Investment management and financial management are distinct but complementary aspects of the financial services industry. Investment management involves handling a client's investment portfolio or a collection of assets, including buying and selling assets, devising short and long-term investment strategies, and managing asset allocation. Financial management, on the other hand, focuses on broader financial planning, budgeting, banking, and other financial duties. While investment management is a subset of financial management, it requires expertise in areas such as asset allocation, financial analysis, and portfolio strategy. Investment managers work with clients to understand their financial goals, risk tolerance, and investment horizons to make informed investment decisions. They also monitor the performance of their clients' portfolios and ensure alignment with the clients' objectives.

What distinguishes investment management from financial management?

| Characteristics | Investment Management | Financial Management |

|---|---|---|

| Definition | The professional management of various securities (such as stocks and bonds) to meet specified investment goals for the benefit of investors. | N/A |

| Clients | Individual or institutional investors | N/A |

| Investment types | Stocks, bonds, commodities, precious metals, real estate, mutual funds, exchange-traded funds, real estate investment trusts | N/A |

| Roles and responsibilities | Financial planning, investing, portfolio management, buying and selling assets, creating tax strategies, managing asset allocation, banking, budgeting | N/A |

| Education and qualifications | Undergraduate degrees in business, finance, economics, accounting, mathematics, or statistics; advanced degrees (e.g. MBA); professional certifications (e.g. CFA, CFP) | N/A |

| Salary | Average base pay: $95,829; Salaries up to: $180,000 | Average base pay: $119,110; Salaries up to: $235,000 |

What You'll Learn

- Investment management is about meeting investment goals, while financial management is about meeting financial goals

- Investment managers are responsible for investment decisions and asset allocation, while financial managers are responsible for budgeting, banking, and other financial duties.

- Investment managers work with a variety of securities and financial assets, while financial managers typically work with cash and fixed-income assets

- Investment management involves buying and selling assets, while financial management involves expense tracking and budgeting

- Investment managers are hired by clients to manage their money, while financial managers are typically employed by financial institutions

Investment management is about meeting investment goals, while financial management is about meeting financial goals

Investment management and financial management are distinct but complementary disciplines. While investment management focuses on optimising investment portfolios to meet specific investment goals, financial management is concerned with broader financial objectives. Here are some key differences between the two:

Investment Management

Investment management, also known as asset or portfolio management, involves handling a client's investment portfolio or a grouping of assets. It includes buying and selling various financial assets, such as stocks, bonds, commodities, and real estate, to meet specified investment goals. Investment managers conduct in-depth research and analysis, develop and implement investment strategies, allocate assets, manage risk, and monitor the performance of their clients' portfolios. They also help clients with financial analysis, portfolio allocation, and investment recommendations. The ultimate goal of investment management is to help clients optimise their investments and navigate the complexities of the financial markets to achieve their investment objectives.

Financial Management

Financial management, on the other hand, takes a more holistic view of an individual's or organisation's finances. It involves planning, organising, directing, and controlling financial activities and decisions to meet overall financial goals. Financial management includes budgeting, evaluating financial performance, managing cash flow, and ensuring compliance with laws and regulations. It also encompasses raising capital, allocating funds, and effectively utilising tangible and intangible assets. Financial management aims to ensure the efficient and effective use of financial resources to achieve an entity's financial objectives and maximise shareholder value.

Key Differences

While both fields are crucial for effective financial planning, the key difference lies in their scope and focus. Investment management is primarily concerned with optimising investment portfolios and making investment decisions to meet specific investment goals. In contrast, financial management takes a broader perspective, encompassing all aspects of financial planning and decision-making to meet overall financial objectives. Investment management is a crucial component of financial management, as it helps individuals and institutions make informed investment choices that align with their risk tolerance, financial priorities, and long-term financial goals.

Breaking into Investment Management: Degrees Aren't Everything

You may want to see also

Investment managers are responsible for investment decisions and asset allocation, while financial managers are responsible for budgeting, banking, and other financial duties.

Investment managers and financial managers have distinct roles and responsibilities, catering to different aspects of a client's financial needs.

Investment Managers

Investment managers are responsible for handling the investment portfolio and making investment decisions on behalf of their clients. They devise investment strategies and direct funds towards various assets, such as property, equities, or debt securities. Their primary goal is to meet their clients' investment objectives, which may include individuals or institutional investors, such as educational institutions, insurance companies, or pension funds.

Investment managers perform financial analysis, allocate assets across different investment options, conduct equity research, and provide buy and sell recommendations. They also monitor the performance of their clients' portfolios to ensure alignment with the clients' financial goals, risk tolerance, and investment horizon.

Financial Managers

On the other hand, financial managers focus on the broader financial duties of an organisation or an individual. This includes budgeting, banking, and other financial tasks. Financial managers may be responsible for financial planning, cash flow management, tax planning, and insurance-related matters. They ensure that the financial aspects of a business or an individual are well-organised and aligned with their short-term and long-term goals.

In summary, while investment managers focus on investment decisions, asset allocation, and portfolio management, financial managers handle the broader financial duties, ensuring that the financial resources are managed effectively to support the overall objectives.

Investment Management: Choosing the Right Degree for Success

You may want to see also

Investment managers work with a variety of securities and financial assets, while financial managers typically work with cash and fixed-income assets

Investment managers and financial managers have distinct roles and responsibilities, with the former dealing with a broader range of securities and financial assets compared to the latter.

Investment managers handle a variety of securities and financial assets, including bonds, equities, commodities, and real estate. They may also manage real assets such as precious metals, artwork, and other tangible and intangible assets. Investment management is a dynamic process that involves buying and selling these assets, developing short- and long-term investment strategies, creating tax plans, and managing asset allocation.

On the other hand, financial managers typically work with cash and fixed-income assets. Their role is more focused on cash flow management and budgeting, ensuring that a company's financial resources are effectively allocated and utilised. This includes managing expenses, budgeting, and tracking income and outgoings.

The distinction between the two roles lies in the nature of the assets they handle and the specific financial activities they undertake. Investment managers deal with a diverse range of securities and investments, requiring expertise in various financial instruments and market trends. In contrast, financial managers focus on cash and fixed-income assets, which involves managing a company's liquidity, budgeting, and financial planning.

Additionally, investment managers often work with individual or institutional investors, helping them reach their investment goals. They provide financial analysis, portfolio allocation, equity research, and buy and sell recommendations. In contrast, financial managers are more likely to be involved in corporate finance, assisting companies and governments with capital raising, debt issuance, mergers and acquisitions, and initial public offerings (IPOs).

In summary, investment managers work with a diverse range of securities and financial assets, devising strategies and executing trades to meet their clients' investment goals. Financial managers, on the other hand, typically focus on cash and fixed-income assets, managing a company's financial resources, budgeting, and handling corporate finance activities.

Investing in a Portfolio: Pros and Cons

You may want to see also

Investment management involves buying and selling assets, while financial management involves expense tracking and budgeting

Investment management and financial management are distinct but complementary disciplines in the financial sector. Investment management involves the professional handling of an investment portfolio or a grouping of assets. It entails buying and selling assets, formulating investment strategies, and managing asset allocation to meet specified investment goals. On the other hand, financial management focuses on the broader task of expense tracking, budgeting, and financial planning. While investment management deals specifically with investment portfolios, financial management encompasses a wider range of financial duties.

Investment management is a dynamic field that goes beyond simply buying and selling stocks or other assets. It involves a comprehensive understanding of the client's financial goals, risk tolerance, and market trends. Investment managers conduct in-depth research and analysis to make informed investment decisions. They also monitor the performance of their clients' portfolios to ensure alignment with the clients' objectives. The scope of investment management includes creating short- and long-term investment strategies, overseeing asset allocation, and developing tax strategies.

Financial management, on the other hand, involves a different set of responsibilities. It focuses on the financial health of an individual or organisation by tracking expenses, creating budgets, and ensuring financial stability. Financial managers may also provide financial planning services, offering advice on cash flow management, taxes, insurance, and debt management. While investment management is primarily concerned with investment portfolios, financial management takes a holistic view of an individual's or organisation's financial situation.

The distinction between investment management and financial management lies in their scope and focus. Investment management is a subset of financial management, dedicated to the specialised task of managing investment portfolios and achieving investment goals. Financial management, on the other hand, covers a broader range of financial activities, including budgeting, expense management, and financial planning. Both disciplines are integral to the effective management of finances, with investment management focusing on the specific task of optimising investment portfolios.

In summary, investment management and financial management serve different but complementary purposes in the financial sector. Investment management is responsible for the active management of investment portfolios, including buying and selling assets, while financial management ensures financial stability through budgeting, expense tracking, and financial planning. Together, these disciplines work in tandem to help individuals and organisations achieve their financial objectives and maintain financial health.

The All-Weather Portfolio: A Guide to Investing for Stability

You may want to see also

Investment managers are hired by clients to manage their money, while financial managers are typically employed by financial institutions

Investment managers are financial professionals who help clients manage their money. They are responsible for handling their clients' investment portfolios and trading them to achieve specific investment objectives. Clients of investment managers can be individual or institutional investors, including educational institutions, insurance companies, pension funds, retirement plans, governments, and private investors.

On the other hand, financial managers are typically employed by financial institutions such as banks, investment firms, and other financial companies. They work within these organizations to manage the finances and assets of the institution itself, rather than serving individual clients directly. Financial managers help their employer organizations with financial planning, budgeting, and managing their investment portfolios. They also ensure that the company's tangible and intangible assets are maintained, accounted for, and well-utilized.

The primary difference between investment management and financial management lies in the nature of their clients. Investment managers work directly with individual or institutional investors to help them manage their money and achieve their financial goals. In contrast, financial managers are employed by financial institutions and work on managing the finances and assets of those institutions.

Another distinction is the scope of their responsibilities. Investment managers focus primarily on investment decisions, asset allocation, and executing trades within their clients' portfolios. They devise investment strategies and direct funds towards property, equities, or debt securities on behalf of their clients. Financial managers, on the other hand, have a broader role that encompasses financial planning, budgeting, and managing the overall finances of their employer organizations.

In terms of qualifications, investment managers typically hold undergraduate degrees in business, finance, mathematics, or accounting. They may also have professional certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Financial managers often have similar educational backgrounds, with degrees in business, finance, economics, or accounting. They may also pursue certifications such as CFP or Master of Business Administration (MBA) to enhance their career prospects.

Savings vs Investments: Where Should Your Money Go?

You may want to see also

Frequently asked questions

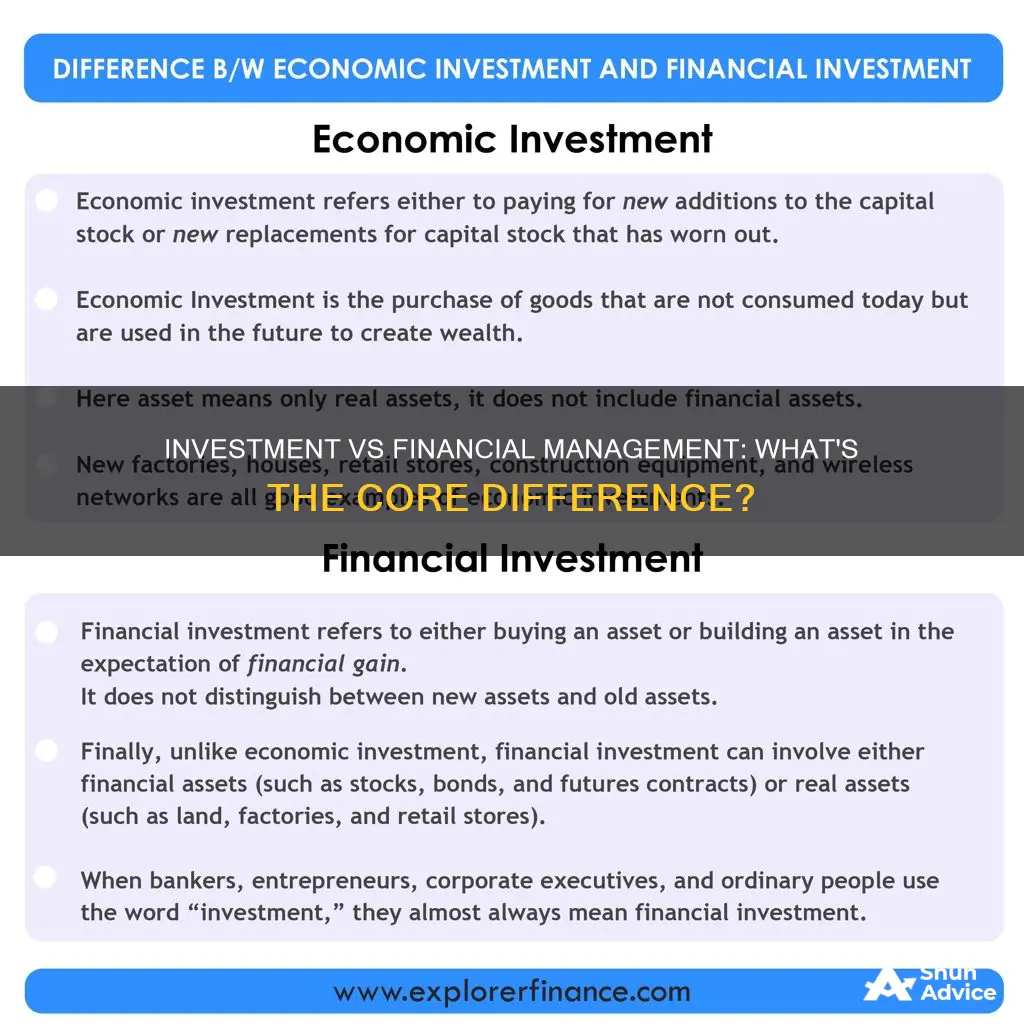

Investment management is the process of handling an investment portfolio or a grouping of assets. It involves buying and selling assets, developing investment strategies, creating a tax strategy, and managing asset allocation.

Financial management is a broader term that encompasses various aspects of managing finances, including budgeting, expense tracking, banking, and evaluating taxes. It involves making strategic decisions to optimise an individual's or organisation's financial health and can include investment management as a component.

Investment management focuses specifically on managing investments to meet specified goals, whereas financial management covers a wider range of financial activities. Investment management typically involves more strategic decision-making and analysis of market trends, whereas financial management may include more transactional and administrative tasks.

Investment management services are usually provided by investment managers, who can be individuals or organisations. These professionals often have qualifications and expertise in areas such as finance, economics, accounting, or investment analysis.

Both individual and institutional investors utilise investment management services to achieve their investment goals. Institutional investors can include pension funds, insurance companies, educational institutions, and governments. Individual investors use investment management services to make the most of their money and build wealth over time.