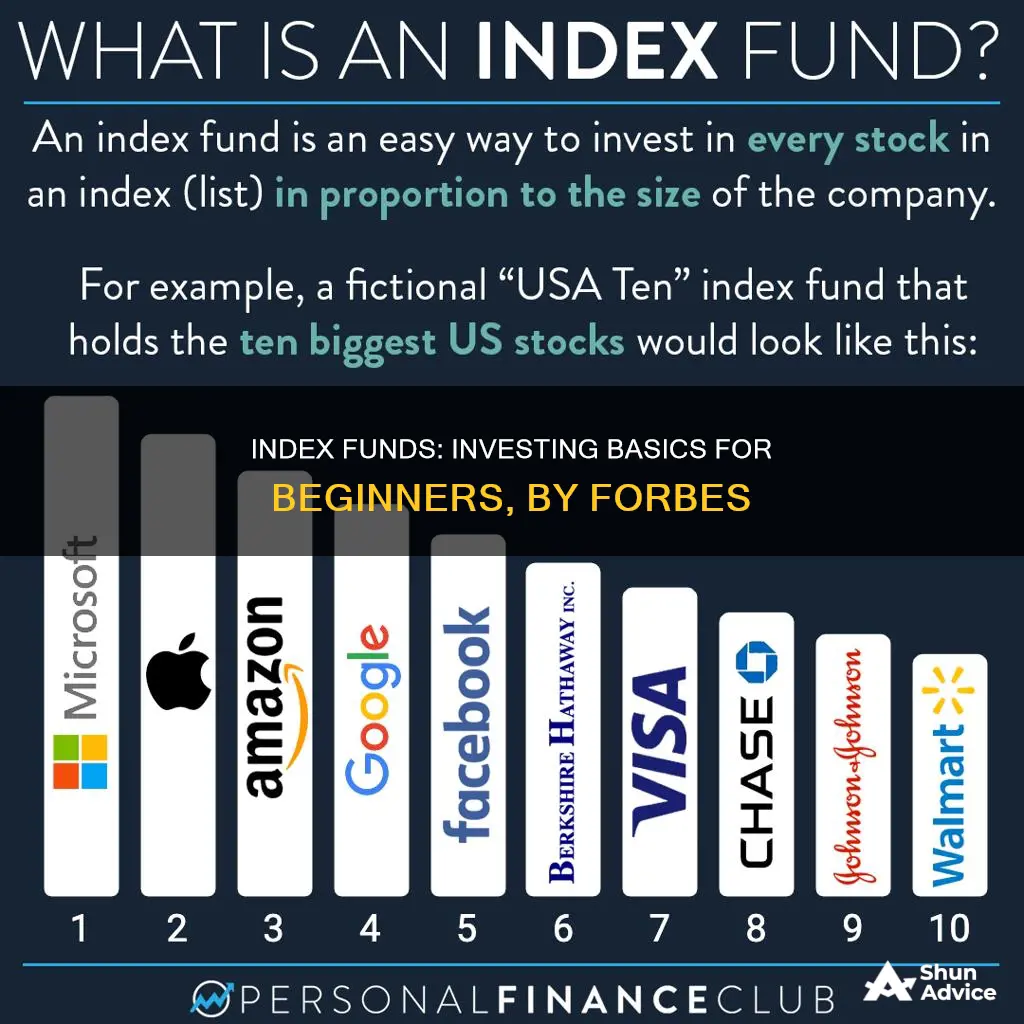

Index funds are a type of investment vehicle that aims to match the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. They are passively managed, meaning they don't require active decision-making and are designed to be a low-cost, simple way to build wealth over the long term. This makes them a popular choice for beginner investors and those seeking a more hands-off approach.

Index funds are typically offered as mutual funds or exchange-traded funds (ETFs) and can be purchased directly from a mutual fund company, a brokerage, or a robo-advisor. They are often favoured for their low fees, instant diversification, and tax efficiency. However, one of the trade-offs is that investors give up control over the specific stocks in their portfolio.

Overall, index funds provide an accessible way to invest in the stock market and are a solid choice for those seeking a long-term, low-maintenance investment strategy.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive management |

| Investment objective | Duplicate the performance of a financial market index |

| Fees | Low fees |

| Diversification | Easy diversification |

| Returns | Long-term growth potential |

| Risk | Little chance for big short-term gains |

| Management | Fund managers ensure the index fund performs the same as its target index |

What You'll Learn

Index funds are a type of mutual or exchange-traded fund (ETF)

Index funds are passive investments, meaning they use a long-term strategy without actively picking securities or timing the market. They are a low-cost way to track a specific group of investments, which can be more broadly diversified than individual stocks and simpler to buy than each of the individual holdings within the index.

Index funds are available in both mutual fund and ETF forms. Mutual funds pool money to buy a portfolio of stocks or bonds, with investors buying shares directly from the mutual fund company at the net asset value (NAV) price, calculated at the end of each trading day. ETFs, on the other hand, are traded on exchanges like individual stocks, allowing investors to employ more trading strategies, such as timing ETF share trades, using limit or stop-loss orders, and short selling.

Index funds are a great way to simplify investing while also reducing costs. They are passively managed, meaning they don't need to actively decide which investments to buy or sell. This results in lower fees than actively managed funds, as there is less involvement by managers and less frequent trading.

Index funds are also a good way to gain instant diversification. For example, an S&P 500 index fund allows you to own a small piece of about 500 of the largest companies in the U.S. across different industries.

However, one of the disadvantages of index funds is that they offer little chance for big short-term gains. As passive investing vehicles, there is little scope for capturing sizable short-term gains. Additionally, index funds may be less diverse than expected, as they are often market-cap-weighted, meaning they invest more of their money in companies with higher market capitalisation.

Mutual Funds: A Smart Investment Strategy?

You may want to see also

They aim to duplicate the performance of a financial market index

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to duplicate the performance of a financial market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. This strategy is called passive management—instead of trying to beat a benchmark, an index fund aims to be the benchmark.

Index funds are a great way to simplify investing while also reducing your costs. Most of the fund options in workplace 401(k) plans are index funds, but you can also own them in an individual retirement account or a taxable brokerage account.

A financial market index groups together assets of a similar type—stocks or bonds, currencies or commodities—and tracks their price performance over time. Investors follow indexes to get a grasp on how markets are performing.

The S&P 500 is the most widely followed market index, as it tracks the stock prices of 500 of the largest U.S. public companies. This group of stocks represents about 80% of the market capitalization of all stocks traded in the U.S., and it is commonly referred to as a stand-in for the entire U.S. stock market.

Market indexes make it simple to understand whether the stock market as a whole is gaining ground or losing value. Other leading stock indexes include the Dow Jones Industrial Average, the Nasdaq Composite and the Russell 2000.

Every index fund tracks a market index. Fund managers create portfolios that mirror the makeup of their target index with the goal of duplicating its performance. For example, an S&P 500 index fund would own the stocks included in the index and attempt to match the overall performance of the S&P 500.

As with other mutual funds, when you buy shares in an index fund, you're pooling your money with other investors. The pool of money is used to purchase a portfolio of assets that duplicates the performance of the target index. Dividends, interest and capital gains are paid out to investors regularly.

The fund manager regularly adjusts the share of the assets in the fund's portfolio to match the makeup of the index. By doing so, the return on the fund should match the performance of the target index, before accounting for fund expenses.

Index funds are passive investments. There is a debate over the virtues of actively managed mutual funds vs. passive index funds, but a strong case can be made that passive funds are less expensive and may have better returns over the long term.

Managers of actively managed mutual funds attempt to outperform a benchmark index. For example, an actively managed fund that measures its performance against the S&P 500 would try to exceed the annual returns of that index via various trading strategies. This approach requires more involvement by managers and more frequent trading—and therefore higher potential costs.

Passive management doesn’t try to identify winning investments. Instead, managers of an index fund merely attempt to duplicate the performance of their target index. This strategy requires fewer managerial resources and less trading, which means index funds usually charge lower fees than actively managed mutual funds.

Pension Funds: A Secure Investment Option?

You may want to see also

Index funds are a great way to simplify investing while reducing costs

The benefits of index funds include low costs, easy diversification, and long-term growth potential. By investing in an index fund, you gain access to a large basket of securities, providing instant diversification at a low cost. The S&P 500, for example, has earned an average return of nearly 10% per year over the past 90 years, offering an attractive long-term growth potential for investors.

Index funds are also a popular choice for workplace 401(k) plans and individual retirement accounts. They are ideal for investors who want a simple, low-maintenance way to invest without the need for extensive research. Additionally, the passive nature of index funds means they require less time and effort to manage, making them suitable for those who don't want to spend a lot of time on their investments.

When choosing an index fund, it's important to consider factors such as company size, geography, business sector, and asset type. It's also crucial to compare fees and performance across different funds to find the most cost-effective option.

Overall, index funds offer a simplified and cost-effective approach to investing, making them a popular choice for those looking to build wealth over the long term.

Everest Investment Funds: Is the Name Taken?

You may want to see also

They are passively managed

Index funds are passively managed, meaning that they are not actively managed by a human fund manager. Instead, they are designed to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. This passive management strategy means that investing decisions are based solely on trying to match the performance of the chosen index.

Passive management has several benefits over active management. Firstly, it is less expensive because it requires less work. Index funds don't need to pay for research analysts or incur high transaction fees and commissions from frequent trades. As a result, index funds have lower fees than actively managed funds, which can lead to higher returns over time.

Secondly, passive management is less risky. Consistently picking winning investments is challenging, even for professionals. By tracking a market index, index funds provide instant diversification, reducing the risk of losing money on individual stocks.

Thirdly, passive management is simpler and requires less research. Investors can clearly understand what they are investing in without having to extensively research different active trading strategies and fund managers' track records.

However, passive management also has some drawbacks. One of the biggest trade-offs is that investors give up control over what is in their portfolio. Additionally, index funds may be less diverse than expected because they are often market-cap-weighted, meaning they invest more in companies with higher market capitalisation.

Overall, the passive management of index funds makes them a popular choice for investors, especially those who are new or who don't want to spend a lot of time managing their portfolios.

Mutual Fund Investment: Income Generation Strategy

You may want to see also

Index funds are ideal for beginners

Index funds are also ideal for beginners because they have lower fees than actively managed funds. Actively managed funds attempt to outperform the market, but this requires more work from fund managers, which results in higher fees for investors. In contrast, index funds are passively managed, meaning that they require less work and have lower fees. Over time, these lower fees can add up to significant savings for investors.

Additionally, index funds offer instant diversification, meaning that beginners can reduce their risk by investing in a wide range of stocks or bonds through a single fund. This is especially beneficial for beginners who may not have a large amount of money to invest, as it allows them to spread their money across a diverse range of investments.

Finally, index funds require minimal maintenance, making them a good choice for beginners who may not have the time or expertise to actively manage their investments. Index funds are often rebalanced automatically, and because they are passively managed, they buy and sell stocks infrequently, reducing the need for the investor to actively monitor and adjust their portfolio.

Mutual Funds: Aggressive Investment Strategies for High Returns

You may want to see also

Frequently asked questions

An index fund is a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

Index funds are a great way to simplify investing while also reducing your costs. They are passively managed, which means lower fees, and they offer easy diversification.

Index funds may provide only average annual returns and there is little chance for big short-term gains. They also offer little downside protection, so if the market has a bad day, your index fund probably will too.

You should understand your overall investing goals before choosing an index fund. If you want to generate predictable income, consider dividend index funds or investment-grade bond funds. If you're looking for long-term growth, equity index funds are a good option.

You can buy index funds directly through an index-fund provider like Vanguard or Fidelity, or through other brokerage accounts and certain investment apps. You will first need to open an investment account such as a brokerage account, individual retirement account (IRA) or Roth IRA.