Distress investment funds, also known as vulture funds, are a type of alternative investment that focuses on purchasing the debt of financially distressed companies, governments, or public entities. These funds seek to profit from the discounted prices of distressed assets and the potential for high returns. When assessing investment opportunities, distress investment funds typically look for three key factors: a successful business model, an in-demand product or service, and a good company with a bad balance sheet. The goal is to gain a controlling position in the debt of a company that has a viable business but is struggling with debt obligations. This allows them to influence the restructuring process and potentially emerge as equity owners. While distress investing carries significant risks, it can also offer lucrative returns, making it an attractive strategy for hedge funds and private equity firms.

| Characteristics | Values |

|---|---|

| Company type | Financially distressed company with an unstable capital structure |

| --- | Too much debt to refinance or unable to meet requirements of existing debt agreements |

| --- | In demand product or service |

| --- | Successful business model |

| Investment type | Debt investing |

| Investor type | Hedge funds, private equity firms, individual investors |

| Investor strategy | Gaining controlling position in company's debt |

| --- | Buying company's debt piece by piece over an extended period |

| --- | Adding value to the company's assets |

| --- | Restructuring the company |

| --- | Selling off assets at a higher value |

| --- | Bankruptcy payout |

| Company outcome | Bankruptcy or successful restructuring |

What You'll Learn

A successful business model

Distressed debt investors are looking for a successful business model when they are assessing companies to invest in. This means that the company should have a viable and profitable business, but one that is facing financial difficulties.

When assessing the business model, investors will consider if the company has a good chance of recovering from its financial distress and becoming profitable again. This could be due to various factors, such as an increase in demand for the company's products or services, a successful restructuring of the company's operations, or a turnaround in the broader economic environment.

The key is that the company has a solid foundation and a viable path to financial recovery. Investors will use their expertise to evaluate the potential for a successful turnaround and will use this information to make investment decisions. They will also consider the company's management and whether changes need to be made to improve the business model and increase the chances of success.

By investing in companies with a successful business model, distressed debt investors can identify opportunities for value creation and potential high returns. They can buy a portion of the company's debt with the goal of gaining a controlling position and influencing the restructuring process. This strategy allows investors to take advantage of the discounted prices of distressed assets while also contributing to the company's turnaround and increasing the value of its assets.

Brokerage Dividend Funds: Invest or Avoid?

You may want to see also

An in-demand product or service

Distressed debt investors are looking for a good company with a bad balance sheet. They seek out companies with an in-demand product or service that is facing financial uncertainty or is on the verge of bankruptcy.

A company with an in-demand product or service is more likely to be able to turn its fortunes around and emerge from bankruptcy as a viable firm. This is an important consideration for distressed debt investors, who are looking to gain a controlling position in the company and influence its restructuring process.

Distressed debt investors are interested in companies with a successful business model, but that are facing problems with debt. This could be due to an unstable capital structure, such as a high debt load or difficulty in refinancing.

When assessing a company for potential investment, distressed debt investors will consider whether the company's business is viable and potentially profitable if it can alleviate its financial challenges. They will also evaluate the company's assets, looking for opportunities to add value and sell them off at a higher price.

It is important to note that investing in distressed debt can be risky, and investors must fully understand the nuances of this type of investment. There is no guarantee that a company will successfully turn around, and the relationship between investors, existing shareholders, and company management can be complicated due to the uncertainty surrounding the future of the distressed company.

Mutual Fund Stocktrak: A Guide to Investing

You may want to see also

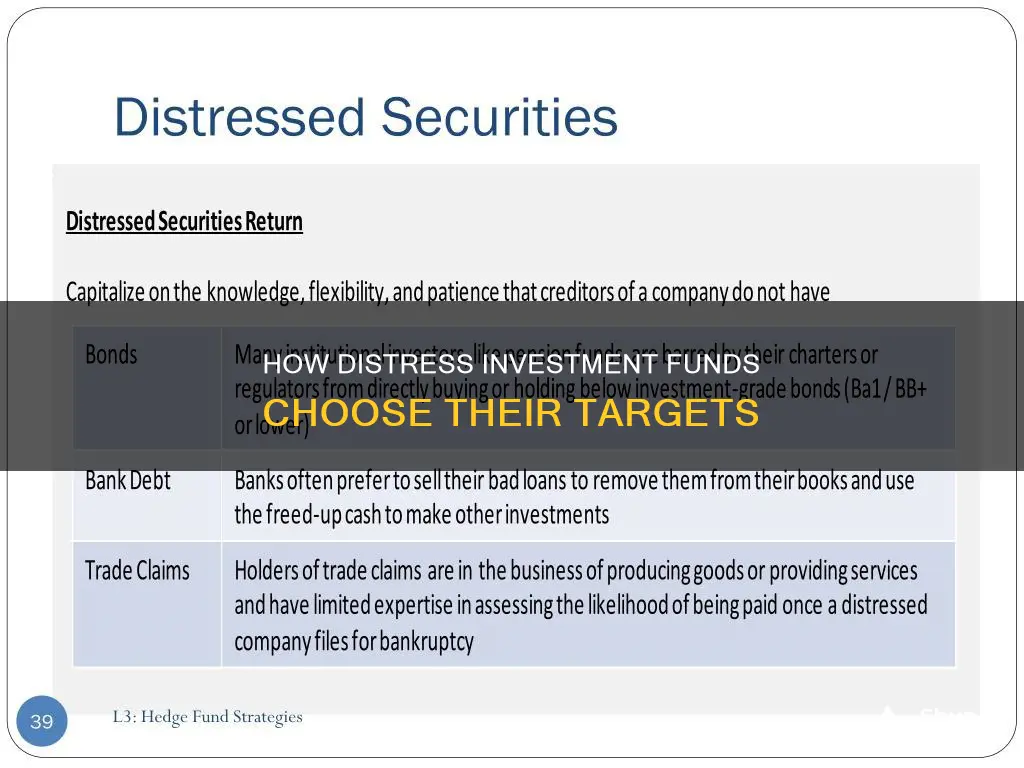

High-yield bonds

There are two subcategories of high-yield bonds:

- Fallen angels: Bonds that have been downgraded by a major rating agency and are headed towards junk-bond status due to the issuing company's poor credit quality.

- Rising stars: Bonds with ratings that have increased due to the issuing company's improving credit quality. These may still be considered junk bonds but are on their way to becoming investment-grade quality.

While high-yield bonds offer the potential for higher returns, they also carry a number of risks, including default risk, higher volatility, interest rate risk, and liquidity risk. Default risk is the most significant concern, and it can be mitigated through diversification, although this limits strategies and increases fees.

The volatility of the high-yield bond market is similar to that of the stock market, and these bonds are generally more liquid than investment-grade bonds. All bonds face interest rate risk, which is higher for longer-term bonds. High-yield bonds also carry liquidity risk, and even the mutual funds and ETFs that hold them are subject to this risk.

In summary, high-yield bonds offer the potential for higher returns but come with a higher risk of default. Investors should carefully consider their financial situation, risk tolerance, and investment goals before investing in high-yield bonds.

A Guide to Investing in the Magellan Fund

You may want to see also

Bankruptcy payout

Distressed debt investors are interested in companies that are near bankruptcy or are currently going through it. In the case of bankruptcy, debt holders are paid out before equity holders. This is because debt takes precedence over equity in its claim on assets if the company is dissolved. However, this does not guarantee financial reimbursement.

When a company files for Chapter 7 bankruptcy, it will stop operations and go into liquidation. Its funds are then dispensed to its creditors, including bondholders. On the other hand, under Chapter 11 bankruptcy, a business restructures and continues operations. If the reorganization is successful, its distressed securities, including both stocks and bonds, may yield surprising amounts of profits.

Distressed debt investors can purchase a company's distressed debt and wait for a payout if the company files for bankruptcy following a failed attempt at restructuring. They can also influence the restructuring process and emerge as equity owners.

Distressed debt investors can limit their risk by taking relatively small positions in distressed companies. They can also buy directly from mutual funds, avoiding paying exchange-generated commissions.

Distressed debt is often included as a small piece of a larger investment portfolio to spread out the risk.

Invest in Tesla: Top Mutual Funds to Consider

You may want to see also

Future buyout

The distressed-debt-to-control strategy, also known as "loan-to-own", is a long-term, "buy-and-hold" approach. It is a calculated bet that the debtor will successfully emerge from a restructuring process.

The distressed-debt-to-control strategy is a multi-step process. First, investors identify companies that cannot pay off their debts because their existing capital structure cannot support debt payments. These companies are often on the path to filing for Chapter 11 or Chapter 7 bankruptcy.

Next, investors purchase enough of the distressed company's debt to gain a controlling stake. This typically involves buying debt tranches near the top of the capital structure, as these securities are more likely to recover their value in a Chapter 11 bankruptcy.

Once the investor has a controlling stake, they can begin the process of restructuring the company. This may involve operational changes such as shutting down unprofitable product lines and store locations, increasing sales and marketing in core markets, reducing management layers, and selling off non-core assets.

Finally, after the company has been restructured, the investor can sell their stake for a profit. The potential for profit is higher if the company's equity value has increased significantly.

It is important to note that distressed-debt-to-control strategies carry significant risk. Investors must carefully research and conduct due diligence on the distressed company before investing. There is also a risk of competing with other investors who may be aiming for a controlling stake. Additionally, the success of the investment depends on the actual turnaround of the debtor, which may not always be achieved.

Unlocking Real Estate: The Benefits of Investing in Funds

You may want to see also

Frequently asked questions

Distressed investment funds are a type of alternative investment, which is any investment besides stocks, bonds, and cash. Distressed investment funds seek out companies that are in financial trouble or on the verge of bankruptcy and try to help these companies turn things around.

Distressed investment funds look for companies with a successful business model and an in-demand product or service but which have an unstable capital structure, such as an overly high debt load or difficulty in meeting restrictions on current debt covenants.

Distressed investment funds can be risky because investors often have limited access to financial information and there is a potential for competition with other investors. However, they can also provide high returns, making them an attractive addition to a larger investment portfolio.