The C Fund, or Common Stock Index Investment Fund, is a US large-cap stock index fund that tracks the S&P 500 index. It is one of the five basic funds that comprise the Thrift Savings Plan (TSP), a retirement savings plan offered to US government employees. The C Fund is invested in the common stocks of 500 large to mid-cap US companies that are included in the S&P 500 index, such as Microsoft, Alphabet Inc., Meta Platforms Inc., and JPMorgan Chase & Co. The fund aims to match the performance of the S&P 500 index, which represents about 75-85% of the US stock market's value.

| Characteristics | Values |

|---|---|

| Fund Name | Common Stock Index Investment Fund (C Fund) |

| Fund Type | Stock fund |

| Inception Date | 29 January 1988 |

| Investment Objective | Match the performance of the Standard and Poor's 500 (S&P 500) Index |

| Investment Strategy | Invest in a portfolio designed to replicate the performance of the S&P 500 |

| Benchmark Index | Standard & Poor's 500 Stock Index |

| Number of Holdings | 500 large to medium-sized U.S. companies |

| Top Holdings | Microsoft Corporation, Alphabet Inc., Meta Platforms Inc., JPMorgan Chase & Co. |

| Sector Allocation | Communications Services, Consumer Discretionary, Information Technology |

| Expense Ratio | 0.025% |

| Risks | Market risk, inflation risk |

| Potential Rewards | Gain from the potential growth of the U.S. economy and corporate profits |

What You'll Learn

The C Fund's investment objective

The C Fund, also known as the Common Stock Index Investment Fund, is one of the five core investment funds available in the Thrift Savings Plan (TSP). The C Fund's investment objective is to match the performance of the Standard and Poor's 500 (S&P 500) Index, which is a broad market index made up of stocks of 500 large to medium-sized U.S. companies.

The C Fund is a stock index fund that tracks the S&P 500 Index, investing in the common stocks of 500 large and mid-cap U.S. companies across many different industries. These companies are some of the largest in the U.S., including well-known names such as Microsoft, Alphabet, Meta Platforms, Berkshire Hathaway, and JPMorgan Chase. The C Fund aims to replicate the performance of the S&P 500 Index, which is designed to provide a representative measure of U.S. stock market performance.

By investing in the C Fund, individuals have the opportunity to experience gains from equity ownership of large and mid-sized U.S. company stocks. The fund has a long-term focus, offering potentially high investment returns, and is suitable for those early in their careers seeking growth in their investment portfolios.

However, it is important to note that the C Fund is subject to market risk, as returns fluctuate with the prices of the stocks in the S&P 500 Index. Additionally, there is no guarantee that the C Fund will outperform inflation in the future. The fund is passively managed, remaining fully invested during all market cycles and economic conditions.

Hedge Funds: Exploring Their Diverse Investment Strategies

You may want to see also

C Fund's volatility and risk

The C Fund is a US stock index fund that tracks the performance of the Standard and Poor's 500 (S&P 500) Index, a broad market index composed of stocks of 500 large to medium-sized US companies. The C Fund is passively managed and remains fully invested during all market cycles and economic conditions.

As of November 2024, the C Fund has an annualized standard deviation of 18.1%. This measures the volatility of the fund, indicating the tendency of its returns to rise or fall drastically over a short period. The higher the standard deviation, the more volatile the fund. The C Fund's standard deviation is higher than that of the G Fund (guaranteed not to lose money) and the F Fund (US bonds), but lower than that of the S Fund (small-cap US stocks) and the I Fund (international stocks).

The C Fund is considered one of the more aggressive TSP funds and is very volatile in the short term. Its returns move up and down with the prices of the stocks in the S&P 500 Index, and there is a risk that the fund's investments will not grow enough to offset inflation. However, investing in the C Fund offers the opportunity to gain from the potential growth of the US economy and corporate profits, which will be reflected in increasing stock prices and dividends.

The C Fund is not suitable for investors approaching retirement or planning to withdraw funds soon, as it is very difficult to predict in the short term. However, for investors early in their careers, the C Fund can be a great choice as it offers the potential for high returns over the long term.

The S&P 500 Index Fund: A Smart Investment Move?

You may want to see also

C Fund's returns

The C Fund, or the Common Stock Index Investment Fund, is a US large-cap stock index fund that tracks the S&P 500 index. The S&P 500 index is an index of 500 large to medium-sized US companies traded on US stock markets, which together represent about 75-85% of the market value of the US stock markets. The C Fund's investment objective is to match the performance of the S&P 500 index. The C Fund holds all the stocks included in the S&P 500 index in virtually the same weights that they have in the index. The performance of the C Fund is evaluated based on how closely its returns match those of the S&P 500 index.

The C Fund is one of the more aggressive TSP funds, with high volatility in the short term but high returns in the long term. Since its inception, the C Fund has made an average annual return of 10.88-11%. As of 11/1/2024, the fund had a compound annual growth rate of 11%, an annualized standard deviation of 18.1%, and a Sharpe Ratio of 0.44. An initial investment of $1,000 on 8/31/1990 would have been worth $35,456 as of 11/1/2024. The YTD return of the C Fund was 21.43%, and the 1-year return was 37.08%. The 3-year return was 9.14%, the 5-year return was 15.10%, and the 10-year return was 13.04%. The Thrift Savings Plan Monthly Return for the C Fund was 2.13% as of 10/10/2024, compared to 2.42% the previous month and 4.77% the previous year. This was higher than the long-term average of 0.97%.

The C Fund is passively managed and remains fully invested during all market cycles and economic conditions. The C Fund is subject to stock market risk as the prices of the stocks in the S&P 500 index rise and fall during bull and bear markets. There is also a risk that the C Fund will not grow enough to offset inflation. However, investing in stocks also offers the opportunity to gain from the potential growth of the US economy and corporate profits, which is eventually reflected in increasing stock prices and dividends.

Pension Funds: Choosing the Right Investment for Your Future

You may want to see also

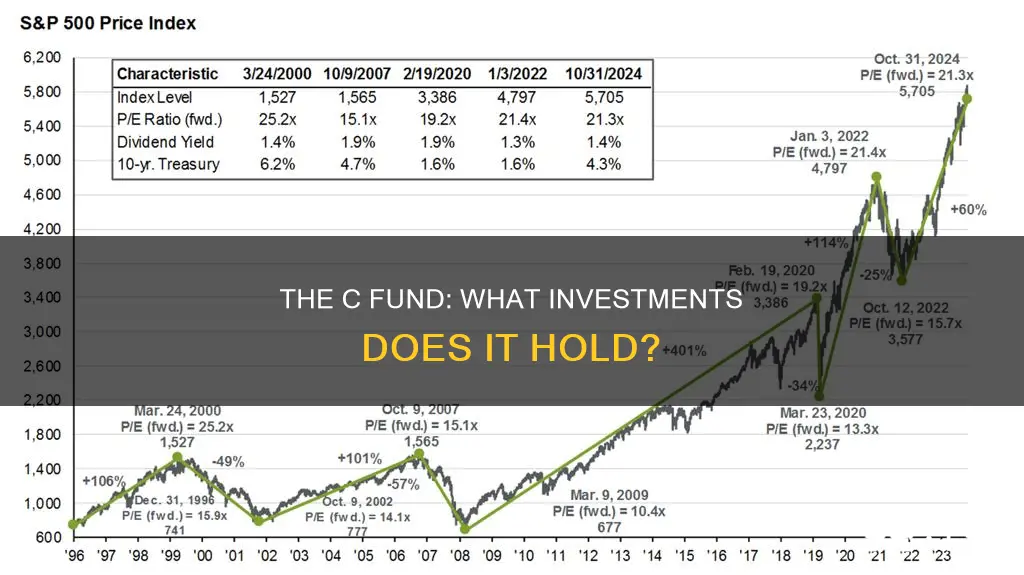

C Fund's historical performance

The C Fund, or the Common Stock Index Investment Fund, is part of the Thrift Savings Plan (TSP). It is a US large-cap stock index fund that tracks the performance of the Standard and Poor's 500 (S&P 500) Index, a broad market index made up of stocks of 500 large to medium-sized US companies. The S&P 500 Index represents approximately 75%-to-85% of the market value of the US stock markets.

As of November 1, 2024, the C Fund had a compound annual growth rate of 11.0%, an annualized standard deviation of 18.1%, and a Sharpe Ratio of 0.44. An initial investment of $1,000 on August 31, 1990, would be worth $35,456 as of November 1, 2024. The worst drawdown since inception was -55.2%.

The C Fund's performance can be evaluated by comparing its returns to those of the S&P 500 Index. As of December 31, 2023, the C Fund had assets of $339.0 billion, with top holdings in companies including Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL and GOOG), Meta Platforms Inc (META), and Berkshire Hathaway Inc (BRK.B).

The C Fund is considered a more aggressive fund due to its volatility in the short term, but it has proven to provide high returns over the long term. Since its inception, the C Fund has made an average annual return of 10.88%.

The C Fund can be a good investment option for those seeking growth in their investment capital, particularly if they are early in their careers and not planning to withdraw funds soon.

Smart Ways to Invest 1000 Rupees in Mutual Funds

You may want to see also

C Fund's millionaire TSP participants

The C Fund is a US stock index fund that is part of the Thrift Savings Plan (TSP). It is invested in common stocks of the 500 companies in the Standard & Poor's 500 (S&P 500) Index, which is a broad market index of large to medium-sized US companies. The C Fund is known as one of the more aggressive TSP funds, offering the potential for high returns over the long term, but with higher volatility in the short term.

The C Fund has produced many millionaire TSP participants, particularly those who have steadily invested in it since its inception in 1988. These investors have become millionaires despite downturns in the market over the years. Those who contributed the maximum deferral limit from their pay each year, along with the government match, are likely to have accumulated even larger sums.

The C Fund's performance is tied to the performance of the S&P 500 Index, which includes well-known companies such as Microsoft, Alphabet, Meta Platforms, and JPMorgan Chase. As of December 31, 2023, the C Fund had assets of $339 billion and an average annual return of 10.88% since its inception.

To become a TSP millionaire, it is important to have good habits and discipline when it comes to investing. While there is no single factor that guarantees millionaire status, a commitment to education and strategy is key. It is also important to remember that the C Fund carries market and inflation risk, and its returns may not always be positive.

Overall, the C Fund provides investors with exposure to a diverse range of large and mid-sized US companies and has the potential to generate significant wealth over the long term.

Mutual of America Funds: Worthy Investment or Risky Business?

You may want to see also

Frequently asked questions

The C Fund is a Common Stock Index Investment Fund, which is a US large-cap stock index fund that tracks the S&P 500 index.

The C Fund is invested in common stocks of the 500 companies in the Standard & Poor's 500 (S&P 500) Index.

The C Fund's investment objective is to match the performance of the S&P 500 index, which is made up of stocks of 500 large to medium-sized US companies.

The C Fund offers the opportunity to experience high returns over the long term. It has a low annual expense ratio of 0.025%, making it a low-cost way to gain diversified exposure to the US stock market.

The C Fund is subject to market risk and inflation risk. Returns fluctuate with the prices of stocks in the S&P 500 index and there is no guarantee that investments will offset inflation.