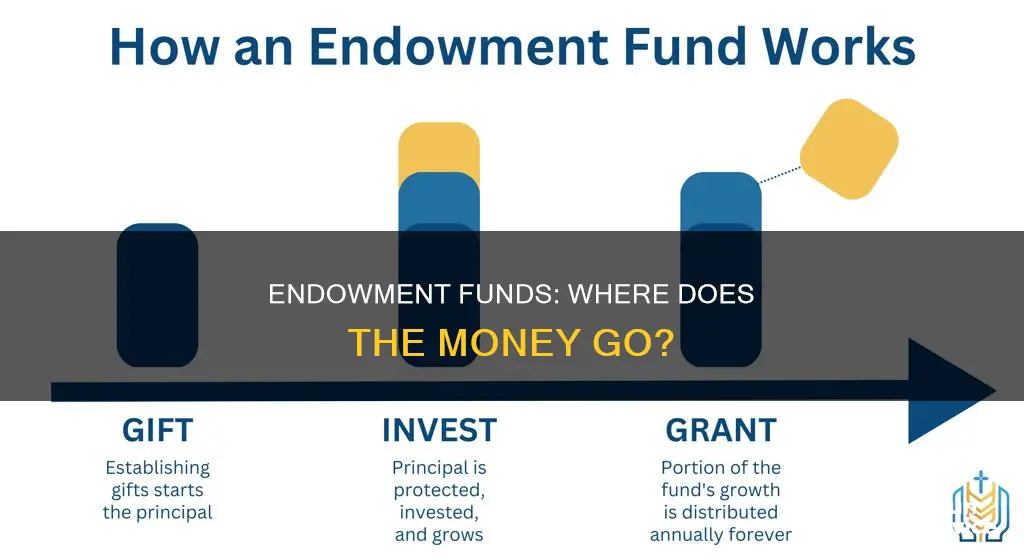

Endowment funds are established to fund charitable and nonprofit institutions such as universities, hospitals, and churches. They are typically funded by donations and are invested in a variety of assets including cash, equities, bonds, and other types of securities. Endowment funds are meant to provide a perpetual source of funding and are often used to support financial aid, professorships, and research and development. The funds are usually structured with intact principals and investment income available for use, with the principal amount remaining untouched while the income is used to further the cause specified by the beneficiary.

| Characteristics | Values |

|---|---|

| Initial capital | Donations |

| Purpose | Funding charitable and nonprofit institutions such as churches, hospitals, and universities |

| Structure | Intact principals and investment income available for use |

| Types | Term, restricted, unrestricted, and quasi-endowment funds |

| Investments | Cash, equities, bonds, and other types of securities that can generate investment income |

| Beneficiary | Non-profit organisation instead of individual investors |

| Principal value | Kept intact |

| Usage | Funding scholarships, scientific research, public services, and other charitable activities |

| Investment policies | Outline types of investments, asset allocation, risk level, and targeted return |

| Withdrawal policies | Limit the amount of money that can be withdrawn within each period |

| Spending rate | Annual withdrawal is usually capped at a low percentage of the total amount |

What You'll Learn

Equities

Endowments are established to fund charitable and nonprofit institutions such as churches, hospitals, and universities. They are typically structured with intact principals and investment income available for use. The principal value of the endowment fund is kept intact, while the investment income can be used for charitable grants to nonprofits. Thus, an endowment fund can be held permanently, allowing donors to support causes they care about in perpetuity.

Endowments allocate the largest percentages of their portfolios to alternative asset classes like hedge funds, private equity, venture capital, and real assets like oil and other natural resources. Many of these alternative investments outperform traditional stocks and bonds but typically have longer gestation periods and impose higher minimum investments.

Endowments have diversified across asset classes, particularly into alternatives, which now make up as much as 40-50% of a portfolio. With so much capital tied up in multiple illiquid managers, it's hard to know how the overall endowment is positioned.

Endowments have long been investment innovators, beginning with the formulation of the original endowment model 25 years ago. While many endowments, particularly those with more resources and access, have outperformed, the median has recently struggled to deliver returns above a 70/30 market benchmark.

In the forward-looking market environment, there are four principles for endowment investing:

- Focus on factor—not manager—diversification: Managing the underlying drivers of return (i.e., risk factors) positions portfolios more optimally for multiple outcomes. In many cases, active managers rely on beta or style risk to outperform, and these are available in cheaper, more liquid form.

- Apply well-resourced convictions: Finding true alpha today involves greater depth than ever. It requires a research edge and a willingness to deploy concentrated capital to best-in-class ideas.

- Employ an innovative approach to private market portfolios: Private markets are evolving rapidly. Having direct market knowledge, as well as the ability to source deals across the best management teams, is critical to success.

- Focus on factor-based technology with risk management tools and deep investment experience: Blending index and active strategies with true alpha opportunities will result in more optimal performance.

By following these principles, endowment funds can improve cost and capital efficiency while generating unique alpha.

Mutual Funds in Your 20s: A Guide to Getting Started

You may want to see also

Bonds

Endowment funds, including those of major universities, often allocate a portion of their portfolios to bonds. Before the economic crisis of 2008, endowments with assets of $1 billion or more typically invested a small percentage of their funds in traditional bonds. These bonds provided a source of fixed income and helped to balance the riskier alternative investments made by these endowments.

When investing in bonds, endowment funds can choose from various types, including government bonds, municipal bonds, corporate bonds, and more. The selection of bonds depends on the investment objectives, risk tolerance, and maturity requirements of the endowment fund. By investing in bonds with different maturities and risk profiles, endowment funds can further diversify their portfolios and manage interest rate risk.

In summary, bonds are an essential component of endowment funds' investment strategies. They provide a stable source of income, help preserve principal, and offer a more conservative investment option to balance riskier alternatives. By investing in a variety of bonds, endowment funds can meet their financial goals while supporting the long-term sustainability of the charitable organizations they serve.

Starting an Investment Fund: UK Small Investors' Guide

You may want to see also

Scholarships

When a donor creates an endowed scholarship, they make a large initial donation to a university, creating an endowed scholarship fund. The money isn't given directly to students all at once. Instead, the money is invested, and the interest earned on the invested money is used to fund scholarships for years to come. The principal amount remains untouched, and only the interest is distributed to students as scholarships. This means that an endowed scholarship can operate in perpetuity, as the principal amount is never spent.

Endowed scholarships are typically offered by a specific university, and students from other universities cannot apply for them. This reduces the number of eligible applicants, making endowed scholarships less competitive than other scholarships.

Endowed scholarships can be need-based or merit-based. Donors can also choose to offer scholarships to students in a particular area of study. For example, scholarships can be tailored to underrepresented students in specific fields of study, like women in STEM programs.

The process of applying for an endowed scholarship is usually the same as that of a regular scholarship. Applications open and close within a specific timeframe, and students submit their applications during that period.

Creating an endowed scholarship usually requires a large sum of money, and the exact minimum amount varies between institutions. Donors can also specify the scholarship details, such as the name, eligibility requirements, and whether it is need-based or merit-based.

Endowed scholarships offer several benefits to donors, including recognition from the university, tax benefits, and brand-building opportunities.

Equity Income Funds: Smart Investment for Steady Returns

You may want to see also

Research

Endowment funds are established to fund charitable and nonprofit institutions such as churches, hospitals, and universities. They are typically structured with intact principals and investment income available for use. Endowment funds are initially invested by donors for certain charitable purposes. They are usually established as trusts, which keep them independent of the organisations that they support.

Endowment funds consist of cash, equities, bonds, and other types of securities that can generate investment income. The major difference between an endowment fund and a typical investment fund is that the beneficiary of an endowment fund is a non-profit organisation instead of individual investors. Typically, the principal value of an endowment fund is kept intact, while the investment income can be used for certain purposes.

The types of endowment funds include:

- Term endowment

- Restricted endowment

- Unrestricted endowment

- Quasi-endowment

Endowments are a great way to ensure a steady stream of funding for universities, hospitals, and charities. They are often used to fund financial aid, professorships, and research and development. Endowment funds are also used to pay for annual expenditures, especially during economic recessions.

Getting Started with Managed Funds: A Beginner's Guide

You may want to see also

Non-profit organisations

Non-profit endowment funds are a long-term commitment, designed to build trust with donors, volunteers, and staff. They are a great way to ensure the longevity of an organisation, though they can be tricky to navigate.

Endowments are usually gifts of cash, equities, bonds, or other securities that can generate investment income. The principal amount is kept intact and invested to grow over time, while the annual investment income is used for charitable purposes. This can include funding for scholarships, research, public services, and other charitable activities.

There are different types of endowments: true or permanent endowments, unrestricted endowments, restricted endowments, term endowments, and quasi-endowments. True endowments are the most common in larger institutions, such as colleges and hospitals, and are restricted so that only the investment income is spent. Unrestricted endowments allow the recipient to spend the money as they choose. Restricted endowments are when the primary amount remains invested, and the investment income is spent according to the donor's wishes. Term endowments are when the principal can be used after a certain time or event. Quasi-endowments, also known as board-designated endowments, are funded by the nonprofit organisation itself and the principal may be used at the discretion of the board.

Endowments are a great way to signal to donors that the organisation is thinking long-term and is committed to its future sustainability. They can also bring intangible benefits, such as increased donor satisfaction and trust. However, there are some potential drawbacks, such as the cost of professional financial expertise and the risk of losing money in the stock market.

Overall, endowment funds can be a valuable tool for non-profit organisations, providing a source of ongoing financial support and helping to build a positive reputation with donors and the community.

Asia's 1997 Financial Crisis: Why Foreign Investment Poured In

You may want to see also

Frequently asked questions

Endowment funds are investment portfolios with the initial capital coming from donations. They are established to fund charitable and nonprofit institutions such as churches, hospitals, and universities.

Endowment funds consist of cash, equities, bonds, and other types of securities that can generate investment income.

Endowment funds are initially invested by donors for specific charitable purposes. They are usually established as trusts, keeping them independent of the organisations they support. The major difference between an endowment fund and a typical investment fund is that the beneficiary of an endowment fund is a non-profit organisation instead of individual investors.

There are four types of endowment funds: unrestricted, term, quasi, and restricted.