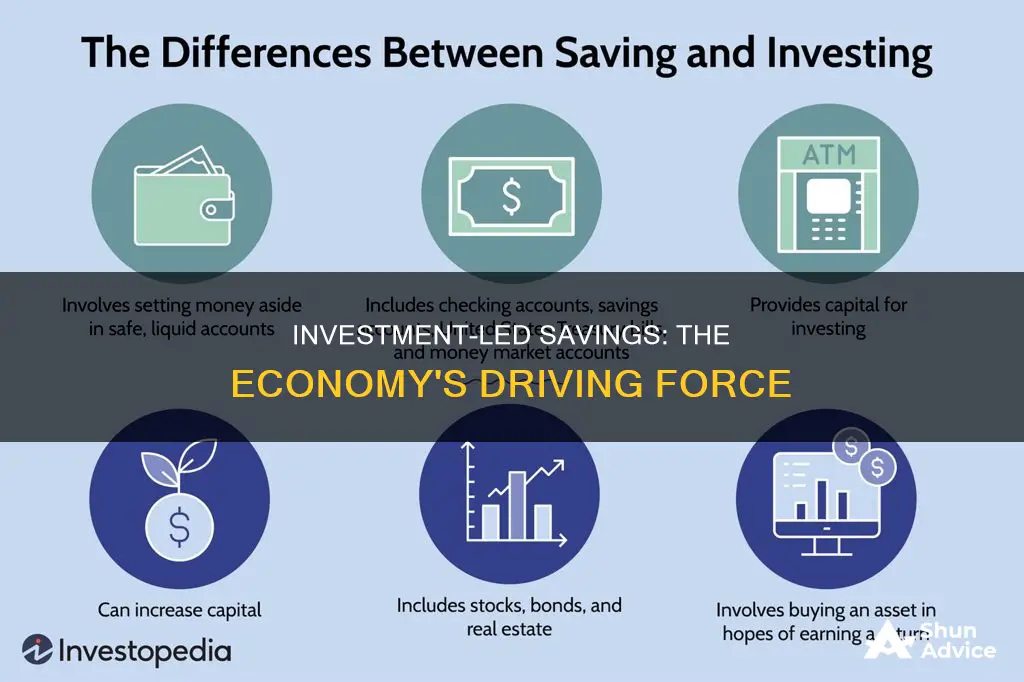

Saving and investing are both important for achieving financial security, but they serve different purposes. Saving is setting aside money for future use, often for short-term goals or emergencies, and is typically associated with low risk and low returns. On the other hand, investing involves using money to buy assets, such as stocks, bonds, or real estate, with the expectation of higher returns over the long term. While investing offers the potential for higher returns, it also comes with the risk of losing money. Therefore, it is crucial to understand the differences between saving and investing to make informed financial decisions.

| Characteristics | Values |

|---|---|

| Definition | Saving is setting aside money for emergencies or future purchases with quick access and low risk. |

| Investing is buying assets with the expectation that they will make money. | |

| Risk | Saving has minimal risk. |

| Investing has a higher risk of loss. | |

| Returns | Saving has lower returns. |

| Investing has the potential for higher returns. | |

| Timeframe | Saving is for short-term goals. |

| Investing is for long-term goals. | |

| Liquidity | Savings are highly liquid and can be used immediately. |

| Investments must be sold before the funds can be used. | |

| Inflation | Savings can have negative, inflation-adjusted returns. |

| Investing can offer attractive, inflation-adjusted returns. |

What You'll Learn

- Savings and investment are equal in a closed economy

- Savings are influenced by interest rates and confidence

- Investment is influenced by interest rates, confidence and economic growth

- Savings and investment are not always equal in a Monetarist sense

- Savings and investment are linked to current account deficits and surpluses

Savings and investment are equal in a closed economy

In economics, the terms savings and investment are often used interchangeably, but they are technically distinct concepts. Savings refers to the money left over after an individual's spending and other expenses have been accounted for. It is typically stored in a low-risk, low-return account or kept as cash. On the other hand, investment involves using money to purchase assets that are expected to generate wealth over time, such as stocks, bonds, or real estate.

In a closed economy, the equation for GDP using the expenditure approach is given as:

> Y = C + I + G

Where Y is the total output, C is consumption, I is investment, and G is government spending.

In a closed economy, the net exports (NX) are assumed to be zero since there is no trade with other countries. Therefore, the GDP equation simplifies to:

> Y = C + I + G

Furthermore, in a closed economy, savings (S) are defined as the portion of output that is not consumed in the current period. This can be expressed as:

> S = Y - C - G

Since investment (I) also represents the portion of output that is not consumed in the current period, it can be substituted into the equation for savings, resulting in:

> S = Y - C - G = I

Thus, in a closed economy, savings and investment are equal because they both represent the amount of output that is not consumed in the current period. This relationship is true in both nominal and real terms.

It is important to distinguish between real savings and financial savings. Real savings refer to physical goods produced in the current period and set aside for future use. Financial savings, on the other hand, are claims on future goods, such as lending money to someone else. In the context of the equation S = I, we are referring to aggregate real savings, not financial savings.

Investment Options for College Savings: What Are Your Choices?

You may want to see also

Savings are influenced by interest rates and confidence

Savings accounts are very safe but tend to offer very low rates of return as a result. Savings accounts are also highly liquid and available for immediate use. For example, using a debit card to make a purchase. Savings accounts are generally low-risk, meaning your money is safe, but the interest rates received are also low.

Interest rates on savings accounts tend to be low but are often higher than those on checking accounts. The best savings accounts can usually be found online because they pay a higher interest rate. Online-only accounts may be examples of high-yield savings accounts, which can offer interest on deposits that are much higher than the national average.

Savings accounts are also a good option if you need to access your money in the near future and can't afford to lose any of it. They are also a good option for those with minimal cash savings. Having cash on hand allows you to pay for unexpected expenses without incurring debt.

However, savings accounts provide negative returns after inflation. Cash's spending power declines over time due to rising prices, also known as inflation. A normal inflation rate is 2% to 3% annually. At those rates, $100 cash on Jan. 1 will buy only $97 to $98 worth of stuff by year's end.

Savings accounts are also not the best option for those looking for higher returns. You may need to take your savings and invest them in securities such as stocks, bonds, or mutual funds. It's important to have savings, but it's also important to combine them with other forms of investing to achieve a balanced approach to financial planning.

SSS Workers Investment and Savings: A Guide to the Program

You may want to see also

Investment is influenced by interest rates, confidence and economic growth

Investment is influenced by a variety of factors, including interest rates, confidence, and economic growth. Here are some ways in which these factors influence investment:

Interest Rates

Higher interest rates tend to discourage investment as they increase the cost of borrowing from banks. This is because higher rates require investment to have a higher rate of return to be profitable. For example, if the interest rate is 7%, an investment project would need to yield an expected rate of return of more than 7% to be worthwhile. Thus, higher interest rates make it more expensive for companies to raise capital, potentially hurting their future growth prospects and near-term earnings.

Confidence

Confidence, or 'animal spirits' as termed by J M Keynes, is a key factor influencing investment decisions. Firms will only invest if they are confident about future costs, demand, and economic prospects. Confidence is often driven by economic growth and changes in the rate of economic growth. Additionally, confidence can be affected by the general economic and political climate, with uncertainty leading to reduced investment.

Economic Growth

The accelerator theory states that investment is influenced by the rate of change in economic growth. In other words, a faster rate of economic growth will lead to increased investment spending. Signs of economic recovery and improved economic prospects will generally lead to stronger growth in investment.

Young Adults: Best Places to Invest Your Savings

You may want to see also

Savings and investment are not always equal in a Monetarist sense

The Monetarist view of savings and investment is considered to apply to money and banking. It focuses on the technical distinctions of how savings are transformed from money balances into capital. In this view, savings do not always equal investment but differ slightly at all times, constituting a behavioural relationship.

Monetarists emphasise the value of savings vehicles in selecting which capital to invest in. They define savings as the total rate at which units of account exceed expenditures, which are then accumulated as unit balances with financial intermediaries. Investment, on the other hand, is defined as the rate at which financial intermediaries and others expend on items intended to end up as capital that directly creates value.

In a Monetarist sense, savings and investment are not always equal because they refer to different things. Savings refer to the money left over after spending and other obligations are deducted from earnings, while investment involves using cash to buy assets that should produce wealth through appreciation or income.

The distinction between savings and investment is important because it affects how individuals and households manage their finances. Savings are typically kept in low-risk accounts that offer safe but minimal returns, while investments involve taking on some risk with the potential for higher returns. Therefore, it is essential to understand the differences between savings and investment to make informed financial decisions.

Condo Conundrum: Save or Invest?

You may want to see also

Savings and investment are linked to current account deficits and surpluses

A current account deficit can spur faster output growth and economic development, although research suggests that developing economies with current account deficits do not grow faster, possibly due to their less developed domestic financial systems. In practice, private capital often flows from developing to advanced economies. Advanced economies, such as the United States, tend to run current account deficits, while developing and emerging market economies often run surpluses or near surpluses.

The savings-investment balance approach highlights that protectionist policies are unlikely to improve the current account balance as there is no clear link between protectionism and savings or investment. The current account can also be viewed in terms of the timing of trade, including intertemporal trade, where a country imports goods today and exports goods in the future.

Intertemporal theories of the current account emphasise the role of current account deficits and surpluses in consumption smoothing. For instance, a country facing a temporary shock can spread the impact over time by running a current account deficit. Conversely, countries prone to large shocks should maintain current account surpluses as a form of precautionary saving.

While current account deficits can indicate a country's liabilities to the world, which eventually need to be repaid, the sustainability of these deficits depends on the country's ability to secure financing. Some countries have maintained persistent current account deficits without major issues, while others have experienced sharp reversals due to the withdrawal of private financing. Empirical research suggests that factors such as an overvalued real exchange rate, inadequate foreign exchange reserves, and high interest rates in industrial countries can contribute to these reversals.

Therefore, while savings and investment are linked to current account deficits and surpluses, the implications can vary depending on the specific economic context and underlying factors driving these imbalances.

Investing While Saving for a Home: Wise or Risky?

You may want to see also

Frequently asked questions

Saving is setting aside money for emergencies or future purchases, which can be quickly accessed and is not subject to risk or taxes. Investing, on the other hand, involves buying assets such as stocks, bonds, or real estate, with the expectation of making money, and is usually done to achieve long-term goals.

Saving is important because it provides a financial safety net in case of emergencies and helps individuals achieve their short-term financial goals. It also ensures that they have funds available for future use and protects them from falling into debt or bankruptcy.

The pros of saving include having a financial cushion, achieving short-term financial goals, and minimal risk of loss. However, a con of saving is that it may result in missing out on potential higher returns from riskier investments, and savings can also lose purchasing power during periods of high inflation.

The pros of investing include the potential for higher returns, the ability to grow wealth over time, and achieving long-term financial goals. On the other hand, investing comes with the risk of losing money, may require a longer time horizon, and there is no guarantee of making a profit.

It is recommended to prioritize saving if you don't have an emergency fund or if you need the money within the next few years. Investing is a better option if you have a sufficient emergency fund, can afford to take on some risk, and are saving for long-term goals such as retirement.