A conservative investment portfolio is designed for those who want to preserve their current funds and prioritise that over maximising returns. It is a strategy that aims to protect an investment portfolio's value by investing in lower-risk securities such as blue-chip stocks, fixed-income securities, the money market, and cash or cash equivalents. Conservative investors have a risk tolerance ranging from low to moderate and are willing to give up potentially high returns for more stable returns. A conservative portfolio is usually designed for the longer term, typically five to ten years, and is composed mainly of big, established companies with steady growth prospects and relatively low risk.

| Characteristics | Values |

|---|---|

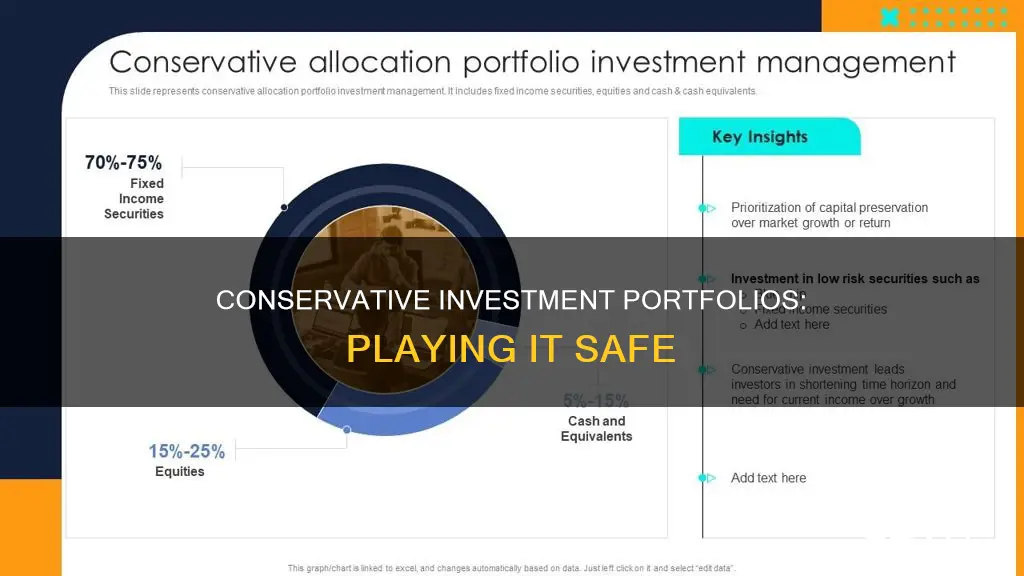

| Investment strategy | Preservation of capital over growth or market returns |

| Risk tolerance | Low to moderate |

| Investment type | Lower-risk securities such as blue-chip stocks, fixed-income securities, the money market, and cash or cash equivalents |

| Percentage of portfolio in lower-risk securities | More than half |

| Typical investor | Older investor with a shorter time horizon, lower risk tolerance, and a need for current income |

| Typical growth expectation | Around 6% per year |

What You'll Learn

Conservative investing strategies

Conservative investment portfolios are generally composed of safer investments, such as cash, cash equivalents, and bonds, rather than stocks, which are considered riskier. This is because companies and industries can fall in and out of favour. If stocks are included in a conservative portfolio, they tend to be large, well-known, and stable companies, known as "blue-chip stocks", which are less prone to wild market swings.

Conservative investors tend to have a larger proportion of their portfolios in low-risk, fixed-income investments, such as Treasuries, high-quality bonds, money markets, and cash equivalents. These investments provide a steady flow of income through interest and dividend payments.

A conservative portfolio may also include a mix of different stock classes, such as growth and value stocks. Value stocks, also known as income stocks, tend to pay better dividends than growth stocks. Conservative portfolios typically contain a higher percentage of value stocks, which can be around 85%.

When constructing a conservative portfolio, it is important to diversify across different sectors and geographies. A guideline for diversification is to include a range of company sizes, such as large-cap, mid-cap, and small-cap companies. Large-cap companies, or blue-chip companies, are typically financially strong, pay regular dividends, and have been through multiple economic cycles. They should make up around 60-70% of a conservative portfolio. Mid-cap companies offer better growth potential along with stability and should account for about 15-20%. Small-cap companies are riskier but can provide significant outperformance if successful, and they usually make up about 10%.

Conservative portfolios also typically include a mix of defensive and cyclical companies. Defensive companies operate in industries that remain in demand during economic downturns, such as utilities, and their share prices tend to be stable. They should comprise 60-70% of a conservative portfolio. Cyclical companies, such as banking stocks, tend to outperform during economic expansions but take a bigger hit during downturns. They usually make up the remaining 30-40%.

Emergency Savings: Where to Invest for Peace of Mind

You may want to see also

Low-risk securities

Conservative investment portfolios typically allocate over half of their funds to low-risk, fixed-income securities and cash or cash equivalents. These might include:

- US Treasury securities: These are backed by the full faith and credit of the US government and are considered the lowest-risk investments available. Options include Treasury bills (with maturities of up to a year), notes (with maturities of two to ten years), and bonds (with maturities of 20 to 30 years). Treasury Inflation-Protected Securities (TIPS) are another option, which are designed to protect investors against inflation.

- Fixed-income securities: These include highly-rated corporate or government bonds that pay a set amount of interest. Money market mutual funds, which invest in short-term debt, are also considered low-risk.

- Certificates of deposit (CDs): CDs are considered safe because they are insured by the FDIC and promise a set rate of interest over a fixed period.

- High-yield savings accounts: These accounts offer a modest return with the benefit of high liquidity. They are also insured by the FDIC.

- Fixed annuities: Sold by insurance and financial services companies, fixed annuities guarantee a fixed rate of return over a set period.

- Investment-grade corporate bonds: These are issued by public companies with a very good credit rating, indicating a low risk of default.

- Preferred stocks: These combine characteristics of stocks and bonds, providing dependable income payments and the potential for shares to appreciate over time.

While low-risk securities are a vital component of a conservative investment portfolio, it's important to remember that they may not offer high returns. Additionally, inflation can erode the value of low-risk investments over time. As such, they are often more suitable for short-term investments or emergency funds.

Choosing the Right Financial Institution for Your Investment Portfolio

You may want to see also

Capital preservation

A capital preservation strategy involves investing in safe, short-term instruments such as Treasury bills (T-bills) and certificates of deposit (CDs). These are low-risk, fixed-income investments that offer stable returns and help protect the principal value of the portfolio. The focus is on preserving the purchasing power of one's capital with the least amount of risk.

Conservative investors typically have a low to moderate risk tolerance and are willing to give up potentially high returns for more stable and secure returns. They understand that they are less likely to experience significant gains but also want to avoid substantial losses. This strategy is often chosen by those with a shorter time horizon, indicating that they intend to access their investments in the near future.

A conservative portfolio is composed of safer investments, such as cash, cash equivalents, and bonds, rather than stocks, which are considered riskier due to their volatility. If stocks are included, they tend to be large, well-known, stable companies, known as "blue-chip stocks," which are less prone to wild market swings. Conservative portfolios also include a relatively high weighting of low-risk securities, such as Treasuries and other high-quality bonds.

It is important to note that while a capital preservation strategy seeks to protect against inflation, it may not generate significant returns over time when compared to more aggressive investment strategies. However, it provides a steady and secure approach to investing, making it suitable for those who want to preserve their capital and prioritise stability over high returns.

Smart Saving and Investing Strategies for Your Kids' Future

You may want to see also

Risk tolerance

Conservative investors typically have a low to moderate risk tolerance. They are willing to sacrifice potentially high returns for more stable and secure investments. Conservative investors seek to preserve their principal, prioritising capital preservation over maximising returns. This strategy is often chosen by older investors nearing retirement, as it helps protect their accumulated wealth and provides a steady income. Conservative portfolios generally have a larger proportion of low-risk securities, such as fixed-income investments, money market securities, and cash or cash equivalents.

The time horizon is another important consideration for investors. It refers to the period of time over which an investment is made or held. Conservative investors often have a shorter time horizon, indicating a need to access their funds in the near future. As a result, they are less willing to take on the higher risk associated with more aggressive investment strategies.

An investor's risk tolerance can also impact their decision to adopt a defensive strategy. In anticipation of a negative turn in the market, investors may temporarily shift to a more conservative approach by moving their assets into safer investments. This strategy prioritises protection against losses over modest growth.

It's important to note that while conservative investing strategies focus on capital preservation, they may not generate significant returns compared to more aggressive approaches. Therefore, investors should carefully consider their risk tolerance and financial goals when determining their investment strategy.

Investment-led Savings: The Economy's Driving Force

You may want to see also

Long-term growth

A conservative investment portfolio is designed for long-term growth, typically over five to ten years. This strategy prioritises the preservation of capital and current income over aggressive market returns. While it may not yield significant returns compared to more aggressive strategies, it offers a steady and relatively safe approach to investing.

Conservative investors generally have a low to moderate risk tolerance and seek to protect their principal value. This type of portfolio is suitable for those with a shorter time horizon, such as older individuals nearing retirement, who want to keep their capital intact. It is also recommended for parents adjusting their investments in a college education account as their child enters high school.

A conservative portfolio is composed primarily of lower-risk securities, including fixed-income investments, money market securities, and cash or cash equivalents. It focuses on large, well-known, stable companies, often referred to as "blue chip stocks," which are less prone to wild market swings. Additionally, conservative portfolios may include a mix of large-cap, mid-cap, and small-cap companies, with a greater emphasis on established entities.

To achieve long-term growth, a conservative portfolio should be properly diversified. Investment professionals recommend including at least 15 different stocks from various sectors and geographies to minimise the impact of single-stock or sector-specific fluctuations. A reasonable growth expectation for a well-diversified conservative portfolio is around 6% per year, although actual returns may vary annually within its lifespan.

When building a conservative portfolio, it is essential to conduct thorough research and make regular contributions. By investing smaller amounts consistently, investors can smooth out the average price of the shares they purchase. This approach helps mitigate the risk of buying a large quantity of shares at a high price and potentially impacting the overall value of the portfolio.

Savings and Investments: Equation for Financial Success

You may want to see also

Frequently asked questions

A conservative investment portfolio is designed for long-term, low-risk investments. It is ideal for those who want to preserve their current funds and prioritise that over maximising returns.

A conservative investment portfolio is made up of a large percentage of lower-risk securities such as fixed-income and money market securities. It also includes blue-chip stocks, which are stocks of large, well-known, and stable companies.

A conservative investment portfolio is suitable for those with a low to moderate risk tolerance. It is also ideal for older investors who want to preserve their capital as they near retirement.

A conservative investment portfolio can protect against inflation and provide steady returns. It also ensures that there are no huge losses, which is important for those who need to withdraw funds within a short period.

Conservative investment portfolios generally have lower returns compared to more aggressive strategies. They may not earn significant returns over time due to the focus on preserving capital.