Autonomous investment refers to investments made by a government or other institutions without considering economic growth or potential returns. These investments are typically driven by geopolitical stability, economic aid, infrastructure development, security, or humanitarian goals. In contrast, induced investments aim to generate profits and respond to economic growth. Autonomous consumption, on the other hand, refers to expenditures that consumers must make even with zero disposable income to fulfil basic necessities. This can lead to borrowing or withdrawing from savings. The paradox of thrift suggests that increased autonomous saving by individuals may lead to decreased aggregate demand and gross output, ultimately lowering total savings and potentially harming the economy.

| Characteristics | Values |

|---|---|

| Definition | Autonomous investment is when a government or other body makes an investment in a foreign country without regard to its level of economic growth or the prospects for that investment to generate positive returns. |

| Purpose | Stability or security, geopolitical stability, economic aid, improving infrastructure, national or individual security, or humanitarian goals |

| Examples | Inventory replenishment, government investments in infrastructure projects such as roads and highways, and other investments that maintain or enhance a country's economic potential |

| Autonomous Investment vs Induced Investment | Autonomous investments are not dependent on changes in GDP, unlike induced investments which increase or decrease in response to economic growth levels. |

| Factors Affecting Autonomous Investment | Interest rates, trade policies, and taxes |

| Autonomous Consumption | Expenditures that consumers must make even when they have no disposable income |

| Autonomous Consumption vs Induced Consumption | Autonomous consumption is influenced by factors such as assets, expectations of future income, ease of borrowing, time period, and minimum standards of living. Induced consumption varies based on income levels. |

What You'll Learn

- Paradox of thrift: saving more may hurt the economy

- Autonomous investment: governments invest for stability and security

- Autonomous consumption: spending on basic needs with little to no income

- Induced investment: profit-driven, variable investments tied to economic growth

- Factors affecting autonomous investment: interest rates, trade policies, taxes

Paradox of thrift: saving more may hurt the economy

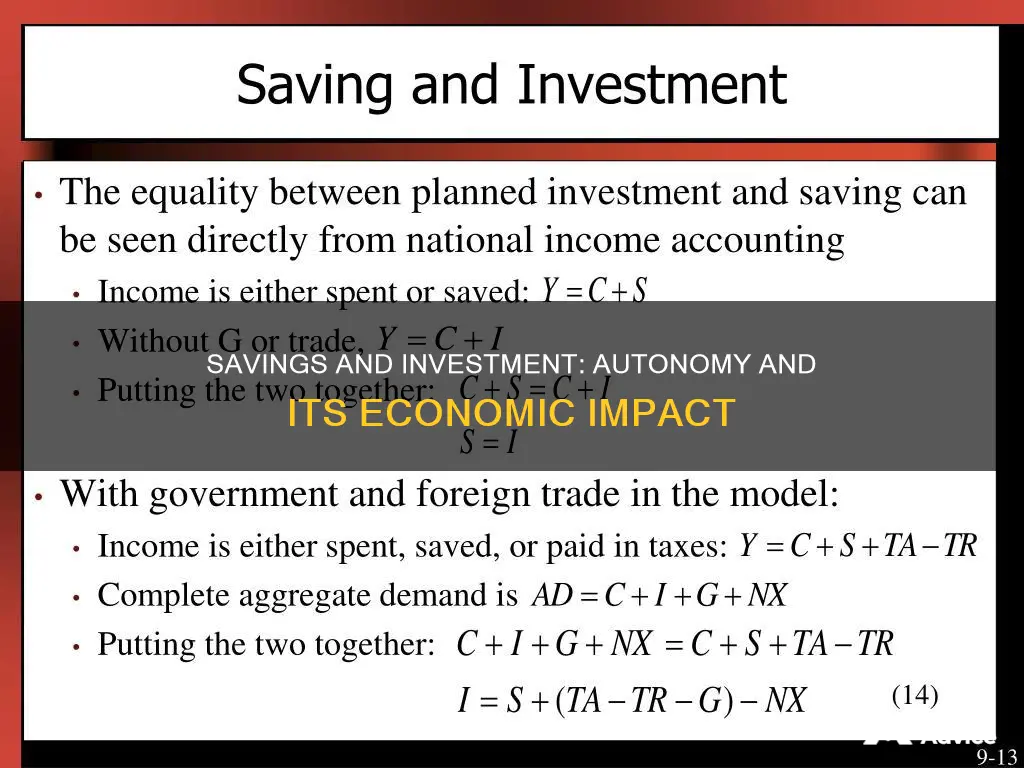

The paradox of thrift, or the paradox of saving, is an economic theory that argues that an increase in individual savings can lead to a decrease in economic growth. This theory, popularized by British economist John Maynard Keynes, suggests that during a recession, higher savings can lead to lower consumer spending, which in turn slows down economic growth. This phenomenon is particularly relevant in a demand-driven economy.

The paradox of thrift can be explained by understanding the relationship between savings, consumption, and economic output. When individuals increase their savings, it leads to a decrease in aggregate demand as people spend less. This reduction in demand causes a contraction in output, resulting in lower incomes for employers and employees. Consequently, the population's total savings may remain unchanged or even decline due to lower incomes and a weaker economy.

For example, consider a town where one of the largest employers, Ivan's factory, is planning to expand its production capacity by installing new machines and hiring additional workers. However, a recession occurs, and Ivan decides to cut costs and prioritize savings. The factory lays off workers and reduces its machine operations. As a result, the unemployed workers, with reduced income to spend, also start saving, further decreasing the demand for goods produced by Ivan's factory. This leads to a decline in the town's economy, with lower production, higher unemployment, and reduced income for many residents.

The paradox of thrift highlights the disconnect between individual and collective rationality. While saving money during tough economic times may be a sensible decision for individuals and households, it can have detrimental effects on the economy as a whole. This paradox is based on the proposition that many economic downturns are demand-based, and insufficient demand can lead to reduced production and economic stagnation.

It's important to note that the paradox of thrift has been criticized by neoclassical economists, who argue that savings represent potential loanable funds that can stimulate investment and spending. They suggest that lower consumption sends a signal to producers to optimize their offerings by lowering prices or changing the types of goods and services produced. Additionally, they emphasize the role of savings in economic growth and technological innovation, which can ultimately raise the total output of an economy.

Investing vs Saving: Understanding the Key Differences

You may want to see also

Autonomous investment: governments invest for stability and security

Autonomous investment refers to investments made by governments or other bodies in foreign countries, independent of economic considerations. These investments are not influenced by the recipient country's economic growth or the potential for positive returns. Instead, they are motivated by geopolitical stability, economic aid, infrastructure development, national or individual security, or humanitarian goals.

Autonomous investment is distinct from induced investment, which is driven by economic opportunities. Induced investments fluctuate with economic growth levels and are motivated by profit. In contrast, autonomous investments are deemed necessary for the well-being, health, and safety of individuals, organisations, or nations. They include inventory replenishment, infrastructure projects like roads and highways, and initiatives that enhance a country's economic potential.

An example of autonomous investment is the 2009 American Recovery and Reinvestment Act (ARRA). Autonomous investments are generally not influenced by external factors, but in reality, interest rates, trade policies, and tax controls can impact them. For instance, high-interest rates can curb consumption, while low-interest rates can stimulate it. Trade policies, such as duties on exports, can affect the cost of finished products in foreign markets. Additionally, governments can influence autonomous investments through taxation policies.

Autonomous investment plays a crucial role in maintaining stability and security. By prioritising these investments, governments can ensure that essential projects and initiatives are undertaken, regardless of economic fluctuations. This helps to reduce volatility in induced investments and promotes long-term stability. Autonomous investments are particularly relevant when disposable income for investments is limited or close to zero, as they are motivated by basic necessities rather than profit.

In summary, autonomous investment refers to investments made by governments or other bodies, primarily for stability, security, or humanitarian purposes. These investments are not influenced by economic growth or profit potential and are instead focused on addressing fundamental needs and maintaining societal welfare. Autonomous investment serves as a stabilising force, complementing induced investments and contributing to the overall well-being of individuals and nations.

Investing Young: Better Than Saving?

You may want to see also

Autonomous consumption: spending on basic needs with little to no income

Autonomous consumption refers to the expenditures that a consumer must make, regardless of their income level. Even if a person has no money, they will still need to purchase certain goods and services, such as food, shelter, utilities, and healthcare. These expenses are deemed autonomous because they cannot be eliminated, regardless of a person's income.

When a person has little to no income, they may be forced to borrow money or access savings to pay for these basic necessities. This is known as "dissaving", where an individual spends money beyond their available income by tapping into savings, taking cash advances, or borrowing against future income. Dissaving can lead to a spiral of debt, with individuals taking on high-interest payday loans to cover their basic needs.

Autonomous consumption is distinct from discretionary consumption, which refers to non-essential goods and services that are desirable when income is sufficient. It also differs from induced consumption, which fluctuates based on income levels. Induced consumption typically involves spending on lavish lifestyles, more purchases, and greater expenses.

Autonomous consumption can change in response to life events, such as job loss or gain, relocation, or changes in recreational habits. It can also be influenced by financing options, such as higher interest rates impacting the cost of credit. Policymakers can use autonomous consumption levels to understand saving trends in an economy, with negative savings indicating that individuals are borrowing against future income to finance current spending.

Government spending on autonomous expenditures, such as Social Security and Medicare, can reduce the financial burden on individuals, while discretionary expenditures on education and transportation can improve societal welfare.

Savings and Investment: Interplay in a Closed Economy

You may want to see also

Induced investment: profit-driven, variable investments tied to economic growth

Induced investment is a type of investment that is dependent on and varies with economic growth. It is profit-driven, aiming to take advantage of economic opportunities and generate positive returns. Induced investments are influenced by shifts in output and disposable income levels. As economic growth increases, induced investments also tend to increase, as investors have more funds available to allocate towards investments. Conversely, during economic downturns or periods of negative economic growth, induced investments may decrease as disposable income levels decline.

Induced investments are typically more variable than autonomous investments. While autonomous investments are driven by necessities or stability concerns, induced investments are motivated by profit potential. When economic conditions are favourable, investors are more likely to allocate funds towards induced investments, anticipating higher returns. However, during economic contractions or periods of uncertainty, induced investments may be reduced or postponed.

The relationship between induced investment and economic growth can be understood through the marginal propensity to invest (MPI). MPI represents the change in investment relative to the change in economic growth. When MPI is positive, it indicates induced investment, as investment levels are influenced by economic growth rates. In contrast, autonomous investment occurs when MPI is zero, indicating that investment decisions are independent of economic conditions.

Induced investments play a crucial role in the economy by responding to market signals and allocating resources towards profitable ventures. They contribute to economic growth by stimulating business activity, creating jobs, and driving innovation. However, induced investments can also be more volatile, as they are susceptible to changes in economic conditions and investor sentiment.

It is worth noting that induced investments can be made by various entities, including individuals, businesses, and even governments. For example, a business may decide to expand its operations or launch a new product line based on favourable market conditions and expected profitability. Similarly, individuals may choose to invest in stocks, real estate, or other assets when economic growth is strong and the potential for capital gains is higher. Governments can also make induced investments, such as allocating funds towards economic development projects or providing incentives for specific industries to boost growth.

Investing in New York's 529: A College Savings Guide

You may want to see also

Factors affecting autonomous investment: interest rates, trade policies, taxes

Autonomous investment refers to investments made by a government or other body in a foreign country without regard to its level of economic growth or the prospect of generating positive returns. These investments are typically made for geopolitical stability, economic aid, improving infrastructure, national or individual security, or humanitarian goals. Autonomous investment is independent of economic considerations, induced investments, and changes in GDP.

Despite being technically independent of external factors, several factors can affect autonomous investments. These include interest rates, trade policies, and taxes.

Interest Rates

Interest rates have a significant impact on investments in an economy. High-interest rates can reduce consumption, while low-interest rates can encourage it, affecting spending within an economy.

Trade Policies

Trade policies between countries can also influence autonomous investments. For example, if a producer of cheap goods imposes duties on exports, it will increase the cost of finished products in other countries.

Taxes

Governments can also control autonomous investments through taxes. If a basic household good is taxed and no substitutes are available, the autonomous investment in that good may decrease.

Maximizing Savings: Strategies to Double Your Money

You may want to see also

Frequently asked questions

Autonomous saving and investment refer to economic decisions made by governments, organisations, or individuals that are not influenced by economic growth or the potential for profit. These decisions are typically driven by basic necessities, stability, or security.

Autonomous investments can include government investments in infrastructure projects, such as roads and highways, or investments in foreign countries aimed at geopolitical stability, economic aid, or humanitarian goals.

Autonomous consumption refers to expenditures that consumers must make even when they have no disposable income. Basic necessities, such as food, shelter, utilities, and healthcare, fall under autonomous consumption. When individuals have limited resources, they may borrow money or dip into their savings to meet these essential needs.