Saving and investing are two different concepts, but they are closely related. Saving is setting money aside for future use, while investing is using money with the expectation that it will generate increased income or grow in value. Both strategies involve accumulating money for future use, but their level of risk is not equal. Saving typically comes with less risk than investing, but with risk comes the potential for higher returns. It's important to find the right balance between saving and investing to build wealth, protect against financial shocks, and secure a solid financial future.

| Characteristics | Values |

|---|---|

| Risk | Saving is low-risk, whereas investing is higher-risk |

| Returns | Saving has lower returns, investing has higher returns |

| Time horizon | Saving is for short-term goals, investing is for long-term goals |

| Liquidity | Savings are more liquid than investments |

| Inflation | Savings may lose out to inflation, investing can help manage inflation |

| Taxes | Savings are taxed less |

What You'll Learn

Liquidity

In general, savings accounts offer high liquidity, meaning you can access your money quickly and with little to no risk. This makes savings accounts ideal for emergency funds, as well as for saving towards short-term goals. For example, you might save up for a new laptop or a vacation. The downside of savings accounts is that they typically earn lower returns than investments, and there's a chance that the interest won't keep up with inflation, leading to a loss of purchasing power.

On the other hand, investments tend to be less liquid, as they are often designed to be held for the long term. This means that it can take longer to access your money, and there may be costs or penalties for withdrawing funds before they mature. However, the benefit of investing is the potential for higher returns over time.

It's important to have a mix of savings and investments in your financial plan. A good rule of thumb is to start by building up your savings, particularly an emergency fund that can cover 3-6 months' worth of living expenses. Once you have a solid savings cushion, you can consider investing to work towards your longer-term goals, such as retirement or a college fund.

By combining savings and investments, you can benefit from both the liquidity of savings and the potential growth of investments, creating a balanced and secure financial future.

What's the Difference: Investment vs Wealth Management?

You may want to see also

Risk

Saving is a way to set aside money for future use, often for emergencies, short-term goals, or long-term plans. It is a low-risk option because the money is easily accessible and typically insured, meaning there is minimal risk of losing your savings. Savings accounts are also liquid, allowing you to withdraw funds without penalties. Additionally, savings accounts are protected by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor in FDIC-insured banks. This further reduces the risk of losing your money due to theft or bank failure.

On the other hand, investing involves purchasing assets such as stocks, bonds, mutual funds, or real estate, with the expectation of generating higher returns than traditional savings accounts. Investing comes with a higher level of risk because there is always the possibility of losing some or all of the funds invested. The value of assets can fluctuate, and there is no guarantee of returns. For example, investing in stocks ties the value of your investment directly to the performance of the company. If the company performs well, the value of your investment increases, but if the company goes bankrupt, your investment could lose most of its value.

However, it is important to note that the risk associated with investing can be mitigated through careful planning and diversification. By investing in a variety of assets and industries, you can reduce the impact of market volatility on your portfolio. Additionally, investing over a longer period can help manage risk, as you have more time to recover from short-term losses and benefit from long-term growth.

While saving is generally safer, it is important to consider the potential drawbacks. Savings accounts may not keep up with inflation, causing your money to lose purchasing power over time. Additionally, the interest rates on savings accounts may not provide significant growth, affecting your overall returns.

In conclusion, when considering whether to save or invest, it is crucial to understand the level of risk associated with each option. Saving provides a low-risk way to set aside money, while investing offers the potential for higher returns but comes with a higher level of risk that can be managed through careful strategies.

Time Management: Can You Handle Your Investments Personally?

You may want to see also

Returns

When you save money, it will typically accrue interest over time, but at a lower rate compared to what investments can provide. Savings accounts can come in various forms, such as a certificate of deposit (CD), a money market account, or a traditional bank savings account. By depositing money and leaving it in one of these accounts, you agree to let the bank keep your money for a specified period, and in return, the bank gives you a percentage of interest on that cash. However, it's important to note that the interest rates on savings accounts may not always keep pace with inflation, which can lead to a loss in purchasing power.

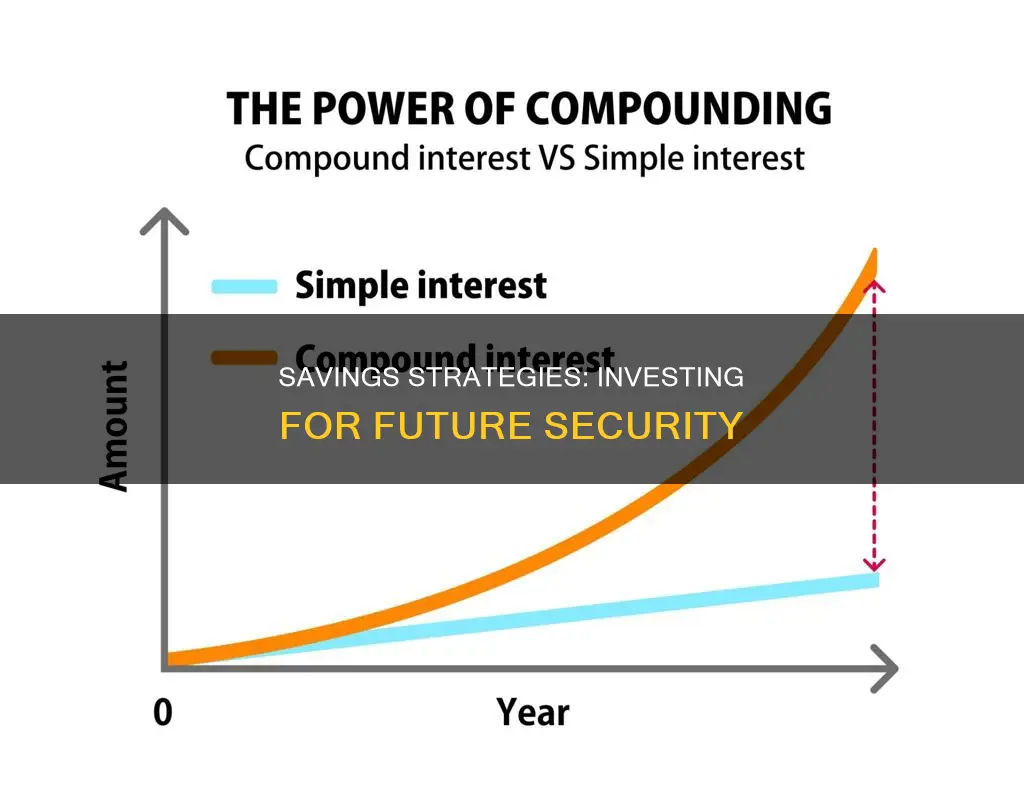

On the other hand, investing offers the potential for higher returns. Investing involves buying assets such as stocks, bonds, mutual funds, or real estate, with the expectation that their value will increase over time. Historically, investing in the stock market has brought more growth potential than cash or bonds, especially with a long-term buy-and-hold strategy. The higher returns from stocks can help manage the effects of inflation, maintaining or even increasing your spending power. Additionally, by diversifying your investment portfolio across different types of assets, you can smooth out market volatility and keep your investment goals on track.

It's worth noting that investing also comes with risks. There is no guarantee of returns, and the value of assets can fluctuate. A recession or market volatility can lead to losses in your portfolio's value. Therefore, it's generally recommended to build up savings and pay off high-interest debt before diving into investing. This ensures you have a financial cushion and protects you from unexpected costs.

Strategizing Your Investment Portfolio: A Smart Division Guide

You may want to see also

Inflation

One of the benefits of investing is that it can help to manage the effects of inflation. Stocks' higher returns can help maintain your spending power and help you meet your long-term goals.

Therefore, while savings are a good option for short-term goals, investing is a better strategy for long-term goals. This is because investing offers a potentially higher rate of return over a long period, which can help to offset the effects of inflation.

Diversifying Your Portfolio: Strategies for Investment Options

You may want to see also

Short-term goals

Saving is a great way to achieve your short-term goals, and it comes with a much lower risk than investing. Short-term goals are those that can be achieved in five years or less.

Firstly, it's important to build an emergency fund. This should cover you for any unexpected costs, such as car repairs or medical bills. It's recommended that you save at least three to six months' worth of expenses, though this may be longer if your employment is insecure or you are self-employed.

You can also save for specific purchases, such as a new laptop, phone, or a holiday. One way to do this is to set aside a portion of your paycheck into a savings account each month. For example, if you want to save $1,000 for a laptop in ten months, you can put aside $100 each month. You can also use automatic transfers to save without having to remember to do it manually.

Savings accounts are also a good option if you are saving for a down payment on a house. They are more liquid than investments, meaning you can access your money more easily.

While saving is a great way to achieve your short-term goals, it's important to combine it with other forms of investing for a balanced financial plan.

Debt and Equity: Understanding Investment Securities

You may want to see also

Frequently asked questions

Saving is putting money aside, typically in a bank account, to meet short-term goals. Investing, on the other hand, is putting money into financial instruments such as stocks, bonds, or real estate, with the aim of growing your wealth over time.

Saving is a low-risk option that provides financial security for unexpected events and short-term goals. However, it may not provide high returns and can lose value due to inflation.

Investing offers the potential for higher returns over time and can help achieve long-term financial goals. However, it comes with a higher risk of losing money and requires discipline and a long-term commitment.

Saving is generally recommended for short-term goals, such as buying a new phone or planning a vacation. Investing is more suitable for long-term goals, like retirement or college funds, where you can handle the risk and have time to recover from potential losses.

It is generally recommended to save enough to cover 3-6 months' worth of living expenses in an emergency fund. You should also aim to save for any short-term goals. The rest of your money can be invested, taking into account your risk tolerance and financial goals.