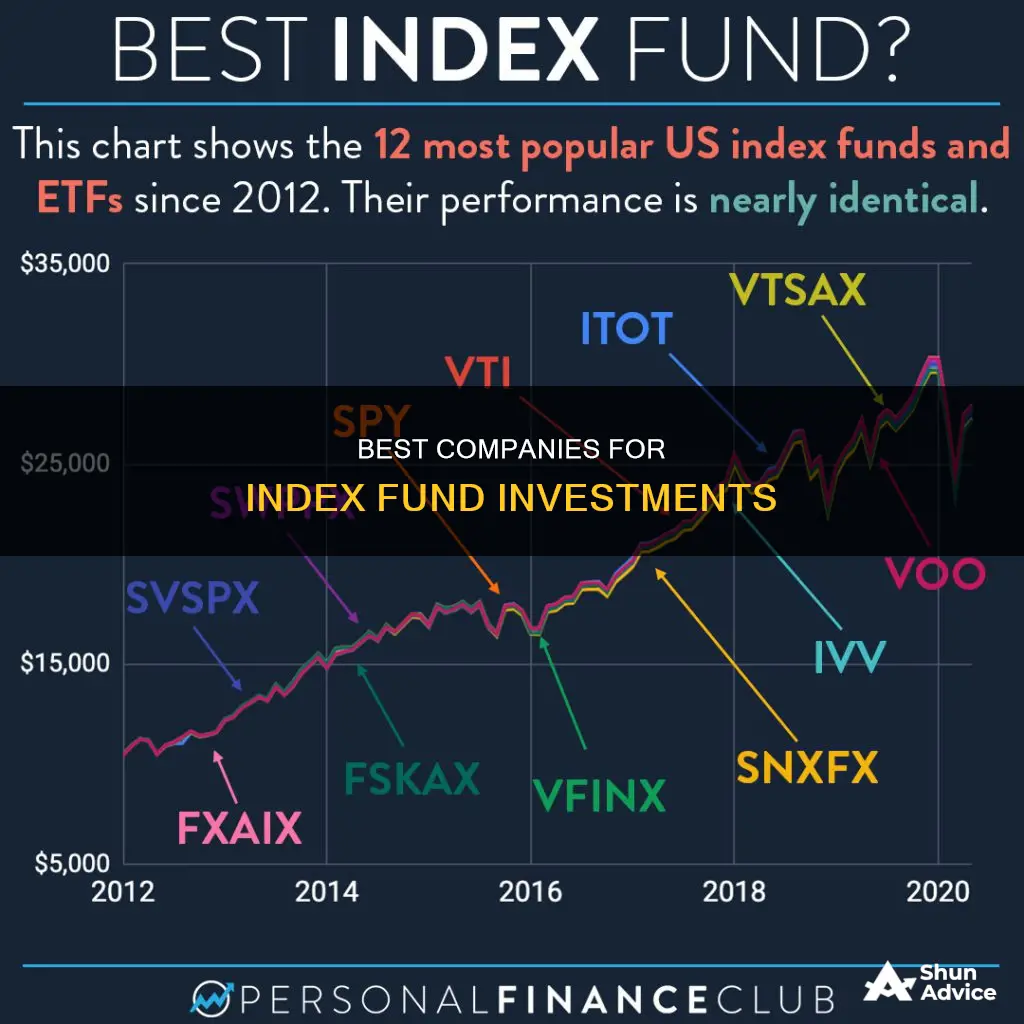

Index funds are a great investment for building wealth over time. They are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. Index funds are passive investments that track an index with the aim of replicating its performance minus expenses. Here are some of the best companies to invest in index funds:

- Vanguard S&P 500 ETF

- SPDR S&P 500 ETF Trust

- iShares Core S&P 500 ETF

- Schwab S&P 500 Index Fund

- Fidelity ZERO Large Cap Index

- Vanguard Russell 2000 ETF

- Vanguard Total Stock Market ETF

- SPDR Dow Jones Industrial Average ETF Trust

- Fidelity Zero Large Cap Index

- Invesco NASDAQ 100 ETF

| Characteristics | Values |

|---|---|

| Company | Fidelity, Vanguard, SPDR, iShares, Schwab, Shelton, Invesco, ROBO Global, State Street |

| Fund Name | ZERO Large Cap Index, S&P 500 ETF, Russell 2000 ETF, Total Stock Market ETF, Dow Jones Industrial Average ETF Trust, NASDAQ-100 Index Direct, QQQ Trust ETF, Growth ETF, Robotics and Automation Index ETF, Emerging Markets Equity ETF, U.S. Sustainability Index Fund, S&P 500 ETF, Total Stock Market, Total International Stock Market, Total Bond |

| Expense Ratio | 0%, 0.03%, 0.1%, 0.03%, 0.16%, 0.52%, 0.2%, 0.04%, 0.95%, 0.11%, 0.11%, 0.16%, 0.08%, 0.03%, 0.13%, 0.35% |

What You'll Learn

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO) is one of the largest exchange-traded funds (ETFs) on the market, with hundreds of billions in the fund. This ETF began trading in 2010 and is backed by Vanguard, a powerhouse in the fund industry.

The Vanguard S&P 500 ETF is a passively managed fund that tracks the performance of the S&P 500 index, aiming to replicate its returns. The S&P 500 is one of the most widely followed stock market indices, comprising 500 of the top companies in the US stock market.

This ETF has an exceptionally low expense ratio of 0.03%, meaning that for every $10,000 invested, you would pay just $3 annually. This makes it an excellent choice for investors seeking a broadly diversified, low-cost fund as a core holding in their portfolio.

The 5-year annualized return for this ETF is 16.0%, and it can be purchased directly from Vanguard or through most online brokers.

Vanguard is widely regarded as an easy entry point for new index fund investors, and its funds are known for keeping costs low.

Mutual Fund Strategies for a Bull Market

You may want to see also

Fidelity ZERO Large Cap Index

When it comes to investing in index funds, one of the most important factors in your total return is cost. Fidelity ZERO Large Cap Index is a mutual fund with no expense ratio. This means that for every $10,000 invested, you pay $0 annually. This is a great option for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

The fund doesn't officially track the S&P 500, but instead follows the Fidelity U.S. Large Cap Index. This means that investor-friendly Fidelity doesn't have to pay a licensing fee to use the S&P name, keeping costs lower for investors. The fund's performance closely mirrors that of the S&P 500. As of mid-May 2024, it was up about 12%, almost identical to the S&P 500 index's year-to-date gains.

The Fidelity ZERO Large Cap Index Fund has no minimum investment, making it a good choice for beginning investors. It can be purchased directly from the fund company or through most online brokers.

Index funds are a great way to build wealth by diversifying your portfolio while minimising fees. They are less risky than investing in individual stocks or bonds because they often hold hundreds of financial securities, spreading your investment risk.

Diversifying Your S&P 500 Investments: Is It Worthwhile?

You may want to see also

SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust is an exchange-traded fund (ETF) that trades on the NYSE Arca under the symbol SPY. It is the largest and oldest ETF in the USA, having been founded in 1993. The fund is part of the SPDR family of ETFs and is managed by State Street Global Advisors.

The SPDR S&P 500 ETF Trust is designed to track the S&P 500 index by holding a portfolio comprising all 500 companies on the index. The S&P 500 Index is a diversified large-cap US index that holds companies across all eleven Global Industry Classification Standard (GICS) sectors.

The fund has a net expense ratio of 0.0945% or 0.095%, depending on the source. Its CUSIP is 78462F103, and its ISIN is US78462F1030.

As of October 28, 2024, the fund's total net assets were $483.744 billion, with 989.23 million shares outstanding. The fund's top holdings as of October 25, 2024, included Microsoft, Meta Platforms, Alphabet, Berkshire Hathaway, and Alphabet Class C.

The SPDR S&P 500 ETF Trust is a good choice for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

Crowdfunding Real Estate: Getting Investors for Your Property Empire

You may want to see also

iShares Core S&P 500 ETF

The iShares Core S&P 500 ETF is a fund sponsored by BlackRock, one of the largest fund companies in the world. The fund, which began in 2000, tracks the S&P 500, a stock market index composed of 500 of the top companies in the U.S. stock market.

The iShares Core S&P 500 ETF is one of the largest exchange-traded funds (ETFs) and has delivered a five-year annualized return of 16%. It has an expense ratio of 0.03%, meaning that every $10,000 invested would cost $3 annually. This low expense ratio makes it a good choice for investors looking for a broadly diversified index fund at a low cost to serve as a core holding in their portfolio.

The fund can be purchased directly from BlackRock or through most online brokers. It is also available to buy on Fidelity, where it trades commission-free.

As of October 24, 2024, the iShares Core S&P 500 ETF had a net asset value (NAV) of $581.95, with a 52-week range of 412.43 - 587.41. The 1-day NAV change as of October 24, 2024, was 1.24 (0.21%), and the NAV total return as of October 23, 2024, was 22.87%.

Property Investment: Raising Capital for Your Dream

You may want to see also

Schwab S&P 500 Index Fund

When it comes to investing in index funds, one of the most important factors in your total return is cost. The Schwab S&P 500 Index Fund (SWPPX) is a mutual fund with a strong record dating back to its inception in May 1997. It is sponsored by Charles Schwab, a well-respected name in the industry known for its investor-friendly products.

With an expense ratio of 0.02%, the fund offers a low-cost way to gain exposure to a diversified portfolio of 500 leading U.S. companies. This includes some of the most well-known U.S.-based companies, providing investors with simple access to these businesses. The fund captures approximately 80% coverage of the available U.S. market capitalization.

The Schwab S&P 500 Index Fund is a good choice for investors seeking a broadly diversified index fund at a low cost to serve as a core holding in their portfolio. It can be purchased directly from the fund company or through most online brokers, with no minimum investment amount. This means investors can start investing with as little as $1.

The fund's performance closely tracks that of the S&P 500, aiming to replicate its total return. In 2022, the fund fell by over 18%, almost identical to the S&P 500's losses for the year. As of mid-2024, the fund was up by about 12%, mirroring the index's gains.

Cemetery Finances: Where Do Their Investments Lie?

You may want to see also

Frequently asked questions

Some of the best companies to invest in index funds that track the S&P 500 include Vanguard, Schwab, Fidelity, and T. Rowe Price.

Some of the best companies to invest in index funds that track the Nasdaq-100 include Invesco and Fidelity.

Some benefits of investing in index funds include lower costs, less volatile performance, and reduced investment research.

Some drawbacks of investing in index funds are the inability to beat the market, potential for downside risk in the short term, and owning a variety of stocks.