An increase in portfolio investment can refer to a rise in the value of a portfolio, or the act of investing more capital. There are several ways to increase the value of a portfolio, including investing in growth sectors, dollar-cost averaging, and diversification. Diversification is a cornerstone of portfolio investment, and it involves spreading investments across different asset classes, sectors, and geographical regions to reduce risk and increase returns. The right mix of assets depends on an investor's risk tolerance, financial goals, and timeline. Additionally, investing earlier in life and taking advantage of tax-favored retirement accounts can also increase portfolio value.

| Characteristics | Values |

|---|---|

| Compound Growth | The longer the investment period, the greater the value |

| Amount of Money Invested | The more money invested, the greater the value |

| Portfolio Rate of Return | Higher returns can be achieved with higher risk |

| Asset Allocation | Diversification across different asset classes and geographic regions can improve returns and reduce risk |

| Taxes | Keeping investment taxes low can increase portfolio value |

| Equities vs Bonds | Equities carry a higher risk than bonds but can offer attractive returns with low volatility |

| Small vs Large Companies | Smaller companies carry a higher risk but have historically provided higher returns |

| Active vs Passive Management | Passive management is cheaper but active management may be more profitable |

| Value vs Growth Companies | Value companies have outperformed growth companies |

| Dollar-Cost Averaging | A strategy to reduce the overall cost basis of shares |

What You'll Learn

Invest early and often

Investing early and often is a key principle for increasing your portfolio value. The earlier you start, the more time your investments have to benefit from compound growth. For example, if you start investing for retirement at 25 years old, a $300 monthly investment earning 8% interest will grow to $1 million by the time you're 65. Waiting until you're 45 to start would require a monthly investment of $1,700 to reach the same goal.

- Invest as much as you can: The amount of money you invest also makes a big difference. While you can make up for lost time by investing more, it's much harder to do so.

- Balance risk and return: Focus on achieving a high portfolio rate of return while managing your risk exposure. Diversification across different asset classes, sectors, and geographic regions can help reduce risk and improve returns.

- Optimize asset allocation: How you divide your portfolio between different asset classes, such as stocks, bonds, cash, and alternative investments, is a critical factor in determining your portfolio's performance. Studies show that asset allocation can account for over 90% of your portfolio returns.

- Keep investment taxes low: Take advantage of tax-favored retirement accounts and long-term capital gains to minimize the taxes you pay on your investments. This allows you to compound your investment growth tax-free or tax-deferred.

By investing early and often, saving as much as possible, balancing risk and return, optimizing your asset allocation, and minimizing investment taxes, you can build wealth and increase your portfolio value over time.

The Emotional Rewards of Saving and Investing

You may want to see also

Diversify your portfolio

Diversifying your portfolio is a key part of any investment plan. The future is uncertain, and diversification is a way to manage risk by investing in a variety of asset classes and different investments within asset classes. By diversifying your portfolio, you can smooth out the inevitable peaks and valleys of investing, making it more likely that you'll stick to your investment plan. Here are some tips to help you diversify your portfolio:

- It's not just about stocks vs. bonds: While the ratio of stocks to bonds in a portfolio is a traditional way to gauge diversification, it's important to also consider the industries and sectors you have exposure to. Be sure to think about the underlying businesses you're investing in and ensure your portfolio isn't overly weighted in one area.

- Use index funds: Index funds and ETFs are a great way to build a diversified portfolio at a low cost. Purchasing funds that track broad indexes like the S&P 500 allows you to buy into a diverse portfolio for a low management fee.

- Don't forget about cash: Cash is often overlooked, but it can provide protection in the event of a market sell-off and give you optionality to take advantage of future investment opportunities.

- Target-date funds: These funds automatically adjust your portfolio allocation over time, investing in riskier assets when you're far from your goal and shifting to safer assets as you get closer.

- Periodic rebalancing: Over time, the size of the holdings in your portfolio will change. Strong performers will become a larger percentage, while weaker ones will decline. To maintain diversification, it's important to rebalance your portfolio occasionally to ensure each investment is at the appropriate weight.

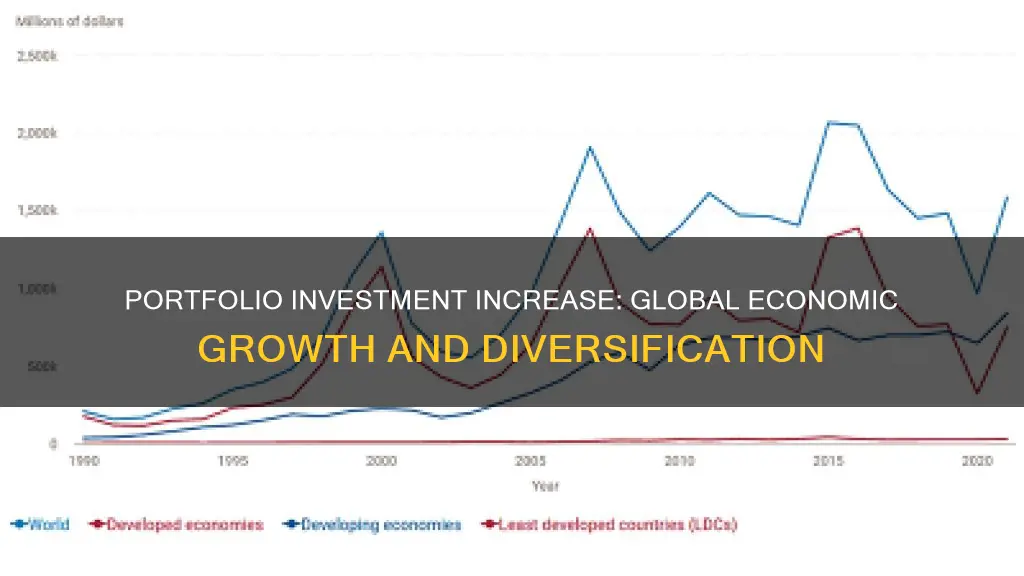

- Think global: Don't forget about investment opportunities outside your home country. There are increasingly attractive opportunities in emerging markets and other countries with faster long-term growth rates than your own.

While diversification is important, it's possible to over-diversify your portfolio. Not all investments add diversification benefits, so watch out for overlapping investments and focus on holding uncorrelated assets that move in opposite directions.

- Start early: Compound growth is the most powerful investment principle. The earlier you start, the more time your investments have to grow.

- Amount of money invested: The more you can invest, the better. Consider automatic investment plans to pay yourself first.

- Portfolio rate of return: Balance the desire for high returns with the risk of large losses. Develop a risk management plan.

- Asset allocation: How you divide your portfolio between different asset classes is crucial. Combining assets with low correlation can reduce volatility and allow for higher-risk/higher-reward investments.

- Taxes: Keep investment taxes low by taking advantage of tax-favored retirement accounts and long-term capital gains.

S-Corp Savings: Investing for Growth and Security

You may want to see also

Choose asset allocation wisely

Choosing asset allocation wisely is a fundamental principle of investing. It involves dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash or money market securities. The right asset allocation can balance risk and potential returns and help you meet your financial goals. Here are some tips to help you choose your asset allocation wisely:

- Understand your financial goals and risk tolerance: Your asset allocation should align with your financial objectives, time horizon, and risk tolerance. If you have a long time horizon and a higher risk tolerance, you may be comfortable with a more aggressive allocation that includes high-risk, high-return options. On the other hand, if you have a shorter time horizon and a lower risk tolerance, you may prefer a more conservative allocation with low-risk, low-return options.

- Diversify your portfolio: Diversification is a key component of effective asset allocation. By investing in a variety of asset classes and subclasses, you can reduce the overall risk of your portfolio. For example, you can invest in large-cap, mid-cap, and small-cap stocks, international securities, emerging markets, fixed-income securities, money market instruments, and real estate investment trusts (REITs). Diversification ensures that your portfolio is not overly exposed to the risks associated with any single asset class.

- Consider historical performance: When deciding on your asset allocation, consider the historical performance of different asset classes. Historically, stocks have offered higher returns than bonds but with higher volatility. Bonds, on the other hand, provide lower returns but reduce portfolio volatility. By understanding the risk-return trade-off, you can decide how much volatility you are comfortable with to achieve your desired returns.

- Regularly review and rebalance your portfolio: Asset allocation is not a one-time decision. It requires regular reviews and adjustments to ensure it remains aligned with your changing financial needs and goals. Over time, the performance of different assets will cause your portfolio to drift from its original allocation. Rebalancing involves adjusting your portfolio back to your intended allocation. This can be done by selling over-weighted assets, purchasing under-weighted assets, or altering your contributions to favour under-weighted assets.

- Seek professional advice: Determining the right asset allocation can be complex, and it is one of the most important decisions you'll make regarding your investments. Consider seeking advice from a financial professional who can help you choose an allocation that suits your goals and risk tolerance. Be sure to research the credentials and disciplinary history of any potential advisors.

Investment Philosophy: Portfolio Diversification Strategies Explained

You may want to see also

Manage your expenses

An increase in portfolio investment can refer to a variety of factors, such as the interest on a certificate of deposit, higher closing prices of stocks, or simply depositing more money into an investment account. Here are some detailed and direct instructions to help manage your expenses:

Develop a Realistic Budget and Stick to It

Create a monthly or weekly budget that works for you and your financial situation. There are many budgeting systems available, such as spreadsheets, online software, or apps, that can help you keep track of your expenses and savings.

Curb Impulse Buying

Take time to consider purchases. Ask yourself if you really need the item and if it aligns with your budget. This simple step can help you avoid unnecessary spending.

Learn to Manage Debt

If you have multiple debts, develop a plan to manage them effectively. You can consider taking a personal financial management course or exploring options like consolidating your loans or negotiating better rates with creditors.

Control Monthly Expenses

Cutting down on monthly expenses can make a significant difference. Review your bills and identify areas where you can reduce spending, such as streaming services, excessive energy use, or cellphone plans.

Identify Ways to Cut Expenses and Save Money

Look for cost-effective alternatives to your current spending habits. For example, instead of dining out, cook at home, or cancel gym memberships if you don't use them often. These small changes can help increase your savings over time.

Pay Off Debts in Full

Avoid the habit of only paying the minimum amount on your credit card bills. Paying off debts in full helps you avoid accumulating more debt due to high-interest rates.

Keep Rental and Mortgage Payments Reasonable

Ensure your housing costs are within a comfortable range for your income. As a rule of thumb, rental payments should ideally not exceed one-fourth to one-third of your monthly income.

By following these steps and staying disciplined, you can effectively manage your expenses and work towards your financial goals.

Savings or Investing: Which Offers Better Liquidity?

You may want to see also

Keep investment taxes low

An increase in portfolio investment refers to a rise in the value of an investment portfolio, which can be achieved through various strategies. One crucial aspect of increasing portfolio value is minimising investment taxes. Here are some strategies to keep investment taxes low:

- Use tax-advantaged accounts: Take advantage of tax-favoured retirement accounts such as Roth and Traditional IRAs, 401(k) plans, and 529 savings plans. These accounts offer tax benefits on the money within them, helping you keep more of your investment returns.

- Practice buy-and-hold investing: The Internal Revenue Service (IRS) taxes realised capital gains, which occur when you sell an investment for cash. By holding onto your investments for the long term, you can defer or even eliminate capital gains taxes. Additionally, passive investing through a buy-and-hold strategy tends to outperform active investing over time.

- Take advantage of tax-loss harvesting: Use tax-loss harvesting to offset taxable capital gains with realised investment losses. This strategy can help you reduce or eliminate your taxable capital gains, resulting in a lower tax bill.

- Consider asset location: Hold dividend stocks or other investments with taxable distributions within the confines of a tax-advantaged account, such as an IRA. This allows you to avoid taxes on distributions while still benefiting from tax deferral on capital gains.

- Contribute to a Health Savings Account (HSA): If you have a high-deductible health insurance plan, consider using an HSA to reduce taxes. Contributions to an HSA are typically tax-deductible, and withdrawals are also tax-free when used for qualified medical expenses.

- Invest in Municipal Bonds: Municipal bonds, or "munis," offer tax-free interest payments, as you don't have to pay federal income tax on the interest. However, be mindful of potential exceptions, such as the "de minimis" tax if you purchase the bonds at a significant discount.

- Take advantage of long-term capital gains rates: The IRS offers preferential tax rates for long-term capital gains, which apply if you hold a capital asset for more than a year. These rates are typically lower than short-term capital gains rates, so holding investments for the long term can result in significant tax savings.

Trade Deficits: Savings, Investments, and the Economy's Future

You may want to see also

Frequently asked questions

A portfolio investment is ownership of a stock, bond, or other financial asset with the expectation that it will earn a return or grow in value over time.

There are several ways to increase the value of your portfolio, including:

- Starting your investment program early

- Investing more money

- Increasing your portfolio rate of return

- Adjusting your asset allocation

- Minimising investment taxes

An increase in portfolio investment can result in greater financial gains and higher returns. It can also help to reduce risk and improve stability by diversifying your investments across different asset classes, sectors, and geographical regions.