Index funds are a low-cost, easy way to build wealth and are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. Index funds are considered a passive management strategy as they don't need to actively decide which investments to buy or sell. Charles Schwab offers two families of index funds: Equity Index Funds, which follow broad market indexes, and Fundamental Index® Funds, which follow innovative indexes that are weighted based on measures of company size, adjusted sales, retained operating cash flow, and dividends + buybacks. These funds are cost-effective, tax-efficient, and provide long-term growth potential.

| Characteristics | Values |

|---|---|

| Investment type | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive investing |

| Investment approach | Long-term growth |

| Risk | Reduced risk through market diversification |

| Cost | Low-cost, with annual expense of 0.03% |

| Tax | Tax-efficient |

| Number of stocks | 500 or 1000 |

| Investment amount | $10,000 |

What You'll Learn

Index funds are a low-cost, passive investment strategy

Index funds are considered passive because they do not require active management. They are designed to be well-diversified, holding a broad representation of the securities in an index, which could mean investing in hundreds or even thousands of companies across various sectors and markets. This diversification helps to reduce risk and minimize costs. With index funds, you don't need to spend time and money researching and choosing individual stocks, making them a great option for investors who don't have the time or expertise to actively manage their portfolio.

Compared to actively managed funds, index funds generally have lower management fees and are more tax-efficient. Actively managed funds tend to buy and sell their holdings more frequently, resulting in higher transaction costs and taxable capital gains distributions. Index funds, on the other hand, typically have lower turnover, which can lead to significant cost savings over time. According to data from Morningstar, the average actively managed mutual fund charges 0.49% in annual fees, while the average index fund charges only 0.06%.

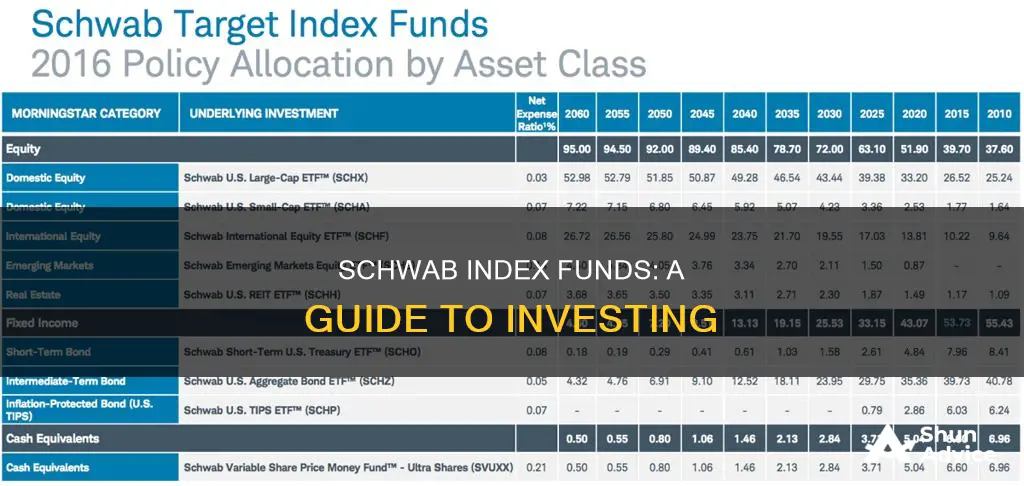

Charles Schwab offers a range of index funds, including the Schwab 1000 Index® Fund, which tracks the performance of 1,000 of the largest publicly traded U.S. companies, and the Schwab S&P 500 Index Fund, which seeks to replicate the performance of the S&P 500 Index. Schwab's index funds are known for their low costs, with fund operating expenses below the industry average and no loads or transaction fees.

Lumpsum Mutual Fund Investment: Timing for Maximum Returns

You may want to see also

They provide broad diversification

Index funds are a great way to invest in a wide range of stocks and other securities without having to spend a lot of time and effort researching individual investments. By investing in index funds, you get the benefit of broad diversification, meaning you can invest in many different stocks across various sectors of the economy.

For example, the S&P 500 index fund includes 500 large US companies, representing about 70% of Americans' value of stocks. Charles Schwab also offers the Schwab 1000, which includes 1000 stocks and represents about 85% of the companies' value in the United States. This means that if one industry, such as oil, is performing well while another, such as utilities, is struggling, you can still benefit from the overall growth of the economy.

Charles Schwab offers a range of index funds that provide broad diversification, including the Schwab U.S. Dividend Equity ETF, which focuses on high dividend-yielding US stocks, and the Schwab International Dividend Equity ETF, which invests in high dividend-yielding stocks from developed markets outside the US. These funds provide exposure to multiple sectors and industries, reducing the risk of a single stock significantly impacting your portfolio's value.

Index funds are also cost-effective, with lower management fees and fewer taxable capital gains distributions than actively managed mutual funds. This means that more of your money stays invested and working for you, potentially leading to better outcomes over time. Additionally, index funds tend to have low turnover, buying and selling securities less frequently, which can result in fewer capital gains taxes.

When investing in index funds through Charles Schwab, you have the option to invest in mutual funds or exchange-traded funds (ETFs). Mutual funds are purchased directly from fund companies and are priced once daily after the markets close. On the other hand, ETFs are purchased through a brokerage account and trade like stocks throughout the day. The choice between mutual funds and ETFs depends on your investment schedule and strategy.

Smart Mutual Fund Investing with 3 Lakhs

You may want to see also

Index funds are tax-efficient

Index funds are considered tax-efficient for several reasons. Firstly, they have a low turnover ratio, meaning they buy and sell securities less frequently, resulting in fewer capital gains distributions to investors. This is in contrast to actively managed mutual funds, where fund managers regularly sell securities to accommodate shareholder redemptions or reallocate assets, creating capital gains for shareholders. The low turnover of index funds helps minimize taxable events and reduces the tax liability for investors.

Additionally, index funds tend to distribute lower dividends than actively managed funds, further reducing the tax burden on investors. Ordinary dividends from mutual funds are taxable as income, and most index funds produce fewer dividends, especially those focused on growth stocks.

The passive nature of index funds also contributes to their tax efficiency. Passively managed equity ETFs, which track the performance of an index, typically rebalance their holdings only when the underlying index changes its constituent stocks. This passive approach reduces the likelihood of distributing capital gains compared to actively managed mutual funds.

Furthermore, the ETF redemption process allows managers to adjust for market changes without directly selling portfolio securities, which can save on capital gains taxes. This flexibility provides another layer of tax efficiency to index funds.

Lastly, when compared to mutual funds, ETFs held in taxable accounts generally generate lower tax liabilities for investors. From the perspective of the IRS, both ETFs and mutual funds are subject to similar tax treatments. However, the structure of ETFs results in minimized taxes for the holder, leading to a lower overall tax bill when compared to a similarly structured mutual fund.

Smart Mutual Fund Investing in Today's Volatile Market

You may want to see also

They are a great investment for building wealth over the long term

Index funds are a great investment for building wealth over the long term. Here's why:

Broad diversification

Index funds give you broad exposure to the market. Some are so broad that a single investment in them means you own a tiny piece of almost every public company in America. For example, investing in an S&P 500 index fund would mean you own stocks in 500 companies, representing about 70% of Americans' value of stocks. This broad diversification means that if one industry goes up while another goes down, you still have an investment in every major sector of the economy.

Low costs

Index funds are typically low cost compared to either buying stocks individually, where you pay a commission for each purchase or sale, or investing in actively managed funds that choose stocks and make trades. With the advent of ETFs, costs have dropped even further. Now, you can get access to the entire US broad stock market for an annual expense of just 0.03%. That means that on a $10,000 investment, your expenses would be $3 a year to own about 2,000 stocks. Lower costs mean more money stays working in your portfolio, and over time, this can have a big impact on your outcome.

Tax efficiency

Index funds are quite tax-efficient compared to many other investments. They tend to have low turnover, meaning they buy and sell securities less frequently, potentially generating fewer capital gains. Over time, returns lost to taxes can add up. In a hypothetical example, $100,000 invested in an active equity fund would have lost over $9,000 more to taxes over 10 years compared to an index equity fund.

Performance

The average annual return for the S&P 500 is around 10% over the long term. While the performance of the S&P 500 index is better in some years than in others, it has averaged an annualised gain of just over 10% over the past 60 years.

Ease of use

Index funds are a simple, time-tested way to invest. They are a straightforward way to participate in the potential growth of the economy over time. They are also a great way for beginning investors to get started, but they can also serve as a core of any stock portfolio, regardless of the investor's level of experience.

Low risk

Index funds typically carry less risk than individual stocks. They are considered a passive management strategy because they don't need to actively decide which investments to buy or sell. Instead, they try to be the market by buying stocks of every firm listed on a market index to match the performance of the index as a whole. This means they are often used to help balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared to individual stocks.

Choice

There are hundreds of indexes you can track using index funds, from large US stocks to small US stocks, international stocks, and bonds. You can also buy broad index funds, such as those that track the S&P 500, or more focused index funds that invest in specific sectors or trends, like artificial intelligence stocks.

Minimal research required

You can rely on the index fund's portfolio manager to simply match the underlying index's performance over time, so you don't need to become a stock market expert.

Dimensional Fund Investing: What Products Are Offered?

You may want to see also

Index funds are less risky than individual stocks

Index funds are ideal for investors who don't want to actively manage their investments or worry about the day-to-day fluctuations in the value of individual stocks. Index funds are a passive investment strategy, meaning they aim to replicate the performance of a particular index, such as the S&P 500. This is in contrast to actively managed funds, which attempt to outperform a benchmark index.

Index funds are considered less risky than individual stocks due to their inherent diversification. By investing in an index fund, you get exposure to a wide range of equities, often across different industries, sectors, and stock classes. This diversification reduces the chance of a significant decline in portfolio value as it is unlikely that every stock in the index will perform poorly at the same time. Even if one company goes bankrupt, the impact on the index fund as a whole would be minimal.

Additionally, index funds tend to have lower costs associated with them. They are typically low-cost compared to buying stocks individually, where you pay a commission for each purchase or sale, or investing in actively managed funds. Lower costs mean more money stays invested in your portfolio, potentially leading to better outcomes over time.

Furthermore, the performance of index funds is less dependent on the skill of a fund manager. Research shows that even professionals find it challenging to actively buy and sell individual securities and consistently match the market's performance. With index funds, you benefit from a more passive approach that tracks the market rather than trying to outperform it.

While index funds offer broad diversification and lower costs, they may not be suitable for all investors. Some investors may prefer the potential for higher returns offered by individual stocks, despite the higher risk. Additionally, index funds may not provide the same level of control over holdings as individual stocks, limiting the ability to invest in specific companies the investor favours.

Invest in an IRA: A Guide to Funding Your Retirement

You may want to see also

Frequently asked questions

An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the Standard & Poor’s 500 index. An index is made up of companies that represent a part of the financial market and offers a look into the health of the economy as a whole.

You can purchase an index fund directly from a mutual fund company or a brokerage. You'll need to open an investment account, such as a brokerage account, individual retirement account (IRA) or Roth IRA. You can then buy the fund in the account.

Index funds are a low-cost, easy way to build wealth. They are less expensive than actively managed funds and typically carry less risk than individual stocks. Index funds are also a great investment for building wealth over the long term, which is why they're popular with retirement investors.