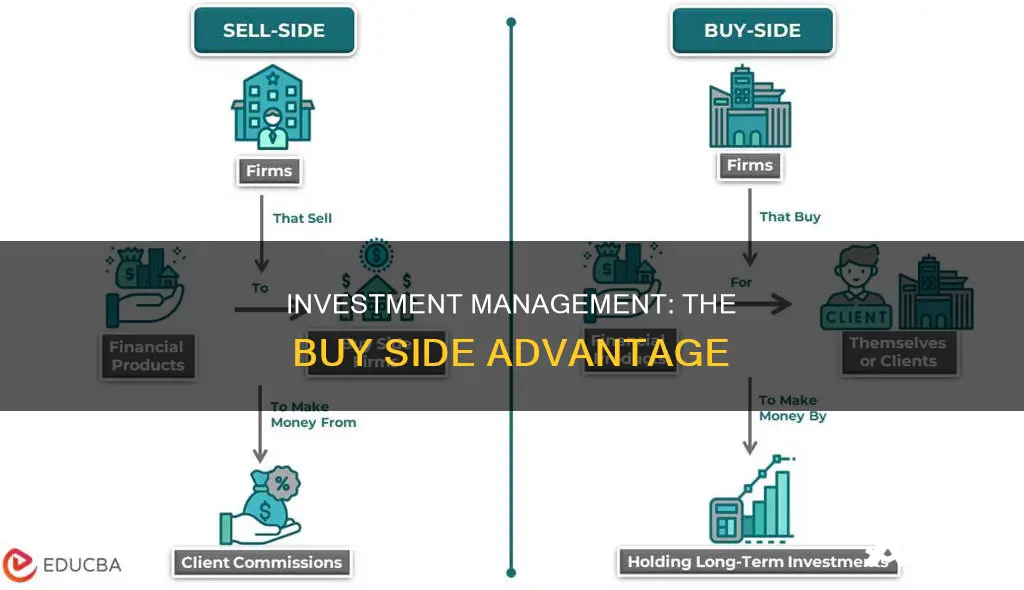

Investment management is a broad term that covers the buying and selling of securities. The 'buy side' refers to firms that purchase securities, including investment managers, pension funds, and hedge funds. These firms are concerned with buying investment services and include private equity funds, mutual funds, and insurance companies. The 'buy side' is the side of the financial market that buys and invests large portions of securities for fund management. They are the buyers of investment services and are concerned with making profitable investment recommendations.

| Characteristics | Values |

|---|---|

| Type of firm | Institutional investors such as hedge funds, pension funds, mutual funds, private equity firms, insurance companies, endowments |

| Type of client | Money managers within their funds |

| Type of research | In-depth research on securities, sectors, and markets |

| Type of recommendations | Not publicly available |

| Focus | Making profitable investment recommendations |

| Risk appetite | More cautious and risk-averse |

| Coverage | Broader coverage of industries or sectors |

| Compensation | Based on the performance of the firm's portfolio |

What You'll Learn

- Buy-side analysts work for institutional investors like hedge funds, pension funds, and mutual funds

- Buy-side firms include asset managers, hedge funds, and other companies that trade securities for their clients

- Buy-side analysts evaluate an investment's potential and whether it aligns with a fund's investment strategy

- Buy-side firms use sell-side services to make investments

- Buy-side firms make money by buying low and selling high

Buy-side analysts work for institutional investors like hedge funds, pension funds, and mutual funds

Buy-side analysts are employed by institutional investors, including hedge funds, pension funds, and mutual funds. They conduct in-depth research on securities, sectors, and markets to inform better investment decisions for their clients.

Buy-side analysts work for firms that manage money on behalf of their clients. They are responsible for identifying promising investment opportunities, analysing financial statements, and building financial models to forecast future performance. They make investment recommendations to portfolio managers, suggesting whether to buy, hold, or sell specific securities.

A key difference between buy-side and sell-side analysts is their focus. Buy-side analysts aim to make profitable investment recommendations for their funds and are often compensated based on the returns generated. As a result, they tend to be more cautious and risk-averse, focusing on potential risks and pitfalls rather than the upside potential of an investment.

Buy-side analysts generally cover a broader range of areas and sectors than their sell-side counterparts. They are less restricted by regulations regarding share ownership, disclosures, and outside employment.

Buy-side analysts play a pivotal role in the investment process, as they are responsible for making investment decisions and managing their clients' money. They aim to grow the firm's portfolio and create value for their clients by identifying and investing in underpriced assets that are expected to appreciate over time.

Adjusting Your Investment Portfolio: Strategies for Success

You may want to see also

Buy-side firms include asset managers, hedge funds, and other companies that trade securities for their clients

Buy-side firms are those that purchase securities on behalf of their clients, with the goal of money or fund management. They include investment managers, asset managers, hedge funds, pension funds, and other companies that trade securities. These firms raise money from wealthy individuals and institutional investors, such as pension funds and insurance companies, and invest on their behalf. They profit from management fees, performance fees, or a combination of both.

Buy-side firms differ from sell-side firms, which issue, sell, or trade securities. Sell-side firms include investment banks, brokerages, market makers, and investment services firms. They earn money by charging commissions on the transactions they facilitate.

Buy-side analysts play a crucial role in the investment process for their firms. They identify promising investment opportunities, analyse financial statements, meet with company management, and build financial models to forecast future performance. Based on their research and recommendations, the buy-side firm will decide to buy, hold, or sell specific securities.

Buy-side analysts are primarily concerned with making profitable investment recommendations for their funds. They have a vested interest in the performance of their investments and are often compensated based on the returns they generate. As a result, they tend to be more cautious and risk-averse than sell-side analysts.

Overall, buy-side firms, including asset managers, hedge funds, and other companies trading securities for their clients, play an important role in the financial market by investing large portions of securities and managing their clients' money.

Keynes' Disconnect: Savings and Investment Unhinged

You may want to see also

Buy-side analysts evaluate an investment's potential and whether it aligns with a fund's investment strategy

Buy-side analysts work for investment firms and manage investment portfolios on behalf of their clients. They are employed by firms that purchase securities, including investment managers, pension funds, and hedge funds. These analysts evaluate an investment's potential and its alignment with a fund's investment strategy, conducting in-depth research on securities, sectors, and markets to inform their recommendations.

Buy-side analysts are responsible for identifying promising investments, analysing financial statements, meeting with company management, and building financial models to forecast future performance. They then advise portfolio managers on whether to buy, hold, or sell specific securities. Their recommendations are exclusive to the fund that employs them and are based on the evidence gathered through their research.

Buy-side analysts are primarily concerned with making profitable investment recommendations for their own funds. They have a personal stake in the performance of their investments and are often compensated based on the returns generated. As a result, they tend to be more cautious and risk-averse than sell-side analysts, focusing more on the potential pitfalls of an investment rather than its upside potential.

Buy-side analysts generally cover more areas and sectors than their sell-side counterparts. They have broader coverage responsibilities and often cover entire sectors, such as technology or industrials, rather than specific industries within those sectors.

In summary, buy-side analysts play a crucial role in the investment process by evaluating investment potential, conducting research, and advising fund managers. They focus on optimising portfolio performance, managing risk, and ensuring that investments align with the fund's investment strategy.

College Savings vs Investments: Where Should Your Money Go?

You may want to see also

Buy-side firms use sell-side services to make investments

Investment management is a buy-side activity. Buy-side firms include asset managers, hedge funds, pension funds, and other companies that trade securities for their clients.

Buy-side analysts evaluate an investment's potential and whether it aligns with a fund's investment strategy. They are responsible for identifying promising prospects, analysing financial statements, meeting with company management, and building financial models to forecast future performance. They then recommend to portfolio managers whether to buy, hold, or sell specific securities.

Sell-side firms, on the other hand, include investment banks, broker-dealers, and market makers that provide investment services to the rest of the market. Sell-side analysts are employed by a brokerage or firm that handles individual accounts and provides recommendations to the firm's clients. They are known for issuing recommendations such as "strong buy", "outperform", "neutral", or "sell".

Buy-side firms tend to have broader coverage responsibilities than sell-side firms. It is common for buy-side firms to have analysts covering the technology or industrials sectors, while sell-side firms tend to have several analysts covering particular industries within those sectors.

Buy-side and sell-side firms have different goals and incentives, but they are dependent on each other. Sell-side firms create and service products that are made available to buy-side firms, and buy-side firms use those products to make investments and manage their clients' money.

Portfolio Investments: Developing Countries' Failure

You may want to see also

Buy-side firms make money by buying low and selling high

Investment management is a broad term that covers the process of managing money or assets on behalf of clients. This can include a range of activities such as investing in stocks, bonds, mutual funds, or other financial instruments. When it comes to the "buy side", this refers to the segment of the financial market that buys and invests large portions of securities for money or fund management.

Buy-side firms include investment managers, pension funds, hedge funds, mutual funds, insurance firms, and other companies that trade securities for their clients. These firms make money by buying low and selling high, also known as creating value through trade activities. They aim to identify and buy underpriced securities, holding onto them until their price increases, and then selling them for a profit. This strategy is commonly known as "buying low and selling high".

For example, a buy-side analyst monitoring the price of a technology stock might observe a drop in its price compared to other stocks, while the tech company's performance remains strong. The analyst may then assume that the tech stock's price will increase in the near future. Based on this research, the buy-side firm will recommend buying this stock to its clients.

Buy-side analysts play a crucial role in this process. They are responsible for identifying promising investments, analysing financial statements, meeting with company management, and building financial models to forecast future performance. They then advise portfolio managers on whether to buy, hold, or sell specific securities.

Buy-side firms have a vested interest in the performance of their investments and are often compensated based on the returns they generate. As a result, they tend to be more cautious and risk-averse than sell-side analysts. They focus on the risks and potential pitfalls of an investment rather than its upside potential.

Overall, the buy-side of the financial market plays a vital role in money and fund management, aiming to generate returns for their clients by buying low and selling high.

Building a Motif Investment Portfolio: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The buy-side refers to firms that purchase securities, including investment managers, pension funds, and hedge funds. The sell-side refers to firms that issue, sell, or trade securities, including investment banks, advisory firms, and corporations.

Examples of buy-side firms include private equity firms, hedge funds, and venture capital firms.

Examples of sell-side firms include investment banks, brokerages, and investment bankers.