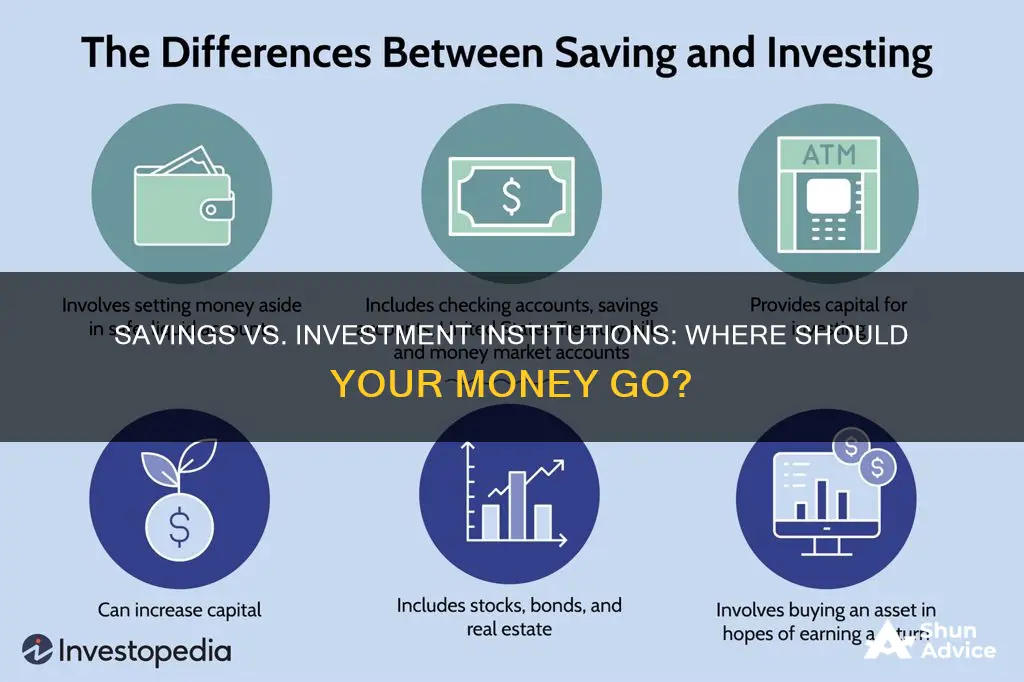

There are several types of financial institutions, each with its own unique structure and purpose. Savings institutions, also known as savings and loan (S&L) associations, thrift banks, or thrifts, focus on providing consumers with opportunities to save and borrow money. They offer various services, including deposits, loans, mortgages, checks, and debit cards, with a particular emphasis on residential mortgages. On the other hand, investment institutions, such as investment banks and brokerage firms, facilitate complex transactions and act as intermediaries for their clients. They help individuals, businesses, and governments raise capital through the issuance of securities and provide advisory services for institutional clients. Understanding the differences between these institutions is essential for individuals and businesses when making financial decisions and choosing the most appropriate avenue for their needs.

| Characteristics | Values |

|---|---|

| Purpose | Savings institutions: Provide savings accounts and lend money for mortgages. |

| Investment institutions: Provide a wider range of financial offerings, including credit cards, wealth management, and investment banking services. | |

| Ownership | Savings institutions: Owned by customers or shareholders. |

| Investment institutions: Owned and managed by a board of directors selected by shareholders. | |

| Customers | Savings institutions: Serve individual consumers. |

| Investment institutions: Serve both consumers and businesses. | |

| Lending | Savings institutions: Focus on residential mortgages. |

| Investment institutions: Focus on working with large businesses and unsecured credit services. |

What You'll Learn

- Savings institutions are owned by customers or shareholders, while investment institutions are owned by a board of directors selected by stockholders

- Savings institutions focus on mortgages and savings accounts, while investment institutions focus on growing wealth

- Savings institutions are often smaller and more local, while investment institutions can be large, multinational corporations

- Savings institutions are insured by the FDIC, while investment institutions are not

- Savings institutions have a narrower range of financial offerings, while investment institutions offer a broader range of services

Savings institutions are owned by customers or shareholders, while investment institutions are owned by a board of directors selected by stockholders

Savings institutions are typically owned by their customers or shareholders, while investment institutions are owned by a board of directors selected by stockholders.

Savings institutions, also known as savings and loan associations, savings banks, thrifts, or thrift institutions, are owned by their customers or shareholders. They were established in the 1930s to provide affordable mortgages to consumers and enable more middle-class Americans to buy their own homes. While they are less common today, they still exist to extend financing to homebuyers. Savings institutions are owned and chartered differently from commercial banks. They tend to have a more locally-drawn customer base and can be owned by their depositors and borrowers under the mutual ownership model, or by a consortium of shareholders with controlling stock ownership.

On the other hand, investment institutions, such as commercial banks, are owned and managed by a board of directors chosen by stockholders. Commercial banks are typically large, multinational corporations that provide a wide range of financial services, including credit cards, wealth management, and investment banking services. They tend to focus on working with large businesses and offering unsecured credit services.

The ownership structure of savings and investment institutions leads to differences in their operations and offerings. Savings institutions focus on mortgages and savings accounts, while investment institutions offer a broader range of financial products. Savings institutions are also more likely to be smaller, locally-focused institutions that offer higher interest rates and more personalized customer service.

Purchasing a Condominium: Saving or Investing?

You may want to see also

Savings institutions focus on mortgages and savings accounts, while investment institutions focus on growing wealth

Savings institutions and investment institutions are two different types of financial institutions that offer various services to their customers. While both types of institutions offer deposit and lending services, there are some key differences in their focus and the types of customers they serve.

Savings institutions, also known as thrift institutions or thrifts, have a strong focus on providing residential mortgages and savings accounts to their customers. They are typically owned by their customers or shareholders and were established to make homeownership more accessible and affordable. While they may also offer other financial products such as checking accounts, home equity loans, and debit cards, their primary goal is to facilitate savings and provide loans for individuals. These institutions are ideal for those looking for competitive interest rates and personalized customer service.

On the other hand, investment institutions focus on growing wealth for their clients. They offer a broader range of financial services, including investment banking, wealth management, and securities trading. Investment institutions work with individuals, businesses, and governments to raise capital and provide investment opportunities. They act as intermediaries in complex transactions, such as initial public offerings (IPOs) or mergers and acquisitions. These institutions typically serve clients with a higher net worth and focus on long-term financial goals, such as retirement planning or saving for college.

The main distinction between the two types of institutions lies in their purpose and client base. Savings institutions cater to retail (individual) clients and focus on providing mortgages and savings accounts, while investment institutions cater to a wider range of clients, including individuals, businesses, and institutions, and offer a broader range of investment services.

Additionally, savings institutions are known for their competitive interest rates on savings accounts and mortgages, while investment institutions offer the potential for higher returns but come with a higher level of risk. Savings institutions are ideal for those seeking a more personalized banking experience and competitive rates, while investment institutions are better suited for those looking to grow their wealth over the long term.

CDs: Investment or Saving?

You may want to see also

Savings institutions are often smaller and more local, while investment institutions can be large, multinational corporations

Savings institutions, also known as savings and loan (S&L) associations, thrift institutions, or simply thrifts, are typically owned by their customers or shareholders. They offer services such as deposits, loans, mortgages, and debit cards, with a focus on residential mortgages. S&Ls are usually smaller and more locally focused, serving specific communities with brick-and-mortar locations. They are also known for providing more competitive interest rates and tailored customer service.

On the other hand, investment institutions, or investment banks, are financial institutions that facilitate complex transactions, such as company mergers or IPOs. They also act as brokers or financial advisors for large institutional clients. Investment banks help raise capital for individuals, businesses, and governments through the issuance of securities. They can be large, multinational corporations, serving both individual and institutional clients.

While savings institutions focus on residential mortgages and serving local communities, investment institutions cater to a broader range of clients, including institutional investors. The scale and scope of their operations differ significantly, with investment institutions often dealing with more significant financial transactions and serving a wider geographic area.

In summary, savings institutions cater to individual customers, offering a range of financial services with a focus on residential mortgages and local communities. In contrast, investment institutions facilitate more complex financial transactions, serving both individual and institutional clients on a larger, often multinational, scale.

Investing Life Savings: Strategies for Long-Term Financial Growth

You may want to see also

Savings institutions are insured by the FDIC, while investment institutions are not

Savings institutions and investment institutions are both types of financial institutions that offer various services to their customers. However, one key difference between the two is that savings institutions are insured by the Federal Deposit Insurance Corporation (FDIC), while investment institutions are not.

The FDIC is a government agency that was created by Congress in 1933 to protect consumers and their deposits in the event of a bank failure. The FDIC insures deposits in banks and savings institutions up to a certain limit, typically $250,000 per depositor per insured bank. This insurance provides customers with peace of mind, knowing that their money is protected even if the financial institution fails.

Savings institutions, also known as savings and loan (S&L) associations, thrifts, or thrift institutions, have a strong focus on residential mortgages and consumer loans. They offer various services such as deposits, loans, mortgages, checks, and debit cards. S&Ls are typically owned by their customers or shareholders and have a more local customer base. As of the end of 2018, there were 691 savings and loan companies insured by the FDIC.

On the other hand, investment institutions, or investment banks, are not insured by the FDIC. Investment banks provide different services compared to savings institutions. They help individuals, businesses, and governments raise capital through the issuance of securities. They also act as intermediaries in complex transactions, such as initial public offerings (IPOs) or mergers and acquisitions. Investment banks often work with large institutional clients such as pension funds and offer financial advisory services.

The distinction between savings institutions and investment institutions lies in their purpose, ownership, and the types of services they offer. Savings institutions focus on consumer-oriented services, especially residential mortgages, and are insured by the FDIC. In contrast, investment institutions facilitate capital raising, provide financial advisory services, and are not covered by FDIC insurance.

By understanding the differences between these two types of financial institutions, individuals can make more informed decisions about where to deposit their savings and seek specific financial services.

Monetary Policy: Investing and Saving Explained

You may want to see also

Savings institutions have a narrower range of financial offerings, while investment institutions offer a broader range of services

Savings institutions and investment institutions are two distinct types of financial entities that serve different purposes and cater to diverse customer needs. Understanding their unique characteristics is essential for individuals looking to manage their finances effectively. While savings institutions have a narrower range of financial offerings, investment institutions offer a broader spectrum of services to their clients.

Savings institutions, also known as savings and loan (S&L) associations, thrift banks, or simply thrifts, have a primary focus on providing residential mortgages to their customers. They were established to make homeownership more accessible to middle-class Americans by offering affordable mortgage options. While they also offer other services such as deposits, loans, checks, and debit cards, their core emphasis remains on residential real estate lending. These institutions are typically owned by their customers or shareholders, and their customer base tends to be locally-drawn.

On the other hand, investment institutions, often referred to as commercial banks, offer a much wider array of financial products and services. They cater to both consumers and businesses, providing services such as deposits, loans, credit cards, wealth management, and investment banking. Commercial banks tend to work with large businesses and focus on unsecured credit services, such as credit cards. They are owned and managed by a board of directors selected by stockholders and often operate as large, multinational corporations.

The distinction between savings institutions and investment institutions lies in their scope of services and target market. Savings institutions cater predominantly to individual clients seeking residential mortgages and savings accounts, while investment institutions offer a broader range of financial products to both consumers and businesses. This includes credit cards, wealth management, and investment banking services, in addition to various lending options.

It is worth noting that the specific services offered by savings and investment institutions may vary, and some institutions may blur the lines between these two categories. However, the fundamental difference lies in their primary focus and the range of financial offerings they provide. Individuals should carefully consider their financial goals and needs when choosing between these institutions, as each serves distinct purposes and caters to different market segments.

Saving Relationships: Worth the Investment?

You may want to see also

Frequently asked questions

Savings institutions are typically owned by their customers or shareholders and focus on mortgages and savings accounts. They receive savings from individuals and use those funds to provide loans, primarily residential mortgages. Investment institutions, on the other hand, facilitate investments in financial assets by individuals and institutions by pooling resources and investing them according to stipulated objectives.

Examples of savings institutions include savings and loan associations, credit unions, and mutual savings banks.

Examples of investment institutions include mutual funds, money market mutual funds, and finance companies.

Savings institutions often offer competitive interest rates and fees, as well as more personalized customer service. They are usually smaller institutions that concentrate on growing homeownership and meeting the financial needs of local consumers.