Equities are shares issued by a company that represent ownership in the company. In other words, they are the value of an ownership stake in an asset or company. When an investor buys shares of a company, they are purchasing a small piece of that company, which is known as shareholder equity. This gives them access to potential capital gains and dividends, as well as possible voting rights. The term equities is often used interchangeably with stocks, but they refer to slightly different things. Equity refers to the general concept of ownership, while stocks are one of the most common types of equity.

| Characteristics | Values |

|---|---|

| Definition | Money invested in a company by purchasing shares of that company in the stock market |

| Synonyms | Stocks, publicly traded stocks |

| Ownership | Ownership in a company or asset |

| Calculation | Asset(s) – liability(ies) = equity |

| Examples | Shareholder equity, home equity, private equity, brand equity |

| Benefits | Increased value of the principal amount invested, diversification, long-term financial stability |

| Risks | Market risk, credit risk, foreign currency risk, liquidity risk, political risk, economic concentration risk, inflation risk |

Shareholder equity

Equities are shares issued by a company, representing ownership in that company. Stocks are a common type of equity, with equity referring to the broader concept of ownership. In other words, an equity investment is money that is invested in a company by purchasing shares of that company on the stock market.

A positive shareholder equity means the company has enough assets to cover its liabilities, while negative shareholder equity indicates that a company's liabilities exceed its assets.

Market Volatility: Is Now the Time to Invest?

You may want to see also

Home equity

Equities are shares issued by a company that represent ownership in the company. Stocks are the most common type of equity, with equity referring to the broader concept of ownership. When investing in equities, individuals purchase shares of a company with the expectation that they will increase in value, leading to capital gains and/or dividend generation.

Now, let's focus on home equity:

- Home Equity Investment (HEI): This option allows homeowners to receive a lump sum of cash from their home equity in exchange for a share of their property's future value. With an HEI, there are typically no monthly payments, no interest charges, and more lenient credit score requirements compared to traditional loans. However, it's important to consider that if the property's value increases significantly over time, the homeowner may end up repaying more than they initially received.

- Home Equity Loan (HEL): A HEL is a type of loan in which the borrower uses their home equity as collateral. It provides a lump sum of cash that the borrower repays with fixed monthly payments over a set period.

- Home Equity Line of Credit (HELOC): A HELOC is a line of credit secured by the borrower's home equity. It functions similarly to a credit card, allowing the borrower to draw funds up to a certain limit and make flexible payments.

- Cash-out Refinance: This option involves refinancing an existing mortgage for a higher amount and receiving the difference in cash. The borrower then repays the new loan with monthly payments over a set term.

When considering accessing home equity, it's important to weigh the pros and cons of each option and ensure a thorough understanding of the associated fees, repayment terms, and potential risks. Home equity investments can provide a valuable source of funds for various financial goals, such as home improvements, debt consolidation, or investing in other assets. However, it's crucial to carefully evaluate the specific terms offered by different companies and ensure they align with the homeowner's financial situation and long-term goals.

How to Reinvest Dividends with Chase You Invest Mutual Funds

You may want to see also

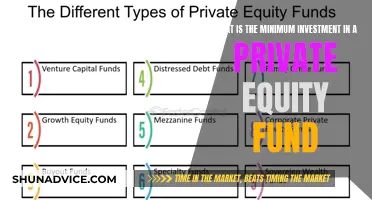

Private equity

Overall, private equity plays an important role in providing capital and expertise to companies, helping them grow and improve their operations. However, it is a high-risk investment with limited liquidity, and investors should carefully consider the risks and returns before committing capital.

TSP I Fund: International Stocks for Retirement Savings

You may want to see also

Common stock

Equities are shares issued by a company, representing ownership of that company. Stocks are a common type of equity, with equity referring to the broader concept of ownership.

Shareholders of common stock can vote to elect the board of directors and on corporate policies, with one vote typically granted per share held. They are also entitled to dividends, which are payments made from the company's earnings. The board of directors decides whether to pay dividends, and they are usually paid out of a company's profits.

In the event of liquidation, common stockholders are last in line to claim the corporation's remaining assets, after creditors, bondholders, and preferred stockholders. This means that common stockholders will only receive their payout after all other obligations have been met.

Index Funds: Best Investment Strategy for Long-Term Wealth?

You may want to see also

Preferred stock

Equities are shares issued by a company that represent ownership in the company. They are typically traded on a stock exchange. The term "stock" refers to ownership or equity in a firm, and there are two types of equity: common stock and preferred stock.

There are several types of preferred stock, including:

- Cumulative preferred stock: If a company suspends dividend payments, the dividends accumulate and must be paid out to cumulative preferred shareholders before any dividends can be distributed to common shareholders.

- Non-cumulative preferred stock: Unlike cumulative preferred stock, this type does not accumulate unpaid dividends. If the company decides not to pay dividends in any given period, those dividends are lost forever for the investor.

- Participating preferred stock: Shareholders have the right to receive additional dividends if the company meets certain financial goals. In the event of liquidation, they may also receive their original investment back, along with a portion of the remaining proceeds.

- Convertible preferred stock: Shareholders have the option to convert their shares into a predetermined number of common shares, allowing them to benefit from any significant rise in the company's stock price.

- Perpetual preferred stock: This type of preferred stock has no maturity date, meaning it can potentially pay dividends indefinitely as long as the company remains in operation.

- Callable preferred stock: Also known as redeemable preferred stock, this type can be "called" (redeemed) by the issuing company after a certain date at a predetermined price.

- Adjustable-rate preferred stock (ARPS): ARPS has dividend rates that periodically adjust based on a predetermined benchmark, such as the US Treasury bill rate or the LIBOR.

- Trust preferred stock: Issued by financial institutions, trust preferred stocks combine features of both debt and equity. They offer high dividends but carry the risks associated with both bonds and preferred equity.

A Guide to Investing in SBI Mutual Funds

You may want to see also

Frequently asked questions

Equities are shares issued by a company that represent ownership in the company. In other words, equity is the value of an ownership stake in an asset or company.

There are several types of equity, including shareholder equity, home equity, private equity, and brand equity. Shareholder equity refers to when an investor invests in a company and owns a small piece of it. Home equity is the current market value of a home less any outstanding debt. Private equity refers to the evaluation of a company that is not publicly traded. Brand equity is made up of intangible assets such as a company's reputation and brand identity.

While the terms "stocks" and "equities" are often used interchangeably, they refer to slightly different things. A stock is one of the most common types of equity, with equity referring to the general concept of ownership. Stocks are market-traded shares of a company.

Investors can use equity to look for investing ideas, compare similar companies, and decide what stocks to invest in. They can also use equity to understand the value of their investments and build long-term financial stability.

Investing in equities carries market risk, company-specific risk, liquidity risk, and economic risk. Market risk refers to the risk of overall market declines, while company-specific risk is the potential for a company's failure or underperformance. Liquidity risk is the risk of not being able to sell shares quickly at a fair price, and economic risk is the possibility of economic downturns or recessions.