Checking your investment portfolio is an important task for any investor, whether you're a beginner or an experienced trader. While it's tempting to monitor your investments frequently, it's generally recommended to check your portfolio periodically, especially if your goals, situation or the market conditions change significantly. This approach helps avoid knee-jerk reactions to short-term fluctuations and ensures you stay focused on your long-term investment strategy.

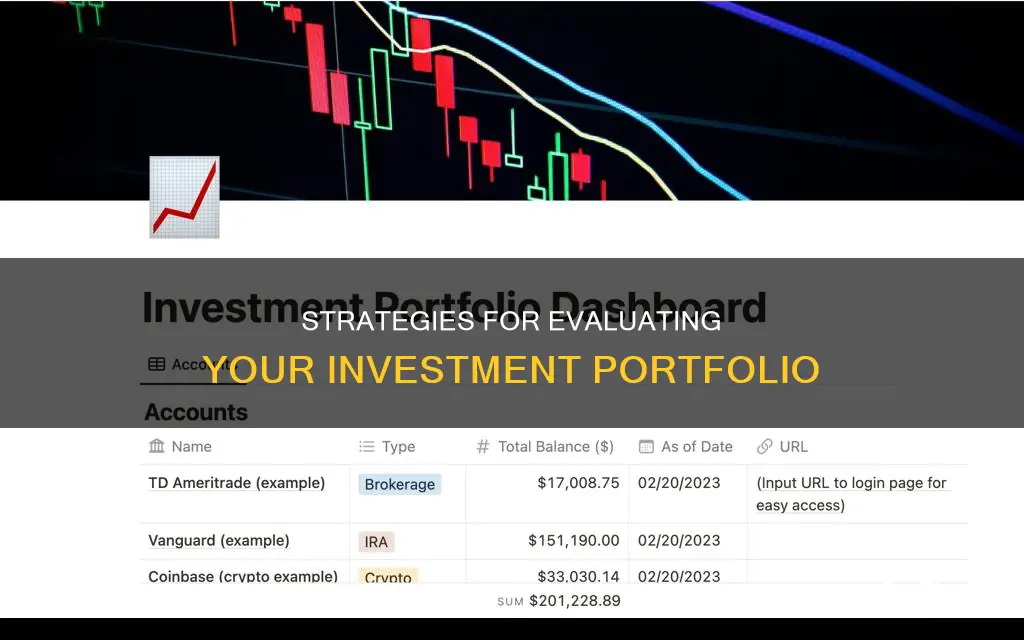

There are various ways to check your investment portfolio, including online portfolio trackers, investment management apps, and spreadsheets. Online portfolio trackers, such as Sharesight, Kubera, and AssetDash, offer convenient ways to monitor your investments across different asset classes and exchanges. Investment management apps, like Empower and Quicken, provide tools for analysing and optimising your portfolio, often with additional features such as budgeting and financial planning. Spreadsheets, like Microsoft Excel and Google Spreadsheets, allow for customisation and control over your investment tracking but may require more manual input.

When checking your investment portfolio, it's essential to evaluate your asset allocation, performance, and individual holdings. Ensure your mix of stocks, bonds, cash, and other investments aligns with your risk tolerance, financial situation, and investment time horizon. Compare your portfolio's performance against appropriate benchmark indexes to assess if it's meeting your goals and performing as expected. Finally, review the fundamentals and outlook of individual stocks or bonds, considering factors like company performance, analyst opinions, and credit ratings.

By conducting regular portfolio check-ups and making adjustments as needed, you can keep your investment strategy on track and work towards achieving your financial goals.

| Characteristics | Values |

|---|---|

| Purpose | To make sure your investments are in line with your goals, investment horizon, financial situation, and risk tolerance |

| Frequency of checking portfolio | Once a month for short to medium-term investments, every three months for long-term positions |

| Tools | Online brokers, financial advisors, robo-advisors, portfolio management apps |

| Key features of a portfolio management app | Performance dashboard, tracking and planning features, relevant news updates, comparison tools |

| Portfolio tracker | A program or service that allows you to trace the movements of your individual holdings |

| Qualities of a great portfolio tracker | Large pool of investment tickers, great research tools, low cost, high speed, user-friendly interface |

What You'll Learn

How to use a portfolio tracker

A portfolio tracker is a program or service that allows you to monitor the performance of your investments and individual holdings. It can help you to see how your current allocation aligns with your long-term goals and how your portfolio is performing compared to the rest of the market.

- Choose a portfolio tracker that suits your needs. Consider factors such as cost, the number of trackable assets, speed, and user-friendliness. Some popular options include Sharesight, Kubera, Personal Capital, and Delta Investment Tracker.

- Set up an account and log in. Most portfolio trackers will require you to create a profile and login credentials.

- Connect your investment accounts. Most portfolio trackers allow you to link your brokerage and retirement accounts so that you can view all your investments in one place. You may also be able to connect other financial accounts, such as bank accounts, credit cards, and loans, for a more comprehensive overview of your finances.

- Customise your portfolio. Depending on the platform, you may be able to create manual portfolios or add portfolios from your investment accounts to test out different investment strategies.

- Utilise the tracker's features. Portfolio trackers often offer a range of tools to help you analyse and manage your investments, such as performance dashboards, tracking and planning features, relevant news updates, and comparison tools.

- Monitor your portfolio regularly. While it is important not to check your investments too frequently, as this can lead to excessive trading, it is a good idea to monitor your portfolio at regular intervals. A good rule of thumb is to check short to medium-term investments once a month and long-term positions every three months.

Build a Secure Investment Portfolio Through Duration Matching

You may want to see also

How to check your portfolio without a tracker

Checking your investment portfolio without a tracker can be cumbersome, but it is important to know what's going on with your investments. Here are some ways to check your portfolio without using a tracker:

Use a Spreadsheet

You can use a spreadsheet program such as Microsoft Excel or Google Sheets to track your investments. This method can be time-consuming and may not provide real-time data, but it can give you a basic overview of your portfolio.

Manual Tracking

If you have a small number of investments, you can manually track them by regularly checking the performance of each individual asset. This can be done by reviewing your brokerage account statements, checking financial news websites, or using online tools provided by your financial institution.

Consolidated Statements

Many financial institutions provide consolidated statements that aggregate information from multiple accounts. These statements can give you an overview of your investments across different accounts and help you understand your overall financial position.

Online Brokerage Accounts

If you have multiple brokerage accounts, you can log in to each one and review your investment holdings and performance. This method can be time-consuming if you have many accounts, but it provides direct access to your investment information.

Financial Advisors

Hiring a financial advisor can be a good option if you want personalized investment guidance and portfolio management. They can provide expertise and help you make informed decisions about your investments. However, financial advisors typically charge fees for their services, so it can be more expensive than managing your portfolio yourself.

While using a portfolio tracker is convenient and offers many benefits, there are alternatives if you prefer not to use one. It is important to stay informed about your investments and regularly review their performance to make sure they align with your financial goals and risk tolerance.

A Safe Investment: Post Office Savings Schemes

You may want to see also

How to check your portfolio less frequently

Checking your investment portfolio too often can be detrimental to your financial health and your stress levels. The stock market is volatile, and the more you check your portfolio, the more you'll notice gains and losses. This can lead to impulsive decision-making and a skewed perception of the riskiness of investing.

A behavioural trait known as loss aversion means that people are more sensitive to losses than gains, so you're likely to feel more stress on days when your investments are down. Research has shown that investors who check their portfolios frequently perceive investing to be riskier and are more likely to make emotional decisions that negatively impact their portfolio's growth potential.

So, how often should you check your portfolio? As little as possible! A review every one to six months is recommended, with some investors choosing to check once per quarter as a happy medium. This will keep you up to date without causing unnecessary stress. If you're investing on your own, checking once a month is a good idea.

Remember, it's important not to make any knee-jerk decisions, such as panic selling due to a temporary price drop. Checking less frequently will help you avoid these impulsive decisions and make smarter financial choices.

Investing Young: Better Than Saving?

You may want to see also

How to check your portfolio if you have multiple accounts

Checking your investment portfolio when you have multiple accounts can be challenging, but there are tools and strategies to help you stay organised and informed. Here are some steps to help you check your portfolio effectively:

- Use a portfolio management app or software: Various portfolio management apps and software allow you to sync and aggregate data from multiple investment accounts, providing a holistic view of your investments. Examples include Empower (formerly Personal Capital), SigFig Wealth Management, Sharesight, and Yahoo Finance. These tools offer features such as performance tracking, asset allocation monitoring, and retirement planning.

- Consolidate your accounts: If you have multiple accounts with different investment firms, consider consolidating them into a single account or a smaller number of accounts. This simplifies the process of checking your portfolio and can provide a clearer overview of your investments.

- Utilise spreadsheets: Creating a spreadsheet, such as an Excel spreadsheet, can help you organise and track your investments across multiple accounts. This method may require more manual work but gives you flexibility in customising the data according to your needs.

- Engage financial advisors: Financial advisors or robo-advisors can assist you in managing and checking your portfolio across multiple accounts. They can provide personalised advice, portfolio rebalancing, and tax optimisation strategies.

- Set up automatic contributions: Consider setting up automatic contributions to your investment accounts on a regular schedule. This helps ensure that your investments remain aligned with your goals, and you don't have to worry about manually contributing each time.

- Focus on your investment goals: Identify your investment goals, such as saving for retirement, building a down payment, or planning for a significant expense. Having clear goals will help you structure your portfolio and make informed decisions when checking its performance.

- Consider tax implications: Be mindful of the tax ramifications of your investments. Diversifying your portfolio across different account types, such as taxable brokerage accounts, tax-advantaged accounts (IRAs, 401(k)s), and health savings accounts, can help optimise your tax burden.

- Stay organised: As the number of accounts increases, staying organised becomes crucial. Regularly review and assess the performance of each account, and consider using tools like Empower to track your overall financial situation.

Diversifying Your Portfolio: Optimal Number of Investments

You may want to see also

How to check your portfolio if you have a financial advisor

If you have a financial advisor, there are several ways to check your portfolio. Firstly, you should ensure that you receive an updated Form ADV from your advisor annually and whenever material changes are made. Form ADV is a disclosure document that investment advisors must file with the U.S. Securities and Exchange Commission and state securities authorities. It includes information such as a description of services offered, fee structure, company history, and any disciplinary actions taken due to misconduct.

Additionally, you should meet with your financial advisor at least once a year to review and optimise your investment goals and portfolio. During these meetings, you can ask questions to ensure that your portfolio aligns with your financial goals and risk tolerance. Here are some key questions to ask:

- What rate of return do I need to ensure my money will last in retirement?

- How much should I allocate toward stocks and bonds?

- How much should I allocate toward U.S. and international stocks?

- Am I taking on too much risk?

- Should I follow an active or passive management approach?

- How much am I paying to manage my investments?

- How often do you implement tax-loss harvesting in my portfolio?

- How much can I withdraw from my portfolio in retirement annually?

- Which accounts should I withdraw from first in retirement?

- How can I reduce capital gains taxes on my portfolio?

- How much can my portfolio potentially fall during a bad stock market?

Betterment: Savings or Investment?

You may want to see also

Frequently asked questions

Checking your portfolio too frequently can do more harm than good. Most experts recommend checking your portfolio once a month for short to medium-term investments and once every three months for long-term positions.

A portfolio tracker is a program or service that allows you to trace the movements of your individual holdings. It helps you see how your current allocation aligns with your long-term goals and compare your portfolio's performance to the rest of the market.

Great portfolio trackers have a large pool of investment tickers, provide real-time price updates, offer research tools, and are user-friendly.

The best stock portfolio tracker depends on your individual needs, investment style, and level of expertise. Look for trackers that offer a free option, a high number of trackable assets, fast load times, and a user-friendly interface.

To build an investment portfolio, you need to open a brokerage account and add funds to it. There are various investment strategies you can consider, such as a core-and-satellite portfolio, which involves selecting smaller, specialized investments to add to a primary investment in a large-cap equities fund.