Venture Capital

Venture capital funds pool money from investors to finance early-stage startup companies. Venture funds focus on companies with high long-term growth potential that need capital to fuel their growth and development. Venture funds tend to invest in a particular industry sector, business type, or geographic region where there is substantial growth potential.

Who can invest in Venture Capital?

Historically, only accredited investors had the opportunity to invest in venture capital. An accredited investor must have a minimum $200,000 annual income, or $300,000 if married, or a net worth exceeding $1 million. However, in 2015, the revised Jumpstart Our Business Startups Act opened the doors for ordinary investors to participate in equity crowdfunding. Several venture capital platforms for non-accredited investors were born, such as MicroVentures, which offers investment opportunities from as little as $100.

How to invest in Venture Capital

There are several ways to invest in venture capital, including funds, stocks, venture capital debt, and direct investments.

Funds

Funds allow investors to invest in a broad swath of startups. For example, the Hercules Capital fund offers a 9.7% yield and investors can get started with a $13.27 investment.

Stocks

An example of a stock investment is Horizon Technology Finance. This business development company makes senior secured loans to venture-backed companies and pays out interest payments as shareholder dividends. The stock currently trades for $11.88 and yields 10.1%.

Venture Capital Debt

AngelList offers both accredited and non-accredited investors the opportunity to invest in startups. Their funds for non-accredited investors are currently closed, but larger accredited investors can partner with others to invest in a startup firm.

Direct Investments

Investors can also make direct investments in individual companies using platforms like Republic. However, due diligence is required to gain high investment confidence.

Things to consider before investing in Venture Capital

Venture capital is a high-risk investment and investors should be prepared to lose all the money they invest. Due to the high number of startup ventures that inevitably fail, venture funds tend to place modest amounts of capital with a large number of companies. Investors should also be aware that there is limited liquidity when investing in venture capital and they may need to wait several years to receive their principal investment.

A Beginner's Guide to Mutual Index Funds Investing

You may want to see also

Who can invest in venture capital?

Venture capital (VC) is a form of private equity financing that is typically provided by firms or funds to startup, early-stage, and emerging companies. These companies are deemed to have high growth potential or have demonstrated high growth in terms of annual revenue, number of employees, scale of operations, etc.

Venture capital investments are generally considered risky and are usually undertaken by investors who can afford to lose money. Historically, only accredited investors were able to invest in venture capital. An accredited investor must meet certain income or net worth requirements, such as having a minimum annual income of $200,000 or a net worth exceeding $1 million.

However, in recent years, the doors have been opened for ordinary, non-accredited investors to participate in venture capital through equity crowdfunding platforms. These platforms allow anyone to invest in startups and small businesses with long-term growth potential.

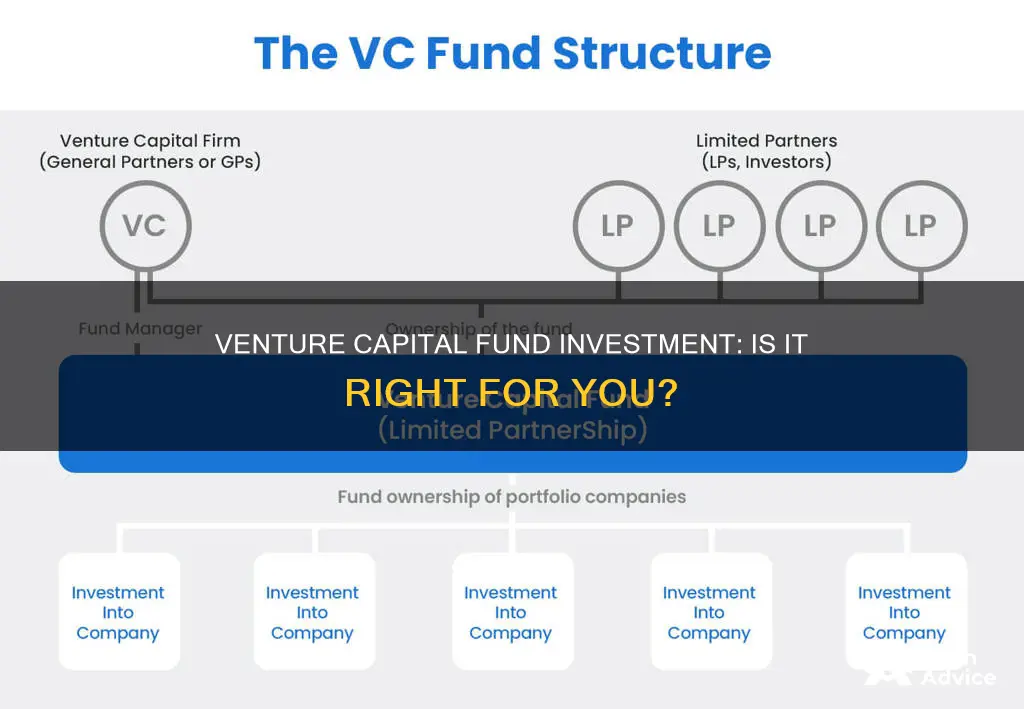

- Venture Capital Firms or Funds: These are specialized investment firms or funds that focus on providing financing to startups and early-stage companies with high growth potential. They raise money from limited partners (LPs) and invest it in promising startups.

- Wealthy Investors or Angel Investors: High-net-worth individuals (HNWI) or angel investors are individuals who invest their own money in early-stage startups, often in exchange for equity. They typically have amassed their wealth through diverse sources and may be entrepreneurs themselves or retired executives.

- Financial Institutions and Investment Banks: Banks and other financial institutions also provide venture capital funding. They may invest directly in startups or work in collaboration with venture capital firms.

- Institutional Investors: Pension funds, endowments, foundations, insurance companies, and pooled investment vehicles called "funds of funds" are examples of institutional investors that provide capital to venture capital funds.

- Ordinary Investors: With the advent of equity crowdfunding and changes in regulations, ordinary, non-accredited investors now have the opportunity to invest in venture capital. They can participate through online crowdfunding platforms or specialized venture capital funds that cater to non-accredited investors.

It is important to note that venture capital investments are not limited to a specific type of investor. The criteria for investing often depend on the specific venture capital fund and the regulations in the relevant jurisdiction.

Overall, anyone with the financial means and risk appetite can consider investing in venture capital, whether through direct investments, crowdfunding platforms, or by becoming a limited partner in a venture capital fund.

Amundi Funds: A Guide to Investing in Their Success

You may want to see also

What is the history of venture capital?

The history of venture capital is a fascinating one, with roots stretching back to the post-World War II era and even further. Some sources claim that the concept of venture capital can be traced back to when Christopher Columbus pitched his voyage to the Americas to Queen Isabella of Spain, who funded the high-risk venture. However, the first modern venture capital (VC) firm, American Research and Development Corporation (ARDC), was founded in 1946 by General Georges Doriot, often referred to as the "father of venture capital". ARDC raised capital from institutions like universities and insurance companies, marking a shift from the traditional model of wealthy families being the main source of risk capital. ARDC's most notable investment was in Digital Equipment Corporation, which later became one of the original 12 publicly traded companies on the Dow Jones.

In the following decades, VC gained traction, particularly in Silicon Valley, which played a pivotal role in the technology sector's growth. The 1950s saw the emergence of Arthur Rock, a pivotal figure in the history of VC. Rock helped secure funding for Fairchild Semiconductor, founded by the "Traitorous Eight", and later established the Bay Area's first VC firm, Davis & Rock. Rock also provided early funding to iconic companies like Intel and Apple.

The 1960s and 1970s witnessed the VC industry solidifying its footing, with a focus on starting and expanding companies. This era also saw the emergence of the Limited Partnership structure commonly used by VC funds today. Notable VC firms founded during this period include Sutter Hill Ventures, Asset Management Company, Mayfield, Norwest, and Venrock.

The 1980s was a golden age for VC, with many risky ventures backed by VCs providing substantial returns. The rise of personal computers and the internet in the 1990s further propelled the industry, leading to the emergence of now-iconic companies like Google, Amazon, and Yahoo, all backed by VC funding. However, the dot-com bubble burst in the early 2000s, resulting in significant losses for many VC firms.

The post-dot-com era witnessed a shift in the VC model, with firms adopting a more targeted approach and focusing on specific sectors or stages. This period also saw the rise of accelerators like Y Combinator, which provided startups with mentorship, networking opportunities, and capital injections.

The 2010s brought about the emergence of micro-VC firms, investing smaller amounts of capital into a large number of seed or pre-seed stage companies. This decade also introduced the term "unicorn" to describe VC-backed companies with valuations exceeding $1 billion. Despite economic downturns and market corrections, VC remains an active source of capital for startups, adapting and evolving alongside technological advancements.

TCI Fund Investment: A Guide to Getting Started

You may want to see also

Frequently asked questions

Investing in a venture capital fund is a high-risk endeavour and you should only invest money that you can afford to lose. Historically, only accredited investors (those with a minimum $200,000 annual income, or $300,000 if married, or a net worth exceeding $1 million) were able to invest in venture capital. This is because the majority of startups fail and there is limited liquidity when investing in venture capital.

Venture capital funds allow investors to get a front-row seat to the growth of a company and, in some cases, be involved in a mentor role with the startup's management team. Investing in venture capital can also offer the opportunity for significant upside potential, with limited risk.

There are opportunities for both accredited and less affluent investors to invest in venture capital funds. These investments include funds, stocks, venture capital debt and direct investments.