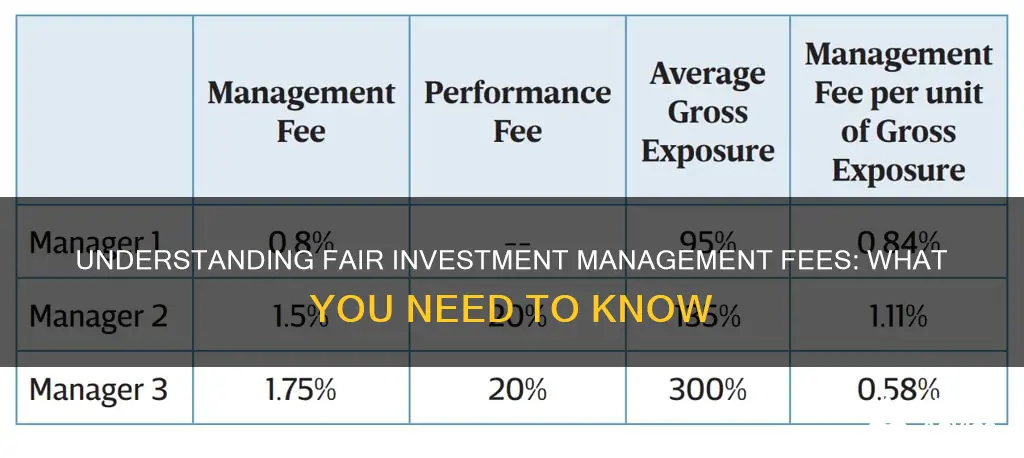

Management fees are a standard feature of investment opportunities, covering the cost of having an investment fund professionally managed. These fees are paid to professionals who are entrusted with managing investments on a client's behalf, and they can vary significantly. The fees are usually calculated as a percentage of the total assets under management (AUM) and can range from 0.10% to over 2%. This variation depends on factors such as the management style, investment size, and whether the fund is actively or passively managed. Actively managed funds tend to have higher fees but do not always yield better returns. It is important for investors to understand the fee structure and what services are included to ensure they are getting value for their money.

| Characteristics | Values |

|---|---|

| Range of management fees | 0.10% to more than 2% of AUM |

| Typical management fees | 0.20% to 2.00% of AUM |

| Management fee for passive investment firms | Lower than active investment firms |

| Management fee for institutional investors or high-net-worth individuals | Lower than other investors |

| Flat management fee | Single rate regardless of asset or investment selection |

| Management fee assessed by asset class on investment balance | Clients pay low to no fees on cash reserves |

| Tiered management fees | Charged based on the value of assets in accounts |

| Annual management fee | Charged as a percentage of assets and paid yearly |

| Wrap fees | Charged for services like investment management, financial planning, and custody |

| Range of wrap fees | 1% to 3% of assets |

| Robo-advisors management fee | A fraction of a percentage point per year on the total value of the account |

| Flat fee for robo-advisors | Charged as a flat monthly dollar figure |

| Traditional advisors' fee | 1% of the assets they manage |

What You'll Learn

Management fees are the norm

The fee structure is usually based on a percentage of assets under management (AUM). Fees tend to range from 0.10% to more than 2% of AUM. The more actively managed a fund is, the higher the management fees. Actively-managed funds do not necessarily yield better returns than those that are more passively managed.

The management fee covers expenses involved with portfolio management, including fund operations and administrative costs. It also covers advisory services, investor relations expenses, and the cost of selecting stocks and managing the portfolio.

Investment firms that are more passive with their investments generally charge lower fees than those that actively manage their investments. Additionally, institutional investors or high-net-worth individuals with large sums of money to invest are sometimes eligible for lower management fees.

It is important to understand the fee structure and what services the fee entails before agreeing to work with an investment manager or advisor. It is also crucial to research other investment management fees to understand what is considered fair in the market.

Vanguard Value Index Portfolio: What's Inside?

You may want to see also

Fee structures

Management fees are the norm in the investment management industry. They are typically determined as a percentage of the total assets under management (AUM) and can cover expenses such as portfolio management, advisory services, and administrative costs. The fee structure can vary from fund to fund, but it is usually based on a percentage of the AUM.

The fees can range from 0.10% to more than 2% of the AUM. The disparity in fees is generally due to the investment method used by the fund manager. Actively managed funds tend to have higher management fees than passively managed funds, but they don't necessarily perform better.

There are different types of investment management fee structures, including flat management fees, management fees assessed by asset class on investment balance, and tiered management fees. Flat management fees are a common fee schedule where the advisor charges a single rate regardless of the client's asset or investment selection. This rate may be lowered as the client's portfolio increases. Management fees assessed by asset class means that clients are charged based on the assets within their account, and they may pay low or no fees on cash reserves. Tiered management fees are a hybrid of flat and asset-based fees, where clients are charged based on the value of their assets but all pay the same rate at the deposit level.

Annual management fees are another type of fee structure, typically charged as a percentage of assets and paid yearly. This is common for retirement accounts. Wrap fees are also charged as a percentage of assets and can be paid monthly, quarterly, or annually. They are all-inclusive fees that cover services like investment management, financial planning, and custody. Investment managers typically charge wrap fees of 1-3% for the assets they manage.

When selecting an investment manager, it is important to understand the fee structure and what services are included. It is also crucial to ensure that the fees are fair and transparent.

Age-Based Investment Strategies: Building a Strong Portfolio Mix

You may want to see also

Flat fees vs. asset-based fees

When it comes to investment management fees, there are typically two main fee structures: flat fees and asset-based fees. Flat fees, also known as fixed fees, are independent of the value of a transaction or portfolio and are charged as a single rate, regardless of the size of the client's investment account. This means that the client pays one predetermined rate for a set list of services, which can include investment advice, financial planning services, and investment management. While flat-fee structures are simple and straightforward, they can be costly for those who are still building their wealth.

On the other hand, asset-based fees, also known as Assets Under Management (AUM) fees, are calculated as a percentage of the client's investment portfolio. The average AUM fee typically ranges from 0.5% to 2% per year but can vary depending on the financial advisor and the services offered. This fee structure is flexible as it scales up and down with the client's wealth, making it a cost-effective option. Asset-based fees are commonly used by firms that provide ongoing services such as tax planning, investment advice, and retirement planning, which have a long-term impact on the client's wealth.

The choice between flat fees and asset-based fees depends on various factors, including the client's wealth, the services offered, and the nature of the client-advisor relationship. Flat fees are often preferred by clients who want a simple and transparent fee structure, while asset-based fees can provide flexibility and adaptability to changes in the client's wealth. However, it is important to note that the fee structure alone does not determine the quality or collaboration of the service provided.

In some cases, a hybrid model that combines flat and asset-based fees may be adopted to align with the specific needs and preferences of the client. This hybrid approach can help minimise conflicts of interest and provide a more tailored solution. Ultimately, it is essential for clients to understand the fee structure, the services included, and the potential benefits and drawbacks of each option before making an informed decision.

To ensure a fair investment management fee, it is crucial to comprehend the fee structure, the services provided, and the value offered by the advisor. It is also recommended to research other investment management fees to understand market rates and to ask questions to ensure comfort and clarity.

Savings Investment Strategies: Where to Invest Your Money Wisely

You may want to see also

Self-directed investing

Management fees are the norm in the investment management industry. They are charged by investment managers for overseeing an investment fund. The fee compensates managers for their time and expertise in selecting stocks and managing the portfolio. Management fees can differ from manager to manager and financial firm to financial firm, but they are often a percentage of the total assets under management (AUM). Typically, fees range from 0.10% to more than 2% of AUM.

Now, if you want to avoid management fees altogether, you can consider self-directed investing. Self-directed investing gives you full control over how you invest your money. You have the freedom to buy a wide range of securities, including individual stocks, bonds, funds, and derivatives, or allocate your money as you see fit.

With self-directed investing, you open a brokerage account and choose what you would like to invest in, as well as when you would like to buy, sell, or trade investments in your portfolio. You can trade stocks, mutual funds, exchange-traded funds (ETFs), and options directly online.

Before opening a self-directed brokerage account, it is essential to determine how much you want to invest, explore the types of investments you would like to include in your portfolio, weigh the benefits and risks of those investments, and feel comfortable managing your own account.

Finding Careers in Investment Management: Strategies for Success

You may want to see also

Advisory fees

The specific fee structure can vary, with flat fees, tiered fees, and annual fees being common options. Flat fees are a single rate regardless of asset value, while tiered fees are a hybrid of flat and asset-based fees, with the rate changing at certain deposit levels. Annual fees are typically charged as a percentage of assets and paid yearly.

When considering advisory fees, it's important to understand the fee structure, the services provided, and whether the fees are competitive. Advisory fees can significantly impact investment returns, so investors should ensure they are getting value for their money.

In summary, advisory fees are an essential aspect of the investment management industry, providing clients with access to professional expertise and services. However, investors should carefully consider the fees and their potential impact on investment returns over time.

Investing in a Portfolio: Pros and Cons

You may want to see also

Frequently asked questions

A management fee is a charge levied by an investment manager for overseeing an investment fund. It compensates managers for their time and expertise in selecting stocks and managing the portfolio.

Management fees cover expenses involved with portfolio management, including fund operations and administrative costs. They can also include investor relations (IR) expenses.

Management fees are usually based on a percentage of assets under management (AUM). They can range from 0.10% to more than 2% of AUM, depending on factors like management style and investment size.

Yes, there are different types of management fees, including flat management fees, fees assessed by asset class on investment balance, and tiered management fees.

To determine if a management fee is fair, it's important to understand the fee structure and what services are included. Researching other investment management fees and asking questions can also help assess the fairness of the fee.