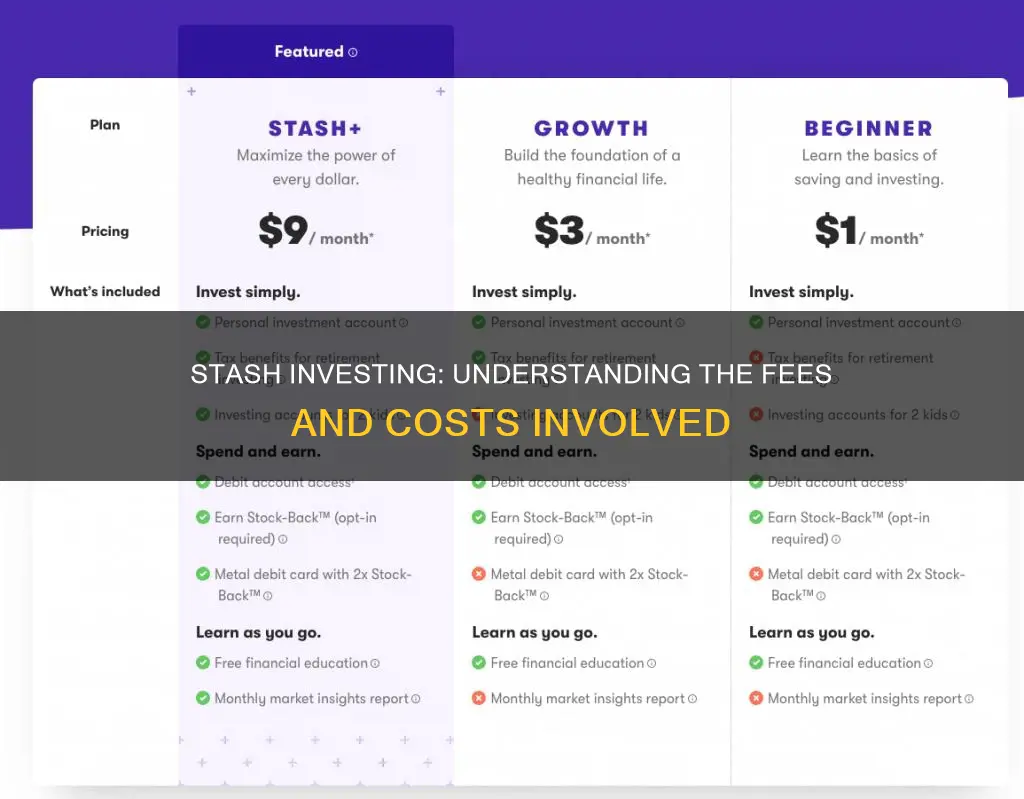

Stash is a financial services app that offers a robo-advisor investing service, retirement and brokerage accounts, and a debit card with stock rewards. It has two pricing tiers: Stash Growth for $3 a month, and Stash+ for $9 a month. Both options offer customers access to financial counselling services, a brokerage account, a Roth or traditional IRA, a Smart Portfolio, life insurance coverage, and a bank account with the associated Stock-Back® Card.

The main difference between the two tiers is that Stash+ includes more extensive financial counselling, two custodial accounts, a higher rewards rate on the debit card, and more life insurance coverage.

Stash's fees are higher than some of its competitors, and it doesn't offer tax-loss harvesting or automated IRA portfolio management.

| Characteristics | Values |

|---|---|

| Subscription plans | Stash Growth ($3/month), Stash+ ($9/month) |

| Investment options | Stocks, ETFs, fractional shares |

| Account types | Personal brokerage, traditional IRA, Roth IRA, custodial, bank account |

| Tools | Stock-Back® Card, Stock Round-Ups, auto-invest, budgeting tools |

| Minimum investment | $5 |

| Fees | Monthly subscription fees, expense ratios, transfer fees, ACAT fee |

What You'll Learn

Stash Growth costs $3/month

Stash Growth is the basic plan offered by Stash, a mobile financial service that provides investment advice and portfolio management. For a monthly fee of $3, Stash Growth offers a range of features to help users build wealth. These features include a basic personal brokerage account, Stash Banking, retirement investing, and access to Smart Portfolios. Stash Growth also provides financial guidance and insurance coverage of up to $1,000 through Avibra.

Stash Growth is designed for beginner investors who want a simple and straightforward way to invest and manage their finances. It offers a low-cost option with no trading or commission costs, making it accessible to those who are new to investing. With Stash Growth, users can invest in a diverse range of stocks and ETFs, set up automatic saving and investing tools, and receive "stock-back" rewards. The plan also includes early access to direct deposits, allowing users to receive their paychecks up to two days earlier.

Stash Growth is a good option for those who want to invest with a hands-on approach while still having access to automated features. It provides the tools and guidance needed to make informed investment decisions. The plan's low cost and educational resources make it ideal for those who want to learn about investing and build their wealth over time.

Stash Growth is just one of the subscription plans offered by Stash. For a higher monthly fee, users can upgrade to Stash+, which includes additional features such as custodial accounts, higher "stock-back" rewards, and increased insurance coverage.

Elite Investors: Strategies for Long-Term Wealth Creation

You may want to see also

Stash+ costs $9/month

Stash+ is the premium plan offered by Stash, a financial services app. It costs $9 per month and includes a range of features to help users save and invest.

Stash+ includes everything offered in the Stash Growth plan (which costs $3 per month), plus the following:

- A Roth or traditional IRA retirement account.

- $10,000 of life insurance coverage through Avibra, compared to $1,000 for Stash Growth.

- Investment accounts for two children (custodial UGMA/UTMA accounts).

- A metal debit card with 2x Stock-Back™.

- A monthly market insights report.

Stash+ also offers more extensive financial counselling than Stash Growth, although this does not include personalised advice from a human financial advisor. Instead, it takes the form of written guides and how-to articles.

Harvesting Salac Berries: HP Investment Strategies

You may want to see also

Stash offers a range of investment accounts

Stash Growth is aimed at beginners and costs $3 per month. It offers a basic personal brokerage account, Stash Banking, retirement investing, and unlocks Smart Portfolios. It also offers financial guidance and provides access to up to $1,000 of life insurance through Avibra.

Stash+ is the premium plan, costing $9 per month. This plan includes everything offered in the Stash Growth plan, plus a higher level of financial counselling, two custodial accounts (meant for children), a higher rewards rate on the debit card (2X the stock rewards), and more life insurance coverage ($10,000 instead of $1,000).

Stash's subscription-based model is rare within the robo-advisor industry, as most providers charge a fee percentage for the assets held on the platform. However, the flat-fee pricing model becomes more favourable as your account size grows.

Stash also offers a retirement account option, Stash Retire, which follows the same investment model as Stash Invest. Stash Retire offers both Traditional and Roth IRAs and the same investment choices as a Personal Portfolio. This is included in the Growth and Stash+ plans and costs either $3 or $9 per month.

Stash also offers an online banking feature. The account comes with no overdraft or monthly maintenance fees and includes access to a large network of fee-free ATMs nationwide.

A Beginner's Guide to TD Direct Investing

You may want to see also

Stash offers a Stock-Back® Card

Stash is an online and mobile financial service, available through the App Store and Google Play. It offers a Stock-Back® Card, a debit card that lets you earn stock rewards.

The Stock-Back® Card is a feature of the Stash+ plan, which comes with a monthly flat fee of $9. This plan includes everything offered in the Stash Growth plan but includes a Roth or traditional IRA retirement account, $10,000 of life insurance coverage through Avibra, investing accounts for two kids, a metal debit card with 2x Stock-Back™ and a monthly market insights report.

The Stash Growth plan, which charges investors a monthly flat fee of $3, also offers a debit account, but it does not include the Stock-Back® Card.

The Stock-Back® Card rewards users with a percentage of their purchases back in stock. For example, when you shop at Walmart or Amazon, you’ll earn stock in those companies. When you spend at a local business, you’ll earn a stock or ETF from a preselected list.

Stash+ customers can earn 1% back in stock on all purchases up to $1,000 each month (subject to terms and conditions). Stash Growth customers earn 0.125% stock on all everyday purchases.

Investing Your Bonus: A Guide to Smart Money Moves

You may want to see also

Stash offers a Smart Portfolio

The Smart Portfolio is built by Stash's investment research team and generally follows a passive, risk-optimized approach to building wealth. The portfolio features a sliding scale to adjust the risk level to your preferences, goals, and financial situation. The asset allocation is invested in ETFs and is broadly invested across domestic, international, and bond holdings.

The Smart Portfolio is Stash's robo-advisor, and it is limited to ETFs as the asset used. Investors can access a fuller range of assets in self-directed accounts, but that is outside of the robo-advisor program.

Stash offers two subscription plans: Stash Growth and Stash+. The Growth plan charges a monthly flat fee of $3 and includes a debit account, automatic saving and investing tools, free financial education, "stock-back" rewards, personalized guidance, and $1,000 of life insurance coverage through Avibra. The Stash+ plan comes with a monthly flat fee of $9 and includes everything in the Growth plan, plus a Roth or traditional IRA retirement account, $10,000 of life insurance coverage through Avibra, investing accounts for two kids, a metal debit card with 2x stock-back, and a monthly market insights report.

The Smart Portfolio requires a minimum investment of $5 to use this feature, which does not offer tax-loss harvesting.

Sound Investment Principles: Robin Hood Foundation's Strategy

You may want to see also

Frequently asked questions

Stash offers two pricing tiers: Stash Growth and Stash+. Stash Growth costs $3 per month, while Stash+ costs $9 per month. Stash Growth includes a basic personal brokerage account, Stash Banking, retirement investing, and unlocks Smart Portfolios. Stash+ includes everything in Stash Growth, plus more extensive financial counselling, two custodial accounts (meant for your children), a higher rewards rate on the debit card (2X the stock rewards), and more life insurance coverage ($10,000 instead of $1,000).

Stash Growth costs $3 per month and includes a basic personal brokerage account, Stash Banking, retirement investing, and unlocks Smart Portfolios. It also offers financial guidance and provides access to up to $1,000 of life insurance coverage through Avibra.

Stash+ costs $9 per month and includes everything in Stash Growth, plus more extensive financial counselling, two custodial accounts (meant for your children), a higher rewards rate on the debit card (2X the stock rewards), and more life insurance coverage ($10,000 instead of $1,000).

There is a $75 transfer-out fee for transferring your account out of Stash.

Fractional shares on Stash start at $0.05 for investments that cost $1,000 or more per share.