Whether or not you should pay an investment advisor depends on your financial situation and your goals. Financial advisors can be paid through commissions, hourly, flat, or advisory fees, or a combination of these. Advisory fees are often charged as a percentage of the assets you have under management, and these fees are usually billed and paid directly from your accounts. Fees can also be structured as a flat rate or hourly rate.

Robo-advisors are a more economical option, but they offer less personalized guidance. They typically charge lower fees, ranging from 0.25% to 0.9% per year, or monthly or annual subscription fees.

It's important to understand how your advisor is compensated and to ask questions about their fee structure. Before settling on an advisor, be sure to shop around and ask about their services, fees, and whether they will be working in your best interest.

| Characteristics | Values |

|---|---|

| Type of fee | Flat fee, hourly fee, percentage of assets under management (AUM), performance-based fee, commission |

| Flat fee range | $2,000-$7,500 per year |

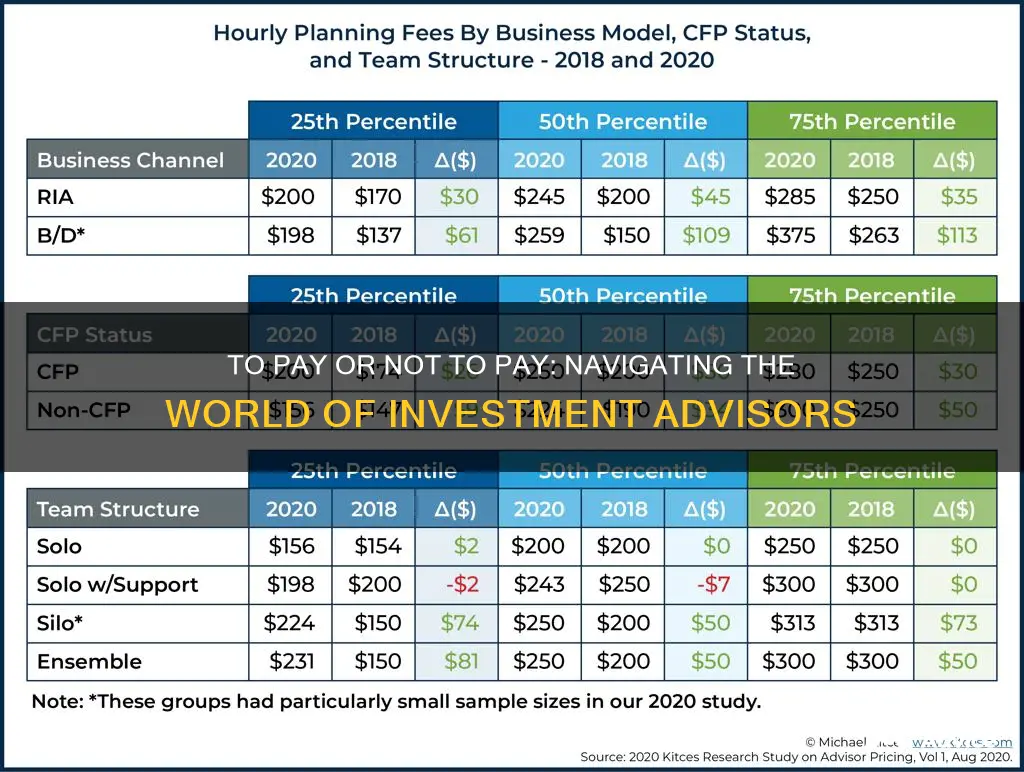

| Hourly fee range | $200-$400 per hour |

| AUM fee range | 0.25%-1% per year |

| Performance-based fee | Added to the standard AUM fee when a predetermined benchmark has been achieved |

| Commission | Compensation from the sale of products that are recommended |

What You'll Learn

Flat fees vs. percentage of assets

When it comes to financial advisors, there are two main ways that they charge fees: a flat-fee structure or a percentage of assets under management (AUM) fee method.

Flat-Fee Structure

Flat-fee-based advisors decide how much their financial advisory services are worth and then charge that same rate for every client. This fee structure is simple and straightforward but can be costly for those still building their wealth. Flat fees are also attractive for clients who feel more comfortable with a uniform fee schedule instead of one that changes as their assets rise and fall. Flat fees are comparable to the rates that a certified public accountant or attorney may charge for their services.

Percentage of Assets Under Management (AUM) Fee Method

The AUM fee is a percentage, based on the value of your investment portfolio. The average financial advisor fee is typically between about 0.5% to 2% per year, but this can vary depending on how the financial advisors operate. This annual fee scales up and down as your wealth changes, making it a flexible cost that pays for itself. Financial advisors who use the AUM fee structure often provide ongoing services that support all your financial goals, like tax planning, investment advice, retirement planning, and other kinds of financial guidance.

Flat Fees vs. AUM Fees

Flat fees are generally better for clients with larger asset balances, while AUM fees work well for clients with smaller balances. For example, a client with over $1 million in assets may be better off with a flat fee, while a client with under $1 million may benefit more from an AUM fee. Additionally, flat fees are ideal for clients who want a uniform fee schedule, while AUM fees are preferable for those whose wealth fluctuates and who want their advisor fees to scale up or down accordingly.

Club Members: Cramer's Investing Army

You may want to see also

Robo-advisors vs. traditional advisors

Robo-advisors and traditional advisors each have their own advantages and disadvantages. The choice depends on what kind of help you need and how much cash you have to invest. Here is a detailed comparison between the two:

Robo-Advisors

- Fees: Robo-advisors typically charge fees ranging from 0.25% to 0.50% of the amount managed per year, with most services falling towards the lower end of that range.

- Account Minimums: Many robo-advisors have no account minimums, making them accessible to people with smaller amounts to invest.

- Personalization: Robo-advisors are configured to meet the needs of many investors by allowing them to set and edit their financial goals. However, they offer limited personalization and are not able to address specific concerns or complex investment strategies.

- Human Interaction: Robo-advisors require little to no human interaction. They are entirely automated, with some offering access to human assistance. This lack of human contact may be a disadvantage for those who value a relationship with their financial advisor.

- Cost-Effectiveness: Robo-advisors are generally more cost-effective than traditional advisors, especially for those who only need investment management rather than comprehensive financial planning.

- Suitability: Robo-advisors are a good fit for those with a simple portfolio, lack of investment experience, or those who are comfortable with technology.

- Flexibility: Robo-advisors offer limited flexibility in terms of customizing investment strategies and do not provide integral financial advice related to tax and estate planning.

Traditional Advisors

- Fees: Traditional advisors typically charge a percentage of assets under management, with the median fee being 1% per year. This fee can be higher for small accounts and lower for larger ones. Some traditional advisors also charge flat-rate or hourly fees.

- Account Minimums: Many traditional advisors require a minimum account balance, with some setting the threshold at $250,000 or more.

- Personalization: Traditional advisors can offer comprehensive financial advice and address specific concerns. They can help with a range of financial matters, including estate planning, tax planning, and social security planning.

- Human Interaction: Traditional advisors provide direct human contact and can build a relationship with their clients. They can offer comfort and explanation during market downturns and take a holistic view of their clients' financial lives.

- Cost-Effectiveness: Traditional advisors generally cost more than robo-advisors due to the higher level of human touch and personalized service they provide.

- Suitability: Traditional advisors are suitable for those with complex financial situations or higher wealth. They are also a good fit for those who prefer in-person meetings and value the peace of mind that comes with having someone watch over their finances.

- Flexibility: Traditional advisors offer more flexibility in terms of customizing investment strategies and addressing a wider range of financial needs.

In summary, robo-advisors are a cost-effective option for those seeking basic investment management and simple portfolios, while traditional advisors are better suited for individuals with complex financial situations or those seeking comprehensive financial planning and personalized advice.

Savings Strategies: Where to Invest

You may want to see also

Fee-only vs. fee-based advisors

Fee-only and fee-based are two of the most common financial advisor fee structures. Although they sound similar, there is a significant difference between the two.

Fee-only financial advisors are paid directly by their clients for their services. They do not receive any other form of compensation, such as commissions from fund providers. They are fiduciaries, which means they are legally obligated to act in their clients' best interests. Fee-only advisors usually charge a flat fee, an hourly rate, or a percentage of the assets under management (typically around 1%).

On the other hand, fee-based financial advisors are paid by their clients but may also receive additional income through commissions from financial products that their clients purchase. This creates a potential conflict of interest, as the advisor may be incentivized to recommend products that earn them a higher commission rather than those that are in the client's best interests. Fee-based advisors are typically not fiduciaries and are only required to recommend "suitable" investments to their clients.

When choosing between a fee-only and a fee-based advisor, most people prefer fee-only advisors because they provide unbiased advice and always act in the client's best interests. However, some individuals may prefer fee-based advisors if they want to work with a single professional for all their financial needs, such as insurance and investments.

It is essential to understand how your financial advisor is compensated and to ask questions about their fee structure and credentials before hiring them.

Invest Now: Where to Put Your Money

You may want to see also

Financial advisor certifications

When looking for a financial advisor, you will come across many different certifications and credentials. Here are some of the most common financial advisor certifications:

- CPA (Certified Public Accountant): CPAs are not just tax experts; they also handle financial reporting, audit work, and forensic research. They can save you money and keep you out of tax court. CPAs are highly qualified, requiring a specialised degree, work experience, and a challenging certification exam.

- CFA (Chartered Financial Analyst): CFAs have in-depth knowledge of asset management and securities analysis, as well as a commitment to ethical standards. They often work for large financial companies and investment firms, providing research, investment advice, portfolio management, and risk management services. Obtaining a CFA qualification requires extensive study, work experience, and passing a challenging three-part exam.

- CFP (Certified Financial Planner): CFPs take a holistic approach to financial planning, offering budgeting, retirement planning, insurance, tax, and estate planning services. They are required to act as fiduciaries, putting their clients' best interests first. CFPs must complete extensive education and pass a difficult exam. They often have specialisations, such as working with specific types of clients or focusing on certain types of financial planning.

- ChFC (Chartered Financial Consultant): ChFCs offer similar services to CFPs, including financial management, retirement planning, tax advice, estate planning, and insurance. The ChFC certification requires more coursework than the CFP and passing an exam after each course. ChFCs must also adhere to a fiduciary standard. They are well-suited for managing complex estates and providing investment strategies to small businesses.

- RIA (Registered Investment Advisor): RIAs refer to companies, rather than individuals, that provide financial planning or investment services. They must register with the SEC or a state regulatory agency and act as fiduciaries. RIAs often offer a range of services beyond investment advice, such as retirement planning, insurance, and estate planning.

- IAR (Investment Adviser Representative): IARs are financial professionals who work for RIAs. They are typically certified through the Series 65 or Series 7 exams and often hold additional certifications like CFP or CFA. IARs have a strong commitment to fiduciary responsibility, disclosing conflicts of interest and recommending more efficient products, even if it means lower commissions.

- CFF (Certified Financial Fiduciary): CFF is an additional qualification that financial advisors can obtain to signal their commitment to the highest fiduciary standards. It is administered by the National Association of Certified Financial Fiduciaries (NACFF) and includes rigorous requirements, such as passing a background check and adhering to a code of conduct.

- RICP (Retirement Income Certified Professional): RICP-certified professionals are trained to help clients with Social Security, risk management, retirement plan distributions, Medicare, life insurance, and retirement tax issues. This certification is often sought by experienced financial advisors, lawyers, accountants, and bankers who want to enhance their understanding of retirement planning.

- CPWA (Certified Private Wealth Advisor): CPWAs are wealth managers who work with affluent clients, creating investment portfolios and managing them. They typically do not offer broad financial advice but instead focus on managing investments as part of a larger planning team. CPWA certification includes training on strategies for maximising growth, minimising taxes, and wealth transfer to the next generation.

- CLU (Chartered Life Underwriter): CLUs are financial advisors who specialise in life insurance planning, often as part of an estate planning team for high-net-worth clients. The qualification is administered by the American College of Financial Services and includes exams, coursework, and continuing education requirements.

Restaurant Owners: Strategies to Repay Investors When Profits Are Elusive

You may want to see also

Additional financial advisor costs

Financial advisors are compensated in several ways, and it's important to know how yours is paid. Here are some additional costs to consider when hiring a financial advisor:

- Brokerage, custodial and other third-party fees: These are fees you'll be responsible for in addition to paying the advisor. For example, if your financial advisor uses mutual funds or exchange-traded funds (ETFs) in your account, you'll have to pay costs associated with those funds on top of the fee you pay your advisor.

- Investment product fees: When a professional advisor makes financial recommendations involving products, there is an additional product fee payable in addition to the advisor's fee. This is because the advisor receives compensation for the human side of the advice, while the financial product has fees associated with the investments secured to implement the recommendation.

- Robo-advisor fees: Robo-advisors are automated software platforms that provide investing advice and typically follow a fee-only compensation structure. Their costs are outlined in new account paperwork, and while these fees are low, the financial institution may offer additional services to customise the experience that will require additional fees.

- Other professionals: Some advisors include tax-planning services without an additional cost, but many partner with accounting firms for all tax-related work. That means tax and legal services may incur an additional cost.

Networking: Your Secret Weapon for Success

You may want to see also