When investments don't yield the expected results, it can be a challenging and often stressful experience. It's important to understand that not every investment will be a success, and sometimes the market, economic conditions, or personal circumstances can lead to unfavorable outcomes. In this paragraph, we will explore the various factors that contribute to investment failures, the potential consequences, and the strategies individuals can employ to navigate through these difficult times.

What You'll Learn

- Financial Losses: Investors face monetary setbacks when their investments underperform or fail

- Market Volatility: Fluctuations in market prices can lead to investment losses

- Strategic Missteps: Poor decision-making or timing can result in investment setbacks

- Economic Downturns: Recessions or economic crises impact investment returns negatively

- Risk Management: Inadequate risk assessment can lead to significant investment losses

Financial Losses: Investors face monetary setbacks when their investments underperform or fail

When investments don't meet expectations, investors often encounter significant financial losses, which can have a profound impact on their overall wealth and financial well-being. These losses can arise from various factors, including market volatility, poor investment choices, or unforeseen economic events. Here's an overview of the potential consequences:

Market Volatility and Underperformance: One of the most common reasons for financial losses is market volatility. Investors may purchase assets at a certain price, only to witness a decline in value due to market fluctuations. For instance, if an investor buys stocks during a period of market downturn, the value of their portfolio could decrease, resulting in losses. Similarly, real estate investments can suffer from market volatility, where property values drop, causing investors to incur financial setbacks.

Poor Investment Decisions: Misjudging the market or making ill-informed investment choices can lead to substantial losses. Investors might rely on tips or rumors, ignoring fundamental research and analysis. When the chosen investment doesn't align with market trends or fails to deliver as expected, investors may face financial strain. This could be a result of overconfidence, lack of diversification, or inadequate risk assessment.

Economic Downturns and External Factors: Unforeseen economic events, such as recessions, financial crises, or geopolitical tensions, can significantly impact investment portfolios. During these periods, various asset classes may experience a decline in value. Investors might find themselves in a position where their investments are worth less than their initial purchase price, leading to financial losses. For example, the 2008 financial crisis caused many investors to suffer substantial losses across different asset classes.

Impact on Long-Term Financial Goals: Financial losses from failed investments can have long-lasting effects on an investor's financial journey. These setbacks may delay retirement plans, reduce the ability to save for future goals, or impact the overall financial security of the investor. It can also lead to increased stress and anxiety, prompting investors to reconsider their risk tolerance and investment strategies.

Managing these financial losses requires a thoughtful approach. Investors should conduct thorough research, diversify their portfolios, and stay informed about market trends. Regular review and adjustment of investment strategies can help mitigate potential risks. Additionally, seeking professional advice can provide valuable insights and guidance during challenging market conditions.

Understanding Dual Currency Investments: A Comprehensive Guide

You may want to see also

Market Volatility: Fluctuations in market prices can lead to investment losses

Market volatility refers to the rapid and significant changes in the value of assets or securities within a market. This phenomenon is an inherent risk in investing, as market prices can fluctuate unpredictably, often in response to various economic, political, or even psychological factors. When an investment is made, investors anticipate a return, but market volatility can cause these returns to be more volatile and uncertain.

The impact of market volatility is particularly evident in the stock market, where share prices can experience dramatic swings. For instance, a company's stock price might surge due to positive news or earnings reports, but it can also plummet if negative events occur, such as a major scandal or a decline in the industry's performance. These price movements can lead to substantial gains or losses for investors, especially those who hold long-term positions.

In the context of investment portfolios, market volatility can have several consequences. Firstly, it can result in short-term losses if investors are forced to sell their holdings at a loss due to a sudden drop in market prices. This is a common challenge for investors who aim to time the market, attempting to buy low and sell high. Secondly, high market volatility can increase the risk of long-term underperformance. If an investor's portfolio is heavily exposed to volatile markets, it may struggle to keep up with the overall market growth, especially during periods of sustained market decline.

To manage market volatility, investors employ various strategies. Diversification is a key approach, where investors spread their investments across different asset classes, sectors, and geographic regions. This strategy aims to reduce the impact of any single market event on the entire portfolio. Additionally, investors may consider using financial instruments like options and futures to hedge against potential losses or to speculate on market movements.

Understanding and managing market volatility is crucial for investors to navigate the risks associated with investment losses. It requires a careful analysis of market trends, a well-defined investment strategy, and a long-term perspective to weather the short-term fluctuations that are an inevitable part of the investment journey.

Code Investment: Maximizing Your Returns

You may want to see also

Strategic Missteps: Poor decision-making or timing can result in investment setbacks

In the realm of business and finance, the adage "timing is everything" holds particularly true. Strategic missteps, often stemming from poor decision-making or ill-timed actions, can significantly impact investment outcomes. These missteps can lead to a cascade of negative consequences, affecting not only the financial health of a company but also its reputation and long-term sustainability. Understanding these strategic pitfalls is crucial for investors and business leaders alike to navigate the complex landscape of investment management effectively.

One common strategic misstep is the failure to conduct thorough due diligence before making an investment. This due diligence process is a critical safeguard, providing a comprehensive understanding of the investment's potential risks and rewards. When investors or companies rush into deals without proper research, they may overlook critical factors such as market trends, competitive landscapes, or even legal and regulatory issues. Such oversight can result in investments that quickly become stranded, leading to financial losses and a tarnished reputation. For instance, a tech startup might invest in a cutting-edge technology without fully assessing the market's readiness for it, resulting in a wasted expenditure when the technology fails to gain traction.

Another strategic error is the lack of adaptability in response to changing market conditions. Markets are inherently dynamic, and what was once a lucrative investment opportunity may become obsolete or risky over time. Investors who fail to recognize these shifts and adjust their strategies accordingly risk being left behind. For example, an investor in the fossil fuel industry might ignore the growing global emphasis on renewable energy, leading to a decline in the value of their holdings as the industry faces increasing scrutiny and regulation. Similarly, a business that fails to innovate and adapt its products or services to meet evolving consumer needs may see its market share erode rapidly.

Timing is a critical aspect of investment success, and strategic missteps can often be attributed to poor timing. This includes entering or exiting investments at the wrong moments, such as during market peaks or troughs. For instance, selling a stock just before a market crash can result in significant financial losses, while buying during a market boom might lead to overvaluation and subsequent depreciation. Effective investors and business leaders must strike a delicate balance between seizing opportunities and avoiding the pitfalls of market timing. This involves a combination of thorough research, a deep understanding of market dynamics, and the courage to make timely decisions.

Furthermore, strategic missteps can also arise from internal issues, such as poor management or internal conflicts. These factors can significantly impact the performance of an investment. For instance, a company with a history of internal strife and poor leadership might struggle to execute its business plan effectively, leading to missed deadlines, budget overruns, and ultimately, a failed investment. Similarly, a startup with a high turnover rate among key personnel may struggle to maintain its competitive edge, making it a risky venture for investors.

In conclusion, strategic missteps in investment decisions can have far-reaching consequences, impacting not only the financial bottom line but also the long-term viability of a business. Poor decision-making, inadequate due diligence, lack of adaptability, and poor timing are all potential pitfalls that investors and business leaders must navigate carefully. By recognizing these strategic errors and implementing robust processes to mitigate their occurrence, investors can significantly enhance their chances of success in an ever-changing market environment.

Tailor Investment Strategies: A Guide to Finding Your Perfect Financial Fit

You may want to see also

Economic Downturns: Recessions or economic crises impact investment returns negatively

During economic downturns, such as recessions or more severe economic crises, the performance of investments can take a significant hit. These challenging periods are characterized by a decline in economic activity, often triggered by various factors like financial crises, geopolitical tensions, or global pandemics. When an economy slows down or enters a recession, it directly affects the overall health of the investment landscape.

In a recession, businesses may struggle, leading to reduced profits and, in some cases, bankruptcy. This, in turn, impacts the value of investments in these companies, especially those in the stock market. For instance, if a tech startup fails to meet its financial projections during a recession, its stock price could plummet, resulting in substantial losses for investors. Similarly, real estate investments might suffer as property values decline, making it harder for investors to recoup their initial capital.

Economic crises can also lead to a decrease in consumer spending and business investment. This reduction in demand can further exacerbate the situation, causing a downward spiral. As a result, many investments may experience a decline in value, and some may even become worthless. This is particularly true for speculative investments or those heavily reliant on market sentiment.

During these challenging times, investors often face the dilemma of whether to hold on to their investments or sell them to minimize losses. The decision is crucial, as holding on might lead to further depreciation, while selling at a potentially lower price could result in financial setbacks. Diversification becomes even more critical in economic downturns to mitigate risks. Investors should consider spreading their investments across various asset classes, sectors, and regions to reduce the impact of any single investment's poor performance.

In summary, economic downturns can significantly impact investment returns, often resulting in losses. Understanding the causes and effects of these crises is essential for investors to navigate such periods effectively. It is a reminder that investing is a long-term strategy, and short-term fluctuations, especially during economic challenges, should be carefully managed to ensure financial stability.

Unraveling the Mechanics of Pipe Investment Strategies

You may want to see also

Risk Management: Inadequate risk assessment can lead to significant investment losses

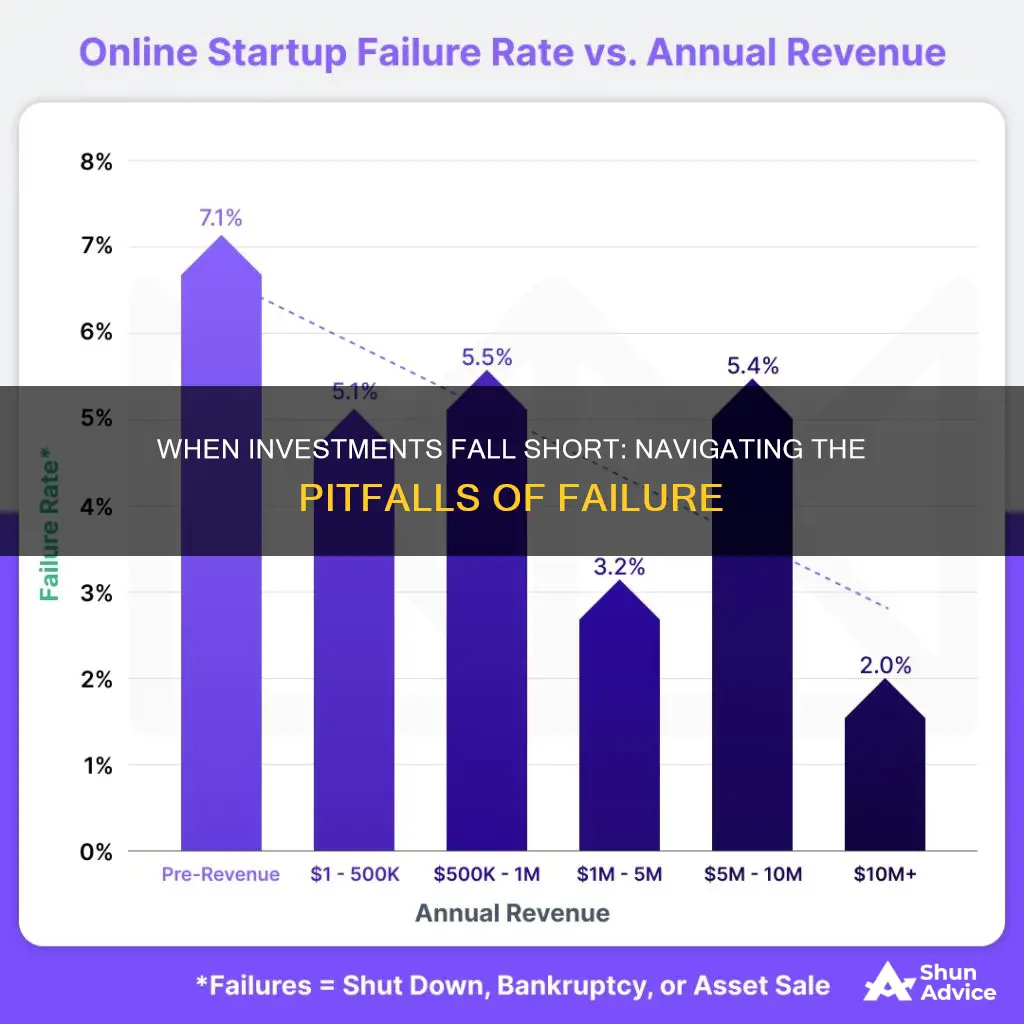

In the realm of investment, risk management is a critical component that can make or break an individual's financial journey. When it comes to inadequate risk assessment, the consequences can be severe and far-reaching. Many investors often underestimate the potential pitfalls and overestimate the returns, leading to a recipe for disaster. This oversight can result in substantial financial losses, highlighting the importance of a comprehensive risk assessment process.

The primary issue arises when investors fail to conduct a thorough analysis of potential risks associated with their chosen investments. This includes understanding market volatility, industry-specific risks, and the overall economic landscape. For instance, investing solely based on past performance without considering the current market conditions can be a costly mistake. A simple example is an investor who poured their savings into a tech startup during a booming market, only to witness a sudden market downturn and the company's rapid decline. This scenario underscores the need for a dynamic risk assessment that adapts to changing market dynamics.

Furthermore, inadequate risk assessment often leads to a lack of diversification, which is a cornerstone of prudent investment strategy. When investors focus on a limited number of assets or sectors, they expose themselves to concentrated risk. Imagine an investor who invested all their funds in a single cryptocurrency, ignoring the advice of financial experts to diversify. When the crypto market experienced a sudden and severe crash, this investor's entire portfolio took a hit, resulting in significant financial strain. Diversification, when properly managed, can mitigate the impact of such losses and provide a safety net for investors.

Another critical aspect of risk management is the understanding of one's own risk tolerance. Investors need to assess their financial goals, time horizon, and personal circumstances to determine the level of risk they can comfortably bear. For instance, a retiree seeking a steady income stream may opt for more conservative investments, while a young, high-earning professional might be more inclined to take on higher risks for potential long-term gains. Misjudging risk tolerance can lead to emotional decision-making, causing investors to make hasty changes during market volatility, which often results in suboptimal outcomes.

To avoid these pitfalls, investors should adopt a systematic approach to risk assessment. This involves researching and analyzing various investment options, seeking professional advice, and regularly reviewing and adjusting their portfolios. By doing so, investors can make informed decisions, ensuring that their investments are aligned with their risk appetite and financial objectives. In summary, inadequate risk assessment can have severe consequences, emphasizing the need for a meticulous and adaptive approach to investment management.

Pay Off the House or Invest: Navigating the Pros and Cons

You may want to see also

Frequently asked questions

It's important to remember that investing is a long-term strategy, and short-term fluctuations are common. If an investment underperforms, it could be due to various factors such as market conditions, economic changes, or even company-specific issues. The first step is to review your investment strategy and assess whether it aligns with your financial goals and risk tolerance. Consider consulting a financial advisor to discuss alternative investment options or strategies to potentially mitigate losses.

Significant losses can be concerning, but they are a natural part of the investment journey. It's crucial to stay calm and not make impulsive decisions. Review your investment strategy and assess the reasons behind the losses. Diversification is key; ensure your portfolio is well-balanced across different asset classes and sectors. Consider rebalancing your portfolio to align with your risk profile. Additionally, regularly monitoring and evaluating your investments can help you make informed decisions and potentially minimize further losses.

Liquidating an investment is a decision that should be made after careful consideration. If you believe an investment is no longer suitable, you can sell it and reinvest the proceeds in a more promising opportunity. However, selling at a loss may result in capital gains tax implications, so it's essential to understand the tax rules in your jurisdiction. Consult with a financial professional to determine the best course of action, considering your financial goals and the potential impact on your overall investment strategy.

Protecting your investments from complete failure involves a proactive approach. Diversification is a powerful tool; ensure your portfolio is spread across various assets to minimize risk. Regularly review and analyze your investments, staying updated on market trends and news. Consider insurance options, such as investment protection policies, which can provide a safety net in case of significant losses. Additionally, maintaining a long-term perspective and a disciplined investment approach can help navigate market volatility and potential downturns.