Investment management is a lucrative career choice with a strong outlook for growth. It involves handling an investment portfolio or a grouping of assets for clients, who can be individual or institutional investors. Investment managers advise clients on their assets, helping them to achieve their financial goals and get returns on their investments. To become an investment manager, you'll need a bachelor's degree in a field such as financial management, economics, finance, accounting, mathematics, engineering, science or business. You'll also need to be able to cope with stress, be passionate about the field, goal-oriented, and proficient in data analysis.

| Characteristics | Values |

|---|---|

| Education | A bachelor's degree in a field such as financial management, economics, business administration, finance or statistics |

| Experience | Work experience or internships during bachelor's degree |

| Skills | Stress management, competitiveness, passion, goal-oriented, mathematics, data analysis, problem-solving, time management, analytical skills, communication skills |

| Clients | Individuals, families, institutions, pension funds, retirement plans, governments, educational institutions, insurance companies |

| Investments | Stocks, bonds, mutual funds, hedge funds, real estate, money market instruments, commodities, financial derivatives, foreign exchange, precious metals, artwork |

| Strategies | Short-term, long-term, tax, active, passive |

| Goals | Financial goals, investment goals, retirement planning, college tuition |

| Risk | Risk analysis, risk tolerance, risk management, risk aversion |

What You'll Learn

Risk assessment and management

Risk Assessment Techniques

There are two main types of risk analysis techniques: quantitative analysis and qualitative analysis. Quantitative analysis involves using mathematical models and simulations to assign numerical values to risk. An example is the Monte Carlo simulation, which uses a variety of variables to discover different possible outcomes. Qualitative analysis, on the other hand, relies on a person's subjective judgment and experience to build a theoretical model of risk for a given scenario. This may include assessing a company's management, relationships with vendors, and public perception.

Standard Deviation

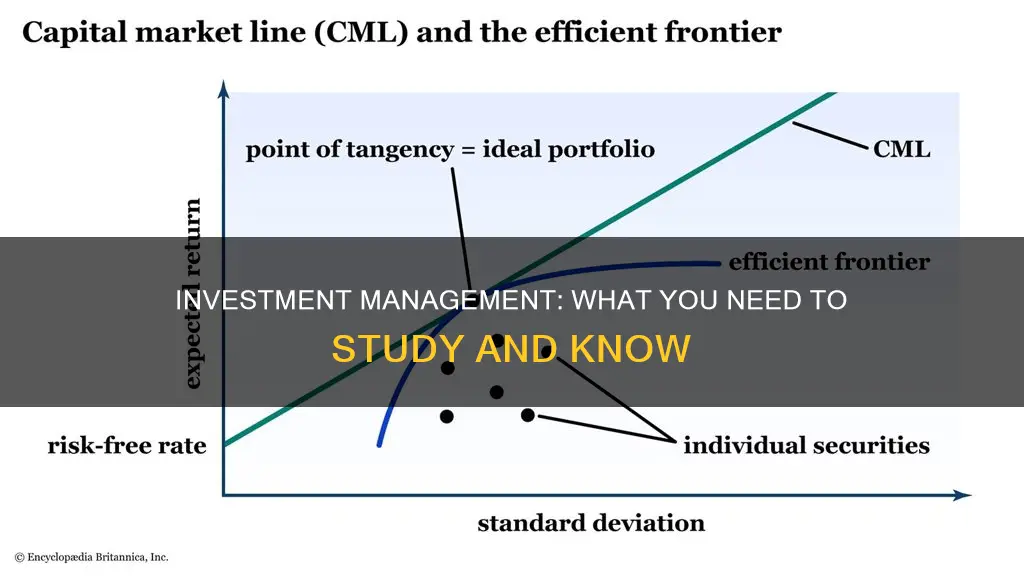

Standard deviation is a commonly used statistical measure that quantifies the dispersion of data from its mean. In finance, it is used to gauge the historical volatility of an investment relative to its annual rate of return. A stock with a high standard deviation experiences greater volatility and is therefore riskier. Standard deviation is often used in conjunction with an investment's average return to assess the dispersion from historical results.

Value at Risk (VaR)

Value at Risk (VaR) is a statistical measure that quantifies the potential loss of a risky asset or portfolio over a given period, providing an easy-to-understand number for the downside risk. VaR tells you the likelihood of a specific outcome occurring, such as a portfolio losing a certain amount of money over a year. However, it has limitations, including underestimating risk during market stress and not providing information about the severity of losses beyond the VaR threshold.

Risk Management Strategies

There are several risk management strategies that can be employed, including avoidance, retention, sharing, transferring, and loss prevention and reduction. Avoidance involves choosing the safest assets with minimal to no risks. Retention accepts risks for the chance of higher returns. Sharing involves spreading risk among multiple parties, such as through insurance. Transferring passes risks to another party, like with health insurance. Loss prevention and reduction mitigate risk by balancing volatile and conservative investments.

Importance of Risk Management

Risk management is essential in investment as it helps investors achieve their financial goals while offsetting potential losses. It involves identifying and quantifying uncertainties, deciding if potential rewards outweigh the risks, and monitoring and adjusting strategies accordingly. Additionally, it helps determine the rate of return needed to justify the risk of an investment.

Investment Management: The Buy Side Advantage

You may want to see also

Investment selection

Understanding Client Objectives and Risk Tolerance

The first step in investment selection is understanding the client's financial objectives, risk tolerance, and time horizons. Investment managers must assess how much risk a client is willing to take and tailor their investment strategy accordingly. This involves evaluating the client's financial goals, such as saving for retirement, funding education, or making a significant purchase.

Asset Allocation and Diversification

Investment managers then determine the appropriate allocation of assets across different classes, including stocks, bonds, money market instruments, real estate, commodities, and financial derivatives. This allocation is based on the client's risk profile and investment objectives. Diversification across multiple asset classes and markets is a key strategy to maximise returns while minimising risk.

Research and Analysis

This stage involves in-depth research and analysis of potential investments. Investment managers study individual stocks, bonds, or other securities, considering factors such as company financials, industry trends, and market conditions. They aim to identify investments that align with the client's goals and have the potential to deliver strong returns.

Selection of Specific Investments

Based on their research and analysis, investment managers select specific investments for the client's portfolio. This may include choosing individual stocks or bonds, or it could involve selecting mutual funds, exchange-traded funds (ETFs), or other investment vehicles that match the client's objectives and risk tolerance.

Performance Monitoring and Rebalancing

Once the investments are made, investment managers continuously monitor their performance against benchmarks and the client's milestones. They provide regular reports to the client, keeping them informed about the progress of their portfolio. Periodically, they may also rebalance the portfolio by adjusting the mix of assets to ensure it remains aligned with the client's goals and takes advantage of market opportunities.

Regulatory and Compliance Considerations

Investment managers must also consider regulatory and compliance requirements when selecting investments. They need to ensure that all investments comply with state, federal, and international laws and regulations. Additionally, they must act in the best interests of their clients, maintaining a fiduciary duty to them.

In summary, investment selection is a complex process that requires a deep understanding of financial markets, asset classes, and the client's objectives and risk tolerance. By following these steps, investment managers aim to maximise returns, minimise risk, and help clients achieve their financial goals.

Becoming an Investment Portfolio Manager: Strategies for Success

You may want to see also

Portfolio monitoring

Metrics and Performance Indicators

Investors use various metrics and performance indicators to monitor their portfolios, such as:

- Portfolio returns

- Risk-adjusted returns

- Tracking error

- Turnover

- Volatility

- Sharpe ratio

Manual vs Automated Monitoring

Benefits of Automated Monitoring

Automating portfolio monitoring can bring several benefits, including:

- Improved data accuracy and efficiency: Automation reduces manual data entry, minimises human errors, and enables real-time or near-real-time access to data.

- Streamlined reporting and compliance: Automation streamlines the reporting process, ensuring consistency and transparency.

- Enhanced risk management: Automation enables real-time monitoring of key risk indicators, providing early identification and mitigation of risks.

- Enhanced investment opportunities: Automation provides advanced analytics and data-driven insights to support decision-making and strategic planning.

- Increased operational efficiency and scalability: Automation streamlines workflows, reduces manual tasks, and accommodates a larger number of portfolio companies and complex data sets.

Challenges of Portfolio Monitoring

- Cost of implementation: Addressing operational complexities within portfolio companies can be time-consuming and resource-intensive.

- Difficulty of gathering accurate data: Inconsistent data, data inconsistencies, and unreliable performance metrics can hinder effective monitoring and analysis.

- Dynamic business environment: Adapting to changing market conditions, competitive landscapes, and regulatory changes requires agile decision-making.

- Limited visibility and control: Monitoring geographically dispersed portfolio companies with varying degrees of operational autonomy can be challenging.

- Complexity of performance analysis: Performance measurement and benchmarking private equity portfolio companies with different reporting standards and accounting practices is complex.

Strategies to Promote Your New Investment Portfolio

You may want to see also

Financial analysis

Investment managers work with investors' money to help them achieve their financial goals. They allocate stocks, bonds, and other securities according to the client's risk tolerance and investment objectives. This requires an in-depth knowledge of various asset classes, such as stocks, bonds, money market instruments, real estate, commodities, and financial derivatives.

A crucial aspect of financial analysis in investment management is assessing and managing risk. Investment managers must determine the level of risk their clients are willing to take and actively manage that risk through careful portfolio construction and ongoing adjustments. They also need to consider tax implications, market conditions, and liquidity to maximise returns while minimising potential losses.

To excel in financial analysis, investment managers must possess strong analytical skills. They need to review and interpret financial data, market trends, and statistical analysis to make informed investment decisions. This includes evaluating individual stocks or securities based on company financials, industry trends, and competitive landscape.

In addition to analytical skills, effective communication skills are essential for investment managers. They need to build trust with their clients, explain investment strategies, and provide recommendations. By actively listening to their clients' needs and goals, investment managers can tailor their advice accordingly.

Overall, financial analysis in investment management entails a comprehensive understanding of financial markets, strong analytical capabilities, and effective communication skills. By combining these skills, investment managers can help their clients make successful investment decisions and maximise their returns while managing risk.

Credit Union and Investment Management: What's the Link?

You may want to see also

Wealth management

Wealth managers conduct in-depth research and analysis of various financial instruments and market trends to make informed investment decisions. They also develop and implement investment strategies, allocate assets, manage risk, and monitor the performance of their clients' portfolios.

Wealth managers must be able to cope with stress and thrive in a competitive work environment. They should be passionate about the field and the needs of their clients. They should be goal-oriented, enjoy mathematics, and be proficient in data analysis and solving problems.

Protect Your Investment Portfolio: Strategies for Success

You may want to see also

Frequently asked questions

Investment management is the process of handling an investment portfolio or grouping of assets. It involves buying and selling assets, devising short and long-term investment strategies, creating a tax strategy, and managing asset allocation.

An investment manager works with individuals, families, and institutions to create strategies for growing and protecting their wealth. They advise clients on their assets, research potential investments, monitor the performance of existing investments, and analyse market trends.

You will need a bachelor's degree in a field such as financial management, economics, finance, accounting, or business. To improve your prospects, you can pursue a master's degree or a doctorate. You can also obtain certifications such as the Chartered Financial Analyst (CFA) qualification.

You will need strong analytical, critical thinking, and mathematical skills. Communication and interpersonal skills are also important, as well as the ability to work in a high-pressure environment.

According to the U.S. Bureau of Labor Statistics, employment in investment management is projected to grow 17% from 2020 to 2030, which is faster than the average for all occupations. The industry offers high salaries and strong job security.