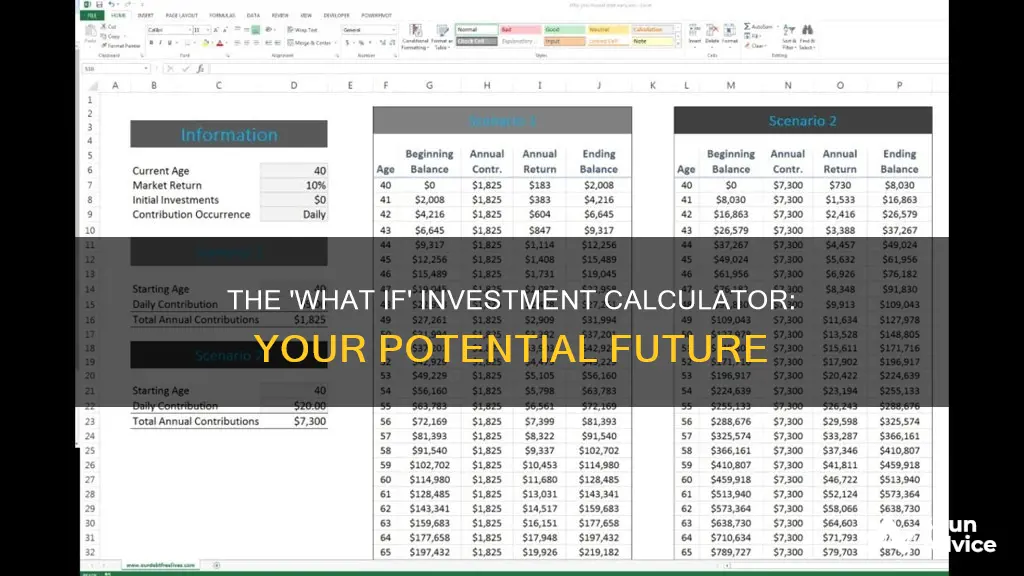

Investment calculators are a great way to estimate how much your savings will compound over time. They can help you figure out how to meet your financial goals by showing how your initial investment, frequency of contributions, and risk tolerance can all affect the growth of your money. These calculators take into account factors such as the amount you invest at the beginning, additional contributions, the number of years you plan to invest, and the expected rate of return. By using these tools, you can gain a better understanding of how your investments might perform and make more informed decisions about your financial future.

| Characteristics | Values |

|---|---|

| Purpose | To estimate how much your investments or savings will compound over time |

| Input | Initial deposit, contribution amount, contribution frequency, years of growth, rate of return, compounding frequency |

| Output | Estimated rate of return |

What You'll Learn

How much to initially invest

When considering how much to initially invest, there are a few key factors to keep in mind. Firstly, it's important to determine your financial goals and risk tolerance. Are you investing to achieve long-term goals, such as retirement or saving for your child's education, or are you looking for shorter-term gains? Your risk tolerance will also play a role in deciding how much to invest initially. If you're comfortable with higher-risk investments, you may be willing to invest a larger sum upfront, whereas if you prefer lower-risk options, you might start with a smaller initial investment.

Another factor to consider is the type of investment you plan to make. Different investments have varying minimum investment requirements. For example, mutual funds and index funds typically require a starting balance of a few hundred dollars to $1,000 or more. On the other hand, you can invest in individual equities and bonds with a smaller initial investment. Additionally, some investments may offer compound interest, which can increase your returns over time.

It's also essential to evaluate your financial situation and budget. Determine how much you can comfortably afford to invest initially without straining your finances. Consider any other financial commitments and goals you have, and allocate your funds accordingly. You might also want to take into account the expected rate of return for your chosen investment. If you're expecting higher returns, you may be more inclined to invest a larger sum upfront.

When deciding on the initial investment amount, it's recommended to seek advice from a financial professional, especially if you're new to investing. They can provide personalised guidance based on your financial circumstances, goals, and risk tolerance. Additionally, keep in mind that investing carries inherent risks, and there is always the potential for loss, so only invest what you can afford to lose.

Best Banks for Investment: Where to Invest Your Money?

You may want to see also

Frequency of contributions

The frequency of contributions to your investment fund can have a significant impact on its growth over time. Here are some key considerations regarding contribution frequency:

Regular Contributions

Making consistent and regular contributions to your investment fund is an effective strategy to accumulate wealth over time. Even small additions to your investment can add up and make a substantial difference in the long run. This approach allows your money to grow through compound interest, where the interest earned also generates interest. You can choose the frequency of your contributions, ranging from weekly, bi-weekly, monthly, semi-annually, or annually.

Contribution Period

The timing of your contributions within each period is also important. Most investment calculators assume that contributions will occur at the end of the selected contribution period. For example, if you choose to contribute monthly, the calculator assumes the contribution will be made at the end of the month. This is significant because it affects how soon your money starts earning a return.

Compounding Frequency

The compounding frequency refers to how often the earnings from your investments are added to your account. The more frequently compounding occurs, the sooner your accumulated earnings will start generating additional earnings. For example, earnings from stocks, mutual funds, and investments in stocks are often compounded annually, while earnings from bonds, bond funds, savings accounts, and CDs are generally compounded more frequently.

Impact of Contribution Frequency on Returns

The rate of return on your investments is influenced by the frequency of your contributions. With regular contributions, your rate of return compounds based on this frequency. For instance, if you contribute monthly, your rate of return will compound monthly. This means that your investment returns will be calculated based on the assumption that your contributions are added to your investment account at regular intervals.

Practical Considerations

When deciding on the frequency of contributions, consider your pay schedule and budget. Some individuals opt for automatic deductions from their income, which could mean monthly or bi-weekly contributions. Others may only manage to contribute to their investments annually. It's important to remember that investing is a long-term strategy, and the impact of compound interest is maximized over time. Therefore, starting to invest early in your career, even with smaller contributions, can be more beneficial than waiting until you're older and able to contribute larger amounts less frequently.

Quant Mutual Funds: Safe Investment or Risky Business?

You may want to see also

Risk tolerance

Understanding Risk Tolerance

Factors Influencing Risk Tolerance

Several factors influence an individual's risk tolerance, including age, investment goals, income, and future earning capacity. Younger investors generally have a higher risk tolerance as they have more time to recover from potential losses. Additionally, investors with a larger portfolio may be more tolerant of risk, as the percentage loss is relatively smaller compared to a smaller portfolio.

Types of Risk Tolerance

Assessing Your Risk Tolerance

To assess your risk tolerance, you can use online risk tolerance assessments, surveys, or questionnaires. It is also helpful to review historical returns for different asset classes to understand the volatility of various financial instruments. Additionally, consider your financial goals and time horizon. If you have a long-term investment goal, you may be willing to take on higher-risk investments, while short-term goals may be more suited to lower-risk cash investments.

Vanguard Dividend Growth Fund: A Comprehensive Investment Guide

You may want to see also

Rate of return

The rate of return is a crucial element of any investment plan. It is the percentage by which an investment increases in value over time and is used to compare the attractiveness of different financial investments. The rate of return is influenced by various factors, including the investment length, additional contributions, and the frequency of compounding.

When calculating the rate of return, it is important to consider the investment's compounding frequency. For example, earnings from stocks and mutual funds that invest in stocks are often compounded annually, while earnings from bonds, bond funds, savings accounts, and CDs are generally compounded more frequently. The more frequent the compounding, the faster accumulated earnings can generate additional earnings.

Additionally, the rate of return depends on the type of investment. For instance, the S&P 500, an unmanaged index of large US stocks, has historically averaged an annual total return of about 10%. This is considered a relatively safe investment option. In contrast, riskier investments, such as buying bonds from companies rated at a risky level, may offer higher rates of interest but carry a higher risk of loss if the company goes out of business.

It is also worth noting that the rate of return for an investment calculator is usually a conservative estimate, assuming an asset allocation that includes stocks, bonds, and cash. This conservative estimate helps ensure individuals do not under-save. As such, individuals could potentially count on a higher rate of return, but this may not always provide an accurate picture of their investing potential.

In summary, the rate of return is a critical factor in investment planning, and individuals should carefully consider their investment objectives, risk tolerance, and time horizon when determining their expected rate of return.

Morgan Stanley Funds: A Guide to Investing

You may want to see also

Investment time frame

When considering your investment time frame, it's important to distinguish between short-term and long-term goals. Short-term goals, such as saving for a home purchase or building an emergency fund, typically require a more conservative approach with lower-risk investments like savings accounts, money market accounts, or certificates of deposit (CDs). These options offer secure and easy access to funds but may not provide high returns, sometimes failing to outpace inflation.

On the other hand, long-term goals like retirement planning or saving for a child's education can justify taking on more risk by investing in stocks, bonds, or mutual funds. These investments have the potential for higher returns over the long term but also carry a higher degree of risk.

It's important to note that historical returns don't guarantee future performance. However, looking at historical data can provide a rough guideline. For example, the S&P 500, an index of large US stocks, has historically averaged an annual total return of about 10% since 1926.

When choosing your investment time frame, it's essential to consider your risk tolerance and the potential impact of market volatility. Diversification across different asset classes, such as stocks, bonds, and cash, can help mitigate risk. Additionally, it's crucial to consult a financial professional for personalized advice based on your specific circumstances.

Bond Funds: Invest Now or Miss Out?

You may want to see also

Frequently asked questions

An investment calculator is a tool that can be used to calculate different variables concerning investments with a fixed rate of return.

An investment calculator can help you figure out how to meet your financial goals. It can show you how your initial investment, frequency of contributions, and risk tolerance can all affect the growth of your money.

Common types of investments include stocks, funds, bonds, real estate, and commodities.