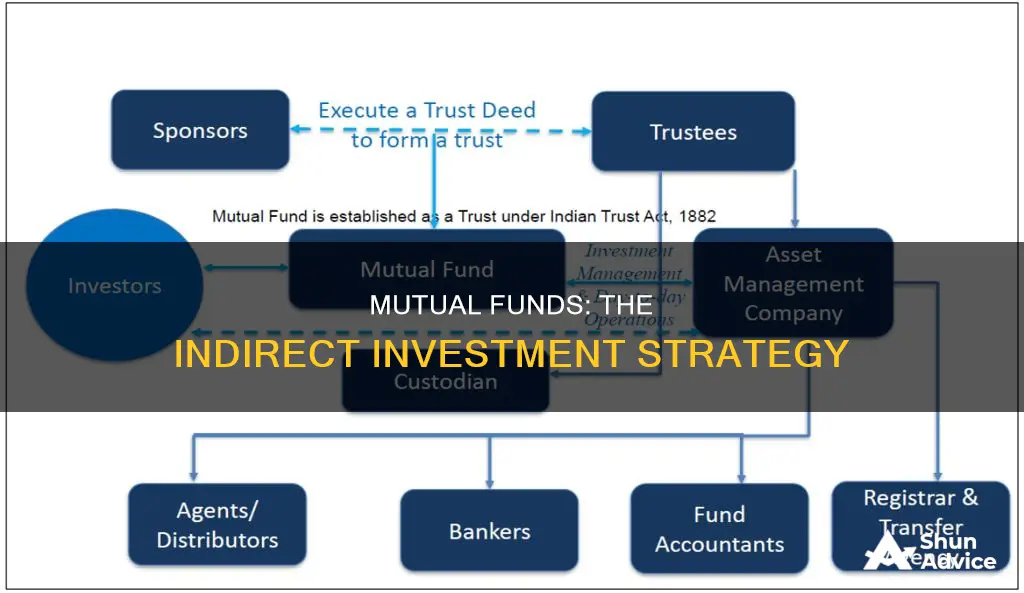

Mutual funds are a type of indirect investment. Indirect investment refers to the process of investing in an asset or security without actually owning it. It involves an investor putting their money into a fund or financial instrument, which then invests in the desired asset. Mutual funds, as indirect investments, allow investors to benefit from the expertise of fund managers who have the knowledge to manage complex portfolios of investments. They also provide investors with diversification, accessibility, and lower costs. However, it's important to consider the fees associated with mutual funds, as they can impact overall returns.

| Characteristics | Values |

|---|---|

| Definition | Indirect investment refers to the process of investing in an asset or security without actually owning it. |

| Process | An investor puts their money into a fund or financial instrument, which then invests in the desired asset or security. |

| Intermediary | An intermediary, such as a mutual fund, ETF, REIT, hedge fund, or private equity fund, facilitates the investment. |

| Ownership | The investor does not directly own the asset but owns a share in the fund that owns the asset. |

| Management | The fund is managed by professionals who make investment decisions on behalf of the investors. |

| Returns | The returns generated by the fund are shared among the investors. |

| Diversification | Indirect investment allows investors to diversify their portfolio and spread risk. |

| Accessibility | Indirect investment is accessible to a wide range of investors due to relatively low investment minimums. |

| Costs | Indirect investment vehicles may have lower costs compared to other investment alternatives. |

| Liquidity | Indirect investments provide flexibility to buy and sell in the market, offering liquidity. |

| Types | Examples include mutual funds, insurance policies, unit investment trusts, and open-end/close-end investment companies. |

What You'll Learn

Open-end investment companies

The price of the shares is based on the underlying assets of the fund, and they can mix different types of investment strategies. They are priced once a day, based on the net asset value of their underlying portfolio assets.

The investors pool their resources into a company, which then invests those funds in a diversified portfolio of stocks, bonds and other securities. The value of the company's shares is determined on a daily basis, and investors are permitted to buy or sell shares at the price currently being offered on the market.

Gold Rush: Largest Investments in the Precious Metal

You may want to see also

Close-end investment companies

Closed-end funds are traded on a stock exchange, and their shares are bought and sold in the same way as stocks. The price of these shares is determined by the equilibrium of supply and demand in the market. As such, closed-end funds are more unpredictable than open-end funds.

Closed-end funds do not repurchase shares from investors, meaning they have more money to invest. They can also make use of leverage—borrowed money—to boost their returns. This means they may be able to offer higher overall returns than open-funds.

However, one of the significant downsides to closed-end funds is that no new shares are issued. So, if you want to invest in a closed-end fund, you would need to find someone willing to sell their shares, or wait until some become available on the market.

Mutual Funds and Treps: A Smart Investment Strategy

You may want to see also

Unit investment trusts

UITs are investment companies that offer a fixed portfolio of stocks and bonds as redeemable units to investors for a specific period. UITs are similar to both open-ended and closed-end mutual funds in that they all consist of collective investments managed by a portfolio manager. However, unlike mutual funds, UITs have a stated expiration date based on the investments held in their portfolio. When the portfolio terminates, investors receive their share of the UIT's net assets. UITs are not actively traded, meaning securities are not bought or sold unless there is a change in the underlying investment, such as a corporate merger or bankruptcy.

UITs are either regulated investment corporations (RIC) or grantor trusts. In a RIC, investors are joint owners, while a grantor trust grants investors proportional ownership in the UIT's underlying securities. Investors can redeem mutual fund shares or UIT units at the net asset value (NAV) to the fund or trust, with the help of an investment advisor. The NAV is calculated as the total value of the portfolio divided by the number of shares or units, and it is calculated each business day.

UITs often have a set maturity date between 12 and 24 months, and securities usually cannot be sold during this time. There are different types of UITs, each with a different investment strategy:

- Strategy Portfolio UITs aim to beat a market benchmark and outperform general investments using fundamental analysis.

- Income Portfolio UITs focus on generating dividend income, often at the expense of capital appreciation.

- Diversification Portfolio UITs aim to diversify assets across a broad range of investments to minimize risks.

- Sector-Specific Portfolio UITs focus on a very specific or niche market, and while they are often higher risk, this may result in higher profits.

- Tax-Focused Portfolio UITs invest in tax-benefit or tax-deferred investments, such as state-exempt or federal-exempt fixed-income securities.

UITs provide investors with access to a diversified portfolio of securities, which can help reduce the risk of losses due to any single security's underperformance. However, some UITs are industry-specific and hold greater risk. UITs are required to disclose their portfolios regularly, providing investors with transparency into their holdings and investment strategies. UITs are generally passive investments, which means they have lower fees and expenses compared to actively managed funds. They are typically structured as pass-through entities, which means they do not pay taxes at the trust level, resulting in greater tax efficiency.

While UITs offer several benefits, there are also some downsides. Investors have little control over the investments made by the trust, and poor performers may be retained. UITs may not provide the same level of diversification as more broadly diversified investments, as they typically invest in a specific market sector or asset class. They are designed to be long-term investments, so they may not be suitable for investors who need quick access to their funds. UITs may also incur upfront fees, and investors may have difficulty buying or selling units. In some cases, UITs may not provide as much information about their investment strategies, performance, fees, or future plans as other types of investments.

Co-Investing: Why Funds Collaborate for Mutual Success

You may want to see also

Insurance policies

Some insurance policies, such as variable universal life and variable annuities, allow the policyholder to invest a portion of their premiums in mutual funds or similar investments. The value of the policy, which increases over time, is influenced by the performance of the underlying investments. These types of insurance policies can be quite expensive and may not be suitable for all investors.

It is important to note that insurance policies, including those offered by mutual insurance companies, are not insured by the Federal Deposit Insurance Corporation (FDIC) as they are not considered financial deposits.

Understanding Trust Funds and Investments: A Beginner's Guide

You may want to see also

Mutual funds

There are several benefits to investing in mutual funds. They offer diversification, or the mixing of investments and assets within a portfolio, to reduce risk. They are highly liquid investments, traded on major stock exchanges, and can be bought and sold with relative ease. They also provide economies of scale, as transaction fees are lower when a large amount of securities are bought and sold at once.

However, there are also drawbacks. Mutual funds require a significant part of their portfolios to be held in cash to satisfy share redemptions each day, which can result in a "cash drag" where this cash earns no return. Fees can also accumulate and compound over time, reducing overall payouts.

There are several types of mutual funds, including stock, money market, bond, and target-date funds. Stock funds invest principally in equity or stocks, with subcategories including small-, mid-, or large-cap companies, and different investment approaches such as aggressive growth, income-oriented, and value. Money market funds consist of safe, risk-free, short-term debt instruments, while bond funds focus on investments that pay a set rate of return, such as government bonds, corporate bonds, and other debt instruments. Target-date funds, meanwhile, are mutual funds that automatically shift their risk profile to a more conservative approach over time.

Nutmeg's Investment Funds: Exploring Their Portfolio Strategy

You may want to see also

Frequently asked questions

Indirect investment refers to investing in an asset or security without directly owning it. This is done by putting money into a fund or financial instrument, which then invests in the desired asset.

Indirect investments offer benefits such as expert management, diversification, accessibility, lower costs, and liquidity.

Mutual funds, exchange-traded funds (ETFs), insurance policies, real estate investment trusts (REITs), and hedge funds are all examples of indirect investments.

You can invest in indirect investments by purchasing shares of a fund or financial instrument, such as a mutual fund or ETF. These can often be bought through a brokerage account or directly from the fund company.

A mutual fund is a type of investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional money managers and provide investors with access to a wide range of assets.