If you're a 50-year-old investor, retirement is likely on the horizon. This means that you might want to shift your focus from growing your portfolio to generating income from it. However, as people are living longer, financial planners are recommending that a portfolio for a 50-year-old should still have a relatively high allocation of stocks, perhaps as much as 50-60%. This is because stocks are volatile but generate the high long-term returns needed to protect against longevity risk and act as an inflation hedge.

That being said, you might want to consider adding a meaningful allocation of bonds to your portfolio as these help to stabilise it and reduce volatility. You should also take advantage of the catch-up contributions available to those over 50, which can significantly improve your retirement prospects.

| Characteristics | Values |

|---|---|

| Age | 50 |

| Retirement savings | Six times their salary saved. For example, $420,000 for someone earning $70,000 a year. |

| Catch-up contributions | $8,000 in an IRA from age 50 to 65 with a 6% average annual return can add nearly $24,000 by retirement. |

| Investment types | Stocks, bonds, cash, real estate, mutual funds, index funds, exchange-traded funds, target-date funds, robo-advisors, international stocks, and tax-exempt bonds. |

| Investment strategy | Diversification, asset allocation, tax reduction, rebalancing, and liquidity. |

| Risk tolerance | Higher risk tolerance when younger, but in your 50s, you may want to reduce risk and preserve wealth. |

What You'll Learn

Catch-up contributions to retirement accounts

When it comes to retirement planning, individuals are advised to save a portion of their annual income and invest wisely to achieve their retirement goals. As people age, their investment strategies may need to change. Those nearing retirement may have more money to invest but less time to recover from losses.

For those aged 50 and above, catch-up contributions are a way to boost retirement savings. Catch-up contributions are additional sums of money that can be contributed to employer-sponsored retirement plans, such as 401(k)s, and individual retirement accounts (IRAs). These contributions are designed to help individuals who may have started saving for retirement later in life or who want to increase their retirement savings.

The catch-up contribution limit for 2024 is $7,500 on top of the standard contribution limit. For example, the total contribution limit for 401(k) plans in 2024 is $23,000, so individuals aged 50 and over can contribute up to $30,500. Similarly, the contribution limit for IRAs in 2024 is $7,000, allowing those aged 50 and above to contribute a total of $8,000.

It's important to note that catch-up contributions must be made before the end of the plan year and are subject to certain rules and regulations. For instance, the SECURE 2.0 Act of 2022 introduced a change where high-income earners (wages above $145,000) making catch-up contributions from 2026 onwards will need to do so after taxes to a designated Roth account.

Retirement planning can be complex, and it's always recommended to seek professional advice to ensure your investment strategy aligns with your specific circumstances and goals.

Savings Strategies: Best Investments to Grow Your Money

You may want to see also

Diversifying your portfolio

Maintain a Mix of Stocks and Bonds:

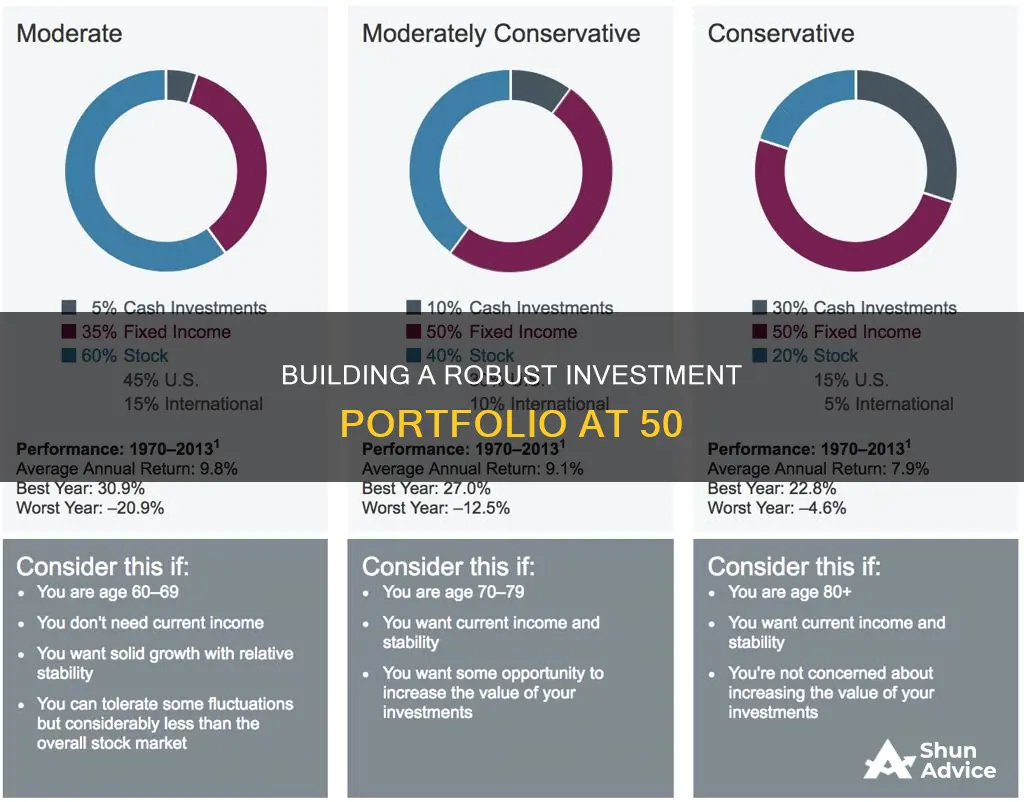

As a 50-year-old, it is essential to have a balanced portfolio that includes both stocks and bonds. While stocks provide long-term growth potential, bonds help stabilise your portfolio and reduce volatility. Consider allocating around 60% of your portfolio to stocks and 40% to bonds. However, you can adjust this ratio based on your risk tolerance. If you are averse to risk, consider decreasing the percentage of stocks and increasing bonds.

Diversify Across Asset Classes:

Invest in a variety of asset classes such as stocks (equities), bonds (fixed-income securities), cash and cash equivalents, commodities, real estate, futures, and derivatives. Each asset class has different risk and reward levels and behaves differently over time, depending on economic conditions. By diversifying across these asset classes, you protect yourself from losing all your money if one asset class underperforms.

Diversify Within Asset Classes:

It's not enough to just invest in different asset classes; you should also diversify within them. For stocks, consider holding 20 or more individual stocks or investing in mutual funds or exchange-traded funds (ETFs). Diversify by individual companies and market sectors, focusing on stable sectors like utilities, consumer staples, and healthcare. For bonds, consider investing in bond funds or varying your holdings across bond maturities, sectors, and types, such as municipal, corporate, and government bonds.

Take Advantage of Taxable Accounts:

In addition to your retirement accounts, consider saving in a taxable account. This provides flexibility for different financial goals and improves the tax diversification of your retirement savings. If you are already on track with your retirement accounts, consider directing your next dollar to a taxable account instead of a tax-deferred one.

Review Your Asset Allocation Regularly:

As you approach retirement, your portfolio should gradually shift from more aggressive to more conservative investments. Review your asset allocation regularly, especially as market uncertainty, major life events, or the rising cost of living can impact your investment strategy. Remember that your portfolio should continue to grow even during retirement to support your financial needs.

Diversifying Your Portfolio: Optimal Number of Investments

You may want to see also

Tax reduction strategy

When it comes to tax reduction strategies for a 50-year-old's investment portfolio, here are some key considerations:

Take Advantage of Tax-Advantaged Accounts:

- Maximize contributions to tax-deferred retirement accounts such as a 401(k) or an Individual Retirement Account (IRA). By doing so, you can lower your taxable income and defer paying taxes until retirement, when you may be in a lower tax bracket.

- Consider a Roth IRA: While contributions are made with after-tax money, withdrawals in retirement are tax-free if certain conditions are met. This can be beneficial if you expect to be in a higher tax bracket later.

Focus on Tax-Efficient Investments:

- When investing outside of tax-advantaged accounts, consider the tax implications of your investment choices. For example, investing in tax-efficient index funds or exchange-traded funds (ETFs) that have low turnover can reduce the impact of capital gains taxes.

- Be mindful of the tax treatment of dividends. Qualified dividends are generally taxed at lower rates than ordinary income, so investing in stocks or funds that pay qualified dividends can be more tax-efficient.

Harvest Tax Losses:

If you have investments outside of tax-advantaged accounts, you can use tax-loss harvesting to offset capital gains. By strategically selling losing investments, you can claim capital losses on your tax return, reducing your taxable income.

Be Mindful of Timing:

- Keep an eye on the timing of your investments and withdrawals. For example, if you plan to sell an investment at a gain, consider doing so in a year when your income is lower to potentially reduce the tax rate on those capital gains.

- Similarly, if you have control over when you realize certain income, you may be able to time it to keep your income within a lower tax bracket for the year.

Review Your Tax Withholding:

Ensure that you are withholding the appropriate amount of taxes from your income. If you are employed, review your W-4 form and adjust your withholdings if necessary. If you are self-employed or have multiple income streams, make estimated tax payments throughout the year to avoid underpayment penalties.

Take Advantage of Tax Credits and Deductions:

Explore tax credits and deductions that you may be eligible for. For example, if you are contributing to a retirement account, you may be able to claim the Saver's Credit, which can reduce your tax liability. Additionally, certain investments or expenses may qualify for tax deductions or credits, such as student loan interest or contributions to a health savings account (HSA).

Savings Investment Strategies: Where to Invest Your Money Wisely

You may want to see also

Additional income streams

When it comes to investment portfolios for 50-year-olds, there are a few key considerations to keep in mind. Firstly, individuals in their 50s are likely to be in their peak earning years, which provides an opportunity to boost retirement savings. Additionally, it's important to note that there is no one-size-fits-all approach to investment portfolios, and personal factors such as needs, experience, and personality should be taken into account. That being said, here are some additional income streams to consider as part of your investment portfolio:

- Stocks: While it's advisable to shift from more aggressive investments to more stable options as you near retirement, stocks should still play a significant role in your portfolio. They provide the high long-term returns needed to protect against longevity risk and act as an inflation hedge. The general rule of thumb is to subtract your age from 100, 110, or 120, with the resulting number being the approximate percentage allocated to stocks.

- Bonds: As you approach retirement, allocating more of your portfolio to income-generating investments like bonds becomes a more attractive option. They offer stability and help reduce volatility in your portfolio. In your 50s, adding a meaningful allocation of bonds can be a prudent strategy.

- Certificates of Deposit (CDs): CDs are another stable investment option to consider. They provide a fixed rate of return and are generally low-risk, making them suitable for individuals who are risk-averse or seeking to balance their portfolio with less volatile assets.

- Taxable Accounts: In addition to traditional retirement accounts, consider saving in a taxable account. This provides flexibility and improves the tax diversification of your retirement savings. It can be a good option if you're already on track with your retirement account contributions and want to explore alternative savings vehicles.

- Real Estate: While this may not be a traditional investment stream, investing in real estate can provide an additional income source through rental properties or capital appreciation over time.

- Annuities: Annuities are an insurance contract where you make a lump-sum payment or series of payments, and the insurer agrees to make periodic payments to you at a later date. While there are different types of annuities, they can provide a stable income stream during retirement and are worth considering as part of your overall financial plan.

Remember, it's essential to periodically review and adjust your investment portfolio as you get closer to retirement. Working with a financial advisor or planner can help you make informed decisions that align with your risk tolerance, goals, and circumstances.

Investment Strategies: Cash Reserves in Your Portfolio

You may want to see also

Asset allocation

- In your 40s and 50s, you are potentially entering your peak earning years. You may also have more financial obligations, such as mortgage payments, and bigger savings goals, such as sending your kids to college. Depending on when you plan to retire, adding stability to your portfolio with bonds may be a wise choice. For example, you may want to begin shifting more of your IRA assets to bonds or bond funds. These investments may produce lower returns in the short term compared to stocks, but they can be useful for generating income once you retire.

- With more than a decade or two of working years left until retirement, it’s important to maintain the growth potential of your portfolio through an appropriate allocation to stocks. In your 50s, you may want to consider adding a meaningful allocation to bonds.

- Stocks remain an important part of the retirement portfolio regardless of age. However, as you approach retirement, you may want to shift towards a more conservative asset allocation, with a higher percentage allocated to bonds and cash.

- The old rule of thumb for asset allocation was to subtract your age from 100 and put that percentage of your portfolio in stocks. For example, if you're 50, you should keep 50% of your portfolio in stocks. However, with people living longer, many financial planners now recommend that the rule should be closer to 110 or 120 minus your age. That's because if you need to make your money last longer, you'll need the extra growth that stocks can provide.

Saving-Investment Model: Understanding the Economics of Macro Theory

You may want to see also

Frequently asked questions

An investment portfolio for a 50-year-old should be tailored to their personal needs, experience, and personality. Generally, a 50-year-old is advised to shift their focus from aggressive stocks to more stable, income-generating investments like bonds and certificates of deposit. This is because, at 50, you are closer to retirement and may not have time to recover from potential market losses.

A rule of thumb for asset allocation is to subtract your age from 100 or 110. This gives you the approximate percentage of your portfolio that should be in stocks. For a 50-year-old, this would be 50-60%. However, this can be modified based on your risk tolerance and investment objectives.

A common mistake to avoid when investing at 50 is investing too conservatively, too soon. Stocks are volatile but can generate the high long-term returns needed to protect against longevity risk and act as an inflation hedge. Another mistake is not taking full advantage of an employer's retirement plan, especially if they offer a matching contribution.

A 50-year-old should review their portfolio allocation at least annually as they get older. This is to ensure their funds are protected and their portfolio aligns with their risk tolerance.