The equilibrium between saving and investment is regarded as a crucial condition for a stable economy by Keynesian and classical economists alike. However, their perspectives on the mechanisms that bring about this equilibrium differ significantly. Classical economists advocate for an economy that equilibrates at full employment, with the interest rate being the strategic variable that adjusts saving and investment levels. Conversely, Keynes rejected the notion of the interest rate as the equilibrating factor, instead proposing that income changes are responsible for bringing saving and investment into equality. This shift in perspective revolutionised economic thinking, highlighting the dynamic nature of saving and investment behaviours.

| Characteristics | Values |

|---|---|

| Classical economists' view of equilibrating variable | Rate of interest |

| Classical economists' view of equilibrium | Full employment |

| Keynes' view of equilibrating variable | Level of income |

| Keynes' view of equilibrium | Any level of employment |

Interest rates

When saving increases while investment remains constant, the interest rate falls. This decrease in the interest rate leads to an increase in investment demand as it becomes more affordable to borrow money. However, a lower interest rate can also discourage saving, as individuals may seek higher returns elsewhere. As a result, the economy moves towards equilibrium, with equal levels of saving and investment, through the expansion of investment and the contraction of saving.

Conversely, when saving decreases, the interest rate rises to incentivise more saving and discourage investment. This shift in interest rates continues until an equilibrium point is reached, where the interest rate stabilises saving and investment at equal levels. Classical economists viewed this equilibrium as a state of full employment, where all available labour and capital are fully utilised.

The classical perspective on interest rates and equilibrium stands in contrast to the theory proposed by Keynes. While he agreed that saving and investment equality is essential, he disagreed with the notion that interest rates are the primary equilibrating factor. Instead, Keynes argued that income changes are the key driver of equilibrium, and this equilibrium is typically reached at less than full employment.

Savings and Investment: Interplay in a Closed Economy

You may want to see also

Income levels

Classical Economists' Perspective

Classical economists believe that the economy reaches equilibrium at full employment. They argue that saving and investment equality is achieved through adjustments in the rate of interest, which they consider a strategic variable. When savings exceed investments, the rate of interest falls, stimulating investment demand. Conversely, when savings decrease, the rate of interest rises to encourage savings and curb investments, ultimately restoring equilibrium. Classical economists view this equilibrium as achievable only at full employment, with interest rates as the equilibrating factor.

Keynes' Perspective

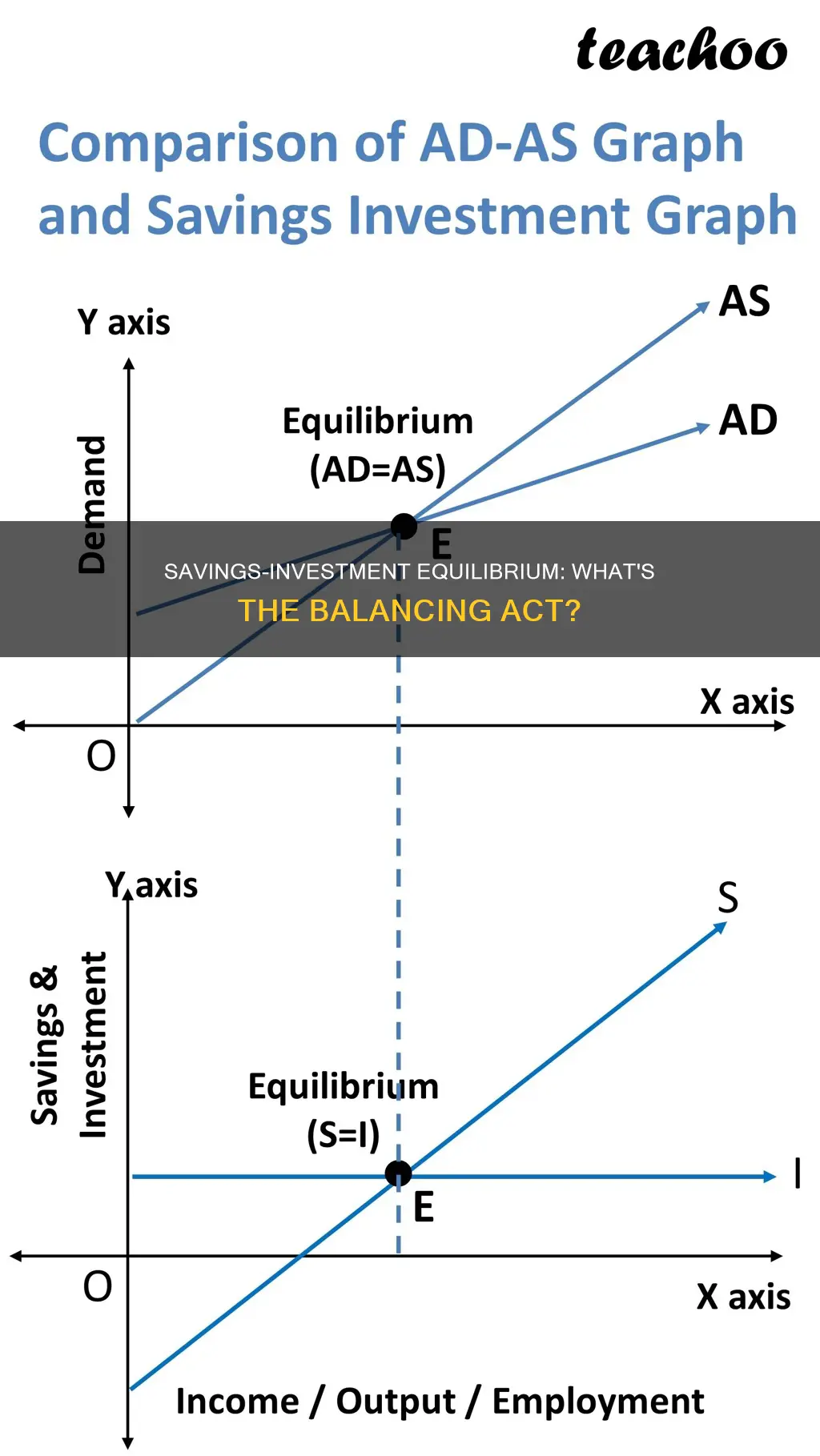

Keynes, however, offers a contrasting perspective. He asserts that saving and investment equality is a condition of equilibrium at any level of employment, often less than full employment. Keynes introduces the concept of income as the strategic variable that brings about saving and investment equality. In his analysis, savers and investors respond to income variations by adjusting their saving and investment behaviours to achieve harmony. When savings exceed investments, income falls, leading to a contraction in savings until equilibrium is restored. Conversely, when investments increase, income rises, resulting in higher savings until a new equilibrium is established at a higher income level.

Impact of Income on Savings and Investments

The relationship between income and savings is direct; as income rises, savings tend to increase. On the other hand, the connection between income and investment is more complex. While higher income can stimulate investment, it is not the sole determining factor. Investment decisions are influenced by dynamic factors such as population growth, territorial expansion, technological advancements, and business expectations. These factors contribute to the unpredictable and autonomous nature of investments.

Achieving Equilibrium

Equilibrium is attained when savings equal investments, resulting in a stable inventory level. If savings surpass investments, producers expand output to boost income and, consequently, savings, until equilibrium is reached. Conversely, when savings fall below investments, firms reduce output to lower savings and restore the desired inventory level. This dynamic process illustrates how income fluctuations facilitate the equilibration of savings and investments.

Retirement Planning: 401(k)s, Investing, or Saving?

You may want to see also

Consumption

The relationship between consumption and income is often modelled using a consumption function, which describes how consumption changes as income varies. One example of such a function is the Keynesian consumption function, which assumes a positive relationship between income and consumption, with consumption increasing at a decreasing rate relative to income. This relationship is represented by the equation:

> C = α + mpc * Y

Where:

- C is consumption

- Α is a constant reflecting changes in tastes and other factors affecting consumption

- Mpc is the marginal propensity to consume, or the change in consumption for a given change in income

- Y is income

This equation demonstrates that as income rises, consumption also increases, but at a slower rate. This is known as the marginal propensity to consume and is a key concept in understanding consumption patterns.

However, this simple relationship between consumption and income has been refined by economists such as Milton Friedman and Franco Modigliani. Friedman proposed the permanent income-consumption function, which suggests that consumption is based on expected long-term income rather than current income. This theory aims to explain why people with higher wealth may not necessarily consume a larger fraction of their income. Modigliani, on the other hand, introduced the life-cycle theory, which posits that consumption patterns vary depending on an individual's life stage. For example, young people tend to consume more than their income as they borrow for education and starting their lives, while middle-aged individuals may consume less and save or invest more.

These refinements to the basic consumption function are important because they recognise that consumption decisions are not made in isolation but are influenced by a variety of factors, including expectations of future income, age, and life stage.

In the context of saving and investment equilibrium, consumption is significant because it directly impacts savings. As the standard Keynesian equation states:

> Income = Consumption + Saving

Or, in mathematical terms:

> Y = C + S

This equation demonstrates that income that is not spent on consumption is saved. Therefore, changes in consumption patterns can have a direct impact on the level of savings. For example, if consumption increases, savings will decrease, assuming income remains constant. This relationship between consumption and savings is essential to understanding the dynamics of saving and investment equilibrium.

Furthermore, consumption can also influence investment decisions. In the Keynesian framework, investment is seen as autonomous and not significantly dependent on income levels. Instead, it is influenced by factors such as population growth, technological progress, and business expectations. However, consumption patterns can impact investment decisions as they provide insights into market demand and economic conditions. For instance, if consumption of a particular good or service is high, businesses may choose to invest in expanding production capacity or developing new products to meet consumer demand.

In conclusion, consumption is a critical factor in understanding the equilibrium between saving and investment. It influences savings levels directly and can also impact investment decisions. By considering consumption patterns and their relationship with income, economists and policymakers can gain valuable insights into the dynamics of an economy and make informed decisions to promote economic stability and growth.

Tracking Savings and Investments: Quicken's Smart Money Management

You may want to see also

Investment demand

However, John Maynard Keynes, in his "General Theory," proposed a different perspective. He agreed that aggregate investment equals aggregate saving but argued that this equality could occur at any level of employment, not just full employment. In Keynes' view, income changes are the driving force behind the equilibrium between saving and investment, rather than interest rate adjustments. He introduced the concepts of "accounting equality" and "functional equality" to explain this relationship.

Accounting Equality:

In national income accounting, savings and investment are always equal. This equality arises from the definition of saving as the excess of current income over current consumption, and investment as the part of current income spent on producing future goods. As a result, income not spent on goods (saving) is numerically identical to the quantity of goods produced that are not bought with current income (investment). This is represented by the equations: Income = Consumption + Saving and Output = Consumption + Investment. Since income equals output, it follows that Saving = Investment.

Functional Equality:

Keynes also proposed the idea of functional equality, where the equality between saving and investment is a consequence of changes in the level of income. In this framework, savers and investors respond to income variations in a way that harmonises their desire to save and invest. If saving exceeds investment, income will fall until saving equals the reduced investment. Conversely, if investment increases beyond saving, income will rise until saving matches the higher level of investment. Thus, a new equilibrium between saving and investment is established at a different income level.

In summary, while classical economists emphasise the role of interest rates in equilibrating saving and investment at full employment, Keynes introduced a dynamic perspective by treating income as the strategic variable that brings about equality between saving and investment at varying levels of employment.

Savings Investment Strategies: Accessibility and Growth

You may want to see also

Full employment

Classical economists view this interest rate mechanism as the strategic variable that equilibrates saving and investment at full employment. However, their belief in the economy's inherent tendency towards full employment has been challenged by Keynesian economics.

Keynesian economics, as articulated by John Maynard Keynes in his "General Theory," offers a different perspective on the relationship between saving and investment. While acknowledging the definitional equality of saving and investment, Keynes argues that this equality does not necessarily imply equilibrium. Instead, he introduces the concept of income as the equilibrating variable, asserting that income changes are what ultimately bring saving and investment into equality.

In the Keynesian framework, saving and investment schedules intersect at different levels of income, resulting in a shifting equilibrium. When investment exceeds saving, a new equilibrium is established at a higher income level, and vice versa. This dynamic approach to saving and investment equality stands in contrast to the classical notion of a static full-employment equilibrium.

Furthermore, Keynesian economics challenges the classical assumption that investment depends significantly on income levels. Instead, it posits that investment is influenced by factors such as population growth, territorial expansion, technological progress, and business expectations. This unpredictability and autonomy of investment cause fluctuations in income, which, in turn, bring about equality between saving and investment. Thus, the Keynesian theory emphasizes the dynamic nature of the economy and the role of income as the equilibrating factor in saving and investment relations.

In summary, the concept of full employment is central to the classical understanding of how saving and investment equilibrate through interest rate adjustments. However, Keynesian economics introduces a more nuanced perspective, emphasizing income as the equilibrating variable and recognizing the dynamic and unpredictable nature of investment.

Saving and Investment Macroeconomics: The Basics of Money Management

You may want to see also

Frequently asked questions

The interest rate.

Classical economists believed that saving-investment equality is brought about by the mechanism of the rate of interest. They held that if saving and investment are equal at a time, they will be soon brought into equilibrium by automatic changes in the rate of interest.

Keynes rejected the classical postulate of the rate of interest being a strategic or equilibrating variable. He said that the saving-investment equality is a condition of equilibrium at any level of employment, and not necessarily always the full employment level.