Low-cost investment funds, also known as index funds, are a type of mutual fund that pools money from a group of investors and constructs a portfolio to match a particular stock index, like the S&P 500 or the Dow Jones Industrial. The performance of an index fund is usually on par with the performance of the index it tracks.

Index funds are passively managed, meaning that instead of human beings deciding which stocks to include, a computer tracks the market and rebalances the fund as needed. This makes them a low-cost way to invest, as there are no (or low) sales commissions and low operating expenses. They are also tax-efficient, as there is generally very little buying and selling.

Index funds are a good option for those who don't have the time or resources to actively manage their investments, as they don't require much knowledge about investing to succeed. They are also a good option for those who want to diversify their portfolio, as they are usually well-diversified and reduce risk in a turbulent market.

| Characteristics | Values |

|---|---|

| Type | Exchange-traded fund (ETF) or mutual fund |

| Investment strategy | Passive indexing |

| Investment focus | Broadly diversified index funds, sector-specific index funds, large-cap, mid-cap, small-cap, value stock, growth stock, dividend stock |

| Investment management | No professional investment managers |

| Fees | Low expense ratios or annual management fees |

| Investment minimums | Low investment minimums or no minimums |

| Tax efficiency | Tax-efficient |

What You'll Learn

Low-cost index funds vs. mutual funds

Index funds and mutual funds are both investment options that allow you to diversify your portfolio without having to hand-pick individual stocks. However, there are some key differences between the two.

Management style

Index funds are passively managed, meaning they aim to replicate the performance of a specific market index, such as the S&P 500. On the other hand, mutual funds can be actively or passively managed. Actively managed mutual funds aim to outperform the market, while passively managed mutual funds aim to mimic the performance of market indices.

Investment objective

The objective of an index fund is to mirror the performance of the underlying index as closely as possible. In contrast, the objective of an actively managed mutual fund is to outperform the index by generating higher returns through expert investment decisions.

Cost

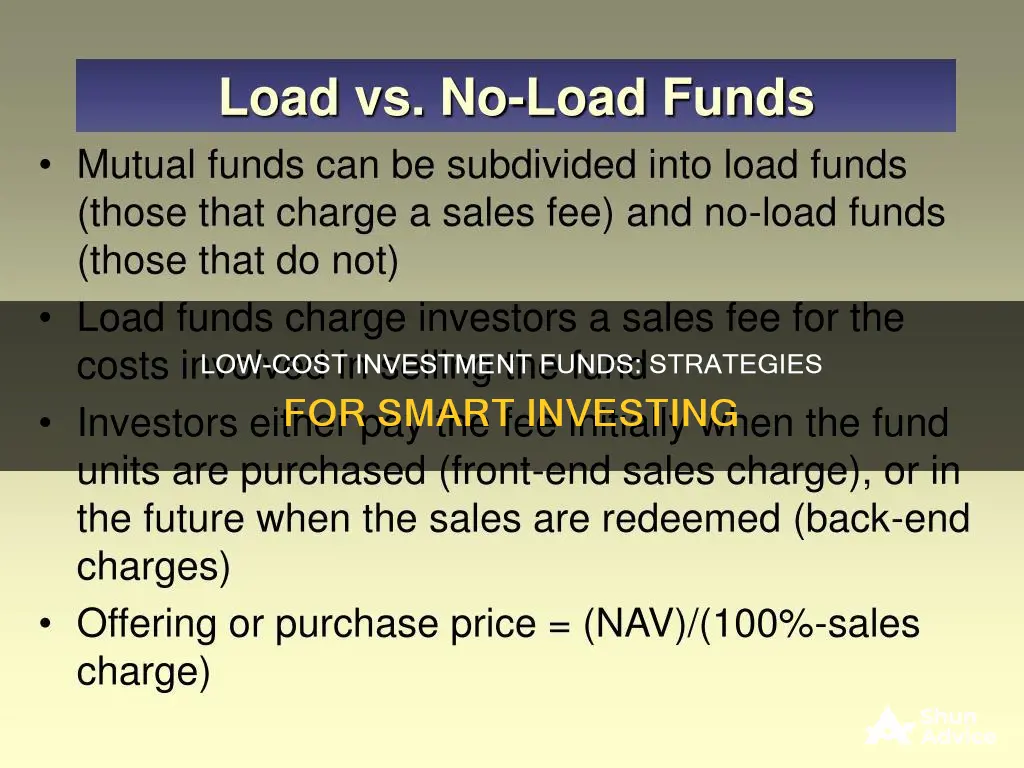

Index funds typically have lower fees than actively managed mutual funds because they are passively managed and require less work. Actively managed mutual funds have higher fees to cover the salaries, bonuses, and benefits of the fund managers, as well as marketing and office space costs. These higher fees can eat into the returns generated by the fund, potentially resulting in underperformance compared to index funds.

Performance

Index funds have a relatively predictable performance as they are designed to match the performance of the underlying index. In contrast, the performance of actively managed mutual funds can be less predictable as it depends on the investment decisions made by the fund managers.

Risk

Actively managed mutual funds can be riskier than index funds because they are actively trying to beat the market. Poor investment decisions by the fund managers can hurt the fund's performance. Additionally, actively managed funds may be more heavily weighted towards a few large companies, increasing the investor's risk if those companies underperform.

Tax efficiency

Index funds tend to be more tax-efficient than actively managed mutual funds because they have lower turnover rates, resulting in fewer capital gains distributions. However, some mutual fund managers use tax management strategies to offset gains against losses and hold stocks for the long term, resulting in lower tax rates.

The choice between index funds and mutual funds depends on your investment goals, risk tolerance, and time horizon. Index funds are generally a good option for long-term, passive investors who want a low-cost, diversified investment. Actively managed mutual funds may be more suitable for those seeking higher returns and are willing to take on more risk.

Understanding Federal Funds Rates, Dividends, and CODs

You may want to see also

Passive indexing

Passive investing is a long-term strategy for building wealth by buying securities that mirror stock market indexes and holding them for the long term. It is a passive strategy because it does not require investors to actively hunt for investments; they simply buy and sell the investments that their target benchmark trades.

Passive investing is typically done by investing in a mutual fund or exchange-traded fund (ETF) that mimics the index's holdings. This is often done through index funds, which are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. They are a low-cost way to track a specific group of investments, which can be more broadly diversified than individual stocks and simpler to buy than each of the individual holdings within the index.

Index funds are passively managed and, therefore, often have low expense ratios. They are also tax-efficient, as they have lower turnover rates, resulting in fewer capital gains distributions.

The primary difference between ETFs and index funds is that ETFs can be traded during market hours like stocks. ETFs cut out the middleman, the mutual fund company, and are often cheaper to buy than index funds.

Passive investing has several benefits, including:

- Lower maintenance: There is no need to constantly track the performance of your investments as a passive investor.

- Steady returns: Passive funds have historically outperformed active funds in the long term.

- Lower fees: Passive investing does not require as much buying and selling, which can lead to lower expense ratios.

- Lower capital gains taxes: Passive investors hold assets for the long term, resulting in lower taxes.

- Lower risk: Passive investing can lower risk by investing in a broad mix of asset classes and industries.

However, there are also some drawbacks to passive investing, including:

- Limited investment options: Investors cannot handpick each investment in an index fund or ETF.

- May not get above-market returns: Passive investing aims to match the market average, not exceed it.

Best Funds to Invest in During a Recession

You may want to see also

Exchange-traded funds (ETFs)

ETFs are similar to mutual funds in that they both offer diversification benefits. However, ETFs are bought and sold from other owners on stock exchanges throughout the day, while mutual funds are bought and sold from the issuer based on their end-of-day price. ETFs are also more transparent than mutual funds, as their holdings are typically published online daily. Additionally, ETFs are more tax-efficient in the US, as investors generally realise capital gains only when they sell their shares for a gain.

ETFs are similar to stocks in that they are traded on exchanges and have unique ticker symbols. However, ETFs differ from stocks in that they represent a basket of stocks and other investments, while stocks represent a single company.

ETFs can be categorised based on the types of investments they hold. Here are some common types:

- Stock ETFs: These comprise stocks and are typically meant for long-term growth.

- Commodity ETFs: These let you bundle raw goods like gold, coffee, and crude oil into a single investment.

- Exchange-traded notes (ETNs): ETNs are technically not ETFs, but they track a basket of assets and are traded on exchanges. They differ from ETFs in that they don't own the underlying assets but rather track their value indirectly.

- Bond ETFs: These don't have a maturity date and are used to generate regular cash payments for the investor.

- International ETFs: These provide an easy and less risky way to invest in foreign stocks and specific country blocs.

- Crypto ETFs: These offer exposure to cryptocurrencies like Bitcoin and Ethereum.

- Sector ETFs: These provide exposure to specific sectors like healthcare, finance, or industrials.

- Leveraged ETFs: These aim to amplify the returns of the index they track by two or three times but also amplify losses to the same degree.

ETFs vary in cost, with share prices ranging from single to triple digits. It's important to consider the fund's expense ratio, which is typically low for passively managed ETFs. The creation and redemption of ETF shares involve the purchase or sale of the underlying assets by "authorised participants", who are typically institutional investors.

ETFs are a popular choice due to their low fees, instant diversification, and ease of trading. However, it's important to evaluate them based on management costs, commission fees, how they fit into your portfolio, and their investment quality.

Mutual Fund Investment: Answers to Your Questions

You may want to see also

Broad diversification

Low-cost investment funds, also known as index funds, are a type of investment fund that offers a cost-effective way to diversify your portfolio. They are typically either a mutual fund or an exchange-traded fund (ETF) and are designed to track a preset basket of stocks or an index.

Index funds are popular with investors because they provide ownership of a wide variety of stocks, greater diversification, and lower risk, usually at a low cost. Broad diversification is a fundamental component of index funds, and it helps to mitigate risk. By investing in a variety of different stocks or assets, investors can reduce the impact of any one investment performing poorly.

When it comes to broad diversification, there are a few key things to keep in mind:

- Market Coverage: Index funds can provide exposure to a wide range of markets, including the total U.S. stock market, specific sectors like technology, or international markets. For example, the Vanguard Total Stock Market ETF (VTI) tracks the total U.S. stock market, while the iShares Core U.S. Aggregate Bond ETF (AGG) provides exposure to the broad bond market.

- Number of Holdings: Broad diversification also involves holding a large number of individual stocks or assets. For instance, the Vanguard Total Stock Market ETF (VTI) holds over 3,700 stocks, while the Vanguard Total World Stock Index Fund Admiral Shares (VTWAX) holds over 9,900 global stocks.

- Market Capitalization: Index funds can provide diversification across different market capitalizations, including large-cap, mid-cap, and small-cap companies. This helps investors tailor their portfolio according to their risk tolerance and investment goals.

- Index Composition: The composition of the index being tracked also plays a role in diversification. For example, the S&P 500 is a benchmark index that includes 500 of the largest U.S. companies, while the Dow Jones Industrial Average tracks 30 large-cap stocks.

- Investment Types: In addition to stocks, index funds can also provide diversification across different investment types, such as bonds, commodities, foreign currencies, and more.

By investing in low-cost index funds with broad diversification, investors can benefit from reduced fees, lower risk, and exposure to a wide range of investments. This makes index funds an attractive option for those seeking a simple, cost-effective way to invest in the stock market.

Passive Fund Inefficiencies: How to Invest and Profit

You may want to see also

Low-cost index funds for beginners

Low-cost index funds are among the most advantageous investment vehicles for people focused on long-term gains. They are a type of exchange-traded fund (ETF) or mutual fund designed to track a certain benchmark index, such as the S&P 500. They are passively managed, keeping operating expenses low.

Understand the benefits

Low-cost index funds offer several advantages over other investment options:

- Minimal fees: Index funds have low expense ratios or annual management fees, allowing investors to generate superior returns over time by minimising costs.

- Diversification: Index funds provide exposure to a diverse range of securities, reducing the risk associated with investing in individual stocks.

- Simplicity and low maintenance: Index funds are a passive investment strategy, requiring minimal research and active management from the investor.

- Tax efficiency: Index funds generally have lower buying and selling activity, resulting in reduced capital gains taxes.

Choose the right fund for your goals

When selecting a low-cost index fund, consider the following:

- Index selection: Decide on the specific market index you want to track, such as the S&P 500, Nasdaq Composite, or Russell 2000.

- Performance and returns: Evaluate the fund's long-term performance and returns to gauge its potential for future growth.

- Costs and fees: Compare expense ratios and sales loads to identify the most cost-effective options.

- Suitability to your investment objectives: Ensure the fund aligns with your risk tolerance, diversification goals, and investment horizon.

Know where to invest

You can invest in low-cost index funds through a brokerage account or directly with a fund provider. When choosing a platform, consider the costs, features, and investment options available. Some brokers offer fractional shares of index funds, allowing you to invest with smaller amounts.

Examples of low-cost index funds

- Vanguard S&P 500 ETF: Tracks the S&P 500 index; expense ratio of 0.03%.

- Fidelity Total Market Index: Tracks the total US stock market; expense ratio information not available.

- Schwab S&P 500 Index: Tracks the S&P 500 index; expense ratio of 0.02%.

- IShares S&P 500 Index: Tracks the S&P 500 index; expense ratio information not available.

- Vanguard Large-Cap ETF (NYSEMKT: VV): Tracks large-cap companies; expense ratio of 0.04%.

- Schwab U.S. Large-Cap ETF (NYSEMKT: SCHX): Tracks large US companies; expense ratio of 0.03%.

- Vanguard Mid-Cap ETF (NYSEMKT: VO): Tracks mid-cap companies; expense ratio of 0.04%.

- IShares Core S&P Small-Cap ETF (NYSEMKT: IJR): Tracks small-cap companies; expense ratio of 0.06%.

Remember, investing in low-cost index funds offers a relatively simple and cost-effective way to enter the stock market, but it's important to conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Axis Blue Chip Fund: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

Investment funds are collective investment schemes that pool your money with other investors to give you a stake in a ready-made portfolio. Index funds are a type of investment fund that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are passively managed, meaning they don't actively pick securities or time the market. This results in lower fees for investors.

Low-cost investment funds offer a simple, no-fuss way to gain exposure to a broad, diversified portfolio at a low cost for the investor. They are passively managed and therefore often have low expense ratios. They can also provide attractive returns in bull markets as the market rises.

One drawback of low-cost investment funds is the lack of downside protection; in prolonged downturns, these funds can perform poorly in line with the broader market. They also lack flexibility as they are designed to mirror a specific market, so they decline in value when the market does.