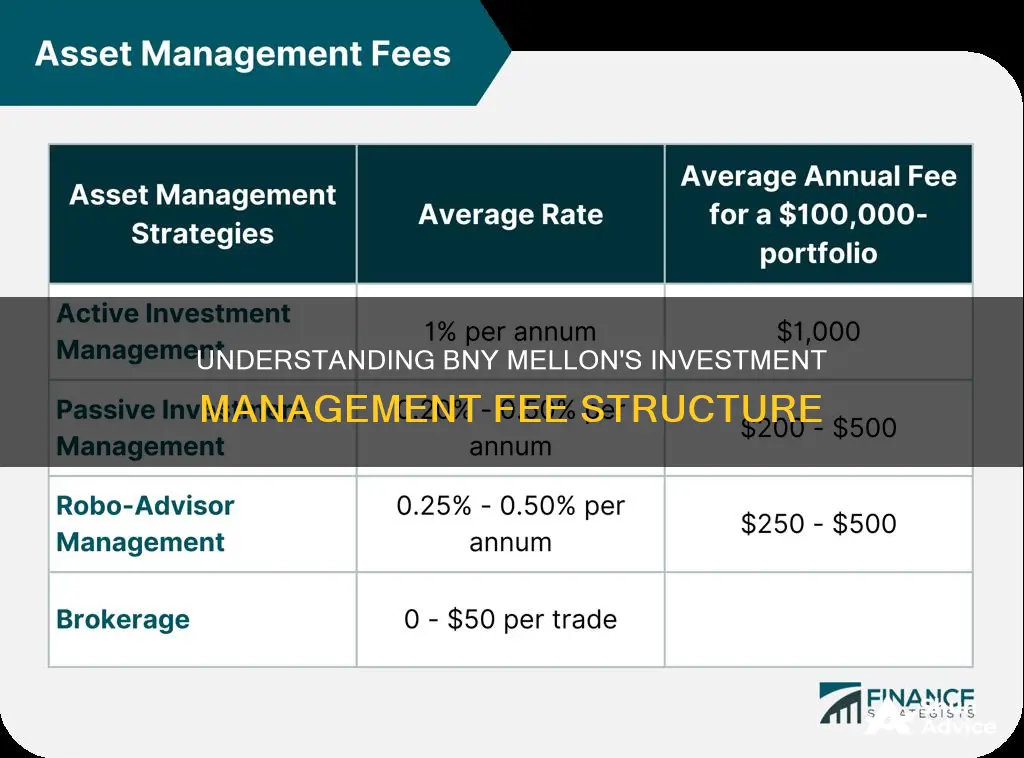

BNY Mellon Wealth Management, a subsidiary of The Bank of New York Mellon Corporation, offers investment management services to its clients. The firm generally charges a percentage of the client's assets under management for its investment advisory services, with a minimum annual fee ranging from $25,000 to $250,000. BNY Mellon's investment management fees vary depending on the specific investment strategy employed and the type of account. The firm also charges additional fees, such as custody, brokerage, administrative, and performance-based fees, for certain accounts and funds.

| Characteristics | Values |

|---|---|

| Minimum fee | $25,000 |

| Minimum account size | $50,000 to $200,000 |

| Cash strategies fees | 0.08% to 0.15% |

| CD interest rate | 0.55% APY |

| Brokerage account minimum | $25,000 |

| Customized investment services minimum | $100,000 |

| Shares | $8.95 for the first 1,000 and $0.01 after 1,000 shares |

| BNY Mellon Managed Asset Program Mutual Fund Series minimum | $25,000 |

| Equity separate account portfolios within the Customized Investment Series minimum | $100,000 |

| BNY Mellon Municipal Bond Series national portfolios minimum | $300,000 |

| BNY Mellon Municipal Bond Series state-specific portfolios minimum | $500,000 |

What You'll Learn

BNY Mellon's minimum annual fee

BNY Mellon Wealth Management, a subsidiary of The Bank of New York Mellon Corporation, offers investment management services to clients with a minimum annual fee ranging from $25,000 to $250,000. This fee depends on the investment strategy employed and varies with the type of account.

For its separately managed accounts, BNY Mellon's minimum fee ranges from $50,000 to $200,000. Brokerage accounts can be opened for a minimum of $25,000, while customised investment services have a higher minimum requirement of $100,000.

In addition to these minimum fees, clients may also incur other costs such as custody, brokerage, administrative fees, and performance-based fees for certain accounts that outperform specified benchmarks.

BNY Mellon's investment management services include guided portfolio management, philanthropy planning, estate planning, and self-directed investment services. The firm caters to a diverse range of clients, from middle-class individuals to high-net-worth families and institutions.

With a long history dating back to 1784 and a global presence in 35 countries, BNY Mellon is a trusted institution for those seeking investment advisory services.

Savings and Investment Spending: Friends or Foes?

You may want to see also

BNY Mellon's performance-based fees

BNY Mellon charges performance-based fees for certain accounts or funds. These fees are based on a portfolio's net return in excess of a specified benchmark or hurdle rate during a specified period of time. Alternatively, they may be based on absolute return strategies.

Performance-based fees are charged when an account outperforms a specified benchmark. For example, the minimum fee for BNY Mellon's separately managed accounts ranges from $50,000 to $200,000, depending on the investing strategy used. The firm generally charges a percentage of assets under management, but it also has a minimum annual fee ranging from $25,000 to $250,000, depending on the strategy employed.

It's important to note that BNY Mellon's performance-based fees are not the only charges clients may encounter. The firm also collects various other fees, including those for custody, brokerage, administrative purposes, and transactions. These additional fees are outlined in the Firm Brochure and the Wrap Fee Program Brochure, which clients should review after enrolling.

When considering BNY Mellon's services, it is essential to carefully review all associated fees and charges to ensure a comprehensive understanding of the potential costs involved.

IT Investment Portfolio: Maximizing Tech Spending

You may want to see also

BNY Mellon's brokerage account fees

BNY Mellon is a subsidiary of The Bank of New York Mellon Corporation, with roots dating back to 1784. Today, BNY Mellon has over $2 trillion in assets under management and operates in 35 countries worldwide. The company has two main business divisions: Investment Services and Investment Management.

The BNY Mellon Brokerage Account is a high-quality and cost-effective way to manage your investments. This full-service brokerage account offers a range of features and benefits, including:

- The ability to house all your assets, including retirement accounts, in one easy-to-manage investment account

- Check-writing and debit-card privileges

- Online trading at competitive rates

- Consolidated statements to help you keep track of your finances

- Access to market/portfolio tracking tools, financial quotes, news, investment ideas, and more

- A broad range of investment options, including over 8,000 mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, options, and the BNY Mellon Managed Asset Program

In terms of fees, BNY Mellon charges a minimum annual fee that ranges from $25,000 to $250,000, depending on the investment strategy employed. For cash strategies, fees range from 0.08% to 0.15%. Additionally, clients may also incur custody, brokerage, and other transaction costs, administrative fees, and performance-based fees for certain account types and funds.

For brokerage accounts specifically, BNY Mellon charges a commission fee, which varies depending on the size of the transaction. Brokerage account holders also pay redemption fees on sales of NTF funds, low balance and inactive account fees, an annual retirement fund fee, and trading fees on margin interest. The cost of shares is $8.95 for the first 1,000 and $0.01 thereafter.

Hiring an Investment Manager: Is It Worth the Cost?

You may want to see also

BNY Mellon's custody, brokerage and transaction costs

BNY Mellon's custody, brokerage, and transaction costs are included in the fees that clients pay for investment advisory services. While the specific rates are not disclosed to non-account holders, here is a detailed breakdown of these costs:

Custody Costs

BNY Mellon, as the world's largest custodian bank, offers global custody services to safeguard and service clients' assets worldwide. Their custody services include:

- Automated trade capture

- Real-time reporting, including fail monitoring and reconciliation

- Proactive resolution of settlement problems

- Special services for cross-border trades and late instructions

- Intra-day controls and trade management

- End-of-day confirmation and control

- Active monitoring of all pending trades

- Cash processing capabilities, such as third-party foreign exchange and auto cash sweeps

- Interest-bearing accounts

- Daily reconciliation of cash and securities

- Segregation of duties and dual control

Brokerage Costs

The BNY Mellon Brokerage Account is a comprehensive and cost-effective way to manage investments. It offers the following features:

- Online trading at competitive rates

- Check-writing and debit-card privileges

- Consolidated statements for easy tracking

- Access to financial quotes, news, investment ideas, and market commentary

- Over 8,000 mutual funds from BNY Mellon and other leading companies

- Exchange-traded funds (ETFs)

- Individual stocks and bonds

- Options trading

- The BNY Mellon Managed Asset Program

The brokerage account has a minimum balance requirement of $25,000 for certain services, and trading fees are $8.95 per trade for the first 1,000 shares and $0.01 per share thereafter.

Transaction Costs

In addition to the above, clients may incur other transaction costs, such as redemption fees on sales of NTF funds, low balance and inactive account fees, annual retirement fund fees, and trading fees on margin interest. Pooled investments like mutual funds and annuities are also subject to applicable fees. BNY Mellon charges a quarterly wrap fee on assets under management to cover these transaction costs.

Adjusting Your Child's Future: Editing 529 Investment Portfolio

You may want to see also

BNY Mellon's investment advisory services

BNY Mellon offers investment advisory services to its clients, including individuals, families, and institutions across the globe. The firm provides a range of services, including investment management, wealth planning, private banking, and credit and lending services. BNY Mellon's wealth management division specifically caters to high-net-worth and ultra-high-net-worth individuals, offering services such as insurance and risk management, portfolio management, tax planning, family governance, estate planning, and private banking.

The Equity Product Line identifies attractive stocks through rigorous quantitative and fundamental analyses, blended with an analysis of current business momentum, and places controls on sector selection. The Multi-Asset Product Line covers a variety of asset classes, spanning both active and index investing approaches, including global and domestic asset allocation strategies. The Index Product Line provides exposure to equity and fixed-income benchmarks with low tracking errors, and the firm believes that indexing strategies offer a cost-effective method to obtain market exposure. Lastly, the Fixed Income Product Line combines top-down, macroeconomic analysis with proprietary, fundamental bottom-up research and includes strategies such as multi-sector, emerging markets debt, government and interest rate, municipal bond fixed income, and short-term investment.

In addition to the annual fee, clients of BNY Mellon may also incur additional costs such as custody, brokerage, administrative fees, and other transaction-related expenses. BNY Mellon also collects performance-based fees for certain account types and funds that outperform specified benchmarks. The firm has a global presence, operating in 35 countries across America, Asia, Europe, Africa, and the Middle East, allowing them to serve a diverse range of clients.

Breaking Up with Your Investment Manager: A Guide

You may want to see also

Frequently asked questions

BNY Mellon Wealth Management requires a minimum fee of $25,000.

BNY Mellon Wealth Management does not specify any minimum account size.

The minimum account balance for the BNY Mellon Managed Asset Program Mutual Fund Series is $25,000.

BNY Mellon's minimum fee for its investment advisory services ranges from $50,000 to $200,000 depending on the investing strategy used.