Cashing out your Vanguard investments is a straightforward process, but there are some important considerations to keep in mind. Firstly, it's essential to understand the purpose of your withdrawal and whether it aligns with your financial goals. Withdrawing for short-term needs or emergencies is different from cashing out for a planned expense or investment. Vanguard offers various investment options, such as stocks, mutual funds, ETFs, and bonds, each with its own set of advantages and considerations. It's important to evaluate the potential impact on your portfolio's diversification, risk exposure, and future growth. Additionally, be mindful of any fees or requirements associated with the withdrawal process, as these can vary depending on the type of account and investment you hold.

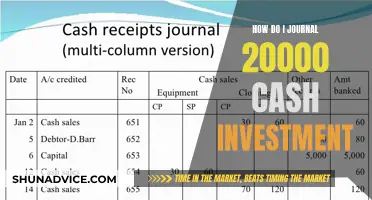

| Characteristics | Values |

|---|---|

| Pros of cashing out Vanguard investments | Cash investments can be used for short-term goals like emergency savings or an upcoming vacation because they're low risk and highly liquid. |

| Cons of cashing out Vanguard investments | Cash investments may result in lower returns and lack the earning potential of other asset classes, such as stocks and bonds. |

| How to withdraw cash from Vanguard investments | Log into your Vanguard account, go to 'Payments' from the left-hand menu, choose the 'Money out' tab, and follow the on-screen instructions. |

| How to transfer Vanguard investments to another firm | Visit Vanguard's Personal Investor homepage, select 'Open an Account', select the transfer option, select the type of account that is moving from your other firm, connect directly to your account at your other firm, and tell Vanguard where the assets should go. |

What You'll Learn

Pros and cons of cashing out Vanguard investments

Pros of cashing out Vanguard investments:

- Cash investments can be beneficial for short-term goals such as emergency savings or vacations because they are low-risk and highly liquid.

- Cash investments can be easily transferred between your bank and Vanguard accounts, providing easy access to your money.

- Cash investments can be a good option if you want to eliminate the stress of deciding when or how often to invest.

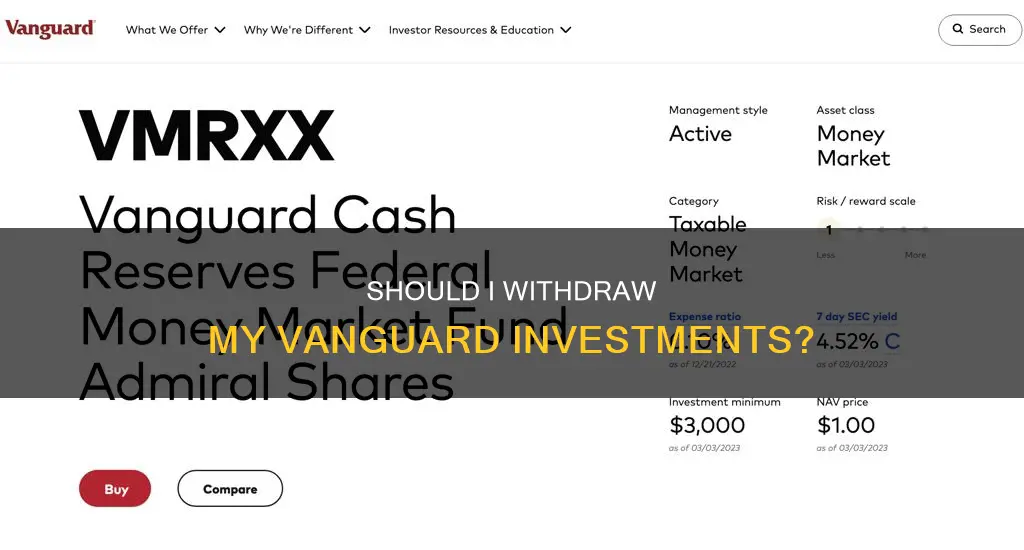

- Vanguard offers a range of cash investment options, including the Vanguard Cash Plus Account, money market funds, and brokered certificates of deposit (CDs).

Cons of cashing out Vanguard investments:

- Cash investments may not be ideal for long-term goals, such as retirement, as they lack the earning potential of other asset classes like stocks and bonds.

- When inflation increases, cash investments may result in lower returns, and you run the risk of not meeting your financial goals.

- Cash investments may not be suitable for active traders as Vanguard's trading platform is basic and lacks analytical and educational tools.

- Some Vanguard funds have investment minimums of $1,000 to $3,000, which may be too high for beginner investors.

Strategies for Investing Surplus Corporate Cash: A Comprehensive Guide

You may want to see also

How to cash out of Vanguard investments

When it comes to cashing out of Vanguard investments, there are a few things to consider. Firstly, it's important to understand the potential impact on your savings and retirement plans, as well as any associated costs and penalties.

- Understand the implications: Cashing out your retirement plan balance can have a significant impact on your savings and future retirement plans. You may also owe money to the IRS, including taxes and penalties, which could erase years of progress. Carefully consider your options and, if necessary, consult a financial advisor.

- Log into your Vanguard account: To initiate the withdrawal process, log into your Vanguard account.

- Navigate to the Payments section: From the left-hand menu, go to "Payments" and then choose the "Money Out" tab.

- Select the amount and withdraw: Any money held as cash and available for withdrawal will be displayed. Choose the "Withdraw Cash" option and follow the on-screen instructions.

- Wait for the funds to be transferred: Withdrawing cash from your Vanguard account typically takes 1 to 3 working days to be paid into your bank account.

- Track your transaction status: You can monitor the status of your withdrawal by checking the "Transactions" and "Cash Statement" tabs in your Vanguard account.

- Sell funds if needed: If you do not have available cash in your Vanguard account, you may need to sell funds to access your money. This process can take 7 to 12 working days, depending on the fund's settlement period.

- Contact Vanguard for managed investments: If Vanguard chooses and manages your investments, you'll need to send them a secure message with the amount you wish to withdraw. They will handle the rest of the process for you.

Remember, cashing out of Vanguard investments can have consequences for your financial goals, particularly for long-term retirement planning. It may be more beneficial to explore other options, such as leaving your money in your former employer's plan, rolling it over to a new employer's plan, or moving it to an IRA. These options can provide a wider range of investment choices and potential tax advantages.

Operating vs Investing: Where Do Customers Fit in Cash Flow?

You may want to see also

Vanguard retirement accounts

Vanguard retirement funds are a great choice for retirement investing, thanks to their low-cost structure and high quality. Vanguard is a mutual company, meaning that when you invest in Vanguard funds, you become a partner as well as a customer. The company has a well-earned reputation for low fees and reasonable expenses, making it well-suited for long-term investing.

Vanguard offers a range of retirement funds, including the Vanguard Target Retirement 2050 Fund, the Vanguard LifeStrategy Growth Fund, and the Vanguard 500 Index Admiral Shares. These funds are designed to be one-fund solutions for retirement investing, adjusting their allocation of stocks and bonds over time as the target retirement date nears.

For those seeking a more aggressive fund, the Vanguard LifeStrategy Growth Fund (VASGX) is about 80% stocks and 20% bonds. This fund is best used when you have more than five years until you plan to withdraw your money. If you're looking for a more conservative option, the Vanguard LifeStrategy Income Fund (VASIX) may be a better choice, with 20% stocks and 80% bonds.

Vanguard also offers the Vanguard Intermediate-Term Bond Index Admiral Shares (VBILX), which provides a nice, moderate-risk fixed-income option. This fund splits its assets between corporate bonds and U.S. government bonds, with maturities mostly ranging from five to ten years.

In addition to these funds, Vanguard offers the Vanguard Dividend Appreciation Index Fund (VDADX), which focuses on high-quality companies with growing dividends, and the Vanguard High-Yield Tax-Exempt Fund (VWAHX), which invests in municipal bonds to help minimize taxes on retirement portfolios.

Vanguard also provides retirement accounts such as the Vanguard Cash Plus Account, money market funds, and brokered certificates of deposit (CDs). These options are suitable for short-term goals, providing low-risk and highly liquid investment opportunities. However, for long-term retirement goals, investing in a diversified portfolio of asset classes like stocks and bonds can be more beneficial due to their higher earning potential.

A Guide to Investing in Cash-Flow Websites

You may want to see also

Vanguard investment alternatives

When considering alternatives to Vanguard, it is important to note that Vanguard offers a wide range of investment options, including stocks, bonds, and cash investments. Here are some alternatives with a similar range of investment options:

- Interactive Brokers: This broker provides access to all asset classes and is available internationally.

- Fidelity: A US stockbroker with no account fees, $0 commission trades, and no minimums to open an account.

- Charles Schwab: A US discount broker with comprehensive research tools, a wide range of products, and low fees.

- Zacks Trade: A US discount broker offering comprehensive research tools, a wide product selection, and low fees.

- Webull: A US discount broker with easy-to-use platforms and zero-commission trading.

- SoFi Invest: A US discount broker ideal for beginners with zero-commission trading and a focus on the US market.

- Merrill Edge: A US discount broker with low fees, quick account opening, and simple platforms.

In addition to the above, there are other alternatives to Vanguard that focus on specific types of investments or have a more limited range of investment options:

- Alpaca Trading: A US API broker ideal for traders interested in algorithmic stock trading.

- Robinhood: A US zero-fee discount broker.

- EToro: A global social trading broker.

- Trading 212: A UK and Europe-based broker offering zero-commission stock trading.

- Betterment: A robo-advisor service that provides investment advice and management for a fraction of the cost of most providers.

- Acorns: An app that helps users invest spare change and provides access to a range of investment options.

- Fidelity Digital Assets: Manages bitcoin and other digital assets for clients while keeping assets under advisory.

These alternatives to Vanguard offer similar products and target similar clients. When considering an alternative, it is important to compare key factors such as fees, deposit and withdrawal options, trading platforms, and the range of markets and products available.

Cashing in on Investments: A Meryl Lynch Guide

You may want to see also

Vanguard customer support

Dear [Recipient],

Thank you for contacting Vanguard Customer Support. We understand that you are considering cashing out your Vanguard investments and are happy to provide you with some information to help you make an informed decision.

At Vanguard, we offer a range of investment options, including cash investments, stocks, and bonds. Each investment type has its own benefits and risks, and the best choice for you will depend on your financial goals and risk tolerance.

Cash investments, such as our Vanguard Cash Plus Account, money market funds, and certificates of deposit (CDs), are suitable for short-term goals and provide high liquidity and minimal market risk. These options are ideal if you need access to your money in the near future, such as for an emergency fund, a vacation, or a down payment on a large purchase. They also offer a competitive annual percentage yield (APY) and easy online transactions.

On the other hand, investments in stocks and bonds have a higher potential for returns over the long term. By diversifying your portfolio across different asset classes and markets, you can increase your earning potential and protect yourself from unnecessary losses during market downturns.

If you are considering cashing out your Vanguard investments, we recommend evaluating your financial goals and risk tolerance. If you need the funds for short-term goals or would like easier access to your money, cashing out could be a good option. However, if your goals are long-term and you are comfortable with the risks, staying invested may be more beneficial.

It's important to remember that investing involves risks, and past performance does not guarantee future results. Before making any decisions, be sure to consider your own financial situation and seek advice from a financial advisor if needed.

If you have any further questions or would like more information about our investment options, please don't hesitate to contact us again. We are always happy to help.

Best regards,

[Vanguard Customer Support Team]

Cashing Out Your SoFi Investment: A Step-by-Step Guide

You may want to see also