Bitcoin has been on a wild ride since its inception in 2009, and those who invested in it early on have reaped incredible gains. If you had invested in Bitcoin in 2010, your returns could be in the billions, as the cryptocurrency's price has skyrocketed from an initial value of close to $0. For example, if you had invested $100 in Bitcoin in October 2010 when it was worth around 10 cents, you would have been able to purchase about 1,000 Bitcoins. At its all-time high in February 2021, those 1,000 Bitcoins would have been worth more than $48 million, assuming you held on to them.

| Characteristics | Values |

|---|---|

| Initial value of Bitcoin | $0.0008 per token |

| Date of debut | July 2010 |

| Value of Bitcoin as of November 12, 2021 | $63,712.34 per token |

| Return on investment (as of November 12, 2021) | 8,000,000,000% |

| Value of $100 investment in Bitcoin on debut day as of November 12, 2021 | $7,964,042,400 |

| Number of Bitcoins that could be purchased with $100 on debut day | 125,000 |

| Current number of people with unique Bitcoin wallets | Over 76 million |

| Maximum number of Bitcoins that can be created | 21 million |

| First "halving" of Bitcoin | November 2012 |

| Value of Bitcoin after first "halving" | $13.50 |

| Value of Bitcoin in early April 2013 | $100 |

| Value of Bitcoin in May 2021 | $62,000 per coin |

What You'll Learn

Returns could be in the billions

Bitcoin's price has been on a rollercoaster ride since its debut in 2009, but the long-term trajectory has been higher. In little more than a decade, it has become one of the most exciting trading opportunities in a long time.

Bitcoin was created by a mysterious individual or group known as Satoshi Nakamoto. Early proponents touted the currency's promise of moving monetary policy out of the hands of governments and central banks and into an autonomously managed system.

Bitcoin famously has a maximum of 21 million coins that can ever be created. In the face of this fixed supply, an ever-increasing demand can send the cryptocurrency soaring. Given these dynamics, speculators have rushed into the space to take advantage of the anticipated price appreciation.

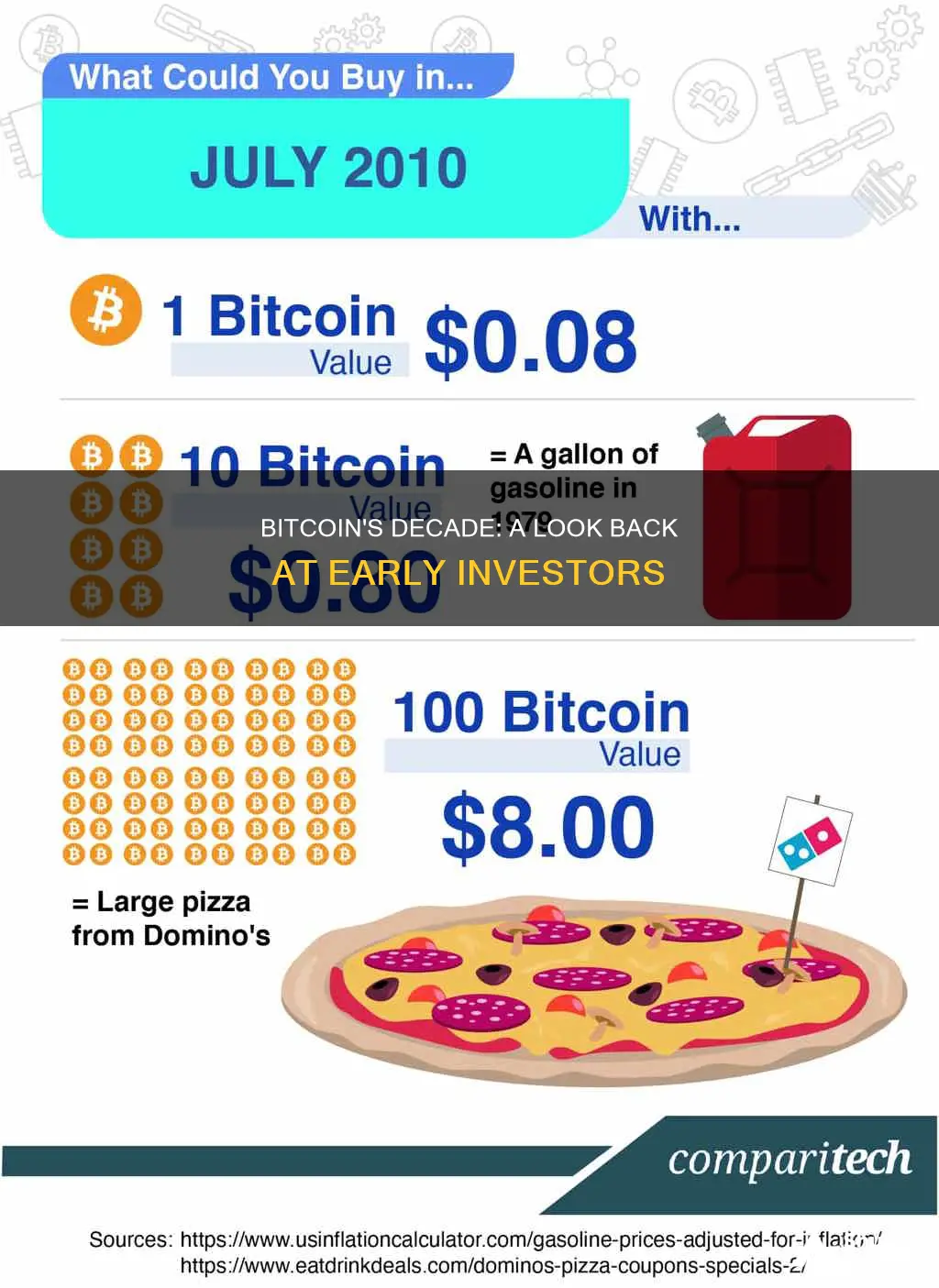

Bitcoin first made its debut for trading at the beginning of July 2010 at a price of $0.0008 per token. That's just eight-hundredths of a penny. If we make the hypothetical assumption that there were no transaction fees, a $100 investment on its debut day could have purchased 125,000 Bitcoin.

As of November 2021, Bitcoin was going for $63,712.34 per token. An initial $100 investment held for a tad over 11 years and four months would have gained almost 8,000,000,000% and would now be worth $7,964,042,400.

To put this into another context, Tesla Motors' CEO Elon Musk is currently the world's richest person, with an estimated net worth of $281.6 billion. If you had the luck, stomach, and wherewithal to invest $3,550 in Bitcoin on Day 1, you'd be the richest person in the world right now.

In October 2021, $1,000 worth of Bitcoin bought in June 2011 would be worth $17,732,000, or a 1,062.82% gain.

In August 2010, $100 would have bought about 1,000 Bitcoins. At its all-time high in November 2021, those 1,000 Bitcoins would've been worth more than $48 million, not accounting for compounding and assuming you bought and held the asset the entire time.

Bitcoin's perception of scarcity, growing utility, and enormous community have contributed to its historic run.

However, there are plenty of reasons to be skeptical about future upside. Firstly, Bitcoin isn't truly scarce. A physical commodity, such as gold, is limited by what's been dug up and what remains to be mined. With Bitcoin, there is no physical scarcity. Only written code caps its token limit, and changes can be made if consensus is reached. That's not true scarcity—it's the perception of scarcity.

Another concern is that Bitcoin may still lag a number of popular cryptocurrencies, even with upgrades. At the moment, Bitcoin's transactions process much slower than its peers and cost substantially more. If businesses were looking for a blockchain-based use case that would improve existing payment infrastructure, Bitcoin would be way down the list of long-term candidates.

Exploring Bitcoin Investment: What's the Real Deal?

You may want to see also

Bitcoin's perception of scarcity

Bitcoin's scarcity is supported by the Halving, which occurs every 210,000 Bitcoin "blocks", or roughly every four years. The Halving reduces the annual issuance rate of Bitcoin by 50%, bringing the network closer to its maximum supply of 21 million tokens. This reduction in supply has historically resulted in significant price appreciation for Bitcoin in the following year.

The perception of scarcity is particularly important for Bitcoin's value proposition, as it is often viewed as a hedge against inflation. As the US money supply has grown since the Great Recession, the thinking is that the true value of the US dollar will decline, and people will flock to Bitcoin, which has a fixed supply.

However, it is important to note that Bitcoin is not truly scarce in the same way that physical commodities like gold are. Gold is limited to what has already been mined and what remains to be mined, whereas Bitcoin's scarcity is based on written code, which could be changed if consensus is reached. Therefore, it could be argued that Bitcoin's scarcity is a perception rather than a reality.

Bitcoin's divisibility also impacts the degree of its scarcity. If there were only one Bitcoin in existence and it was completely indivisible, there would likely be little to no demand for it. On the other hand, if there were 21 million Bitcoin but they couldn't be divided any further, Bitcoin might actually be scarcer compared to the current situation.

Despite these considerations, Bitcoin is still considered a scarce resource. The demand for Bitcoin has been increasing over time, and its transparency, predictability, consensual nature, and censorship resistance make it a unique monetary asset. As a result, it is expected that Bitcoin's scarcity will continue to increase, and many people will only be able to own a small amount in the future.

The Bitcoin Millionaires: Fortunes of the Crypto Investors

You may want to see also

Cryptocurrency's volatility

As a relatively new asset class, cryptocurrency is widely considered to be volatile, with the potential for significant upward and downward movements over short periods. Generally, the more volatile an asset is, the riskier it is considered to be as an investment. Cryptocurrency's volatility is driven by several factors, including news coverage, trading volume, and external economic factors.

Historical Volatility

The price of Bitcoin, the most well-known cryptocurrency, has been on a rollercoaster ride since its debut in 2010, when it was valued at $0.0008 per token. In the years since, its value has fluctuated from a few cents to tens of thousands of dollars, reaching a peak of over $64,000 in mid-April 2021. Bitcoin's price is notoriously driven by market sentiment, with periods of "greed" where it soars amid utopian promises, and "fear" phases where its price struggles to gain traction as sellers push it lower.

Factors Affecting Volatility

Several factors influence the volatility of cryptocurrencies like Bitcoin. Firstly, positive or negative news coverage can impact the market. For example, in 2021, China's warnings and restrictions on cryptocurrency transactions contributed to a significant drop in Bitcoin's price. Secondly, trading volume plays a role; unusually high or very low trading volumes can correspond to increased volatility. Lastly, external economic factors such as interest rate hikes, elections, and geopolitical tensions can also affect the volatility of cryptocurrencies.

Strategies for Investors

For investors, volatility can present both opportunities and risks. Some investors view high volatility as appealing due to the potential for high returns. However, for those with lower risk tolerance, strategies such as dollar-cost averaging can help limit the downside impact of volatility. Additionally, investing in stablecoins, which are cryptocurrencies designed to have low volatility by pegging their value to a reserve asset like the US dollar, can be considered.

Best Apps for Bitcoin Investment and Trading

You may want to see also

How to invest in Bitcoin

Investing in Bitcoin can be a risky endeavour, but if you're willing to take the risk, there are several ways to do it. Here are the steps you can take to invest in Bitcoin:

- Choose a cryptocurrency exchange: Select a reputable and well-known exchange, such as Coinbase, Kraken, Gemini, or Crypto.com, that offers a large selection of currencies.

- Create an account: You will need to provide personal information and verify your identity to register on the exchange.

- Fund your account: Before buying any Bitcoin, you need to deposit fiat money, such as US dollars, into your exchange account.

- Place a buy order: Decide how much Bitcoin you want to purchase and follow the exchange's instructions to submit and complete your buy order.

- Store your Bitcoin in a digital wallet: You can choose to store your Bitcoin in a hot wallet, which is hosted by the exchange or an independent wallet provider, or a cold wallet, which is a small, encrypted portable device that you can use to download and carry your Bitcoin.

It's important to keep in mind that the price of Bitcoin is extremely volatile and subject to rapid and unpredictable changes. Additionally, there are transaction fees associated with buying and selling Bitcoin, so be sure to take those into account when making purchases.

If you're not comfortable purchasing Bitcoin directly, there are other ways to invest in Bitcoin and cryptocurrency:

- Traditional stockbrokers: Some online brokers like Robinhood, Webull, TradeStation, and Fidelity offer access to Bitcoin and other cryptocurrencies.

- Peer-to-peer money transfer apps: Apps like PayPal, Venmo, and Cash App allow users to buy, store, and sell Bitcoin directly within the apps.

- Bitcoin exchange-traded funds (ETFs): As of January 2024, the SEC has approved spot Bitcoin ETFs, which means you can invest in Bitcoin through traditional brokerage accounts.

- Bitcoin ATMs: These work like regular ATMs, but they allow you to buy and sell Bitcoin. You can find them in locations such as convenience stores.

Small Bitcoin Investments: Worth the Risk?

You may want to see also

Bitcoin's growing real-world utility

Neutral, Censorship-Resistant Money

Bitcoin is neutral and censorship-resistant. It doesn't discriminate based on political affiliation, country, race, etc. For example, during the Canadian trucker protest in early 2022, the Canadian banking system froze the accounts of people involved in the protests. However, thousands of people donated Bitcoin to the cause, amounting to over $1 million, which the government or banking system couldn't stop.

Portable Wealth

Bitcoin allows you to carry your wealth anywhere in the world without anyone knowing. All you need is a seed phrase, typically 12 to 24 words, to access your Bitcoin. This is especially useful for people fleeing hostile areas or countries with strict capital controls.

Energy Grid Stabilization

Bitcoin mining stabilizes energy grids. Miners act as energy consumers of first and last resort, always buying energy if it's available. This helps energy producers by providing a consistent demand for their product. Additionally, Bitcoin mining encourages the use of efficient and green energy sources, as miners seek to minimize their energy costs.

Always-On Banking

Bitcoin's network has an uptime of 99.99% over 12 years, with only 14 hours of downtime. This means that, unlike traditional banks, you can access your Bitcoin at any time, anywhere, as long as you have an internet connection.

Micropayments and Internet Commerce

Bitcoin and its scaling layers, such as the Lightning Network, are disrupting e-commerce with internet-native micropayments. For example, content creators can now rely on their audience to fund their ventures directly through micropayments, without having to rely on advertising or subscriptions. Additionally, Bitcoin can be used to easily pay for content or services online, without having to divulge personal or financial information.

The Ultimate Guide to ProShares Bitcoin ETF Investing

You may want to see also

Frequently asked questions

If you invested $100 in Bitcoin on its debut day in July 2010, you would have purchased around 125,000 Bitcoins, which would be worth nearly $8 billion as of November 2021.

Bitcoin's growth is attributed to its perception of scarcity, growing utility, and large community support. The limited supply of 21 million tokens, its use as an inflation hedge, and increasing real-world adoption have driven its value.

Over the short term, Bitcoin and cryptocurrencies have outperformed traditional asset classes like stocks, housing, bonds, and commodities. However, over the long term, the stock market remains the most successful investment vehicle for creating wealth.

Bitcoin is highly volatile and subject to significant price swings. It also faces competition from new coins and blockchain innovations. Additionally, its utility as a medium of exchange is limited, and it may struggle to replace traditional currencies or gold as a store of value.

Investing in Bitcoin carries high risks due to its volatility. It is recommended to invest only what you can afford to lose and to diversify your investments across multiple cryptocurrencies. It is also important to carefully manage your private keys and digital wallets to avoid losing access to your funds.