Whether young people should invest in dividend ETFs is a divisive subject. On the one hand, young investors have time on their side, which means they can build a considerable amount of wealth through dividend reinvestment. They can benefit from the compound wealth effect while seeking maximised returns over time. Dividends can also be a good option for those seeking a little more safety, as they can offset potential losses. Additionally, dividends can be more reliable than growth stocks and can even outperform them over time.

On the other hand, dividends are generally seen as safe investment strategies reserved for older, more risk-averse investors. Dividend-paying companies are often seen as old-fashioned with no growth trajectory, and dividend investing may not give a better return than growth investing. Dividends are also taxable, which can eat away at returns.

| Characteristics | Values |

|---|---|

| Investment opportunities for young people | Relatively small amounts of capital and a rudimentary knowledge of how investing works |

| Number of U.S.-based ETFs | Over 3,000 |

| Liquidity | High |

| Cost structure | Low |

| Investment Management Choice | Passive, active, or somewhere in between |

| Tax efficiency | High |

What You'll Learn

- Dividend stocks are a safe investment strategy for older, risk-averse investors

- Young investors can benefit from dividends through compound wealth effects

- Dividends are taxed, which can reduce total returns

- Dividend-paying companies are often mature and not growing as much

- Dividend stocks can be more reliable than growth stocks

Dividend stocks are a safe investment strategy for older, risk-averse investors

Dividend stocks are also attractive to older investors as they provide regular income, which can be especially beneficial for retirees. The income generated from dividend stocks can be used to supplement retirement funds or reinvested to boost returns. Additionally, dividends can act as a cushion during volatile or declining markets, as investors still receive dividend payments even if stock prices fall.

Furthermore, dividend stocks are less volatile than growth stocks, making them more suitable for older investors who may not have the time to recover from significant market downturns. While growth stocks have the potential for higher returns, they also carry greater risk, which may not align with the risk tolerance of older or more conservative investors.

For older investors, the preservation of capital and stable returns may take precedence over the potential for higher gains. Dividend stocks offer the security of consistent payouts and the assurance that the company is mature and financially stable.

However, it is essential to note that dividend investing is not without its drawbacks. Dividend-paying companies may not always deliver high growth, and the taxes associated with dividend income can be a burden, especially for those relying on it as their primary source of income.

Toxic People: Invest Time Wisely

You may want to see also

Young investors can benefit from dividends through compound wealth effects

Young investors are often tempted to invest in high-growth tech stocks, rather than dividend-paying stocks, to achieve greater short-term capital appreciation. However, young investors can benefit from dividends through compound wealth effects.

Dividends are cash payouts that large, well-established companies provide to shareholders as a proportion of their revenue. The types of companies that offer dividends are typically those that have stood the test of time, offering modest, stable, and often increasing returns even through recessions, cyclical shocks, and now a global pandemic.

Young investors have time on their side, which lends itself to the potential for building a considerable amount of wealth through dividend reinvestment. Reinvesting cash payments back into the dividend-paying companies creates a compound wealth effect while seeking maximized returns over time. Because young investors have a longer time horizon, the upfront investment can be much lower than if they wait until retirement to invest in dividends. Dividends are, therefore, an accessible way for young investors to build wealth passively with little downside risk.

Research shows that, over the long term, reinvested dividends are a major contributor to total returns. For example, in the period December 1994–October 2017, 40% of the total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding.

While dividends are most commonly reinvested, they can also be used as earned cash without the investor ever needing to sell a single share. Just as retirees use dividends to supplement their retirement income, young investors in the workforce can use dividends to reliably supplement their occupational income regardless of stock performance. Therefore, even the most extreme risk-takers could benefit from adding the immediate positive returns of dividends to their financial plan.

When deciding whether to invest in dividend ETFs, young investors should also consider the tax implications. Dividends are taxed as income, so unless the investment is in a Roth IRA, for example, investors will be increasing their taxable income.

Americans: Investors or Not?

You may want to see also

Dividends are taxed, which can reduce total returns

Dividends are usually taxed as income, which can reduce total returns. The tax rate on dividends depends on the type of dividend, your income, filing status, and whether the dividend is qualified or nonqualified. Nonqualified dividends are taxed as income at rates up to 37%. Qualified dividends are taxed at lower rates of 0%, 15%, or 20%.

For example, if you receive a dividend of $100 and fall into the 20% tax bracket, you would only keep $80 after paying the dividend tax. This tax applies even if you automatically reinvest the dividends to buy more shares.

To avoid unnecessary taxes on dividends, some investors choose to hold their investments for a minimum of 61 days to qualify for the lower tax rate. Others opt for tax-free dividends by investing in municipal bonds or ensuring their taxable income falls below a certain threshold. Additionally, holding dividend-paying investments inside a retirement account can shelter dividends from taxes or defer taxes on them.

It is important to note that the tax implications of dividends can vary based on individual circumstances and tax laws, which may change over time. Therefore, it is always advisable to consult a qualified tax professional or financial advisor for personalized advice.

Forging Checks: A Risky Investment Gamble

You may want to see also

Dividend-paying companies are often mature and not growing as much

Companies that are still growing rapidly usually reinvest their profits to fuel further growth. They may also choose to accumulate profits to fund new initiatives, acquire other companies, or pay down debt—all of which can increase share prices.

Dividend-paying companies are often well-established and viewed as more stable than growing companies. They are seen as financially strong, and their ability to pay steady dividends demonstrates their financial strength and positive expectations for future earnings.

Dividend-paying companies include Apple, Microsoft, Exxon Mobil, Wells Fargo, and Verizon. These companies are likely to have already experienced significant growth and may not have as much room for further expansion. Instead, they opt to return profits to shareholders.

Young investors are generally advised to focus on growth stocks rather than dividend stocks. This is because they can tolerate more risk and have more time to absorb fluctuations in the market. Growth stocks have the potential for faster stock price growth, even though they may not provide the steady income of dividend stocks.

In summary, dividend-paying companies are often mature businesses that have passed their rapid growth phase. They choose to distribute profits as dividends to attract investors and signal their financial strength.

FTX: How Investors Got Duped

You may want to see also

Dividend stocks can be more reliable than growth stocks

Dividend Stocks are Less Risky

Dividend stocks are generally considered less risky than growth stocks. This is because dividend-paying companies are typically well-established, mature businesses with predictable markets and stable incomes. They often operate in slow-growth industries and may not have much growth potential, but they are also less volatile and less likely to experience significant fluctuations in their stock prices. On the other hand, growth stocks tend to be more volatile and carry more risk, as they focus on reinvesting profits into the company to pursue higher growth rates.

Dividend Stocks Provide Regular Income

Dividend stocks provide regular income in the form of cash payments to shareholders. This can be especially attractive for retirees or investors seeking a steady income stream. Dividend-paying companies usually distribute dividends annually, semi-annually, or quarterly, and some even offer monthly dividend payments. This consistent income can be a source of financial stability and predictability for investors.

Dividend Stocks Offer Reinvestment Opportunities

Dividends can be reinvested to enhance the return on investment. By reinvesting dividends, investors can benefit from the power of compound interest, which can lead to significant growth over time. Additionally, some companies offer dividend reinvestment plans (DRIPs), which automatically reinvest dividends into purchasing more shares of the company stock. This allows investors to gradually build their portfolio and increase their ownership in the company.

Dividend Stocks May Provide Psychological Benefits

Investing in dividend stocks can provide psychological benefits to investors, especially those who are risk-averse or prefer a more conservative approach. Seeing the regular dividend payments being reinvested can be motivating and help keep investors disciplined during market downturns. Dividend investing also removes the need to actively sell shares to realize gains, avoiding the difficult questions of when and how much to sell.

Dividend Stocks Can Offer Stability During Recessions

During economic downturns or recessions, dividend stocks may provide a degree of stability. Companies that pay dividends tend to have more stable and predictable cash flows, which can help them weather economic storms. Additionally, in a recession, investors may value the steady income stream from dividends, as it can help cover living expenses or provide a source of cash flow if they lose their job.

Retirement Account: Investing Beyond $5500

You may want to see also

Frequently asked questions

Dividend-paying companies are typically well-established, offering modest, stable, and often increasing returns. Young investors have time on their side, which allows for building a considerable amount of wealth through dividend reinvestment and compound wealth effects. Dividends can also provide a steady income stream without needing to sell assets, which can be beneficial during a recession.

Dividend-paying companies may be perceived as old-fashioned and lacking a growth trajectory. Dividends can increase taxes, as they are considered taxable income. Additionally, focusing solely on dividends may result in lower total returns compared to growth stocks or other investment options.

Dividend ETFs may offer lower returns than growth stocks, especially in the tech industry. However, dividend stocks can be more reliable and experience less volatility over time. Young investors should ideally focus on a combination of growth and dividend stocks or ETFs to balance risk and return.

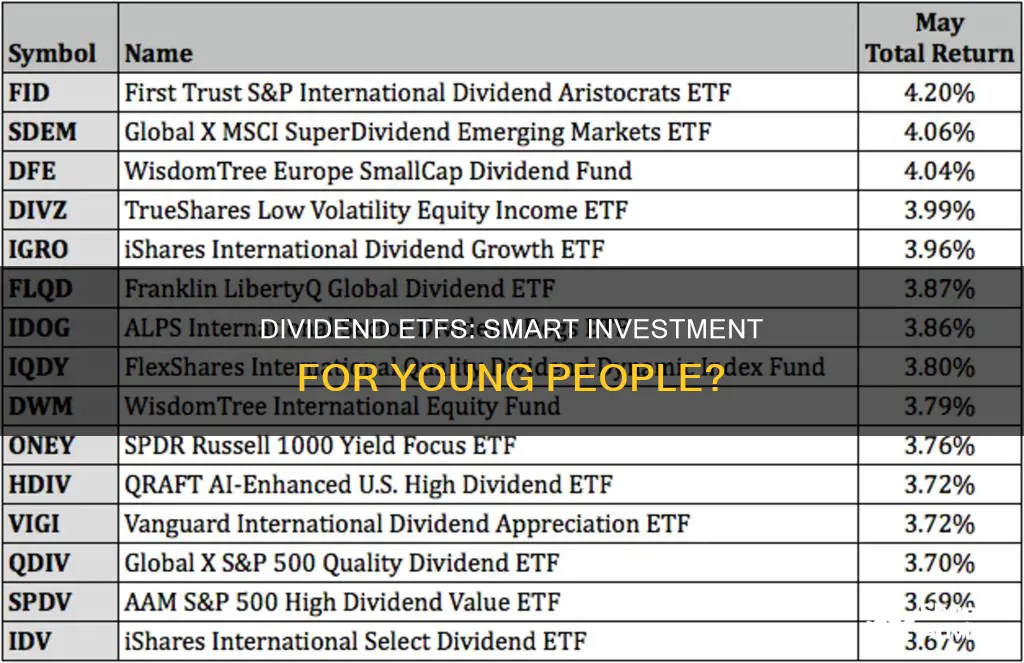

The TrueShares Low Volatility Equity Income ETF (DIVZ) includes companies pursuing growth strategies while offering consistent dividends, such as Johnson & Johnson and Verizon. Other dividend ETFs to consider are SCHD and VYM.