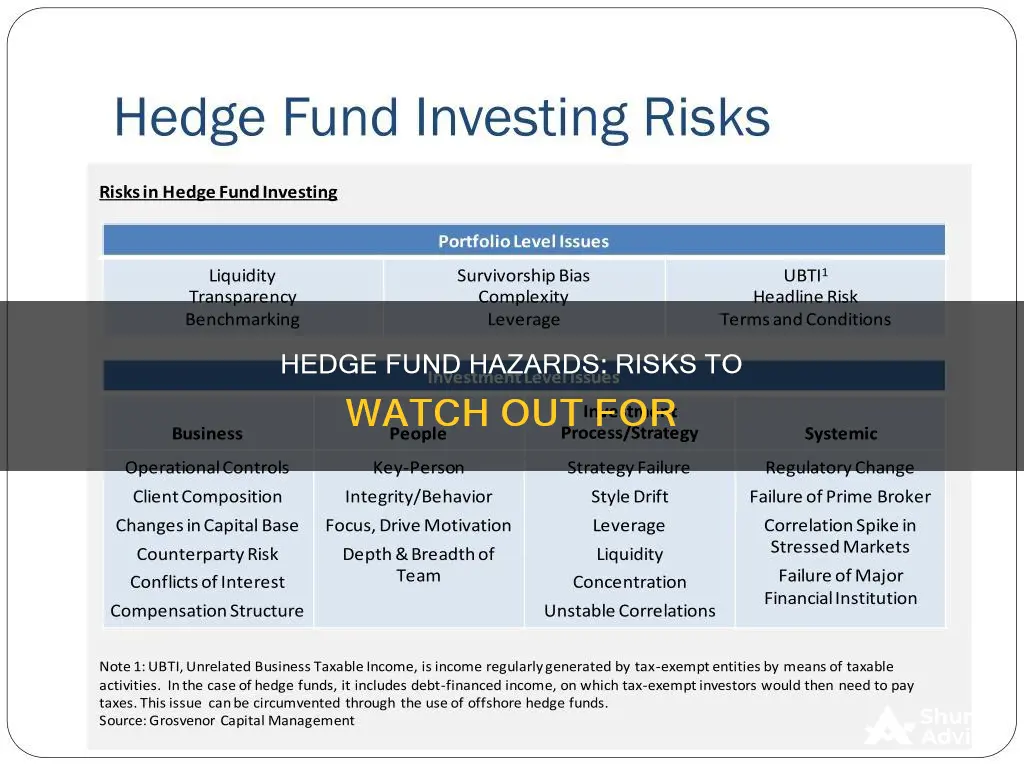

Hedge funds are a risky business. They employ aggressive investment strategies, like leveraged debt-based investing and short-selling, and they can purchase types of assets that other funds can't, such as real estate, art and currency. They are loosely regulated and charge higher fees than other funds. As a result, investors could lose some or all of their investment.

Hedge funds are also illiquid, meaning that investors may only be able to withdraw their money after a certain amount of time or during specific periods of the year.

There are also operational risks, such as the shortcomings of policies, procedures and activities of a hedge fund and its employees. For example, hedge funds often deal in the over-the-counter market, where it is difficult to value positions because they are not publicly traded and very illiquid.

Hedge funds are seen as an exclusive club that only certain investors qualify for. They are not intended for the average investor.

| Characteristics | Values |

|---|---|

| Risk of losing investment | High |

| Regulatory landscape | Not regulated by the SEC |

| Investment risk | High due to free reign of fund managers |

| Specific investment risks | Style drift, overall market risk, leverage |

| Risk of fraud | High due to lack of regulation |

| Operational risk | Includes shortcomings in policies, procedures and activities |

What You'll Learn

The risk of losing your investment

Hedge funds are risky investments. Investors could lose some or all of their money. Fund managers have a lot of freedom to make investment decisions, and the industry is not heavily regulated. This means that even a fund that seems safe could end up taking on unexpected levels of risk.

Hedge funds are not limited in the same ways that mutual funds are. They often use aggressive investment strategies, like leveraged or debt-based investing, and short-selling. They can also invest in types of assets that other funds can't, such as real estate, art, and currency. These strategies come with significant risk.

Hedge funds are seen as an exclusive club that only certain people qualify to join. They are usually targeted at wealthy investors. Minimum initial investments can range from $100,000 to upwards of $2 million. Because of the high level of risk, the U.S. Securities and Exchange Commission (SEC) places regulations on who can invest in hedge funds. To invest as an individual, you must be an institutional investor, like a pension fund, or an accredited investor. This means having a net worth of at least $1 million or an annual income over $200,000 ($300,000 if married).

Hedge funds are not very liquid. They may only allow investors to withdraw money after a certain amount of time has passed or during specific times of the year. This is known as the lock-up period, and it usually lasts for at least a year.

Hedge funds also carry high fees. They typically charge an asset management fee of 1-2% of the amount invested, plus a performance fee of 20% of the fund's profit. These fees can eat into overall returns.

Historically, hedge funds have underperformed stock market indices. From January 2009 to January 2018, they only beat the S&P 500 in a single year. In that year, 2018, hedge funds lost 4.07% compared to the S&P 500's loss of 4.38%.

Despite the risks, hedge funds can be a smart way to diversify your portfolio and hedge against market volatility if you qualify as an accredited investor and are willing to invest large amounts of money.

Debt Fund Investment: Strategies for Success

You may want to see also

Lack of regulation

Hedge funds are not regulated in the same way as other funds, such as mutual funds. This lack of regulation is a key quality of hedge fund investment risk. Fund managers have free rein over the investment decisions they make, and they are not bound by the same stringent reporting standards as other funds. This means that investors are exposed to a heightened risk of unethical behaviour on the part of the fund and its employees, including fraud.

Hedge funds are not required to disclose as much information as other funds, but investors should still review the fund's documents and agreements, which contain information about the fund's investment strategies, location, and anticipated risks. It is also important to understand the level of risk involved in the fund's investment strategies and whether they align with your personal investing goals, time horizons, and risk tolerance.

Additionally, investors should determine if the fund is using leverage or speculative investment techniques, as these techniques will typically invest both the investors' capital and borrowed money to make investments. Evaluating potential conflicts of interest disclosed by hedge fund managers and researching the background and reputation of the fund managers are also crucial steps in mitigating the risks associated with investing in hedge funds.

Furthermore, understanding how a fund's assets are valued is essential, as hedge funds may invest in highly illiquid securities, and valuations of fund assets will affect the fees that the manager charges. Hedge funds also employ a standard "2 and 20" fee system, which includes a 2% management fee and a 20% performance fee, which can eat into overall returns.

Finally, understanding how a fund's performance is determined is vital. Investors should know whether the performance reflects cash or assets received by the fund or the manager's estimate of the change in value. This understanding will help investors make informed decisions about the potential risks and returns associated with investing in hedge funds.

Federal Building Fund: Investment Strategies for Success

You may want to see also

Style drift

Hedge fund managers may have broad investment mandates that allow them to invest in a wide range of instruments without regard to position limits. This flexibility can make it challenging for investors to detect style drift. However, if a hedge fund manager faces litigation, the plaintiff's attorney will scrutinize whether the manager adhered to the investment program outlined in the fund's offering documents.

The risks of style drift are higher for alternative funds such as hedge funds compared to regulated funds. Investors in hedge funds should conduct due diligence by reviewing holdings reports, asset mix breakdowns, sector breakdowns, and other transparent information to identify style drift and understand the changing allocations of their investment fund.

To mitigate the risks of style drift, investors may consider choosing index funds, which offer a wide range of strategies, including style, theme, value, growth, and momentum. Customized index funds that track a specific style can be particularly effective in mitigating style drift risks.

Additionally, recent regulatory actions and investor litigation have brought style drift into sharper focus. The U.S. Securities and Exchange Commission (SEC) has charged fund managers with fraud for changing fund strategies without disclosing it to investors. Investor lawsuits arising from losses attributed to style drift are also becoming more common.

Emergency Funds: Invest or Save?

You may want to see also

Overall market risk

For instance, widening credit spreads pose the most significant threat to the performance of fixed-income funds. As these funds typically take long positions in corporate bonds and short positions in comparable treasuries, adverse economic shifts can cause corporate yields to increase while treasury yields decline. This dynamic widenes the spreads between positions, ultimately hurting the fund's performance.

Additionally, the complex and illiquid nature of hedge fund investments further exacerbates overall market risk. Hedge funds often invest in sophisticated financial instruments and follow intricate trading strategies that are typically employed by larger financial institutions with more robust risk management systems. This complexity raises concerns about the appropriateness of risk management practices within the hedge fund industry.

Furthermore, hedge funds' aggressive investment strategies, such as leveraged investing and short-selling, contribute to overall market risk. These strategies involve placing bets on investments seeking short-term gains, sometimes with borrowed capital. While these bets can pay off, they also carry the risk of significant losses.

To mitigate overall market risk, hedge fund managers often employ hedging strategies. They may invest a portion of the fund's assets in securities that move in the opposite direction of the fund's core holdings. For example, a hedge fund focused on a cyclical sector like travel may allocate some assets to a non-cyclical sector like energy, aiming to use positive returns from non-cyclical stocks to offset potential losses in cyclical stocks.

Smart Strategies for Investing $30,000 in Mutual Funds

You may want to see also

Leverage

There are two main types of leverage: explicit leverage and off-balance sheet leverage. Explicit leverage includes margin, short selling, and repurchase agreements, which appear on the fund's balance sheet. Off-balance sheet leverage includes futures, forwards, swaps, and other derivative contracts, where either all or part of the notional value of the contract is off-balance sheet.

Most hedge funds use at least some form of leverage. However, this practice can expose investors to risks they may not fully understand. It is crucial for investors to conduct due diligence and be aware of the potential risks associated with leverage. Additionally, stress testing and correlation testing are important tools to assess the impact of leverage on a fund's performance under extreme market conditions.

The use of leverage in hedge funds is also influenced by the lack of regulation in the industry. Unlike mutual funds, hedge funds are not as strictly regulated by the U.S. Securities and Exchange Commission (SEC). This allows hedge funds to employ more aggressive investment strategies, including leveraged and debt-based investing. However, this lack of regulation also increases the risk of fraud or unethical behaviour by fund managers.

In summary, leverage plays a significant role in the risks associated with investing in hedge funds. Investors should be aware of the potential pitfalls of using borrowed money to amplify investment returns. The complex nature of hedge fund investments and the lack of regulatory oversight further emphasize the importance of thorough research and due diligence before investing in hedge funds.

ICICI Prudential Bluechip Fund: Is It Worth Your Investment?

You may want to see also

Frequently asked questions

A hedge fund pools money from investors to buy securities or other types of investments. They employ aggressive investment strategies, like leveraged, debt-based investing and short-selling, and they can purchase types of assets other funds can’t invest in, like real estate, art and currency.

Hedge funds are considered riskier than most other investments. They use borrowed money, and risky investment strategies, like leveraged, debt-based investing and short-selling. There is also the possibility of fraud, regulatory action, or market illiquidity.

Due to the higher levels of risk associated with hedge funds, the U.S. Securities and Exchange Commission (SEC) places regulations on who can invest in them. To invest in hedge funds as an individual, you must be an institutional investor, like a pension fund, or an accredited investor. Accredited investors have a net worth of at least $1 million or annual individual incomes over $200,000.

Hedge funds charge an asset management fee that is 1% to 2% of the amount invested, plus a performance fee that is equal to 20% of the hedge fund’s profit.