A liquid investment portfolio is a collection of investments that can be easily converted into cash while retaining their market value. Liquid investments are important because they allow individuals to quickly access funds in case of financial emergencies. Examples of liquid investments include cash, money market assets, marketable securities, stocks, bonds, mutual funds, and treasury bills. It's important to note that the liquidity of an investment depends on factors such as the established nature of the market, the ease of ownership transfer, and the time it takes to sell the assets.

| Characteristics | Values | |

|---|---|---|

| Definition | A liquid investment portfolio is a collection of investments that can be easily and quickly converted into cash while retaining their market value. | |

| Importance | Liquid investment portfolios are important in cases of financial emergency. They also contribute to an individual's or business's overall net worth. | |

| Examples | Cash, stocks, bonds, mutual funds, money market funds, treasury bills, certificates of deposit, retirement accounts, mobile payment accounts, and certain types of investments. | |

| Factors Affecting Liquidity | How established the market is, how easily ownership can be transferred, and how long it takes for the assets to be sold (liquidated). |

What You'll Learn

What are liquid assets?

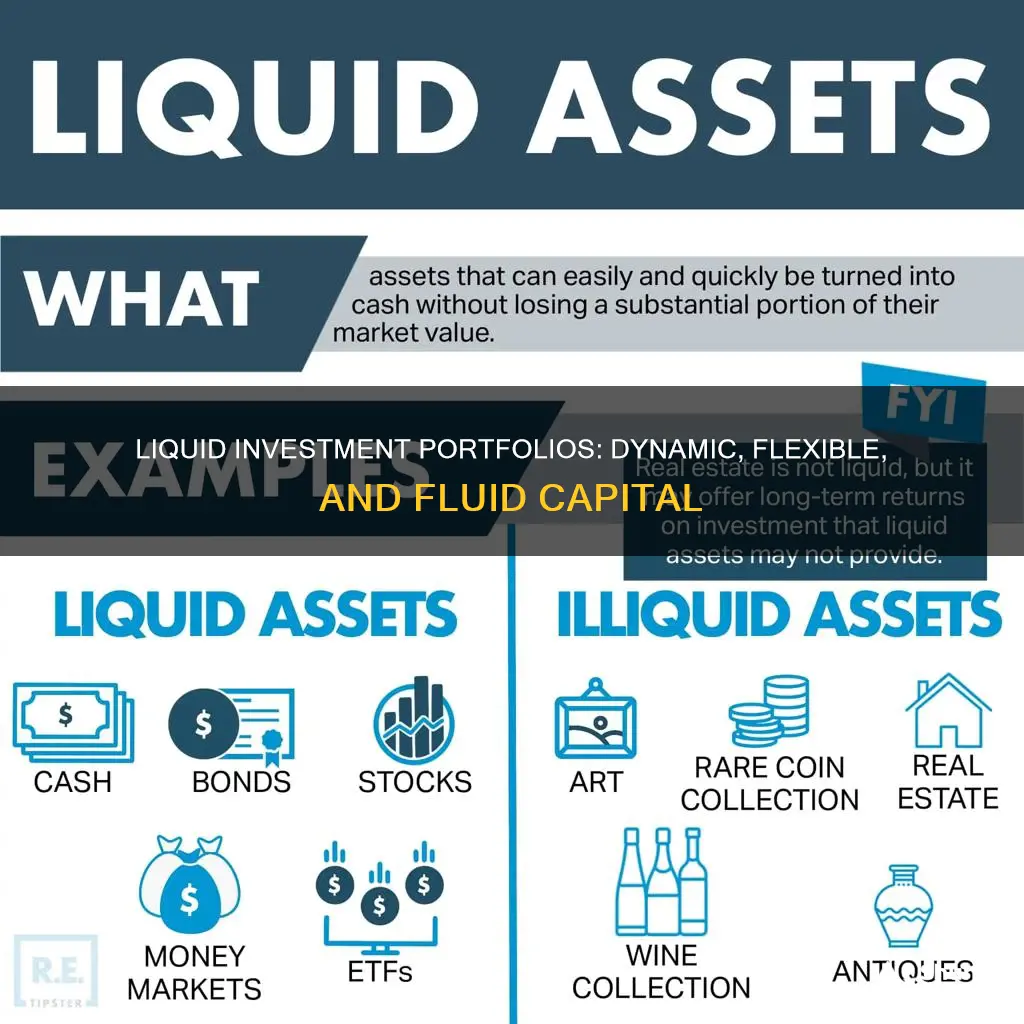

A liquid asset is an asset that can be readily converted into cash while retaining its market value. Liquid assets are a safeguard in the event of financial hardship and can contribute to your overall net worth.

Liquid assets include cash and other assets that can be turned into cash quickly without losing value. They are important as they allow you to pay for basic living expenses and handle emergencies. However, holding liquid assets can come at a cost. More liquid assets tend to increase in value more slowly over time.

- Cash

- Treasury bills and treasury bonds

- Certificates of deposit

- Stocks

- Exchange-traded funds (ETFs)

- Mutual funds

- Money market funds

- Precious metals

- Checking accounts

- Savings accounts

- Money market accounts

- Taxable investment accounts

- Tax-advantaged accounts

- Trusts

It's important to note that liquidity is a spectrum, and some assets are more liquid than others. At the far end of the spectrum are illiquid assets, such as real estate, art, and jewellery, which are difficult to sell and convert into cash.

Saving vs. Investing: Ramsey's Key Differences Explained

You may want to see also

What are the benefits of liquid assets?

A liquid investment portfolio is one that contains liquid assets, which are assets that can be readily converted to cash. They can be sold quickly and easily, with little impact on their value.

Fast access to cash

Liquid assets provide fast access to cash when needed. This is useful for both individuals and businesses. For example, an individual can use liquid assets to pay a sudden medical bill or take advantage of a vacation deal, while a business can use them to invest in growth opportunities, replace equipment, or hire new employees without taking out loans or seeking investors.

Favourable view of your portfolio

Having liquid assets in your portfolio can make it easier to get funding or loans. This is because liquidity demonstrates your ability to manage and safeguard assets, giving lenders and investors confidence in your ability to repay them.

Flexible investment ability

Liquid assets offer the flexibility to make investment changes. You can easily use some of your liquid assets to fund another type of purchase, such as selling one type of stock to buy another or using cash to buy non-liquid assets, like property or equipment.

Potentially reduced risk

Liquid assets tend to have lower risks than non-liquid assets. Having at least some liquid assets in your portfolio ensures access to a certain amount of cash value, even if markets change and non-liquid assets lose value.

While liquid assets provide these benefits, it is important to maintain a balance of liquid and non-liquid assets to create a diverse and stable financial portfolio.

529 Savings Plans: Smart Investment Strategies, per Forbes

You may want to see also

What are some examples of liquid assets?

A liquid investment portfolio is a collection of investments that can be easily converted into cash while retaining their market value.

- Cash: This includes physical cash, such as the bills in your wallet, as well as money in your bank accounts, including checking and savings accounts. It also includes cash from foreign countries, though some foreign currencies may be harder to convert.

- Mobile Payment Accounts: Money in mobile payment services like Venmo or PayPal is considered a liquid asset.

- Money Market Accounts: These are a type of savings account at a bank or credit union that typically offers higher interest rates than traditional savings accounts.

- Treasury Bills and Bonds: Treasury bills and bonds are considered highly stable and liquid investments, backed by the US government. They can be sold on the secondary market if you need cash before they mature.

- Certificates of Deposit (CDs): While CDs usually have steep early withdrawal fees, they can still be liquid assets, especially if they are specialty accounts with low or no early withdrawal penalties.

- Stocks: The stock market is a liquid market with a constant number of buyers and sellers, making stocks liquid assets.

- Mutual Funds: Mutual funds pool money from multiple investors to purchase stocks and other securities, providing diversification and relative liquidity.

- Exchange-Traded Funds (ETFs): ETFs are investment funds that trade like stocks on public exchanges, making them fairly easy to sell quickly.

- Precious Metals: In some states, certain gold and silver coins are considered legal tender, making them as liquid as cash. Physical precious metals can also be exchanged for cash through dealers.

- Accounts Receivable: While debated, many business owners consider money owed by clients as liquid assets.

- Retirement Accounts: Retirement accounts like 401(k)s and IRAs are considered liquid assets once the owner reaches retirement age.

Saving and Investing: Building Wealth and Security

You may want to see also

How does liquidity affect profitability?

Liquidity is one of the most important metrics of any asset, and it refers to an asset's ability to be converted into cash quickly and easily. The more liquid an asset, the more easily it can be sold and the faster you can access the cash.

In general, the more liquid an asset, the less its value will increase over time. For example, cash is the most liquid asset, but it may be affected by inflation, which decreases its purchasing power. Less liquid assets, such as real estate, art, and jewellery, may increase in value over time. However, they are harder to sell and may take longer to convert to cash.

When it comes to profitability, highly liquid assets are typically either less profitable than illiquid assets, or they come with greater risk. This is because very liquid assets that are also highly profitable and almost risk-free do not exist. Therefore, investors need to balance their portfolios by combining highly liquid investments with less liquid but more lucrative ones. This way, they can benefit from potential high returns while still having a portion of their money that is easily accessible.

Additionally, having liquid assets is crucial in cases of financial emergencies. These assets can be quickly converted to cash to cover essential expenses and bills. Most financial advisors recommend having an emergency fund that covers expenses for at least three to six months.

In summary, while liquidity does not directly affect profitability, it is an important factor for investors to consider when building their investment portfolios. By having a mix of liquid and illiquid assets, investors can balance profitability and risk while ensuring they have access to cash when needed.

Condo Conundrum: Save or Invest?

You may want to see also

Why is liquidity important?

Liquidity is important in investment portfolios because it allows investors to quickly convert their assets into cash in the event of financial emergencies. It is a crucial metric for any asset, alongside profitability and risk. While profitability and risk are important, investors also need to be able to access their money when they need to.

Liquid assets are important for several reasons. Firstly, they allow individuals to pay for basic living expenses and handle unexpected costs. For example, in the case of a medical emergency, liquid assets can be used to pay for treatment without having to sell non-liquid assets, such as property, which can take a long time.

Secondly, liquid assets are important for businesses to weather financial challenges, secure credit, and settle liabilities with short notice. A company that generates a lot of revenue but cannot convert it into liquid cash will struggle.

Thirdly, liquidity is important for businesses when they are seeking loans or credit. Lenders will assess the liquidity of a business's assets when considering a loan application. A business with more liquid assets will be more likely to get better loan terms and interest rates.

Finally, liquidity is important for individuals when applying for a mortgage. Lenders will assess the liquidity of an individual's assets to determine if they have enough easily accessible money to cover mortgage payments in the event of financial hardship.

It is worth noting that while liquidity is important, it is not the only metric that investors should consider. Highly liquid assets are typically either less profitable or more risky than illiquid assets. Therefore, a combination of liquid and illiquid assets in a portfolio can provide great returns while keeping some money easily accessible.

Trade Deficit: Investment, Savings and the Economy

You may want to see also

Frequently asked questions

A liquid investment portfolio is a collection of investments that can be easily converted into cash while retaining their market value. This means that the investments can be sold or exchanged for cash quickly, without losing value.

Examples of liquid investments include cash, stocks, bonds, mutual funds, exchange-traded funds (ETFs), money market funds, and certain types of investment accounts such as savings or checking accounts.

Liquidity refers to an asset's ability to be converted into cash quickly and easily. While liquidity is important, it does not necessarily affect profitability. Highly liquid assets are typically either less profitable or more risky than illiquid assets. Therefore, investors consider a combination of liquidity, profitability, and risk when evaluating investment opportunities.

Liquidity is important in investments because it allows individuals or businesses to access cash quickly in case of financial emergencies or unexpected expenses. It also helps to weather financial challenges, secure credit, and settle liabilities with short notice.

Liquid assets can be converted into cash within a short period, usually within one year or less. Illiquid assets, on the other hand, take a longer time to convert into cash and may involve significant conversion costs or loss of value. Examples of illiquid assets include real estate, vehicles, collectibles, and private equity.