Investment philosophy is a broad term that covers an investor's goals, risk tolerance, and strategies for achieving those goals. One of the most important concepts in financial planning and investment management is diversification, which is the practice of spreading investments across different assets to reduce risk.

Diversification is an active strategy and a powerful source of alpha, and it is a cornerstone of modern portfolio theory. By diversifying, investors can balance their comfort level with risk against their time horizon. For example, a young investor might invest too conservatively, risking that the growth rate of their investments won't keep pace with inflation. On the other hand, an older investor might invest too aggressively, leaving their savings exposed to market volatility.

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio to reduce portfolio risk. It is most often achieved by investing in different asset classes such as stocks, bonds, real estate, or cryptocurrency, but it can also be achieved by purchasing investments in different countries, industries, company sizes, or term lengths.

The primary goal of diversification is to reduce the impact of volatility on a portfolio and balance risk and reward.

| Characteristics | Values |

|---|---|

| Purpose | Reduce risk without sacrificing much in the way of returns |

| Definition | Spreading investments across different asset classes, industries, and geographic regions |

| Benefits | Improve potential returns, stabilize results, make investing more fun, increase risk-adjusted returns |

| Drawbacks | More time-consuming and expensive to manage, may limit gains in the short term |

| Risk | Cannot eliminate all risk, powerless against market-specific risk |

| Strategies | Diversifying across sectors and industries, companies, asset classes, borders, time frames |

What You'll Learn

Diversification reduces risk and volatility

Diversification is a risk management strategy that reduces volatility and risk by creating a mix of various investments within a portfolio. It is a powerful source of alpha and is considered the crown jewel of modern portfolio theory.

Diversification is the practice of spreading your investments so that your exposure to any one type of asset is limited. It is a way to balance risk and reward in your investment portfolio. The primary goal of diversification is to limit the impact of volatility on a portfolio. By diversifying your assets, you can help mitigate the risk and volatility in your portfolio, reducing the number and severity of ups and downs.

Diversification can be achieved by investing in different asset classes such as stocks, bonds, real estate, or cryptocurrency. It can also be achieved by purchasing investments in different countries, industries, company sizes, or term lengths for income-generating investments. For example, if you have an investment portfolio that only contains airline stocks, you can counterbalance these stocks with railway stocks so that only part of your portfolio will be affected by industry-specific bad news.

Studies have shown that maintaining a well-diversified portfolio of 25 to 30 stocks yields the most cost-effective level of risk reduction. While diversification may lead to lower portfolio-wide returns, it can also increase the risk-adjusted rate of return for an investor. It can also help to preserve capital, especially for retirees or older investors.

Additionally, diversification can make investing more enjoyable for those who like researching new opportunities. It can also lead to better opportunities and higher risk-adjusted returns. However, it is important to note that diversification does not eliminate all types of risk within a portfolio.

National Saving Certificates: Smart Investment Strategies

You may want to see also

Diversification can increase returns

Diversification is a powerful investment strategy that can increase returns while managing risk. By spreading investments across various asset classes, industries, and geographic regions, investors can reduce the overall risk of their portfolio. This strategy aims to hold a variety of investments so that the poor performance of one can be offset by the better performance of another, leading to a more consistent overall return.

Risk-adjusted returns

Diversification is thought to increase risk-adjusted returns, meaning that investors earn greater returns when the risk they are taking is factored in. While diversification may lead to lower portfolio-wide returns, it also reduces the volatility of the portfolio over time. This means that investors can potentially achieve higher returns relative to the risk they are taking, which is especially important for older investors and retirees who need to preserve their wealth.

Better opportunities

Diversification can lead to better investing opportunities due to wider exposure. For example, investing in a streaming service to diversify away from transportation companies may expose investors to positive changes in the technology sector. This can result in higher overall returns for the portfolio.

Enjoyment in investing

For some, diversification can make investing more enjoyable. Instead of focusing on a narrow group of investments, diversification involves researching new industries, comparing companies, and emotionally investing in different sectors. This can make the process of investing more fun and engaging.

Reduced impact of market volatility

While diversification does not eliminate risk, it can help reduce the impact of market volatility. By diversifying across asset classes, investors can protect themselves from significant losses due to systematic risks such as inflation rates, exchange rates, and political instability.

Long-term performance

Diversification can help strike a balance between risk and return, especially over the long term. For example, a portfolio with 49% domestic stocks, 21% international stocks, 25% bonds, and 5% short-term investments generated average annual returns of nearly 9% over a period, with a narrower range of highs and lows compared to a more aggressive portfolio.

In conclusion, diversification is a powerful tool for investors to increase returns while managing risk. By spreading investments across various assets and sectors, investors can achieve more consistent returns, better opportunities, and reduced volatility. However, it is important to note that diversification may also lead to lower overall returns and can be cumbersome and expensive to manage.

Investment Strategies: University of Michigan's Portfolio Management

You may want to see also

Diversification is a defensive strategy

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio to reduce the overall risk of any individual holding or security. It is a way to balance comfort levels with risk against the time horizon. For example, if a young person invests their retirement savings too conservatively, they run the risk of their investments not keeping pace with inflation, and not growing sufficiently. On the other hand, if an older person invests too aggressively, they could expose their savings to market volatility, which may erode the value of their assets.

The process of diversification involves spreading investments across different asset classes, industries, and geographic regions. The idea is that by holding a variety of investments, the poor performance of one investment can be offset by the better performance of another, leading to a more consistent overall return. Diversification aims to include assets that are not highly correlated with one another.

The US Securities and Exchange Commission actively promotes diversification. It is a strategy that works best when there is activity to capture price movements, and it can be applied to the investment process itself.

The primary goal of diversification is to limit the impact of volatility on a portfolio. It is not to maximize returns. By diversifying, an investor can benefit from owning top performers without suffering the full effect of owning bottom performers.

There are several benefits to diversification. It can increase the potential for higher long-term investment returns, stabilize results, and protect against losses. It can also be enjoyable for investors who like to research new opportunities. However, diversification may also lead to lower portfolio-wide returns and can be burdensome to manage, with higher transaction fees.

While diversification can reduce risk, it cannot eliminate it. It can reduce asset-specific risk but not market risk. It is powerless against market-specific risk.

A well-diversified portfolio will include a mix of stocks, bonds, funds, real estate, CDs, and even savings accounts.

Savings Surplus: Impact on Economy and Investment Opportunities

You may want to see also

Diversification is a powerful source of alpha

Diversification is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of an investment portfolio. The idea is that by holding a variety of investments, the poor performance of any one investment can be offset by the better performance of another, leading to a more consistent overall return.

Additionally, diversification can increase the risk-adjusted returns of a portfolio. This means that investors earn greater returns when factoring in the risk they are taking. While diversification may lead to lower overall portfolio returns, it can also help to preserve capital and generate more consistent returns, which is particularly important for investors seeking to preserve wealth.

Furthermore, diversification can provide better opportunities for investors. By researching and investing in new industries, investors can take advantage of positive changes across sectors that may not have been possible without diversification. Diversification can also make investing more enjoyable for those who like to research new opportunities.

However, diversification has its limitations and may not always lead to alpha. It can be cumbersome and expensive to manage a diverse portfolio, and it may require more time and effort to track a larger number of holdings. Additionally, diversification may result in lower overall portfolio returns as the benefits of diversification diminish after a certain number of holdings.

In conclusion, diversification is a powerful source of alpha as it helps to balance risk and reward, preserve capital, increase risk-adjusted returns, and provide better opportunities for investors. However, it is important to consider the limitations of diversification and the potential for lower overall portfolio returns.

Savings Investment: Choosing Wisely for Your Future

You may want to see also

Diversification is not a guarantee of success

Diversification is a common investing technique used to reduce the chances of experiencing large losses. However, it is important to remember that diversification does not guarantee success. While it can help manage risk and improve returns, it is not a silver bullet. Here are some reasons why diversification is not a guarantee of success:

- Risk of Loss: Diversification does not ensure a profit or guarantee against loss. While it can help reduce the overall risk of an investment portfolio, it does not eliminate risk completely. There are certain risks, such as systematic or market risk, that cannot be avoided through diversification.

- Lower Returns: Diversification can potentially lower returns. By spreading investments across different assets, industries, and geographic regions, investors may miss out on the high returns of a specific stock, asset class, or market segment that is outperforming.

- Complexity and Cost: Diversification can be complex and cumbersome to manage, especially for inexperienced investors. It may also be expensive due to transaction fees, brokerage charges, and the cost of certain asset classes.

- Impact of Global Events: Some risks, such as the COVID-19 pandemic, can affect multiple asset classes simultaneously. Diversification may mitigate some losses in these cases but cannot protect against overall market downturns.

- Time and Effort: Diversification requires time and effort to research and select appropriate investments, monitor their performance, and rebalance the portfolio periodically. It is not a one-time task and needs regular attention and adjustment.

- Individual Differences: The optimal level of diversification varies from person to person. The Financial Industry Regulatory Authority (FINRA) states that diversification is specific to each individual and should be decided based on one's investment goals, risk tolerance, and professional advice.

In conclusion, while diversification is a valuable tool for managing investment risk, it does not guarantee success. Investors should strike a balance between diversification and maximizing returns, considering their risk tolerance and investment goals.

Building a Solid Investment Portfolio: A Beginner's Guide

You may want to see also

Frequently asked questions

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio to limit exposure to any single asset or risk.

Diversification can improve your potential returns and stabilize results. By owning multiple assets that perform differently, you reduce the overall risk of your portfolio, so no single investment can hurt you too much.

You can develop a diversification strategy by investing in different asset classes, such as stocks, bonds, real estate, or cryptocurrency. You can also invest in different countries, industries, sizes of companies, or term lengths for income-generating investments.

Asset allocation covers the mix of stocks and bonds, while diversification is a portfolio approach within one asset class.

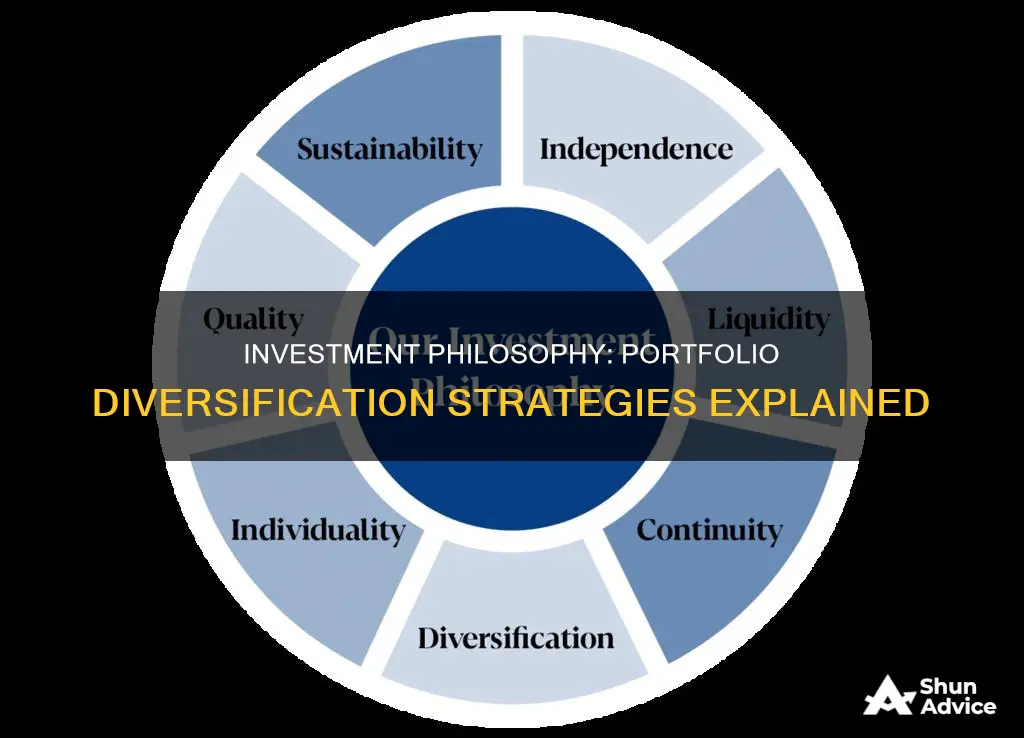

Investment philosophy and portfolio diversification are closely related. Investment philosophy is guided by principles such as asset allocation, efficient market theory, and modern portfolio theory. Diversification, as a powerful source of alpha, is an essential component of modern portfolio theory.