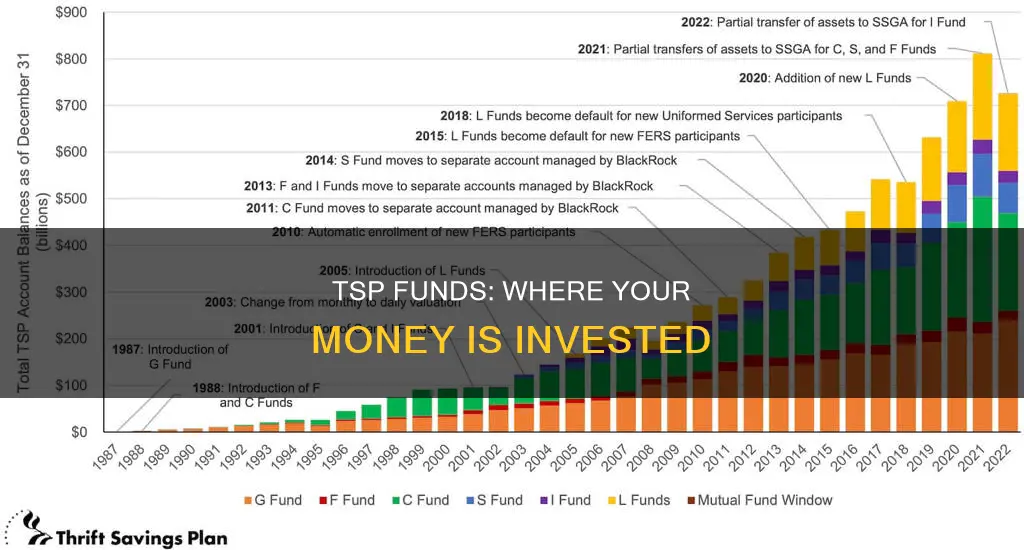

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and military personnel in the US. It offers five core investment funds, four of which are diversified index funds. Each index fund specialises in a different asset class or market segment, such as US equities, international equities, and corporate bonds. The fifth core fund, the G Fund, invests in very low-risk, low-yield government bonds. The TSP also offers Lifecycle (L) Funds, which are composite funds that invest in a combination of the five core funds.

What You'll Learn

Government Securities Fund

The Government Securities Investment Fund (G Fund) is one of the five core investment funds available in the Thrift Savings Plan (TSP). The TSP is a retirement investment program offered exclusively to federal employees and members of the uniformed services in the United States.

The G Fund is the only core fund that does not invest in an index. Instead, it invests in a special non-marketable treasury security issued specifically for the TSP by the U.S. government. This means that the G Fund is the only fund in the TSP that guarantees the return of the investor's principal.

The G Fund has the lowest risk of the five funds and is intended for very conservative investors. It pays an interest rate based on non-marketable short-term treasury securities with a maturity of 4 years or more. Historically, the G Fund has provided the lowest rate of return of any of the core funds.

The G Fund is designed for investors who want to invest their money for a longer duration but prioritize the safety of their investments. The fund seeks to generate returns by investing in central government securities with maturities between one and 30 years. These bonds are considered very safe because the repayment of investors' money is backed by the government. However, they are subject to sharp fluctuations due to changes in interest rates.

ULIP vs Mutual Funds: Where Should You Invest Your Money?

You may want to see also

Fixed Income Investment Fund

The Fixed Income Investment Fund, or the F Fund, is one of the five core investment funds available in the Thrift Savings Plan (TSP) offered to all U.S. government employees. The F Fund is a broadly diversified U.S. bond index fund that uses a "passive management" (indexing) investment approach. It aims to match the performance of the Bloomberg U.S. Aggregate Bond Index, a broad index representing the U.S. bond market.

The F Fund provides broad exposure to U.S. investment-grade bonds, investing about 30% in corporate bonds and 70% in U.S. government bonds of all maturities. By law, it must be invested in fixed-income securities. This fund represents the next step up in the risk/reward ladder in the TSP. It invests in a wide range of debt instruments, including publicly traded treasury and government agency securities, corporate and non-corporate bonds, and asset-backed securities (ABS).

The F Fund offers the opportunity for higher long-term returns compared to short-term securities like the G Fund. However, it does come with certain risks. These include market risk, credit default risk, inflation risk, and prepayment risk. Market risk refers to the fluctuation of F Fund returns with the bond market. Credit default risk is the possibility that the principal and interest payments on the bonds may not be paid. Inflation risk means that the fund's returns may not keep up with the reduction in purchasing power. Lastly, prepayment risk is the chance that if interest rates fall, the bonds will be paid back early, forcing lenders to reinvest at lower rates.

Despite these risks, the overall risk of the F Fund is considered relatively low compared to certain other fixed-income investments in the market. This is because the fund includes only investment-grade securities, and its diversified portfolio helps to mitigate risks. As of December 31, 2023, the Bloomberg U.S. Aggregate Bond Index included 13,334 notes and bonds, making it infeasible for the F Fund to invest in each security in the index. Instead, the fund's asset managers select a large representative sample of the various types of asset-backed, U.S. government, corporate, and foreign government securities included in the overall index.

Schwab Index Funds: A Guide to Investing

You may want to see also

Common Stock Index Fund

The Common Stock Index Investment Fund, or the C Fund, is one of the five core investment funds available in the Thrift Savings Plan (TSP). The C Fund is invested in a stock index fund that tracks the Standard and Poor's 500 (S&P 500) Index, a broad market index comprising 500 large to medium-sized US companies.

The C Fund's objective is to match the performance of the S&P 500 Index, which represents approximately 85% of the market value of the US stock markets. By investing in the C Fund, participants have the opportunity to experience gains from equity ownership in large and mid-sized US companies.

The C Fund is considered the most conservative of the three stock funds available in the TSP. However, it does carry market and inflation risk. The returns of the C Fund move in tandem with the prices of the stocks in the S&P 500 Index, and there is a risk of loss if the index declines due to changes in overall economic conditions.

The C Fund is managed by BlackRock Institutional Trust Company, N.A., and State Street Global Advisors Trust Company. As of December 31, 2023, the C Fund held assets totalling $339.0 billion, with a total expense ratio of 0.048%.

Contingency Fund Investment: Where to Place Your Safety Net?

You may want to see also

Small Capitalization Stock Fund

The Thrift Savings Plan (TSP) is a retirement investment program offered exclusively to federal employees and members of the uniformed services in the United States. It is one of the simplest and most efficient retirement plans available today, with thousands of civilian and military personnel contributing a portion of their earnings to the plan each year.

The TSP offers five core mutual funds for investment, four of which are diversified index funds. Each index fund focuses on a distinct market segment or asset class, such as U.S. equities, international equities, or corporate bonds.

One of these five core funds is the Small-Capitalization Stock Index Fund, also known as the S Fund. This fund holds securities that mirror the Dow Jones U.S. Completion Total Stock Market Index, which includes over 4,000 companies. These companies are typically smaller and less established than those in the S&P 500, presenting greater growth potential than those in the more conservative C Fund.

The S Fund is regarded as one of the two funds with the highest risk in the TSP. Historically, it has outperformed the C Fund, exhibiting greater volatility over time. While the BlackRock iShares does not offer an exact equivalent of the S Fund, investors seeking to replicate this fund outside of the TSP can consider the following four funds:

- IShares Russell Midcap ETF (IWR)

- IShares Russell 2000 Index ETF (IWM) – focusing on small caps

- IShares Core S&P Total U.S. Stock Market ETF (ITOT)

- IShares Russell 3000 ETF (IWV)

The S Fund is an attractive option for investors seeking exposure to smaller, high-growth companies within the TSP framework.

Golden Butterfly Portfolio: Best Funds for Long-Term Wealth

You may want to see also

International Stock Fund

The Thrift Savings Plan (TSP) is a retirement investment program offered to US government employees. It is similar to the 401(k) plans offered by private-sector employers. The TSP offers five core mutual funds to invest in, four of which are diversified index funds. Each index fund specializes in a different asset class or market segment, such as US equities, international equities, and corporate bonds.

The International Stock Index Investment Fund (I Fund) is one of the five core funds offered in the TSP. The I Fund invests in securities mirroring the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index. This is one of the broader international indexes investing in larger, more established companies located in 21 developed countries around the world.

As of July 31, 2024, the I Fund's benchmark index is the MSCI ACWI IMI ex USA ex China ex Hong Kong Index. The fund's objective is to match the performance of this index. The I Fund holds most of the large and medium-sized companies in the index and uses a mathematical technique to hold a representative sample of smaller stocks.

The I Fund is an excellent way to diversify the stock portion of your TSP allocation. It offers the opportunity to experience gains from equity ownership of non-US companies. The fund's returns are subject to market and inflation risk. The returns will move up and down with the returns in the MSCI ACWI IMI ex USA ex China ex Hong Kong Index. The I Fund is also exposed to currency risk, as the index prices will rise or fall relative to the value of the US dollar compared to the currencies of the countries represented in the index.

The I Fund can be useful in a portfolio that also contains stock funds that track other indexes, such as the C Fund and the S Fund. Investing in all segments of the stock market can reduce your exposure to market risk. The I Fund can also be a good addition to a portfolio that contains bonds, as a retirement portfolio containing a mix of stock funds and a bond fund will tend to be less volatile than one that contains only stock funds.

Index Funds: Long-Term Investment Strategies Explored

You may want to see also

Frequently asked questions

The Thrift Savings Plan (TSP) offers five core investment funds:

- Government Securities Investment Fund (G Fund)

- Fixed-Income Investment Index Fund (F Fund)

- Common Stock Index Investment Fund (C Fund)

- Small-Capitalization Stock Index Fund (S Fund)

- International Stock Index Investment Fund (I Fund)

The G Fund invests in very low-risk, low-yield government bonds. The F Fund invests in a range of debt instruments, including publicly traded treasury and government agency securities, corporate and non-corporate bonds, and asset-backed securities (ABS). The C Fund invests in large-capitalisation US stocks, specifically the 500 large and mid-cap companies that comprise the Standard and Poor's 500 (S&P 500) Stock Index. The S Fund invests in the stocks of small and medium-sized US companies, tracking the Dow Jones US Completion Total Stock Market Index. The I Fund is an international stock index fund that tracks the investment performance of the Morgan Stanley Capital International ACWI IMI ex USA ex China ex Hong Kong Index.

Lifecycle Funds are composite funds that invest in a combination of the five core funds. They are target retirement date funds, with each fund designed to match the investor's age and years until retirement.

The G Fund is very low risk, while the F Fund offers a higher interest rate than the G Fund. The C, S and I Funds offer higher returns but are more volatile.