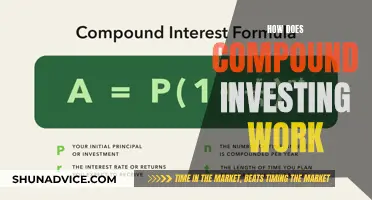

Retirement and investment planning is a complex and multistep process that evolves over time. It involves determining your long-term financial goals, assessing your risk tolerance, calculating expenses, and choosing the right investment vehicles and retirement accounts. The process can begin at any time during your working years, but it's ideal to start as early as possible to take advantage of compound interest.

Retirement planning typically includes creating a strategy for accumulating enough money to support your desired lifestyle after leaving the workforce. This may involve utilising various investment options, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Additionally, retirement accounts like 401(k)s, IRAs, and employer-sponsored plans offer tax advantages to savers.

It's important to consider factors such as your family plans, retirement goals, and the types of tax-advantaged retirement accounts available to you. By starting with a clear understanding of your goals and time horizon, you can build a solid foundation for your retirement plan.

| Characteristics | Values |

|---|---|

| Purpose | To enable an individual to maintain their current lifestyle after leaving the workforce |

| Planning | Should begin as early as possible |

| Risk | Should be balanced with potential returns |

| Time | The earlier you start, the better |

| Investments | Should be diversified |

| Accounts | 401(k), IRA, pension plans, brokerage accounts, etc. |

What You'll Learn

Retirement planning

Getting Started with Retirement Planning:

The first step in retirement planning is determining your long-term financial goals and risk tolerance. It's essential to start as early as possible during your working years, as this provides more time for your investments to grow. The process involves identifying income sources, calculating expenses, implementing a savings plan, and effectively managing your assets. Remember, your retirement plan is a living document that should be regularly updated and reviewed to ensure progress and adaptability to changing circumstances.

Key Components of a Retirement Plan:

A well-crafted retirement plan considers various factors, including your estimated future expenses, liabilities, and life expectancy. It's important to determine how much income you'll need to maintain your standard of living during retirement. This involves projecting your retirement age, calculating the income required to sustain your current lifestyle, and factoring in estimated increases in the cost of living due to inflation. Additionally, consider the market value of your current savings and investments, as well as the projected rate of return.

Saving for Retirement:

There are several methods for saving for retirement, including employer-sponsored retirement plans (such as 401(k)s), personal retirement savings through investments, and Social Security retirement benefits. It's recommended to start saving early and take advantage of tax-advantaged retirement savings plans, such as 401(k)s or Individual Retirement Accounts (IRAs). These plans offer tax benefits and can be a great way to boost your savings over time.

Investment Strategies:

When it comes to investing for retirement, it's important to consider your age and risk tolerance. Younger investors may want to focus more on high-return investments, such as stocks, while older individuals approaching retirement may benefit from including bonds in their portfolio for a more conservative approach. Diversification and shrewd asset allocation are also key to successful retirement planning, as they help protect your portfolio during economic downturns.

Common Retirement Planning Mistakes:

It's important to be aware of common mistakes in retirement planning. These include failing to plan ahead, not saving or investing early, not maximising employer matching contributions, making poor investment choices, and taking Social Security benefits too early. Remember, the earlier you start saving and investing for retirement, the better your chances of achieving a comfortable retirement.

Gas Investment: Worth the Risk?

You may want to see also

Investment portfolio

An investment portfolio is a collection of financial investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), commodities, cash, and cash equivalents. The concept of diversification is key in portfolio management, where investments are spread across various financial instruments, industries, and categories to reduce risk and maximise returns.

When building an investment portfolio, it is important to consider your risk tolerance, investment objectives, and time horizon. You can choose to manage your portfolio yourself or enlist the help of a money manager, financial advisor, or another finance professional.

- Decide on the level of help you want: If you want a hands-off approach, you can outsource portfolio management to a robo-advisor or financial advisor. They will consider your risk tolerance and goals and build and manage your portfolio accordingly.

- Choose an account that aligns with your goals: Select an investment account that suits your needs. For example, if you are investing for retirement, consider a 401(k) or an individual retirement account (IRA) that offers tax advantages.

- Choose your investments based on your risk tolerance: Fill your portfolio with a mix of assets that match your risk tolerance and investment objectives. Common types of investments include stocks, bonds, mutual funds, and ETFs.

- Determine your asset allocation: Decide on the proportion of each asset class in your portfolio based on your risk tolerance. A common rule of thumb is to subtract your age from 100 or 110 to determine the percentage of your portfolio allocated to stocks.

- Rebalance your portfolio as needed: Over time, the allocation of your assets may shift. Rebalancing involves adjusting your investments to restore your portfolio to its original makeup or desired allocation.

Remember, a good portfolio is tailored to your investment style, goals, risk tolerance, and time horizon. Diversification is generally recommended to reduce risk and maximise returns.

DIY Retirement: Navigating Your Financial Future

You may want to see also

Risk tolerance

An individual's risk tolerance is influenced by various factors, including age, investment goals, income, and future earning capacity. For example, younger investors with a longer time horizon until retirement may have a higher risk tolerance and be more inclined to invest in stocks or equity funds. On the other hand, investors nearing retirement age typically have a lower risk tolerance and seek more conservative investments, such as bonds or income funds, to preserve their capital.

Aggressive investors, or those with a high-risk tolerance, are comfortable with the possibility of losing money in exchange for potentially higher returns. They tend to have a good understanding of market volatility and employ strategies aimed at achieving above-average returns. Their investment portfolios often emphasize capital appreciation and may include a significant allocation to stocks with minimal or no exposure to bonds or cash.

On the other hand, conservative investors have a lower risk tolerance and are averse to volatility in their portfolios. This group typically includes retirees or individuals approaching retirement, as they prioritize protecting their principal investment over aggressive growth. Conservative investors usually opt for guaranteed and highly liquid investment vehicles, such as bank certificates of deposit (CDs), money markets, or U.S. Treasuries.

It's important to note that risk tolerance is not static and can change over time as an individual's financial situation, goals, and time horizon evolve. Therefore, it is essential to periodically reassess your risk tolerance and adjust your investment strategies accordingly.

Online risk tolerance assessments and questionnaires can be helpful tools for individuals to understand their risk tolerance better. These tools can provide a starting point for investors to determine their comfort level with risk and make more informed investment decisions. However, it is crucial to approach these assessments critically, as they may be biased towards certain financial products or services. Consulting a financial advisor or planner can also help individuals better understand their risk tolerance and make investment choices aligned with their goals and comfort level.

Investing: Personal Definitions of Risk and Reward

You may want to see also

Estate planning

Legal Documents

The foundation of estate planning is having a will in place. A will serves as a rule book for distributing your assets and can prevent disputes among your heirs. It is essential to have a will regardless of the size of your estate. You can hire an attorney to draft your will, or you can create one yourself using online services or software packages. It is important to sign and date your will in the presence of two non-related witnesses and have it notarized. Additionally, consider creating a trust, especially if you have dependent children or elderly family members who need assistance managing their affairs. A trust allows you to appoint a trustee to manage and oversee the assets you bequeath for the benefit of your chosen beneficiaries.

Inventory and Asset List

Create a comprehensive inventory of your physical assets, including your home, vehicles, jewellery, collectibles, and financial assets such as bank accounts, investment portfolios, retirement accounts, and insurance policies. Make sure to include account numbers, contact information for the firms holding these assets, and the location of any physical documents. It is also important to review and update your beneficiary designations on your retirement and investment accounts to ensure a smooth transfer of assets to your heirs.

Debts and Obligations

Make a separate list of your debts, including credit cards, auto loans, mortgages, and any other obligations. Note the account numbers, the location of signed agreements, and the contact information of the creditors.

Powers of Attorney

Consider establishing both financial and medical powers of attorney. These documents allow you to appoint trusted individuals to make financial and medical decisions on your behalf if you become incapacitated.

Insurance and Annuities

Review and update your insurance policies, including life insurance, annuities, long-term care insurance, and health insurance. Ensure that your beneficiaries are up to date and listed correctly.

Choose an Estate Administrator

Appoint a responsible and competent individual as your estate administrator or executor. They will be in charge of administering your will when you die, so choose someone who can make impartial decisions, especially during an emotional time.

Regular Review and Updates

Simplify Your Finances

If you have multiple retirement accounts or investments, consider consolidating them to simplify management and lower costs. This can also provide better investment choices and make it easier for your heirs to manage after your death.

Seek Professional Advice

Consult with an estate attorney or financial planner to ensure you have covered all the necessary aspects of estate planning. They can provide valuable insights into tax laws, income taxes, and estate taxes, helping you optimise your estate plan.

Remember, estate planning is an ongoing process, and it is never too early or too late to start. By taking the time to plan and seek professional guidance, you can ensure that your wishes are carried out and your loved ones are provided for.

People-Centric Investments: Key to Success

You may want to see also

Retirement accounts

Individual Retirement Accounts (IRAs)

IRAs are individual retirement accounts created by the IRS that offer tax benefits for saving for retirement. There are two main types: Traditional IRAs and Roth IRAs. With a traditional IRA, contributions are made with pre-tax dollars, reducing taxable income, and taxes are paid upon withdrawal during retirement. In contrast, Roth IRAs are funded with after-tax dollars, and withdrawals in retirement are tax-free. IRAs offer flexibility in investment choices and are widely available through financial institutions and online brokerages.

- K) Plans

- K) plans are employer-sponsored retirement plans that are commonly offered by companies. Employees can contribute to the plan with pre-tax wages, and the contributions grow tax-free until withdrawal during retirement. Some employers may offer matching contributions, providing an additional incentive. 401(k) plans often include a range of investment options, such as stocks, and allow for automatic deductions from paychecks, making it a convenient way to save for retirement. However, early withdrawals may be subject to penalties.

- B) Plans

- B) plans are similar to 401(k) plans but are typically offered by public schools, charities, and certain churches. Like 401(k) plans, they offer tax advantages and the ability to invest in various assets. 403(b) plans may also include employer-matching contributions. However, early withdrawals can result in additional taxes and penalties.

- B) Plans

- B) plans are available to employees of state and local governments and certain tax-exempt organizations. These plans allow employees to contribute pre-tax wages, which grow tax-free until retirement. 457(b) plans offer special catch-up savings provisions for older workers, and withdrawals before the typical retirement age are not subject to the same penalties as other plans. However, they usually do not include employer-matching contributions.

Spousal IRAs

Spousal IRAs allow the spouse of a worker with earned income to contribute to an IRA, even if they do not have their own earned income. This enables non-working spouses to take advantage of the benefits of an IRA, either traditional or Roth. Spousal IRAs offer flexibility in investment choices and can be set up through financial institutions.

Rollover IRAs

Rollover IRAs are created when an individual moves their retirement account, such as a 401(k) or IRA, to a new IRA account. This allows them to continue taking advantage of the tax benefits associated with IRAs. Rollover IRAs can be traditional or Roth and provide individuals with the ability to convert their account type, although tax consequences should be carefully considered.

These are just a few examples of retirement accounts, and there are other options available as well, including pension plans, annuities, and government-specific plans. It's important to carefully consider the features and benefits of each type of retirement account to determine which ones align with your financial goals and needs.

Understanding the Timing of Investment Expenses: Strategies for the Savvy Investor

You may want to see also

Frequently asked questions

People generally need around 80% of their pre-retirement income to maintain their standard of living after they stop working. This will depend on your expenses, how much you'll get from Social Security, and your savings and pension plans.

Many advisors recommend saving 10-15% of your income. However, this may vary depending on your circumstances. You can use an online retirement calculator to help you work out how much you should save.

Start by understanding your investment options and the different types of retirement accounts available to you. Then, begin saving early, tracking your net worth, and watching out for fees. Consider seeking advice from a financial professional.

At 55, you might consider a mix of 60% stocks, 35% fixed income, and 5% cash. However, this will depend on your risk tolerance and investment goals.

Start saving and investing as early as possible to take advantage of compounding returns. Focus on growth investments when you're young, then shift towards income and capital preservation as you approach retirement.