Investment risk refers to the degree of uncertainty inherent in an investment decision. In other words, when you invest in something, there is no guarantee of a return. In fact, you may lose money. There are different types of investment risk, and each has its own impact on your investments. These include market risk, business risk, liquidity risk, and concentration risk. Investment risk can be broadly categorized into two types: systematic risk and unsystematic risk. Systematic risk affects the prices of all comparable investments, and it refers to the economic, political, and sociological factors that impact all securities to varying degrees. Unsystematic risk, on the other hand, is unique to a firm, industry, or property, and can be reduced through diversification.

| Characteristics | Values |

|---|---|

| Systematic risk | Interest rate, market, reinvestment rate, purchasing power/inflation, currency |

| Unsystematic risk | Business risk, financial risk, default risk, liquidity/marketability risk, event risk |

| Credit risk | Loss from a borrower's failure to meet a contractual obligation |

| Downgrade risk | A bond or preferred stock is downgraded due to problems such as excessive business or financial risk |

| Liquidity and marketability risk | Uncertainty of converting an investment into cash in a short period |

| Event risk | Unanticipated and damaging events, such as regulatory changes, fraud, or negative media attention |

| Concentration risk | Having too many financial eggs in one basket, e.g., putting all your money in a single stock |

| Liquidity risk | Difficulty in cashing out of an investment |

| Inflation risk | Reduction in purchasing power due to inflation |

| Interest rate risk | Changes in interest rates affecting bond values |

| Foreign-exchange risk | Changes in currency exchange rates affecting the price of the asset |

| Political risk | Political instability or changes affecting an investment's returns |

| Country risk | A country's inability to honour its financial commitments |

What You'll Learn

Inflation risk

The impact of inflation on investments is that it undermines the performance of an investment, the value of an asset, or the purchasing power of an income stream. Inflation risk is especially pertinent to fixed-income assets, such as bonds, where coupon amounts remain consistent but their real value declines. For example, if an investor buys a 30-year bond with a 4% interest rate, but inflation skyrockets to 12%, the investor faces serious trouble as the purchasing power of their investment diminishes with each passing year.

To counteract inflation risk, investors can build an inflation premium into the interest rate or required rate of return (RoR) demanded for an investment. Some securities, such as Treasury Inflation-Protected Securities (TIPS), also adjust their cash flows for inflation to prevent changes in purchasing power.

India's Pharma Industry: Investing for a Healthier Future

You may want to see also

Interest rate risk

When interest rates increase, bond prices tend to decrease, and vice versa. This inverse relationship occurs because the market value of existing bonds adjusts to align with the attractiveness of newly issued bonds offering higher or lower rates. As a result, investors may face opportunity costs as older bonds with lower interest rates become less attractive, leading to a decline in their market value.

The impact of interest rate risk depends on the bond's maturity and coupon rate. Longer-term bonds are more susceptible to interest rate fluctuations as investors are locked into a fixed rate for an extended period, making the bond's value more sensitive to interest rate changes. Bonds with lower coupon rates also tend to be more vulnerable to interest rate risk, as their lower interest payments become less appealing when rates rise.

To manage interest rate risk, investors can employ strategies such as diversifying their portfolios by including a mix of short-term and long-term bonds, as well as other types of securities that are less prone to interest rate fluctuations. Additionally, hedging strategies, such as the use of derivatives like interest rate swaps, options, futures, and forward rate agreements, can be utilised to mitigate potential losses.

Creating an Investment Model: Excel Essentials

You may want to see also

Market risk

The most common types of market risk include interest rate risk, equity risk, currency risk, and commodity risk. Interest rate risk is relevant to fixed-income investments and stems from fluctuations in interest rates due to central bank monetary policy changes. Equity risk pertains to changing stock prices, while currency risk, or exchange-rate risk, arises from changes in the relative value of currencies. Lastly, commodity risk relates to fluctuations in the prices of raw materials such as crude oil, corn, cotton, and steel.

While market risk cannot be entirely eliminated, investors can employ hedging strategies and diversify their portfolios to soften potential financial losses.

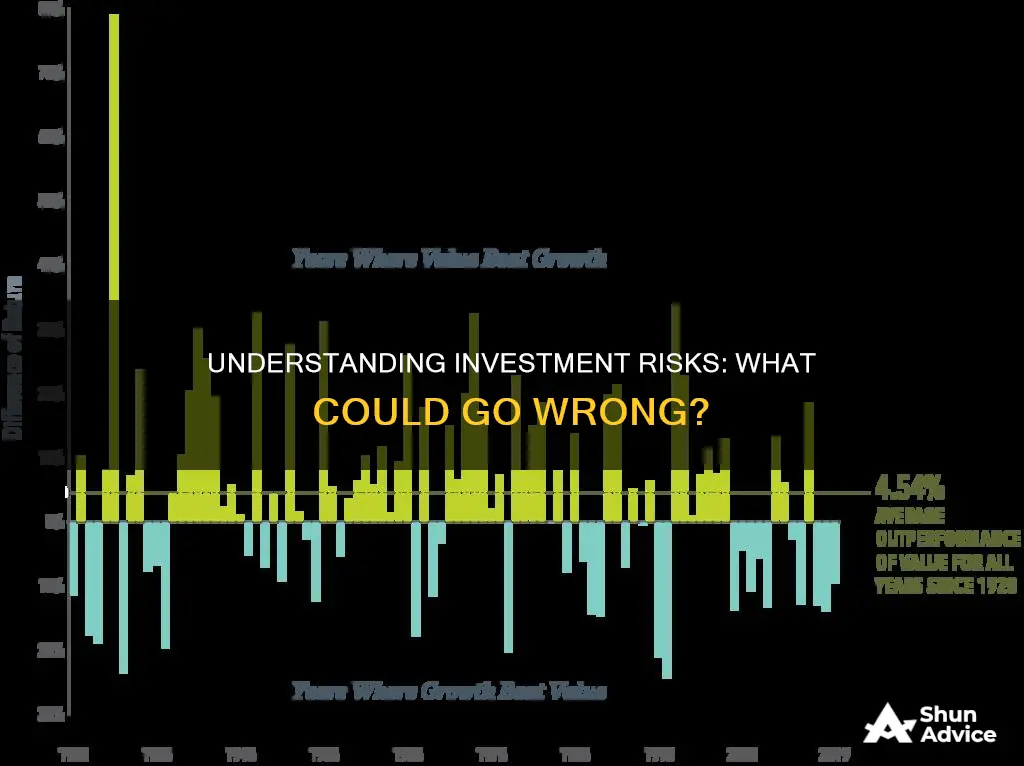

Tilt Your Investment Portfolio: Value and Small-Cap Focus

You may want to see also

Credit risk

The risk of default is higher for corporate bonds than for government bonds. Government bonds, especially those issued by federal governments, have the lowest default risk and, consequently, the lowest returns. On the other hand, corporate bonds tend to have higher interest rates but also a higher risk of default.

Credit rating agencies like Moody's Investors Services and Fitch Ratings evaluate the credit risks of bond issuers and assign ratings to them. Bonds with lower ratings have a higher risk of default, while those with stronger ratings have a lower risk.

While it is challenging to predict exactly who will default on their obligations, proper assessment and management of credit risk can help lessen the severity of potential losses.

Understanding High-Risk Fidelity Investments: What to Know

You may want to see also

Liquidity risk

Market liquidity risk occurs when an enterprise cannot execute transactions at current market prices due to insufficient market depth or disruptions. This is especially common in illiquid markets, where imbalances in supply and demand dynamics can make it challenging to execute large transactions without affecting the market. For example, selling a large volume of shares in a thinly traded stock could significantly lower the share price, leading to losses for the seller.

Funding liquidity risk, on the other hand, refers to the inability to obtain sufficient funding to meet short-term financial obligations. This is often a reflection of the entity's mismanagement of cash, its creditworthiness, or unfavourable market conditions, which may deter lenders or investors from providing funding. Even creditworthy entities might struggle to secure short-term funding at favourable terms during periods of financial turbulence.

Basel III is an example of a regulatory framework that enforces stringent liquidity standards on banks to ensure financial stability and protect depositors' interests. It sets liquidity coverage and stable funding ratios that banks must adhere to, promoting resilience against liquidity risk.

Savings vs. Investment Institutions: Where Should Your Money Go?

You may want to see also

Frequently asked questions

Investment risk refers to the degree of uncertainty inherent in an investment decision. There are no guarantees when it comes to investing, and the possibility of losing money is always present.

Investment risks can be broadly categorized into two types: systematic risk and unsystematic risk. Systematic risk, also known as market risk, is caused by factors such as economic conditions, political events, and market sentiment, which affect a wide range of investments. Unsystematic risk, also known as specific or diversifiable risk, is unique to a particular company, industry, or property and can often be reduced through diversification.

Generally, as investment risks increase, the potential for greater rewards or losses also increases. Investors who take on risky investments expect higher returns to compensate for the risk they are assuming.

While it is impossible to eliminate investment risk entirely, there are strategies to manage it. Diversification, asset allocation, and hedging are common approaches to reduce risk. Additionally, understanding your risk tolerance and investment time horizon can help guide your investment decisions.

Some common types of investment risks include interest rate risk, currency risk, credit risk, liquidity risk, and event risk. Interest rate risk refers to the impact of changing interest rates on the value of investments. Currency risk arises from fluctuations in exchange rates for international investments. Credit risk is the potential for loss due to a borrower's failure to meet their contractual obligations. Liquidity risk pertains to the ease of converting an investment into cash. Event risk considers the impact of unanticipated events, such as regulatory changes or negative media attention, on the value of an investment.