Warren Buffett is widely regarded as one of the greatest investors of all time. With a net worth of over $100 billion, people are all ears when he speaks about investing. Known for his value investing philosophy, Buffett looks at companies holistically and focuses on their intrinsic worth rather than the intricacies of the stock market. He considers factors such as company performance, debt, and profit margins when making investment decisions.

Buffett's investment strategy has evolved over time, and he has diversified his portfolio to include well-known companies like Apple, Amazon, and American Express, as well as lesser-known firms. He also advocates for investing in oneself as a key to success.

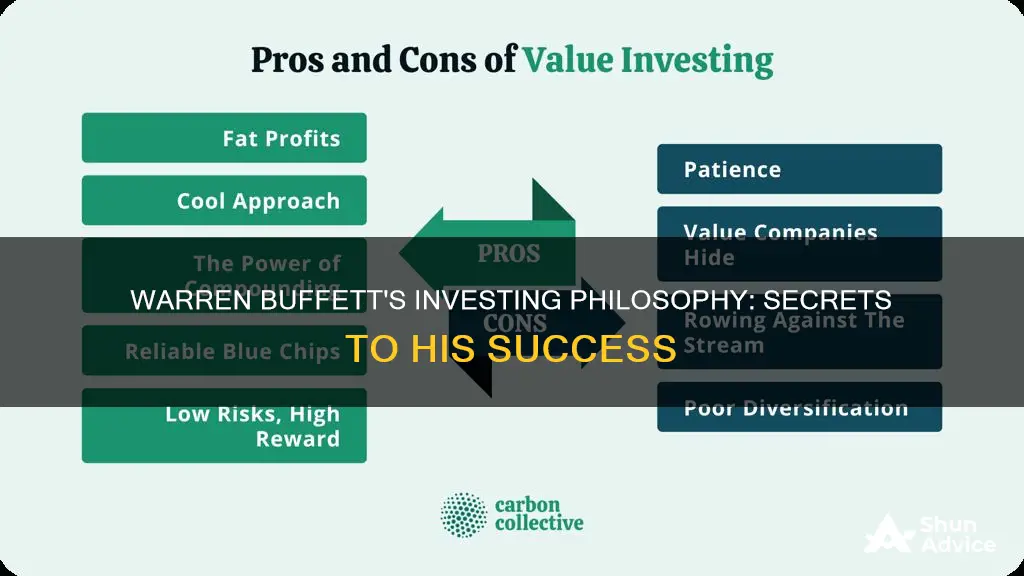

Buffett's top investment tips include taking a patient approach, analysing the business behind a stock, and focusing on long-term gains rather than short-term fluctuations. He recommends investing in small companies, taking advantage of compound interest, and not panicking when stock prices drop.

By following these principles, Buffett has achieved enormous wealth and success, solidifying his reputation as a legendary investor.

| Characteristics | Values |

|---|---|

| Investment philosophy | Benjamin Graham's school of value investing |

| Investment focus | Securities with prices that are unjustifiably low based on their intrinsic worth |

| Investment focus | Companies as a whole rather than the supply-and-demand intricacies of the stock market |

| Investment considerations | Company performance, company debt, profit margins, whether companies are public, how reliant they are on commodities, and how cheap they are |

| Investment strategy | Wait and pounce, buy and hold for the long term, pick businesses not stocks |

| Investment tips | Resist the panic to sell when holdings falter, buy and keep buying |

| Investment tips | Analyse the business behind a stock, focus on businesses you understand and have some knowledge of |

| Investment tips | Plan to own a stock for at least 10 years |

| Investment methodology | Company performance, return on equity, debt-to-equity ratio, profit margin |

| Top holdings | Bank of America, Apple, American Express, Coca-Cola, Burlington Northern Santa Fe Railroad, GEICO Insurance, Occidental Petroleum |

What You'll Learn

- Buffett follows the Benjamin Graham school of value investing

- He looks at company performance, debt and profit margins

- He considers whether companies are public, their reliance on commodities and their value

- He focuses on long-term investments

- He has a preference for maintaining a highly concentrated portfolio

Buffett follows the Benjamin Graham school of value investing

Warren Buffett is known as one of the world's most successful investors, with a net worth of over $100 billion as of 2024. He is a follower of the Benjamin Graham school of value investing, which involves seeking out securities with prices that are unjustifiably low based on their intrinsic worth.

Buffett's investment strategy is focused on the fundamentals of a company as a whole, rather than the supply-and-demand intricacies of the stock market. He considers factors such as company performance, debt, and profit margins when making investment decisions. This approach has led to him making some very successful investments over the years, and he is now one of the world's wealthiest people.

Buffett takes a long-term view when investing, looking to hold stocks for years or even decades. He is not concerned with short-term price fluctuations and is known for his famous quote: "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This reflects his belief that a company's true value will eventually be recognised by the market.

Buffett's investment strategy also involves looking for companies with a "protective moat", meaning they have characteristics that are hard to replicate and give them a competitive advantage. He also prefers companies that have been around for at least 10 years and has a particular interest in those with strong brand names.

Overall, Buffett's investment approach can be summed up as a search for quality companies that are extremely capable of generating earnings. He is not interested in short-term capital gains but instead seeks ownership in businesses that can make money over the long term. This strategy has clearly paid off, solidifying his reputation as one of the greatest investors of all time.

Systematic Saving and Investing: A Smart Strategy

You may want to see also

He looks at company performance, debt and profit margins

Warren Buffett is one of the world's most successful investors, with a net worth of over $130 billion as of July 2024. He follows the Benjamin Graham school of value investing, which looks for securities with low prices relative to their intrinsic worth.

Buffett focuses on company performance, debt, and profit margins when deciding where to invest. He looks at each company holistically and bases his stock choices on their overall potential. Here's a more detailed look at these three factors:

- Company Performance: Buffett examines a company's return on equity (ROE) to gauge how well it has performed compared to industry peers. He calculates ROE by dividing net income by shareholder's equity and considers historical ROE over five to ten years.

- Debt: Buffett prefers companies with minimal debt. He looks at the debt-to-equity (D/E) ratio, which is calculated by dividing total liabilities by shareholders' equity. A higher ratio indicates a greater proportion of debt financing, which can lead to volatile earnings and higher interest expenses.

- Profit Margins: Buffett values companies that consistently increase their profit margins over time. He calculates profit margins by dividing net income by net sales and typically reviews at least five years of historical data. A high and steadily increasing profit margin indicates effective management and control over expenses.

Buffett's investment strategy also involves considering whether companies are public, their reliance on commodities, and how cheap they are. He tends to invest in companies that have been around for at least ten years and focuses on businesses he fully understands.

Understanding Cash Outflow: Investing Strategies and Money Management

You may want to see also

He considers whether companies are public, their reliance on commodities and their value

Warren Buffett is one of the world's most successful investors and his investment strategy has reached almost mythical status. He is a follower of the Benjamin Graham school of value investing, which looks for securities with prices that are unjustifiably low based on their intrinsic worth.

Buffett typically considers the following factors when deciding where to invest:

- Company performance: He looks at return on equity (ROE) and debt-to-equity (D/E) ratios to evaluate how well a company has performed compared to others in the same industry.

- Company debt: Buffett prefers companies with small amounts of debt and earnings growth generated from shareholders' equity rather than borrowed money.

- Profit margins: He looks for companies with high and steadily increasing profit margins, indicating good business execution and efficient management.

- Public status: Buffett usually only considers companies that have been around for at least 10 years, and he tends to avoid investing in companies he doesn't fully understand.

- Commodity reliance: Buffett tends to avoid companies that rely heavily on commodities like oil and gas, unless they have a unique selling point or a "protective moat" that gives them a competitive advantage.

- Value: Buffett looks for companies that are undervalued by the market or not recognised by the majority of buyers. He determines a company's intrinsic value by analysing its fundamentals, such as earnings, revenues and assets, and compares it to its current market value.

Overall, Buffett's investment strategy involves finding quality companies that are capable of generating earnings and holding their stocks for the long term. He is not concerned with the intricacies of the stock market but focuses on the overall potential of the company as a whole.

Target's Cash Equivalents: Investment Policy Explained

You may want to see also

He focuses on long-term investments

Warren Buffett is a legendary investor, and his investment strategy has reached mythical proportions. He is known for focusing on long-term investments and has said that his favourite holding period is "forever". Here's a deeper look at Buffett's approach to long-term investing.

Buffett is a strong advocate of long-term investing and has stated that he is not concerned with the short-term fluctuations of the stock market. He famously said, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This implies that he is more interested in the intrinsic value of a company rather than its stock market performance.

Buffett's long-term investment philosophy is closely tied to his value investing approach. He follows the Benjamin Graham school of value investing, which involves seeking out securities with prices that are unjustifiably low compared to their intrinsic worth. This strategy requires a long-term perspective, as it may take time for the market to recognize the true value of these investments.

Buffett has also advised investors to "buy and hold" stocks for the long term. He has held onto some of his investments for decades, such as Coca-Cola, which he has owned since 1988. He has also stated that investors should plan to own a stock for at least ten years, if not longer. This long-term perspective allows him to focus on the overall potential of the company rather than short-term market volatility.

Buffett's long-term investment strategy also involves building positions in companies over time. He is known for gradually accumulating shares in companies he believes in, rather than making impulsive decisions. This approach allows him to average out his purchase price and benefit from the power of compound interest over time.

In addition to his focus on long-term investments, Buffett also emphasizes the importance of investing in businesses that he understands. He has passed on investing in certain companies, such as Google and Amazon, because he did not feel he had sufficient knowledge of the industry to make an informed decision. This disciplined approach aligns with his long-term investment philosophy.

Buffett's long-term investment strategy has been a key contributor to his success as one of the world's most successful investors. By taking a patient and disciplined approach, he has been able to build an impressive track record of generating significant returns over the long term.

How Cashing Investments Affect Debt Service Coverage

You may want to see also

He has a preference for maintaining a highly concentrated portfolio

Warren Buffett is a highly successful investor, and his investment strategies are closely followed by many. One of his notable strategies is his preference for maintaining a highly concentrated portfolio, rather than diversifying his investments widely.

Buffett has been quoted as saying, "diversification is for those who don't know what they're doing", and this philosophy is reflected in the structure of his portfolio. Excluding his Japanese brokerage stocks, Apple alone accounted for 26% of his equity holdings at one point, and that number has been as high as almost 50% in previous years.

Buffett's top five equity holdings make up about two-thirds of his portfolio's value, and the top 10 account for more than 80%. This concentrated approach allows him to focus on a smaller number of companies that he believes in, rather than spreading his investments too thin.

Buffett's large positions are thought to be handled by himself, while his co-managers, Ted Weschler and Todd Combs, are believed to be responsible for the smaller buys and sells.

While Buffett's specific investments have changed over time, his commitment to a concentrated portfolio has remained consistent. This strategy has contributed to his success as one of the world's most renowned investors.

Cashing Out Your Fidelity Investments: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Buffett subscribes to the Benjamin Graham school of value investing, which involves looking for securities with prices that are unjustifiably low based on their intrinsic worth. He focuses on company performance, company debt, and profit margins, and other factors like whether companies are public and how reliant they are on commodities.

Buffett advises investors to take a step back when they find a company they want to invest in, and to resist panicking and selling their holdings when they falter. He also recommends investing in businesses rather than stocks, and to only invest in businesses you understand.

As of July 2024, these included Bank of America, American Express, and Occidental Petroleum.

Buffett established new positions in Dominos Pizza and Pool Corp., and added slightly to his stake in Heico. He also continued selling Apple and Bank of America stock.

Buffett takes a concentrated approach with his investments, typically holding the majority of his portfolio in just a few companies. His largest holdings at the end of the third quarter of 2024 included Apple, American Express, Bank of America, Coca-Cola, and Chevron.