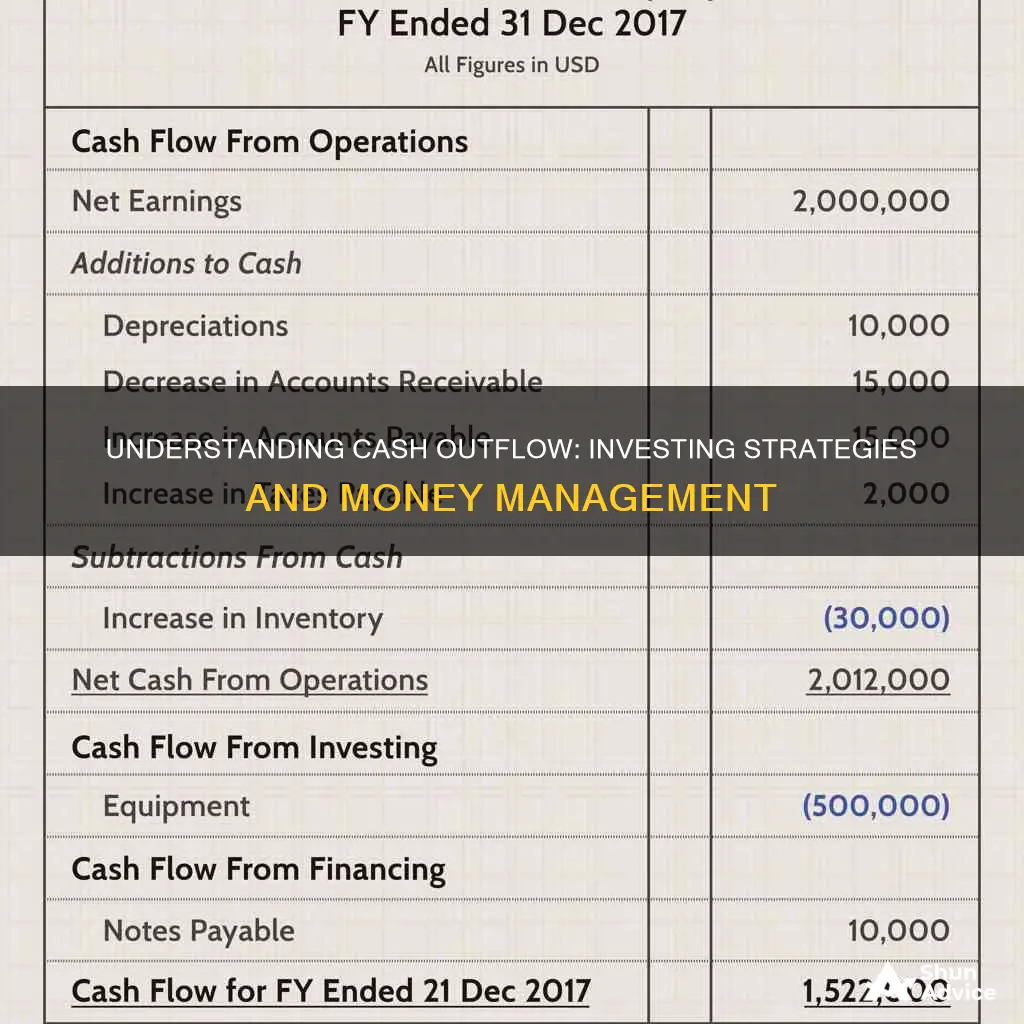

Cash outflow is the money leaving a business, and it is a critical component of financial management. It includes expenses, investments, and debt payments that are essential for a company's operations. One type of cash outflow is investing cash outflow, which is part of the cash flow statement and reports the cash inflows and outflows resulting from investment activities. These activities involve the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities. For example, if a business owner invests in a new factory building to expand its operations, that purchase would be considered an investing cash outflow.

Characteristics of Investing Cash Outflow

| Characteristics | Values |

|---|---|

| Definition | Cash outflow from investing activities includes money spent on various investment-related activities. |

| Examples | Capital expenditures, investment purchases, loans to other businesses, purchase of plant and machinery or other fixed assets |

| Formula | Total cash outflow = Cash flow from operating activities + Cash outflow from investing activities + Cash flow from financing activities |

| Importance | Crucial for financial management, representing the company's ability to allocate resources effectively to maintain operations and pursue expansion |

What You'll Learn

Capital expenditures (CapEx)

CapEx is important for companies to grow and maintain their business, and financial analysts and investors pay close attention to a company's capital expenditures. These expenditures normally have a substantial effect on the short-term and long-term financial standing of an organization. Therefore, making wise CapEx decisions is critical to the financial health of a company. Many companies try to maintain their historical levels of capital expenditures to show investors that they are continuing to invest in growth.

There are two main types of capital expenditures: maintenance CapEx and growth CapEx. Maintenance CapEx refers to expenditures that maintain the current level of a company's operations, while growth CapEx involves expenditures that enable future growth. Capital expenditures are typically very expensive, especially for companies in industries such as manufacturing, telecommunications, utilities, and oil exploration.

CapEx is also used in calculating free cash flow, one of the most important metrics in corporate finance. The formula for free cash flow is:

> FCF = Cash from Operations – Capital Expenditures

Additionally, CapEx is used in the cash-flow-to-capital-expenditures (CF-to-CapEx) ratio, which relates to a company's ability to acquire long-term assets using free cash flow. A ratio greater than 1.0 may indicate that a company's operations are generating enough cash to fund its asset acquisitions, while a ratio less than 1.0 may suggest issues with cash inflows and the need to borrow money to fund capital asset purchases.

Cash is Not King: Exploring Investment Alternatives

You may want to see also

Investment purchases

Any money spent on the purchase of an investment (non-current asset) is considered a cash outflow. This includes the purchase of plant and machinery or other fixed assets, and loans to other businesses.

Negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are important to the health and continued operations of the company. For example, a company might be investing heavily in plant and equipment to grow the business. These long-term purchases would be cash-flow negative but could be positive in the long term.

Understanding Cash Equivalent Investments: Basic Features Explained

You may want to see also

Research and development (R&D)

Investment in research and development (R&D) is a critical aspect of cash outflow from investing activities. While it may seem like a luxury, R&D is essential for innovation and staying ahead of the competition, particularly in the technology and biotech sectors.

R&D can be a significant cash outflow for companies, but it is often a sign of investing in the long-term health and growth of the company. This is not always a warning sign, as it can lead to significant gains if those investments are managed well.

The impact of R&D investment is influenced by a company's financial position and cash flow predictability. When companies have improved financial cash flows, they are more likely to increase their investment in R&D. This is because better financial cash flows make the cash flow components more predictable, reducing volatility and enhancing the ability to finance R&D projects.

Additionally, reducing debt and interest payments can positively impact R&D investment by improving cash flow predictability and boosting external financing capacity. This is supported by a study on Japanese manufacturing firms, which found that financially constrained firms with improved financial cash flows were more sensitive to R&D investment than those with improved operating cash flows.

Overall, R&D investment is a crucial aspect of a company's investing cash outflow, and it plays a vital role in driving innovation and competitiveness in the market.

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Market expansion

- Research and development: Companies may invest in R&D to innovate and create products or services tailored to the new market. This can include adapting existing offerings or developing new ones to meet the specific needs and preferences of the target audience in the new market.

- Marketing and promotional activities: Investing in marketing and promotional campaigns is crucial for creating awareness and generating interest in the new market. This can include advertising, public relations, social media campaigns, and localised content creation.

- Infrastructure and personnel: Expanding into a new market often requires establishing a physical presence, such as offices, retail spaces, or production facilities. This involves investing in real estate, equipment, and hiring local talent, which can be a significant cash outflow.

- Regulatory and compliance costs: Entering a new market may involve navigating different laws, regulations, and compliance standards. Companies may need to invest in legal and consulting services to ensure they meet the necessary requirements, obtain permits, and avoid legal issues.

- Distribution and supply chain: Establishing an efficient distribution network and supply chain in the new market is essential. This may involve investing in transportation, logistics, and local suppliers to ensure the smooth flow of goods or services to customers.

- Local partnerships: Forming strategic alliances with local businesses or industry partners can facilitate market entry and acceptance. However, this may come at a cost, such as through joint ventures, licensing agreements, or other collaborative arrangements.

It is important to note that market expansion costs can vary significantly depending on the industry, the size of the company, and the specific market being entered. Some markets may be more expensive to enter due to higher costs of living, labour rates, or regulatory barriers.

Overall, market expansion investing cash outflow is a critical aspect of a company's growth strategy. By allocating resources towards expanding their reach, companies can tap into new customer bases, diversify their operations, and ultimately drive long-term success. However, it is essential to carefully manage these costs and ensure they are aligned with the company's overall financial goals and capabilities.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

Loans to other businesses

The cash flow statement is one of the three financial statements that a business uses, the other two being the balance sheet and the income statement. The cash flow statement is important as it bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

The cash flow statement is divided into three sections, one for each type of activity: operating activities, investing activities, and financing activities. The investing section of the cash flow statement includes the movement of money associated with a company's investments. This includes both short-term investments, such as the purchase of marketable securities, and long-term investments, like buying new equipment or buildings. The purchase of any investment counts as a cash outflow, meaning that a certain amount of cash is leaving the business in exchange for the investment.

A company's cash flow statement is important as it provides an overview of the sources and use of cash over a certain period. It is also used by corporate management, analysts, and investors to judge how well a company is able to pay its debts and manage its operating expenses.

Investing in Startups: Strategies for Cash-Strapped Investors

You may want to see also

Frequently asked questions

An investing cash outflow is the money spent by a company on investment-related activities. This includes the purchase of physical assets, investments in securities, or the acquisition of another company.

A negative cash flow from investing activities is not always a bad sign. It can indicate that the company is investing in long-term growth and capital strategies. However, it is important to monitor cash outflow to ensure the company does not overspend and can meet its financial commitments.

Examples of investing cash outflow include the purchase of fixed assets such as property, plant, and equipment, as well as investments in securities or marketable securities.