Unit Investment Trust Funds (UITFs) are a type of investment vehicle that pools money from multiple investors to purchase a fixed portfolio of securities, such as stocks or bonds. UITFs are often centred around empowering investors to maximise the growth potential of their wealth while ensuring simplicity, transparency, and expert fund management. They are considered medium to long-term investments and are not suitable for those who need access to their funds at short notice. One of the main benefits of UITFs is their simplicity, as they are passive investments with a defined strategy. However, this can also be a downside, as the assets are not frequently bought or sold, and investments can be locked into a plan that cannot be changed.

What You'll Learn

- Unit Investment Trust Funds (UITFs) are open-ended pooled trust funds

- UITFs are ready-made investments that allow the pooling of funds from different investors

- UITFs are managed by professionals who carefully select financial instruments

- UITFs are considered medium to long-term investments

- UITFs are not the same as investment trusts

Unit Investment Trust Funds (UITFs) are open-ended pooled trust funds

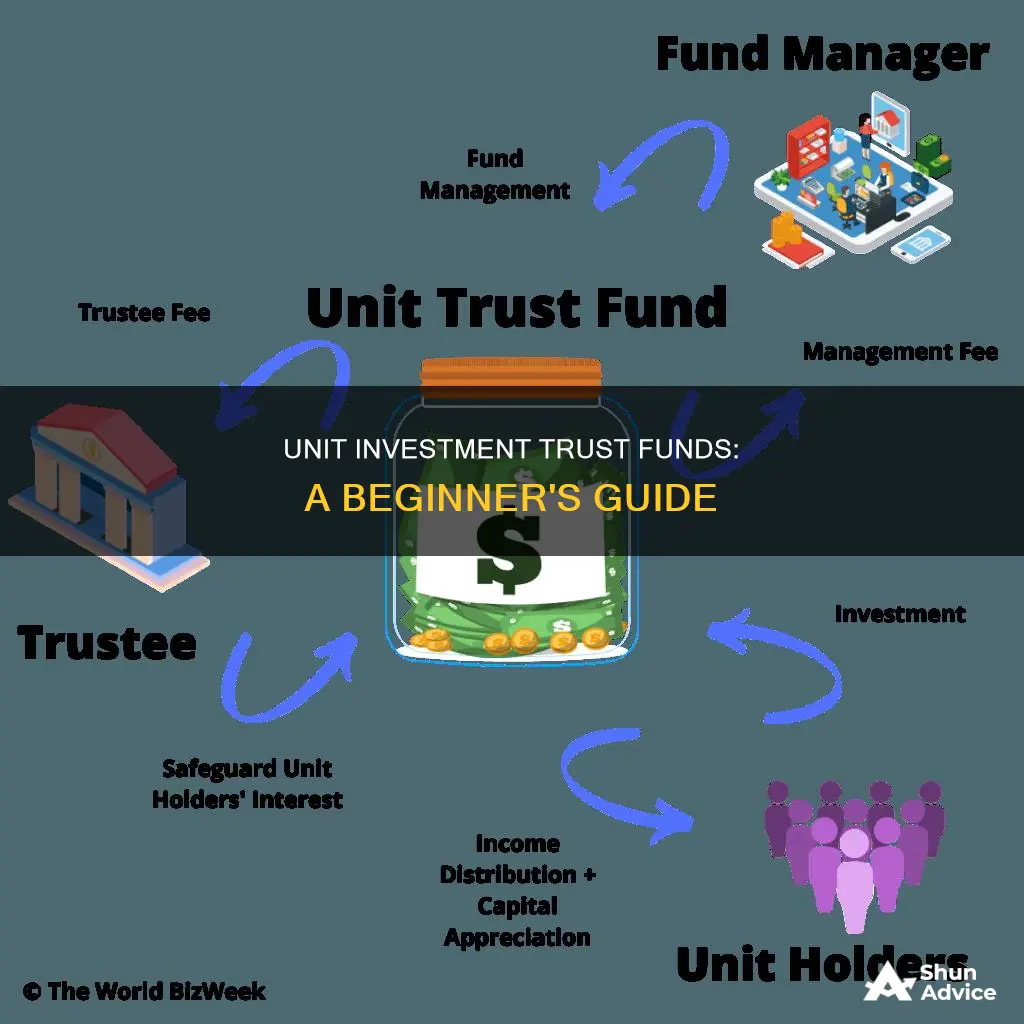

A Unit Investment Trust Fund (UITF) is an open-ended pooled trust fund, which means that it allows clients to invest or redeem their investments at any time and the UITF will continue to be managed with no predefined termination date. UITFs are ready-made investments that allow the pooling of funds from different investors with similar investment objectives. The pooled funds are managed by professionals who carefully select financial instruments like money market securities, bonds, and equities. The funds from various clients with similar investment objectives are pooled together into one fund, which the trustee invests in various types of securities with the aim of maximizing returns within reasonable risk levels.

Each UITF product is governed by a Declaration of Trust (or Plan Rules) which contains the investment objectives of the UITF as well as the mechanics for investing, operating, and administering the fund. UITFs are established and managed based on a set of investment objectives and strategies, and these have varying levels of risks and returns. UITFs may be denominated in Philippine Pesos, US Dollars, and acceptable third currencies.

There are four general major classifications of UITFs, listed according to ascending levels of risk, return, and investment time horizon:

- Money Market Funds: These funds are invested principally in short-term, fixed-income deposits and securities with a portfolio duration of one year or less.

- Bond Funds: The mandate of these funds is to invest in a portfolio of bonds and other similar fixed-income securities with portfolio durations that may exceed one year.

- Balanced Funds: The mandate of these funds is to invest in a diversified portfolio of bonds and stocks, with investments in stocks of up to a maximum of 40% to 60% of the fund, and the balance invested in fixed-income securities.

- Equity Funds: The mandate of these funds is to invest substantially in equities. Cash may be kept for liquidity and portfolio re-balancing purposes.

Investing in UITFs offers several benefits, including diversification, liquidity, affordability, better earnings potential, exemption from reserve requirements, professional fund management, transparency, and being a regulated product. However, it's important to note that UITFs are not deposit products and are not insured by the Philippine Deposit Insurance Corporation (PDIC). The performance of the funds and their underlying securities are not guaranteed, and there is a possibility of incurring losses.

Strategies for Investing Like a Hedge Fund Manager

You may want to see also

UITFs are ready-made investments that allow the pooling of funds from different investors

Unit Investment Trust Funds (UITFs) are a form of collective investment scheme that allows individuals to pool their money with other investors who share similar investment objectives. The pooled funds are then professionally managed, with experts carefully selecting financial instruments such as money market securities, bonds, and equities. UITFs are an excellent way to create a well-balanced portfolio that can withstand different market cycles.

UITFs are ready-made investments, meaning individuals can start investing with a small amount of money and add more funds as they become available. This makes UITFs a great option for those who want to start building their wealth but don't have a large sum to invest upfront. The funds are managed by a team of experienced managers, traders, and researchers who work together to maximize returns while minimizing risks.

One of the key advantages of UITFs is that they provide access to financial instruments that may not be readily available to individual retail investors. By pooling their funds with other investors, individuals can benefit from the expertise of seasoned fund managers who actively monitor the markets for investment opportunities. UITFs also offer better returns than traditional savings accounts and are highly competitive relative to peers.

Another benefit of UITFs is their transparency. UITF investors have access to information about the fund's performance, including the Net Asset Value per Unit (NAVPU), which is published at least weekly. This allows investors to make informed decisions about their investments and compare the performance of different funds. Additionally, each UITF is subject to an annual audit by an independent auditor, providing further transparency and accountability.

When considering investing in UITFs, it is important to remember that they are typically medium to long-term investments. Individuals should ensure they have the financial resources to stay invested for a reasonable period to maximize their earnings potential. UITFs may not be suitable for those who need immediate access to their funds, as there may be penalties for early withdrawal.

Seeking Investment Funds for Your Dream Zoo

You may want to see also

UITFs are managed by professionals who carefully select financial instruments

Unit Investment Trust Funds (UITFs) are managed by professionals who carefully select financial instruments to meet investors' goals. UITFs are a type of investment vehicle that pools money from multiple investors to purchase a fixed portfolio of securities, such as stocks, bonds, or other financial instruments. The fund is then managed by a team of experienced professionals, including managers, traders, and researchers, who work together to make investment decisions and maximise returns while minimising risk.

The selection of financial instruments is an important aspect of UITF management. These professionals carefully analyse and select a range of investments, such as money market securities, bonds, equities, and other types of securities, to create a well-balanced and diversified portfolio. This diversification helps to spread risk across various investments and issuers, providing a level of protection for investors.

The fund managers of UITFs have the expertise and skills necessary to make informed investment decisions. They employ various strategies, such as fundamental analysis, to determine which investments may outperform the market. They also consider factors like investment capacity, horizon, and risk profile to ensure that the selected financial instruments align with the investors' goals and risk tolerance.

The performance of UITFs is closely monitored and measured against benchmarks. Fund managers strive to consistently beat these benchmarks through their careful selection of securities and implementation of investment strategies. UITFs are subject to regulations and are required to disclose their portfolios regularly, providing investors with transparency and insight into their holdings and strategies.

Overall, UITFs offer investors access to a team of professionals who carefully select and manage a diverse range of financial instruments. This expert management aims to maximise returns, minimise risks, and help investors achieve their financial goals.

Launching a Hedge Fund: A Teen's Guide to Investing

You may want to see also

UITFs are considered medium to long-term investments

Unit Investment Trust Funds (UITFs) are pooled funds offered by the trust department of major banks. They are open-ended, meaning clients can invest or redeem their investments at any time, and are denominated in pesos or any other acceptable currency. UITFs are considered medium to long-term investments because they are subject to market volatility and are designed to maximise earnings potential over time.

UITFs are not suitable for those who need access to their funds in the immediate future. They are better suited to investors with financial resources who can stay invested for a reasonable period to maximise their earnings potential. UITFs are not actively traded, meaning that securities are not bought or sold unless there is a change in the underlying investment, such as a corporate merger or bankruptcy.

UITFs are also not the same as investment trusts, which are public limited companies that invest in other companies. UITFs are similar to mutual funds in that they are both open-ended pooled funds managed by professional fund managers and invested in a diversified basket of stocks, bonds, or other securities. However, a UITF buys units in a fund, whereas a mutual fund buys shares.

UITFs are ideal for those investing for retirement. The long-term nature of this goal allows investors to weather fluctuations in their funds. Even with fluctuations, investments in UITFs are generally on the growth side. The performance of a UITF depends on the fund chosen and the rules of the risk and return relationship. Riskier funds, like stock or equity funds, will generate higher returns than lower-risk funds like bond funds, but may experience negative growth in bad years.

Overall, UITFs are considered medium to long-term investments due to their potential for growth over time and the need for investors to stay invested to maximise their earnings.

Fat Tail Funds: Strategies for Investing in Uncertain Markets

You may want to see also

UITFs are not the same as investment trusts

Unit Investment Trust Funds (UITFs) are not the same as investment trusts. Here are some key differences:

Nature and Structure:

- UITFs are open-ended pooled trust funds, allowing clients to invest or redeem their investments at any time. In contrast, investment trusts are typically closed-end funds with a fixed number of shares.

- UITFs are operated and administered by a trust entity, while investment trusts are public limited companies.

- UITFs are denominated in specific currencies (such as pesos), while investment trusts are not necessarily currency-specific.

Investment Objectives and Strategies:

- UITFs have diverse investment objectives, including money market funds, bond funds, balanced funds, and equity funds. Investment trusts, on the other hand, focus on investing in other companies to generate returns.

- UITFs are managed by professionals who carefully select financial instruments like money market securities, bonds, and equities. Investment trusts may also be actively managed, but their primary objective is to invest in a diverse range of assets.

Geographical Presence:

UITFs are prevalent in countries like the Philippines, with regulations governed by the BSP. Investment trusts, on the other hand, are more common in Japan and the United Kingdom.

Risk and Returns:

- UITFs offer potential returns that are variable and cannot be guaranteed due to their marked-to-market valuation method. Investment trusts may trade at a premium or discount to their net asset value (NAV), creating opportunities for buying shares at a discount or selling them at a premium.

- UITFs carry various risks, including interest rate risk, market/price risk, liquidity risk, and credit risk. Investment trusts also carry risks, and investors should assess their financial goals and risk tolerance before investing.

It is important to understand these differences between UITFs and investment trusts to make informed investment decisions that align with your financial goals and risk appetite.

Unlocking Hedge Fund Investment in South Africa

You may want to see also

Frequently asked questions

A Unit Investment Trust Fund (UITF) is an open-ended pooled trust fund that allows multiple investors with similar investment objectives to pool their money into one fund, which is then managed by professionals. UITFs are denominated in pesos or any acceptable currency and are operated and administered by a trust entity.

Each UITF is governed by a Declaration of Trust, which outlines the investment objectives and mechanics of the fund. Investors purchase units of participation in the fund, representing their proportionate share in the fund's total value. The UITF trustee then invests in various types of securities, aiming to maximize returns within reasonable risk levels.

UITFs offer several benefits, including diversification, liquidity, affordability, better earnings potential, professional fund management, transparency, and regulation by financial authorities. UITFs also have low minimum investment requirements, making them accessible to a wider range of investors.