The S&P 500 index fund is a popular investment option, but is it the right choice for you? The S&P 500 is a stock market index composed of 500 large US companies, often considered a benchmark for the overall health of the US stock market. While you cannot invest directly in the index itself, you can invest in index funds or exchange-traded funds (ETFs) that track the S&P 500.

Index funds are passively managed, meaning they aim to replicate the performance of the index by holding the same stocks and weightings. This means that if the index performs well, your investment should too. Index funds are typically considered less risky than investing in individual stocks and are more diversified.

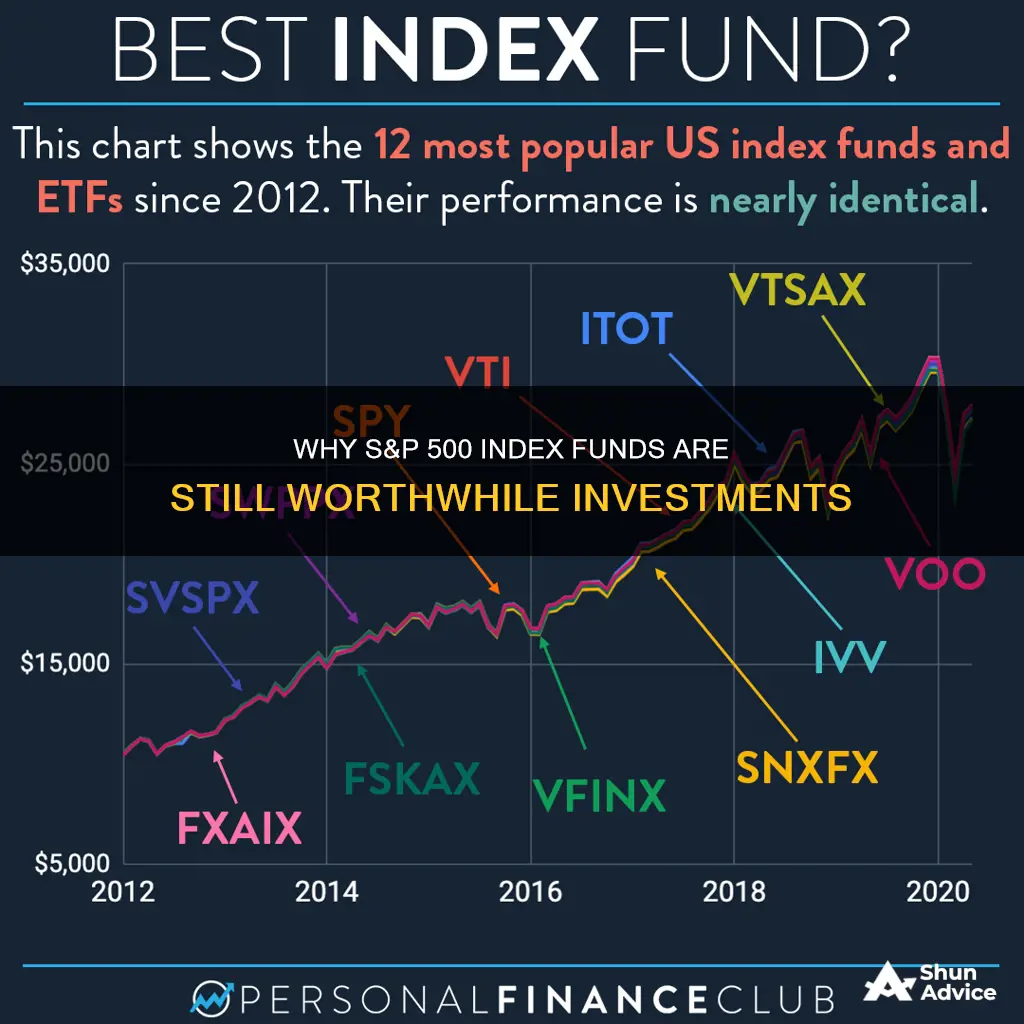

When choosing an S&P 500 index fund, consider factors such as the expense ratio, sales load, dividend yield, and inception date. Compare different funds to find the one with the lowest fees and the best performance history. You can invest in an S&P 500 index fund through a taxable brokerage account or a tax-advantaged account like a 401(k) or IRA.

Keep in mind that while the S&P 500 offers diversification, it may not be enough for your portfolio, and you might want to consider other indexes or investment options as well. Additionally, while index funds are a more hands-off approach, they may not offer the same potential for high returns as actively managed portfolios.

Should you invest in an S&P 500 index fund? It depends on your investment goals, risk tolerance, and the amount of time you want to spend managing your investments.

What You'll Learn

What is the S&P 500?

The S&P 500, or Standard & Poor's 500, is a stock market index that tracks the stock performance of 500 large, publicly traded U.S. companies. It is one of the most widely followed equity indices and is regarded as a bellwether for the American stock market and the stock market overall. The S&P 500 was launched in 1957 by the credit rating agency Standard and Poor's and is considered one of the best gauges of large U.S. stocks.

The S&P 500 is a market-capitalization-weighted index, which means it gives a higher percentage allocation to companies with the largest market capitalizations. As of January 2024, the index included approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of over $43 trillion. The index includes a diverse range of companies across industries, including technology, consumer discretionary, software, banks, and manufacturers.

The S&P 500 is not an exact list of the top 500 U.S. companies by market cap, as it uses other criteria for inclusion. To be included in the index, companies must meet certain requirements for liquidity and market capitalization, have a public float of at least 10% of their shares, and have positive earnings over the trailing four quarters.

While you cannot invest directly in the S&P 500, you can invest in index funds or exchange-traded funds (ETFs) that track the index. These funds aim to replicate the performance of the S&P 500, offering investors exposure to a diverse range of large U.S. companies.

Robinhood Index Fund Investing: A Beginner's Guide

You may want to see also

Why do investors like S&P 500 index funds?

S&P 500 index funds are popular with investors because they offer a range of benefits. Here are some of the key reasons why investors like S&P 500 index funds:

Ownership of Many Companies

S&P 500 index funds provide investors with ownership of hundreds of stocks, even if they own just a single share of the fund. This diversification across a broad range of companies helps to reduce risk.

Low Cost

Index funds, including the S&P 500 index funds, tend to have low expense ratios because they are passively managed. This means that more of the investor's money is invested, rather than being paid out in fund management fees.

Solid Performance

Historically, the S&P 500 index has delivered solid returns over the long term, averaging about 10% annually. By investing in an S&P 500 index fund, investors can expect their returns to match the performance of the index.

Easy to Buy

S&P 500 index funds are simple to invest in and do not require investing expertise or time-consuming research. This makes them accessible to a wide range of investors.

Diversification

The S&P 500 index fund offers a diversified portfolio of large U.S. companies across different sectors. This diversification helps to further reduce risk for investors.

Overall, the combination of solid historical performance, low costs, and diversification makes the S&P 500 index fund an attractive investment option for investors seeking long-term growth.

Bond of America: State Investment Destinations

You may want to see also

How to invest in an S&P 500 index fund

The S&P 500 index fund is among today's most popular investments. The index is a bellwether for the American stock market, comprising about 500 of the largest US companies.

- Find your S&P 500 index fund: Look at the fund's expense ratio and sales load to determine its affordability. Index funds are typically inexpensive, and S&P 500 index funds are no exception, with some charging less than 0.10% annually.

- Go to your investing account or open a new one: Access your existing investing account (401(k), IRA, or taxable brokerage account) or open a new one. If you're a beginner, consider a broker that offers a wide range of ETFs and mutual funds without trading fees.

- Determine how much you can afford to invest: Figure out how much you can invest regularly and transfer that amount to your brokerage account.

- Buy the index fund: Go to your broker's website and set up the trade by inputting the fund's ticker symbol and the number of shares you want to buy. Many brokers allow you to set up a recurring investment schedule.

Additional considerations:

- Diversification: While the S&P 500 index fund provides diversification across large US companies, consider adding mid- and small-cap companies, international companies, and other asset classes to your portfolio for broader diversification.

- Timing: Don't worry too much about timing the market. Focus on long-term investing and diversification.

- Costs: Consider the costs associated with investing in an S&P 500 index fund, such as the expense ratio and potential sales load. Compare fees across different funds to find the most affordable option.

A Beginner's Guide to Mutual Funds in Pakistan

You may want to see also

How to invest in the S&P 500 with an ETF

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It is considered a bellwether and benchmark for many major funds and portfolio managers.

ETFs (exchange-traded funds) are a great way to invest in the S&P 500. ETFs are passively managed, meaning they aim to duplicate the performance of a market index like the S&P 500. Here are the steps to investing in the S&P 500 with an ETF:

- Find your S&P 500 ETF: Look for an ETF with a low expense ratio, or the cost that the fund manager will charge you over the year as a percentage of your investment in the fund. You can consider ETFs like SPDR S&P 500 ETF Trust (SPY), Vanguard's S&P 500 ETF (VOO), or the SPDR Portfolio S&P 500 Value ETF (SPY).

- Go to your investing account or open a new one: Access your investing account or open a new one if you don't have one. You can use a 401(k), an IRA, or a regular taxable brokerage account.

- Determine how much you can afford to invest: Figure out how much you're able to invest and add money regularly to the account. You can set up your account to transfer money regularly from your bank.

- Buy the ETF: Go to your broker's website and set up the trade, inputting the ETF's ticker symbol and how many shares you'd like to buy based on how much money you've put into the account.

Some key advantages of investing in the S&P 500 with an ETF include:

- Exposure to the world's most dynamic companies: The S&P 500 includes some of the world's top companies like Apple, Amazon, Microsoft, and Johnson & Johnson.

- Consistent long-term returns: Over long periods, the S&P 500 has consistently performed well, with an average annual return of about 10%.

- No intricate analysis required: You don't need to analyze or pick stocks when investing in the S&P 500 through an ETF.

- Can serve as a core holding: S&P 500 ETFs are liquid and trade with tight bid-ask spreads, making them ideal as core holdings for investment portfolios.

However, there are also some disadvantages to consider:

- Dominated by large-cap companies: The S&P 500 is dominated by large-cap companies, with its biggest constituents accounting for about one-third of the index. This means limited exposure to small-cap and mid-cap stocks with potentially higher growth rates.

- Inherent risks of equity investing: The S&P 500 has risks associated with equity investing, such as volatility and downside risk, which may be challenging for newer investors.

- Only includes U.S. companies: The S&P 500 only includes U.S. companies, so it doesn't provide exposure to international markets.

Overall, investing in the S&P 500 with an ETF can be a great way to gain exposure to a diversified portfolio of large U.S. companies, but it's important to consider the potential drawbacks and ensure it aligns with your investment goals and risk tolerance.

Hedging Mutual Fund Investments: Strategies for Risk Mitigation

You may want to see also

Other considerations for investing in the S&P 500

While the S&P 500 is a good investment option, it should not make up the majority of your portfolio. Joe Favorito, managing partner at Landmark Wealth Management, says that there are other areas of the market to consider, such as small-cap, mid-cap, and international stocks. Building a diversified portfolio also means complementing S&P 500 funds with bond holdings.

The S&P 500 is dominated by large-cap companies, with its 10 biggest constituents accounting for almost one-third of the index. This means it has limited exposure to small-cap and mid-cap stocks, which may have greater growth potential. The index also only includes U.S. companies, so it does not provide exposure to international markets.

Additionally, the S&P 500 has risks inherent in equity investing, such as volatility and downside risk, which may be difficult for newer investors to tolerate.

When choosing an S&P 500 fund, consider the following criteria:

- Expense ratio: Because S&P 500 index funds are passively managed, expense ratios should be low. As all S&P 500 index funds perform very similarly, the fees become an important differentiating factor.

- Minimum investment: Ensure the fund's minimum purchase amount matches the amount you have to invest.

- Dividend yield: Compare dividend yields, as these can boost returns even in down markets.

- Inception date: Funds with longer track records show how they performed during bull and bear markets.

Best Mutual Funds to Invest in the USA

You may want to see also

Frequently asked questions

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It represents nearly 80-85% of the total capitalization of the U.S. stock market.

Investing in the S&P 500 provides exposure to some of the world's most dynamic and large-cap companies, such as Apple, Amazon, and Microsoft. It offers consistent long-term returns and does not require intricate analysis or stock-picking. S&P 500 index funds and ETFs are also highly liquid and trade with tight bid-ask spreads, making them ideal as core holdings for most investment portfolios.

You can invest in the S&P 500 through index funds or exchange-traded funds (ETFs) that track the index. You can use a taxable brokerage account, a 401(k), an IRA, or a robo-advisor platform. When choosing an S&P 500 index fund, consider factors such as the expense ratio, minimum investment, dividend yield, and inception date.

The S&P 500 is dominated by large-cap companies, with limited exposure to small-cap and mid-cap stocks that may have higher growth potential. It also includes only U.S. companies and has risks inherent in equity investing, such as volatility and downside risk.