Compound investing is a powerful strategy that can significantly boost your financial growth over time. It involves reinvesting the earnings generated from your initial investment, allowing your wealth to grow exponentially. This process is particularly effective in various investment vehicles, such as stocks, bonds, and mutual funds, where the returns are reinvested to earn additional returns. By understanding how compound investing works, you can unlock the potential for substantial wealth accumulation, making it an essential concept for anyone looking to build a robust financial future.

What You'll Learn

Compound Interest: How it Accumulates Over Time

Compound interest is a powerful financial concept that can significantly impact your investments and savings over time. It is the process by which interest is calculated on the initial principal amount, and any accumulated interest is then added to the principal, generating further interest. This compounding effect can lead to substantial growth in your investments, making it an essential tool for long-term financial success.

When you invest or save money, the interest earned is often added to the initial amount, creating a new total. This new total then earns interest in the next period, and so on. The key to understanding compound interest is recognizing that it is not just about the initial amount but also the interest it generates. As time passes, the interest compounds, meaning it is calculated on the growing total, including the previously earned interest.

For example, let's say you invest $10,000 at an annual interest rate of 5%. After the first year, you would earn $500 in interest, making your total $10,500. In the second year, the interest is calculated on this new total of $10,500, so you earn $525 in interest. This process continues, and with each passing year, the interest earned increases because it is based on the higher cumulative amount.

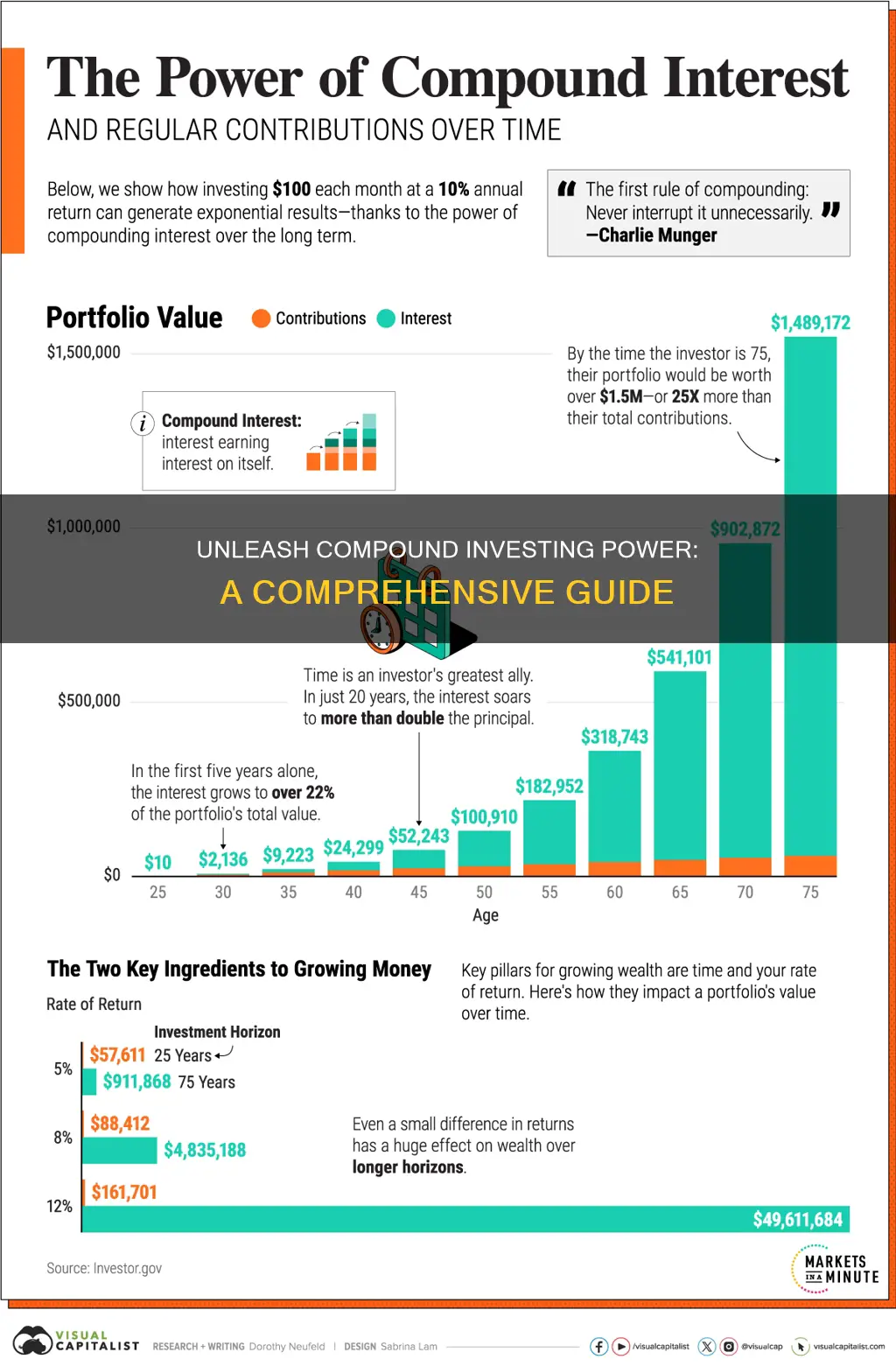

The power of compound interest becomes more evident over extended periods. The longer your money remains invested or saved, the more significant the impact of compounding. For instance, if you start with $1,000 and it grows at 10% interest annually, after 20 years, your investment could be worth approximately $6,700 (using the compound interest formula). However, if you let it compound for 40 years, the value skyrockets to over $48,000. This illustrates how compound interest can work in your favor, especially in long-term investments.

Understanding how compound interest works is crucial for making informed financial decisions. It encourages individuals to start investing or saving early, as the longer the money is allowed to grow, the more substantial the potential returns. Additionally, it highlights the importance of consistent contributions to investments, as regular additions can take advantage of compounding, leading to even greater wealth accumulation over time.

VOO: Invest Now or Later?

You may want to see also

Reinvestment: The Power of Compounding Returns

Reinvestment is a fundamental concept in compound investing that can significantly boost your financial growth. When you reinvest the returns or dividends from your investments, you're essentially putting your money to work for you, allowing it to grow exponentially over time. This strategy harnesses the power of compounding, where your earnings generate additional earnings, creating a snowball effect.

The beauty of reinvestment lies in its ability to accelerate wealth accumulation. By reinvesting, you're continuously adding to your initial investment, and the subsequent returns are then used to purchase additional shares or assets. This process compounds the growth of your portfolio, as the reinvested returns contribute to the purchase of more shares, which in turn generate their own returns. As a result, your wealth grows at an increasing rate, often outpacing the growth of a simple savings account.

One of the key advantages of reinvestment is its long-term impact. Over extended periods, the cumulative effect of reinvesting returns can be substantial. For instance, if you invest $1,000 and earn a 10% annual return, reinvesting those $100 returns each year will lead to a much larger final amount compared to simply withdrawing the earnings. This strategy is particularly effective for long-term goals, such as retirement planning, where consistent reinvestment can turn a modest initial investment into a substantial nest egg.

To maximize the benefits of reinvestment, it's essential to consider your investment strategy. Diversification is a critical aspect, as it reduces risk and provides a more consistent stream of returns. By investing in various assets, such as stocks, bonds, or mutual funds, you can ensure that your reinvested returns are utilized across different sectors and industries. This approach minimizes the impact of any single investment's performance on your overall portfolio.

Additionally, understanding the tax implications of reinvestment is crucial. In many jurisdictions, reinvested dividends or capital gains may be taxed differently from regular income. Being aware of these tax rules can help you optimize your reinvestment strategy. Some investors choose to reinvest only a portion of their returns to balance tax considerations and the desire for continuous growth.

In summary, reinvestment is a powerful tool for compound investing, enabling investors to harness the full potential of compounding returns. By reinvesting earnings and allowing them to work for you, investors can accelerate their wealth accumulation and achieve their financial goals more efficiently. It is a strategy that requires careful planning, diversification, and an understanding of tax implications to ensure optimal results.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Exponential Growth: A Key Concept in Compound Investing

Exponential growth is a fundamental principle in compound investing, and understanding it is crucial for anyone looking to build wealth over time. This concept refers to the rapid increase in the value of an investment due to the reinvestment of earnings, which then generates its own returns. In simple terms, your money grows not just through the initial investment but also through the interest or dividends earned, which are then invested again, creating a snowball effect.

The power of exponential growth lies in its ability to accelerate wealth accumulation. When you invest a certain amount, the initial return may seem small, but when reinvested, it compounds over time. For instance, if you invest $1,000 at an annual interest rate of 5%, the first year you earn $50 in interest, bringing your total to $1,050. In the second year, you earn 5% interest on the new total, resulting in $52.50 in interest. This process continues, and the growth becomes increasingly rapid.

This phenomenon is often best illustrated by the 'Rule of 72,' a simple formula to estimate the number of years it takes for an investment to double in value. By dividing 72 by the annual interest rate, you can quickly determine how long it will take for your money to double. For example, at a 6% interest rate, your investment will double in approximately 12 years (72/6 = 12). This rule highlights the significant impact of even relatively low interest rates over time.

The key to harnessing exponential growth is consistency and patience. Regular contributions to an investment account, such as a retirement plan or a dedicated savings account, can take advantage of this effect. Each deposit becomes an opportunity to earn interest on the growing balance, leading to substantial gains over the long term. This strategy is particularly effective for long-term goals, like retirement planning, where the power of compounding can turn modest initial investments into substantial sums.

In summary, exponential growth is a critical aspect of compound investing, allowing investors to build wealth through the reinvestment of earnings. It demonstrates how small initial returns can lead to significant gains over time, making it an essential concept for anyone seeking to grow their money effectively. Understanding and embracing this principle can empower individuals to make informed financial decisions and work towards their financial goals.

Investment Losses: Can TurboTax Carry Them Over for You?

You may want to see also

Time Value of Money: The Longer You Invest, the Better

The concept of compound investing is a powerful tool in personal finance, and understanding its relationship with the time value of money is crucial for long-term financial success. The time value of money is a fundamental principle in finance, which states that a dollar today is worth more than a dollar in the future due to its potential earning capacity. This principle is the foundation of compound investing, where the earnings from an investment are reinvested to generate even more returns over time.

When you invest, you have the option to either withdraw your initial investment and any earnings or to reinvest those earnings. Compound investing leverages the power of reinvesting earnings. For example, if you invest $10,000 and earn a 5% annual return, at the end of the first year, you will have $10,500. In the second year, this $10,500 will earn a 5% return, resulting in $11,025. Notice how the initial investment of $10,000 grows with each passing year due to the reinvestment of earnings. This is the essence of compound growth.

The longer you invest, the more significant the impact of compound growth becomes. This is because the earnings from your investment are added to the principal, and in the next period, they earn returns on top of that. Over time, this creates a snowball effect, with your money growing exponentially. For instance, if you start with $10,000 and invest it for 20 years at a consistent 5% annual return, you could end up with over $40,000, assuming no additional contributions. This illustrates the power of time and compound interest in building wealth.

The key to maximizing compound investing is starting early and being consistent. The earlier you begin, the more time your money has to grow. Additionally, regular contributions, even if they are small, can significantly impact your final balance due to the power of compounding. This strategy is often referred to as dollar-cost averaging and is a popular method for long-term investors.

In summary, compound investing, combined with the time value of money, offers a robust strategy for wealth accumulation. By reinvesting earnings and allowing your money to grow over an extended period, you can achieve substantial financial gains. It highlights the importance of patience and a long-term perspective in investing, demonstrating that the longer you invest, the better the potential returns.

Madoff Victims: A Global Reach

You may want to see also

Dividend Reinvestment: Building Wealth Through Compounding Dividends

Dividend reinvestment is a powerful strategy that leverages the concept of compound investing to build wealth over time. It involves reinvesting the dividends earned from your investments back into the same investment, allowing your wealth to grow exponentially. This approach is particularly effective for long-term investors seeking to maximize their returns. Here's how it works:

When you invest in a company that pays dividends, you receive a portion of the company's profits as a shareholder. Traditionally, investors would use these dividends to cover their living expenses or save them for future use. However, in dividend reinvestment, the strategy is to utilize these dividends to purchase additional shares of the same company. By doing so, you increase your ownership stake in the company without having to invest additional capital. As the company's value grows, so does your investment, and the dividends earned can be reinvested, creating a cycle of growth.

The beauty of dividend reinvestment lies in its ability to compound over time. Each time you reinvest dividends, you earn dividends on the new shares purchased. This process compounds the growth of your investment, leading to significant wealth accumulation. For example, if you invest $1,000 in a company that pays a 5% dividend yield, you would receive $50 in dividends annually. Reinvesting these dividends allows you to buy more shares, and the subsequent dividends earned will be applied to the growing number of shares, resulting in exponential growth.

This strategy is especially advantageous for long-term investors as it provides a steady stream of income and allows for the power of compounding to work in your favor. Over time, the cumulative effect of reinvesting dividends can lead to substantial wealth creation. Additionally, reinvesting dividends can help you avoid the temptation of spending the dividend income, ensuring that your investments continue to grow.

To implement dividend reinvestment, you can set up automatic reinvestment plans with your broker or financial institution. This ensures that the dividends are automatically reinvested, allowing you to build your investment portfolio without constant intervention. It's a disciplined approach that requires patience and a long-term perspective, but it can be a powerful tool for wealth accumulation.

Uber: The Investment Appeal

You may want to see also

Frequently asked questions

Compound investing is a strategy where the earnings from an investment are reinvested, allowing the principal amount to grow exponentially over time. This process is often referred to as the "power of compounding."

When you invest, you earn returns, which can be in the form of interest, dividends, or capital gains. Instead of withdrawing these returns, compound investing involves reinvesting them back into the investment. As a result, the returns are earned on a larger base amount, leading to exponential growth. For example, if you invest $1000 at an annual interest rate of 5%, the first year's return is $50. In the second year, the $1050 (initial investment + first year's return) earns $52.50, and so on.

This strategy offers several advantages. Firstly, it allows for long-term wealth accumulation as the investment grows faster over time. Secondly, it can lead to higher returns compared to simple interest investments, where only the initial principal earns interest. Additionally, compound investing is a powerful tool for retirement planning, as it enables investors to build substantial savings over their working years.

Absolutely! Compound investing is a versatile strategy that can be applied to various investment vehicles, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. The key is to identify investments with the potential for consistent growth and then reinvest the returns to accelerate the growth of your portfolio.