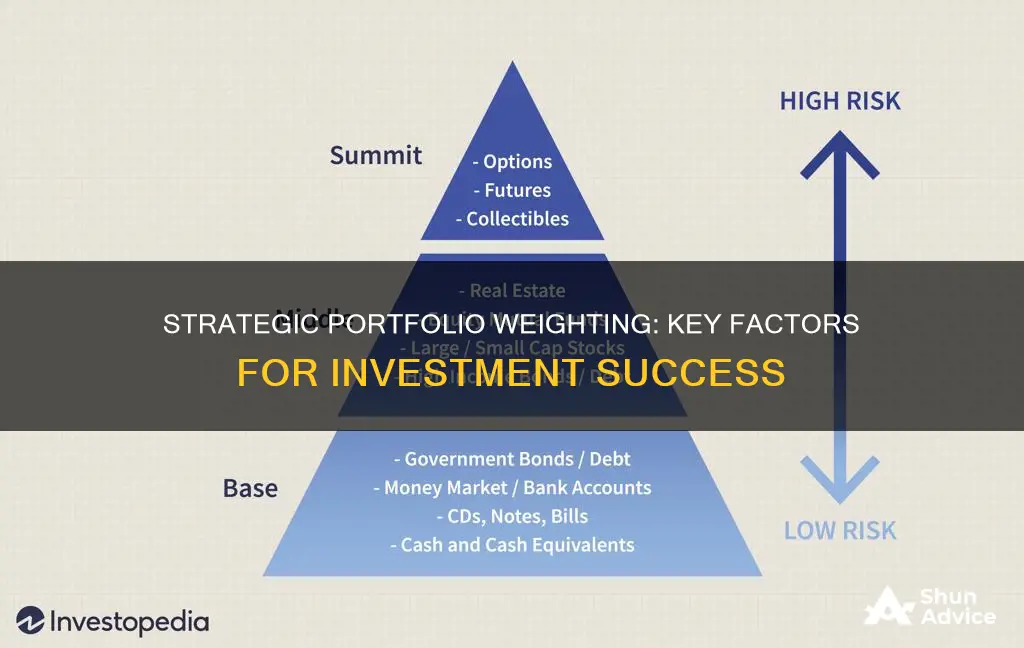

When considering how to weight an investment portfolio, it's important to understand the concept of portfolio weight, which is the percentage of a portfolio that a particular holding or type of holding comprises. There are several factors to take into account when determining the weight of assets in a portfolio, including the time frame of the investment, the investor's risk tolerance, and the specific risks of the individual securities. The Modern Portfolio Theory (MPT) suggests that investors seek to maximise their portfolio's volatility-adjusted return, and tools such as the Kelly Criterion can help investors determine how to weight their portfolios based on factors like upside, certainty, and risk. Additionally, it's crucial to consider the appropriate mix of investments, including stocks, bonds, and cash, to protect against significant losses and smooth out overall investment returns. Diversification is key to reducing investment risk, and rebalancing is necessary to maintain the desired asset allocation.

| Characteristics | Values |

|---|---|

| Time frame of the investment | Long-term financial goals |

| Risk tolerance | Volatility-adjusted return |

| Specific risks of individual securities | Loss of principal |

| Portfolio diversification | Stocks, bonds, cash, mutual funds |

| Investor profile | Individual or institutional |

| Investment strategy | Active or passive |

| Market conditions | Bullish or bearish |

| Tax implications | Capital gains tax, income tax |

| Transaction costs | Brokerage fees, management fees |

| Regulatory environment | SEC regulations, investor protection |

Risk tolerance

An investor's risk tolerance is influenced by various factors, including age, investment goals, income, and future earning capacity. Younger individuals, for example, generally have a higher risk tolerance as they have more time to recover from potential losses and can be more aggressive in their investment strategies. Conversely, older investors, especially those near retirement age, tend to have a lower risk tolerance as they seek to preserve their capital and opt for more conservative investment choices.

The time horizon of an investment also plays a crucial role in risk tolerance. Investors with long-term financial goals may be more inclined to take on higher-risk investments, such as stocks, as they have a greater potential for substantial returns over time. On the other hand, short-term financial goals may be better suited for lower-risk cash investments, which offer more stability and predictability.

It's important to note that risk tolerance is a highly individualised concept, and each investor's comfort level with risk differs. Some investors are naturally more comfortable with taking risks, while others may find market volatility stressful. Therefore, understanding one's risk tolerance is crucial for making informed investment decisions and constructing a portfolio that aligns with their financial objectives and personal preferences.

Invest Less, Save More: Strategies for Financial Success

You may want to see also

Timeframe

When weighting an investment portfolio, the time frame of the investment is a critical factor to consider. The period for which an investor can keep their money invested is essential to establishing the portfolio's timeframe. The longer an investor can stay engaged, the more likely the portfolio is to generate acceptable returns.

An investor's financial goals and risk tolerance play a significant role in determining the appropriate timeframe for their investment portfolio. It is crucial to understand that there is no guarantee of making money from investments. However, by gaining knowledge about saving and investing and following a well-thought-out plan, investors can aim for financial security in the long term.

The time horizon of an investment goal can influence the types of assets included in the portfolio. For instance, financial experts generally agree that long-term goals, such as retirement or college savings, should include at least some stocks or stock mutual funds. On the other hand, short-term financial goals may be more suited to cash investments or cash equivalents to avoid the risk of losing money in more volatile assets.

Additionally, the time frame of an investment portfolio also impacts the rebalancing strategy. Rebalancing involves bringing the portfolio back to its original asset allocation mix to maintain a comfortable level of risk. Some experts recommend rebalancing at regular intervals, such as every six or twelve months, while others suggest rebalancing only when the relative weight of an asset class deviates from the desired allocation by a certain percentage.

In conclusion, when considering the timeframe of an investment portfolio, investors should evaluate their financial goals, risk tolerance, and the appropriate types of assets to include. The time horizon plays a crucial role in determining the potential returns, risk management, and rebalancing strategy of the portfolio.

Global Share Portfolio: Invest in BizNews for Future Success

You may want to see also

Security risks

Security weighting is a crucial consideration when determining how to weight an investment portfolio. It reflects the relative importance and risk of each security in achieving the portfolio's objectives. Security weighting can be based on different criteria, such as market value, expected return, volatility, or diversification.

The first step in determining security weighting is to calculate the percentage of the portfolio that is invested in a specific security, such as a stock, bond, or derivative. This is done by dividing the dollar value of a security by the total dollar value of the portfolio. This calculation provides a baseline understanding of the weight of each security in the portfolio.

However, it is important to recognise that security prices fluctuate, and these changes will impact the overall value of the portfolio. Therefore, active investors and professional money managers must periodically adjust the weights in their portfolios. This process is known as rebalancing, and it helps maintain the desired level of risk and return for the investor.

When considering security risks, it is essential to evaluate the specific risks associated with individual securities. These risks can include market risk, liquidity risk, credit risk, and operational risk, among others. By understanding these risks, investors can make more informed decisions about the weighting of their portfolios. Additionally, security weighting can be adjusted to align with the investor's risk tolerance and goals.

There are several methods for determining security weighting, each with its advantages and disadvantages. Market value weighting is a simple approach based on the current market value of each security. However, this method may overemphasise securities with high prices or large market capitalisations. Equal weighting, on the other hand, assigns equal weights to all securities, regardless of their market value, but may ignore differences in risk and return. Risk parity weighting focuses on balancing the risk contribution of each security by assigning weights based on their volatility. This method is more sophisticated and risk-adjusted but may require more frequent rebalancing. Lastly, optimisation weighting uses mathematical models to maximise expected returns for a given level of risk or minimise risk for a desired level of return. While this method is advanced and efficient, it relies on estimates and assumptions that may be unreliable.

Adjusting Your Child's Future: Editing 529 Investment Portfolio

You may want to see also

Market efficiency

The weak form of EMH suggests that past price movements are not indicative of future prices. Thus, investing strategies based on momentum or technical analysis are unlikely to consistently outperform the market. However, this form allows for the possibility that excess returns can be achieved through fundamental analysis.

The semi-strong form assumes that stock prices quickly adjust to new public information, rendering technical and fundamental analysis unreliable for superior returns. Only private information, inaccessible to the market, can provide a trading advantage.

The strong form of EMH asserts that market prices reflect all information, both public and private. Consequently, even corporate insiders cannot profit above the average investor, even with access to new insider information.

The concept of market efficiency is central to portfolio weighting as it influences investment strategies. Investors who subscribe to the EMH tend to favour passive portfolio management and invest in index funds that track overall market performance. In contrast, active traders believe they can generate abnormal profits by exploiting arbitrage opportunities, indicating their disagreement with the hypothesis.

The efficient market hypothesis is a subject of ongoing debate among academics and practitioners, with varying viewpoints on the actual efficiency of the market. While some investors align with the strong form of EMH, value investors hold opposing beliefs, asserting that stocks can be undervalued or overvalued. They profit by buying stocks when undervalued and selling when their price rises to meet or exceed their intrinsic value.

Savings-Investment Identity: Understanding the Logical Balance

You may want to see also

Portfolio diversification

There are several ways to diversify your portfolio:

Asset Classes

Asset classes such as stocks, bonds, and cash are broad categories of investments that generally behave differently under similar market and economic conditions. Within these broad categories are sub-asset classes, such as large, small, and mid-cap stocks, and different styles like growth and value. Diversifying across asset classes can help mitigate investment risk as different asset classes may have higher or lower correlations with each other. For example, the correlation between US large-cap stocks and bonds is relatively low, meaning that when US stocks experience negative returns, bonds may perform differently due to their low correlation.

Industries and Sectors

Diversifying across industries and sectors is crucial, especially for stock investments. The performance of stocks in the technology sector, for instance, may be influenced by different factors than those impacting the energy sector.

Bond Types

Bonds are another important component of portfolio diversification. The price of a bond typically moves inversely to interest rates. Bonds with longer maturities and lower credit quality are generally more sensitive to interest rate changes. Additionally, bonds issued outside the US may be influenced by the exchange rate between the US dollar and the issuing country's currency.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are excellent tools for diversifying your portfolio. These funds are typically invested in specific asset classes, such as stocks, bonds, or cash, or a mix of different asset classes. By holding several mutual funds and ETFs, you can achieve diversification across asset classes and benefit from their holdings of various stocks, bonds, or other securities.

Geographic Regions

Investing in different geographic regions, such as developed countries and emerging markets, can provide another layer of diversification. The relative value of currencies and the inherent differences in economies can impact the return on these investments.

It's important to note that while diversification can enhance risk-adjusted returns and help preserve capital, it does not eliminate investment risk entirely. Additionally, diversification can be challenging and costly, especially for investors who choose to manage their portfolios independently. Engaging the services of a financial advisor or utilizing robo-advisors can be beneficial in developing a diversification strategy that aligns with your investment goals, risk tolerance, and time horizon.

Strategies for Evaluating Your Investment Portfolio

You may want to see also