The saving-investment model is a concept in national income accounting that explores the relationship between saving and investment in an economy. It suggests that the amount saved in an economy will be reflected in investments in new physical machinery, inventories, and similar assets. This model is often associated with Keynesian economics and serves as a variation of the injections-leakages model, which captures the interplay between induced saving and autonomous investment expenditures. The saving-investment model provides an alternative to the Keynesian cross, focusing on the saving function rather than the consumption function.

What You'll Learn

Saving and investment equality

The saving-investment identity can be observed in both open and closed economies. In an open economy, private saving, governmental saving (the government budget surplus or negative of the deficit), and foreign investment domestically (capital inflows from abroad) must equal private physical investment. In other words, the investment must be financed by some combination of these sources.

In a closed economy with a government, the remainder of aggregate output (Y), after subtracting consumption by individuals (C) and the government (G), must equal investment (I). This can be expressed as: I = Y - C - G.

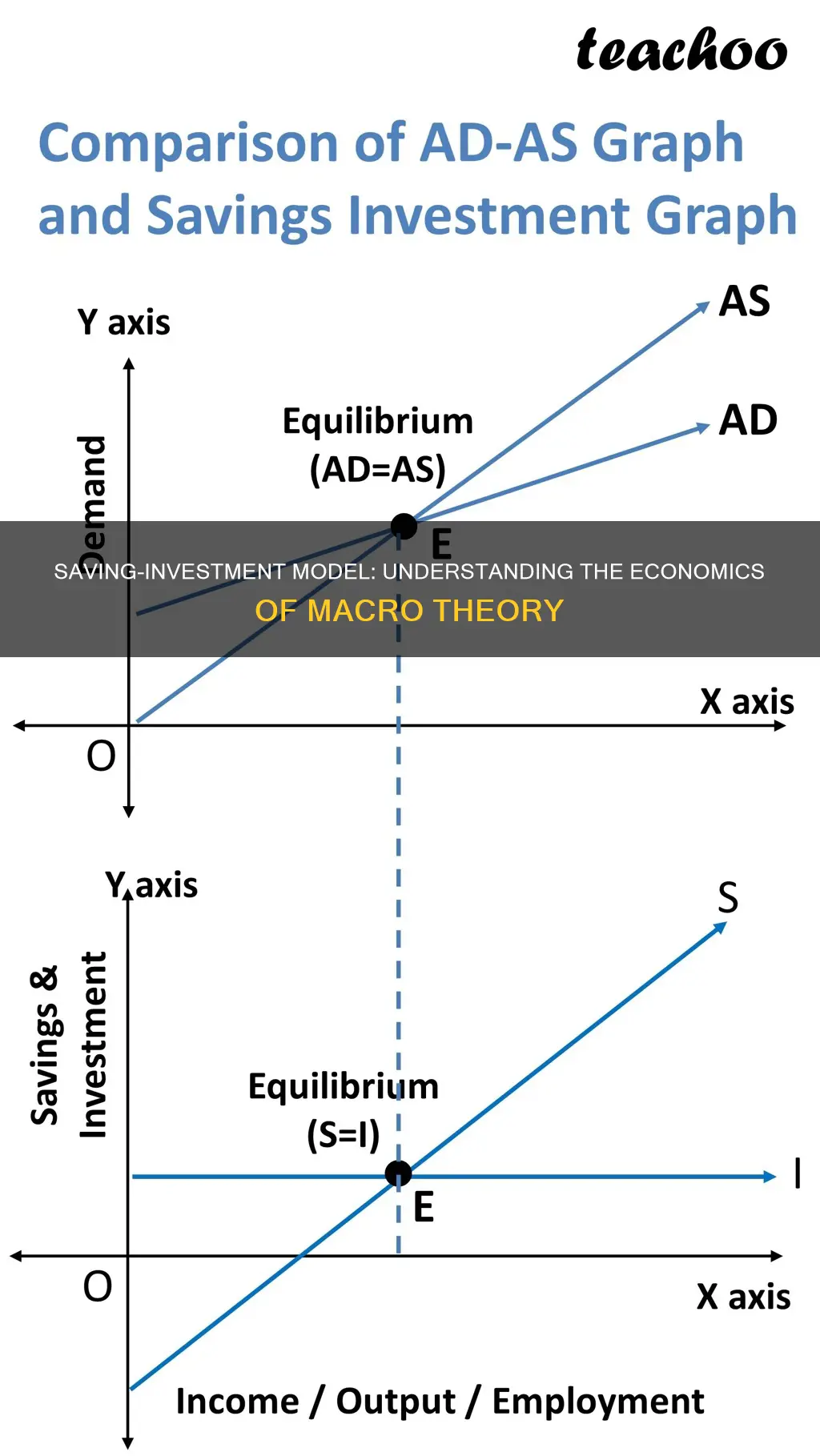

The saving-investment identity is also related to the concept of equilibrium in economic theory. In the general equilibrium model, savings must equal investment for the economy to clear. Classical economists believed that saving and investment equality is brought about by the rate of interest, whereas Keynes believed it was brought about by changes in income.

The IS-LM model, which stands for "investment-saving" (IS) and "liquidity preference-money supply" (LM), is a Keynesian macroeconomic model that illustrates the interaction between the market for economic goods and the loanable funds market. The IS-LM graph consists of two curves: the IS curve, which depicts the set of all levels of interest rates and output (GDP) at which total investment (I) equals total saving (S); and the LM curve, which depicts the set of all levels of income (GDP) and interest rates at which money supply equals money (liquidity) demand. The intersection of these curves shows the equilibrium point of interest rates and output when money markets and the real economy are in balance.

The saving-investment model is a variation of the Keynesian injections-leakages model, which includes the household sector and the business sector. This model provides an alternative to the two-sector Keynesian model, focusing on the saving function instead of the consumption function. In the saving-investment model, equilibrium is identified as a balance or equality between saving and investment expenditures.

Public Saving and Investment: Two Sides of the Same Coin?

You may want to see also

The IS-LM model

The intersection of the IS and LM curves indicates the short-run equilibrium point between interest rates and output when the money markets and the real economy are in balance. This equilibrium point reflects the unique combination of interest rates and real GDP. The IS-LM model can be used to analyse how changes in market preferences impact the equilibrium levels of GDP and market interest rates. It also highlights the importance of demand shocks, such as monetary and fiscal policy decisions, on output and national income in the short run.

While the IS-LM model has its limitations and simplifications, it remains a valuable introductory tool in macroeconomic teaching. It provides insights into the relationship between interest rates, output, liquidity, investment, and consumption within an economy.

ETFs: Smart Short-Term Investment Strategy for Savings?

You may want to see also

Saving and induced consumption expenditures

Saving

Saving, in economic terms, refers to consuming less in the present to be able to consume more in the future. It involves setting aside money that is not spent now, either for emergencies or future purchases. Economists view saving as a means to increase the stock of capital, which can then be invested to generate higher future consumption. Saving adds to the pool of funds available for investment, which can drive economic growth.

Induced Consumption Expenditures

Induced consumption, on the other hand, is the portion of consumption that varies with disposable income. When individuals have disposable income, their consumption tends to increase, and they are willing to spend on items that are not necessary for their basic needs. Induced consumption often includes purchases of lavish items, luxury goods, entertainment, and dining out. It is influenced by income levels, and as income rises, induced consumption also tends to increase.

The key difference between saving and induced consumption is that saving involves setting aside money for future use, while induced consumption involves spending disposable income on non-essential items. Saving is associated with delaying consumption to benefit from increased future consumption, whereas induced consumption reflects the present use of income on non-essential goods and services.

The Relationship Between Saving and Induced Consumption

The relationship between saving and induced consumption is complex. While saving may reduce current consumption, it can also provide individuals with a buffer to manage their finances and make larger purchases in the future. Induced consumption, on the other hand, can stimulate economic activity and increase demand for goods and services. It can lead to increased investment in products and services, overall market prosperity, and job creation. However, induced consumption may also lead to social disharmony in cases where only a fraction of the population can afford it.

In conclusion, saving and induced consumption expenditures are interconnected aspects of economic behaviour. Saving provides the foundation for future consumption and investment, while induced consumption reflects the spending patterns of individuals with disposable income. Together, they influence the dynamics of an economy, impacting both aggregate demand and the distribution of income.

Saving and Investing: Strategies for Future Financial Goals

You may want to see also

Autonomous investment expenditures

According to the classical economic theory, an increase in autonomous expenditures will lead to at least an equivalent increase in aggregate output, such as GDP. Autonomous expenditures are generally influenced by external factors such as trade policies, political uncertainties, and interest rates. While technically, they are not affected by external factors, in reality, these factors can impact consumption patterns and, consequently, spending within an economy.

The IS-LM model, which stands for "investment-saving" and "liquidity preference-money supply," is a Keynesian macroeconomic model that illustrates the interaction between the market for economic goods and the loanable funds market. It demonstrates the short-run equilibrium between interest rates and output, with the intersection of the IS and LM curves representing this equilibrium. The IS-LM model simplifies the economy to two markets—output and money—and their dynamics drive the economy towards an equilibrium point.

Savings and Investment: Finding Equilibrium Balance

You may want to see also

The injections-leakages model

Injections add to the national income, and consumers and businesses have more money to purchase and manufacture goods and services. The money businesses receive from households is returned to the economy when businesses purchase resources in the factor market. The factors of production include labor, land, natural resources, capital, and entrepreneurship, all provided by households. In return, businesses pay households wages, rent, interest, and profits.

Leakages, on the other hand, refer to the diversion of funds from some iterative process. In the context of the Keynesian model, leakages are the non-consumption uses of income, including saving, taxes, and imports. Imported goods, for example, can cause leakage by transferring income earned in one country to another. Leakages are equal in quantity to injections of spending from outside the flow at the equilibrium aggregate output. Leakages reduce the money available in the rest of the economy.

In the simplest model of credit creation, it is assumed that all loans borrowed from banks are re-deposited into the system, allowing for a simple calculation of the amount of credit created. However, in reality, cash leakages occur when money is borrowed from banks but not re-deposited, or when funds are deposited but not lent out. This type of leakage lowers the ability for credit creation.

Maximizing UK Savings: Investment Strategies for Beginners

You may want to see also

Frequently asked questions

The saving-investment model is a variation of the Keynesian injections-leakages model that includes the two private sectors, the household sector and the business sector. It provides an alternative to the two-sector Keynesian model, also known as the Keynesian cross.

The two sectors included in this model are the household sector and the business sector. The household sector includes everyone in an economy who consumes goods and services, while the business sector contains private, profit-seeking firms that produce goods and services.

Injections are non-consumption expenditures on aggregate production, including investment expenditures, government purchases, and exports. Leakages are non-consumption uses of the income generated from production, including saving, taxes, and imports.

Equilibrium is achieved when there is a balance between injections and leakages, or when saving equals investment expenditures. This results in a stable volume of the circular flow of income, production, and consumption.