A registered investment advisor (RIA) is a financial professional or firm that advises clients on securities investments and may manage their investment portfolios. RIAs are registered with either the Securities and Exchange Commission (SEC) or state securities administrators. They have a fiduciary duty to act in the best interests of their clients.

A hedge fund, on the other hand, is a limited partnership of private investors whose money is pooled and managed by professional fund managers. These managers employ complex trading and risk management techniques, including leverage and the use of non-traditional assets, to achieve above-average investment returns. Hedge funds are considered alternative investments and are not subject to the same strict regulations as mutual funds. They typically cater to wealthy investors and institutional investors such as pension funds and insurance companies.

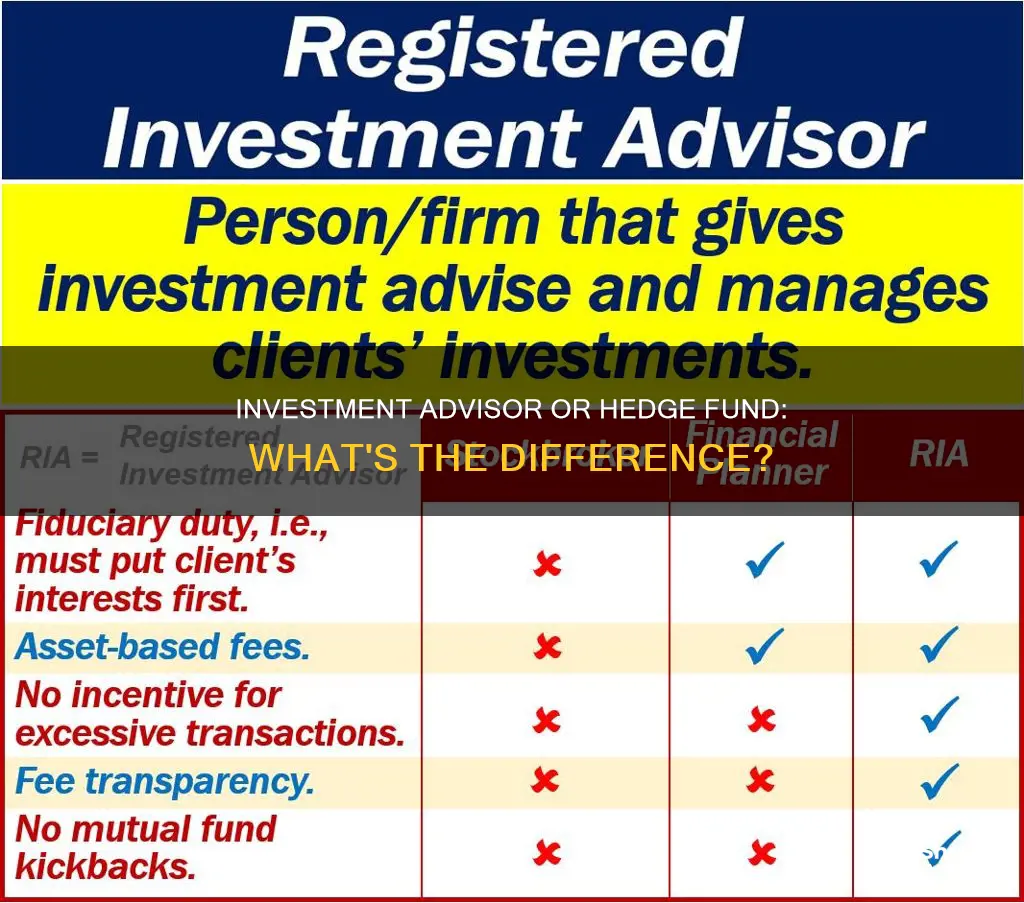

While RIAs provide financial advice and may manage client portfolios, hedge funds are investment vehicles that pool investor funds and aim to generate high returns. RIAs have a fiduciary duty to their clients, while hedge funds are known for taking on higher risks to maximize returns.

What You'll Learn

Hedge funds: registration and regulation

Hedge funds are often described as unregistered or lightly regulated investment pools. While this characterisation is true to an extent, there are certain regulations that hedge fund managers must follow, including the Investment Advisers Act of 1940 and the securities laws of the manager's state of residence. These regulations may require a hedge fund manager to be registered as an investment advisor.

In general, an investment advisor is any person or company that receives remuneration for providing investment advice to a client. This includes all hedge fund managers. However, not all hedge fund managers will need to be registered. An investment advisor will need to be registered with the U.S. Securities and Exchange Commission (SEC) or with the state securities division if the advisor does not fall within an exemption from the registration provisions. Exemptions may exist at the federal level, the state level, or both.

All investment advisors are fiduciaries and must act in the best interest of their clients. Advisors must adhere to the anti-fraud provision of the Investment Adviser's Act of 1940, whether or not they are registered.

Hedge funds with regulatory assets under management in excess of $100 million are required to register with the SEC. Advisors who have regulatory capital under management of less than $150 million and qualify for the private fund advisor exemption do not have to register with the SEC. If the entirety of assets managed are from private accredited investors, then the limit is raised to $150 million.

The 2010 Dodd-Frank Act and its implementation in the Investment Advisers Act of 1940 changed the registration requirements for hedge fund advisors. The Act raised the lower limit for hedge fund advisors to register with the SEC from $25 million to $100 million. Dodd-Frank legislation also defined a new category of advisors called mid-sized advisors, who have regulatory assets under management between $25 million and $100 million. An advisor of a mid-sized hedge fund does not have to register with the SEC but should be registered with the state where their principal office is located. If an advisor of a mid-sized hedge fund does not have adequate state regulation, then that advisor is required to register with the SEC.

The registration process began its implementation in 2012, the same year the SEC created a special unit to oversee the industry. Under the new legislation, hedge funds are also required to report information covering their size, services offered, investors, and employees, as well as potential conflicts of interest to their clients in appropriately communicated disclosures.

A hedge fund advisor may avoid registration with the SEC if they qualify for the private fund advisor exemption legislated in the Dodd-Frank Act and communicated in Section 203(m)(1) of the Investment Advisers Act of 1940. This exemption is applicable to an advisor of a hedge fund who has principal offices located in the United States, has regulatory assets under management below $150 million, and only has private fund clients. If a hedge fund advisor has at least one non-private fund client, they are not eligible for the private fund advisor exemption. All assets count towards the $150 million threshold, including assets managed outside of the United States.

Mutual Fund Investment: Strategies for Success

You may want to see also

Registered investment advisors: who they are and what they do

A registered investment advisor (RIA) is a financial professional or firm that advises clients on securities investments and may manage their investment portfolios. RIAs are registered with either the Securities and Exchange Commission (SEC) or state securities administrators. They have a fiduciary duty to their clients, meaning they are legally obligated to act in their clients' best interests and avoid any conflicts of interest. RIAs typically earn their income through management fees, calculated as a percentage of a client's assets under their management.

Registered investment advisors are financial firms that manage the assets of high-net-worth individuals and institutional investors. They can create portfolios with individual stocks, bonds, and mutual funds, using a mix of funds and individual issues or only funds to streamline asset allocation and reduce commission costs.

The rules governing investment advisors are outlined in the Investment Advisers Act of 1940. This law requires individuals or businesses offering professional investment advice to register with the SEC, though there are exemptions for smaller firms. Advisors with $25 million or more in assets under management (AUM) can register with the SEC, and those with over $100 million AUM are required to do so.

RIAs must follow certain practices and procedures when providing advice to their clients. They are required to disclose any risks or potential conflicts of interest regarding specific transactions they recommend and ensure the client understands these risks. If a dispute arises, the RIA bears the burden of proof, meaning they must demonstrate that the risk was disclosed and that the investment was in the client's best interest. RIAs must also comply with the SEC and the Financial Industry Regulatory Authority (FINRA) regulations and maintain extensive documentation per SEC record-keeping rules.

To register as an RIA, firms must disclose information to the SEC, including their investment style, AUM, disciplinary actions, and conflicts of interest. They must also provide details on key officers if the RIA is a company. This information must be updated annually and made available to the public.

The demand for RIAs is growing, with expectations that they will manage about a third of the market by 2027. RIAs offer benefits such as legally mandated fiduciary duty, personalized services, transparent fee structures, and a broad range of financial planning services.

Surplus Fund Investing: A Profitable Venture?

You may want to see also

Registered investment advisors: registration and rules

Registered investment advisors (RIAs) are financial professionals or firms that advise clients on securities investments and manage their investment portfolios. RIAs are registered with either the Securities and Exchange Commission (SEC) or state securities administrators. They have a fiduciary duty to their clients, meaning they must always act in their clients' best interests.

Registration requirements for RIAs depend on the value of the assets under their management. RIAs with assets under management (AUM) of $25 million or more may register with the SEC, and those with over $100 million are required to do so. RIAs with smaller AUMs typically register with state-level agencies.

To register with the SEC, RIAs must disclose information such as their investment style, AUM, disciplinary actions, and potential conflicts of interest. They must also update this information annually and make it publicly available.

RIAs have certain responsibilities and rules they must follow. They must disclose any risks or conflicts of interest to their clients and ensure the client understands these risks. If a dispute arises, the RIA bears the burden of proof, meaning they must prove that the risk was disclosed and that the investment was in the client's best interest. RIAs must also comply with the SEC and the Financial Industry Regulatory Authority (FINRA) requirements, including filing Form ADV.

In terms of revenue, RIAs typically earn through management fees, calculated as a percentage of the client's AUM. Fees can range from 0.5% to 2% or more, depending on the client's assets.

It is important to note that RIAs differ from broker-dealers. While RIAs advise on a wide range of finance-related matters and have a fiduciary duty to their clients, broker-dealers tend to focus on facilitating asset purchases and sales and are only required to meet a suitability standard when providing advice.

Retirement Fund Investment: Choosing the Right Path

You may want to see also

Hedge fund managers: registration requirements

Hedge fund managers are subject to different registration requirements depending on the state in which they operate and their assets under management (AUM). In general, hedge fund managers are regulated by the state in which they do business or by the Securities and Exchange Commission (SEC) if their AUM is large enough.

Hedge fund managers with over $100 million in AUM are required to register as investment advisors at the federal level per the Investment Advisers Act of 1940. Managers with over $150 million in AUM, including leverage, calculated as Regulatory Assets Under Management (RAUM) automatically require registration as an investment advisor with the SEC. If the manager also advises clients in separately managed accounts, the RAUM threshold for SEC registration drops to $100 million.

Some states require official registration as an investment advisor and payment of a licensing fee, but most states require the Series 65 license. A few states also set a Series 7 license as a prerequisite for obtaining a Series 65 license. The Series 7 license is usually required for trading on behalf of customers.

Additionally, hedge fund managers may need to acquire additional FINRA licensing depending on the size of the fund and the types of assets invested in. For example, if a hedge fund manager is considering investing in commodity futures, they may need to register as a Commodity Pool Operator or Commodity Trading Advisor with the National Futures Association (NFA), which requires obtaining a Series 3 license.

Hedge fund managers are also encouraged to obtain professional designations and credentials, such as the Chartered Financial Analyst (CFA) designation, to build trust with investors.

Money Market Funds: Safe Investment or Risky Business?

You may want to see also

Registered investment advisors: how they make money

Registered Investment Advisors (RIAs) are financial professionals or firms that advise clients on securities investments and manage their investment portfolios. RIAs are registered with either the Securities and Exchange Commission (SEC) or state securities administrators.

RIAs have fiduciary obligations to their clients, meaning they have a fundamental duty to always and only provide investment advice that is in the best interests of their clients. They are not paid on commission, which could create a conflict of interest. Instead, RIAs typically earn their income through management fees, calculated as a percentage of a client's assets under management. These fees can range from 0.5% to 2%, but the more assets a client has, the lower the fee they can negotiate.

RIAs with $25 million in assets under management (AUM) can register with the SEC, but it is mandatory for those with $100 million or more. Those with smaller sums are usually required to register with state securities authorities.

The following are some common fee structures for investment advisory firms:

- Management Fees: RIAs can collect an annual fee as a percentage of the AUM. This is how most RIAs earn their income.

- Performance-Based Fees: RIAs can charge a fee based on the performance of a portfolio. However, only clients with at least $1.1 million in assets managed by the RIA or $2.2 million in net worth are generally eligible for this structure.

- Asset Class-Based Fees: Some RIAs charge varying management fees based on the asset class. For example, they might charge 1.5% for equities and 0.75% for fixed-income investments.

- Hourly or Flat Fees: Some RIAs charge fees based on the time spent with the client or a flat rate for a bundle of services, rather than the client's investment amount.

Growth Mutual Funds: Strategies for Smart Investing

You may want to see also

Frequently asked questions

A Registered Investment Advisor is a financial professional or firm that advises clients on securities investments and may manage their financial portfolios. RIAs are registered with either the Securities and Exchange Commission (SEC) or state securities administrators and have a fiduciary duty to act in their clients' best interests.

A hedge fund is a limited partnership of private investors whose money is pooled and managed by professional fund managers. Hedge funds employ a variety of strategies, including leverage and the trading of non-traditional assets, to achieve above-average investment returns. They are considered alternative investments and are usually only available to wealthy investors due to high minimum investment requirements and higher fees.

RIAs are financial advisors or firms that provide investment advice and portfolio management services to their clients, for which they charge a fee. Hedge funds, on the other hand, are investment vehicles that pool money from investors to invest in securities or other types of investments. Hedge funds are managed by professional fund managers who employ risky strategies to aim for high returns.

Both RIAs and hedge funds provide investment-related services and charge fees for their services. They are also both subject to regulatory requirements, although hedge funds are not as heavily regulated as mutual funds or RIAs.

RIAs are required to register with the SEC or state securities regulators, while hedge funds may or may not need to register, depending on the specific circumstances. Hedge funds that invest in "securities" are required to register as investment advisors, but those that solely invest in commodities, futures, currencies, or certain real estate investments are exempt from registration.