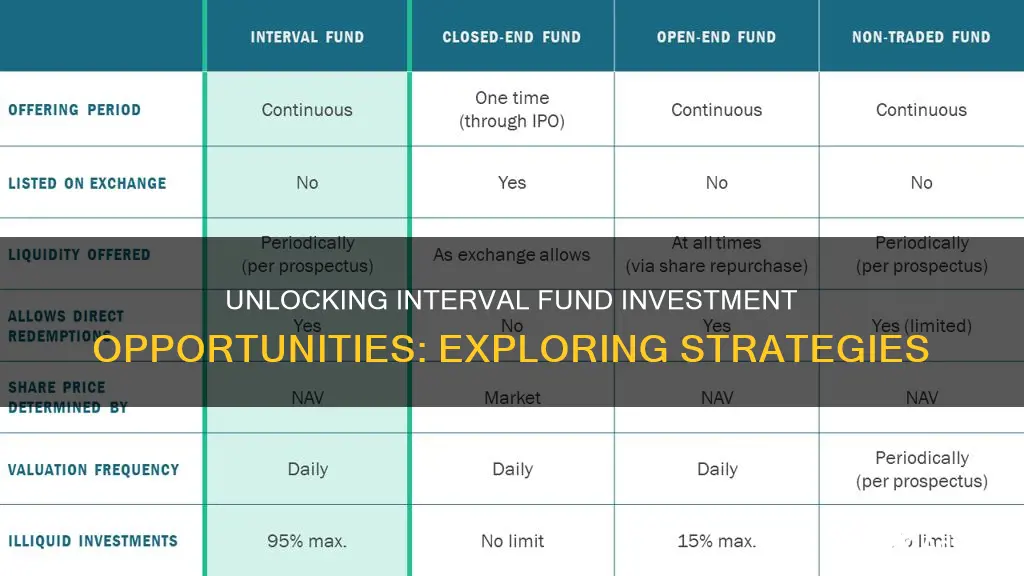

Interval funds are a type of closed-end fund that offers liquidity to investors at regular intervals, typically quarterly, semi-annually, or annually. This means shareholders can sell a portion of their shares at regular intervals, with the fund offering to buy back a percentage of outstanding shares at net asset value (NAV). Interval funds may invest in a wide range of strategies, securities, and asset classes, including less-liquid and illiquid assets such as high-yield bonds, loans, structured products, private debt, private equity, and infrastructure investments. With higher yields and returns than open-end funds, interval funds provide an attractive investment opportunity, but it's important to carefully consider the higher fees and illiquidity associated with them.

| Characteristics | Values |

|---|---|

| Investment type | Investment company |

| Investment style | Closed-end fund |

| Share trading | Shares do not trade on the secondary market |

| Share repurchase | Funds periodically offer to buy back a percentage of outstanding shares at net asset value (NAV) |

| Liquidity | Less liquid compared to other funds |

| Investment focus | Alternative types of assets, such as commercial real estate, consumer loans, debt, and other illiquid assets |

| Minimum investment | Typically $10,000 to $25,000 |

| Expense ratios | Up to 3% |

| Returns | Higher returns than open-end funds |

| Regulatory oversight | Regulated under the Investment Company Act of 1940, Securities Act of 1933, and Securities Exchange Act of 1934 |

Commercial real estate

Interval funds are a type of closed-end fund that does not trade its shares on the secondary market. Instead, they periodically offer to buy back a percentage of their shares from shareholders at net asset value (NAV). This is typically done every three, six, or twelve months, as disclosed in the fund's prospectus and annual report. Shareholders are not required to sell their shares back to the fund.

One alternative investment class available through interval funds is commercial real estate. Interval funds that invest in commercial real estate do so directly by purchasing properties themselves, as opposed to real estate investment trusts (REITs), which invest in property pools and trade like stocks.

The minimum investment for an interval fund is typically between $10,000 and $25,000, and they have expense ratios as high as 3%. Overall fees for interval funds tend to be much higher than those for open-end mutual funds.

Before investing in an interval fund, it is important to carefully read all the fund's available information, including its prospectus and most recent shareholder report.

Index Fund Investing: A Beginner's Guide to Getting Started

You may want to see also

Consumer loans

Interval funds are a type of closed-end fund that offers to buy back shares from shareholders periodically. They are considered illiquid investments due to their limited selling opportunities and are known for providing higher returns than open-end funds. One of the main reasons for their higher yields is their ability to invest in alternative assets, such as consumer loans.

There are several types of consumer loans available in the market. Mortgage loans, for instance, are used to finance the purchase of a home or to access the equity in a property. Home equity financing can be structured as a loan or a line of credit, known as a Home Equity Line of Credit (HELOC). Auto loans are another common type of consumer loan, where a lien is placed on the vehicle being purchased, and the interest rate depends on the borrower's credit score.

Personal loans are also a popular form of consumer lending, offering flexibility to finance various purchases. Credit cards fall under the consumer loan category as rolling credit accounts, where responsible usage can improve cash flow management and generate rewards. Lastly, student loans for higher education expenses are another example of consumer loans, which can increase an individual's lifetime earning potential.

By investing in consumer loans, interval funds gain exposure to a diverse range of lending products that cater to a wide range of consumer needs. This allows interval funds to offer attractive returns to their investors while managing the illiquid nature of these investments.

Investment-Grade Bond Funds: A Safe Bet?

You may want to see also

Debt

Interval funds are a type of closed-end fund that offers liquidity to investors at stated intervals, allowing them to invest in less-liquid assets such as debt, as well as illiquid assets. They have the ability to invest in a diverse range of alternative assets, including consumer loans, debt instruments, and other illiquid investments. There is no restriction on the amount of less-liquid and illiquid assets that an interval fund may hold.

Interval funds provide investors with access to private markets and less-liquid areas of the fixed-income market, which can offer enhanced income and return potential compared to traditional stocks and bonds. The lack of liquidity constraints associated with interval funds allows them to pursue investment strategies that may not be available to other types of funds.

By investing in debt instruments, interval funds can generate returns through interest payments and capital appreciation. They can invest in a variety of debt securities, including high-yield bonds, loans, structured products, and private debt. These debt investments may have longer maturities or be issued by borrowers with lower credit ratings, providing the potential for higher returns.

The ability to invest in debt and other illiquid assets contributes to the higher yields offered by interval funds compared to traditional open-end mutual funds. However, it is important to consider the higher fees associated with interval funds, which can impact the overall returns.

When considering interval funds as an investment option, it is crucial to assess your financial objectives, risk tolerance, liquidity needs, and investment time horizon. While interval funds offer the potential for higher returns, they also come with the risk associated with illiquid investments, and the higher fees can offset some of the gains.

Smart Ways to Invest 10K in Mutual Funds

You may want to see also

High-yield bonds

- Vanguard High-Yield Corporate Investor Shares (VWEHX)

- Fidelity Floating Rate High Income Fund (FFRHX)

- Fidelity Capital & Income Fund (FAGIX)

- American Funds Emerging Markets Bond Fund Class F-1 (EBNEX)

- T. Rowe Price Credit Opportunities Fund (PRCPX)

- American Century High Income Fund Investor Class (AHIVX)

- Northern Multi-Manager High Yield Opportunity Fund (NMHYX)

DSP Blackrock Tax Saver Fund: Worth Investing?

You may want to see also

Private equity

Interval funds are able to invest in illiquid or less liquid assets because they have limited redemption windows. They can hold up to 95% of their portfolio in illiquid assets, whereas open-end funds can only hold 15%. This means interval funds can invest in assets that have no secondary market, such as private equity.

Interval funds are regulated under the Investment Company Act of 1940, the Securities Act of 1933, and the Securities Exchange Act of 1934. They are required to provide a high level of transparency into holdings and operations through regular filings with the U.S. Securities and Exchange Commission.

The use of interval funds has grown in recent years, largely due to their ability to invest in less-liquid assets. They provide investors with access to institutional-grade alternative investments with relatively low minimums. However, interval funds are considered riskier than standard mutual funds due to their illiquidity and alternative asset investments.

Liquid Fund Investment: A Beginner's Guide to Getting Started

You may want to see also

Frequently asked questions

Interval funds are a type of closed-end fund that offers liquidity to investors at stated intervals, such as quarterly, semi-annually or annually.

Interval funds may invest in a wide range of strategies, securities and asset classes. This includes less-liquid assets, such as high-yield bonds, loans and structured products, as well as illiquid assets, such as private debt, private equity and infrastructure investments.

Interval funds differ from traditional closed-end funds in that their shares do not trade on the secondary market. Instead, the fund periodically offers to buy back a percentage of outstanding shares at net asset value (NAV).

Interval funds offer higher returns than open-end funds and provide access to alternative investments with relatively low minimums. They are also less volatile and market-reactive since investments are not tied to equities.

Interval funds are considered illiquid and have higher fees compared to open-end mutual funds. There may also be transparency and conflict-of-interest issues if the portfolio manager is allowed to invest in other funds of the fund sponsor.