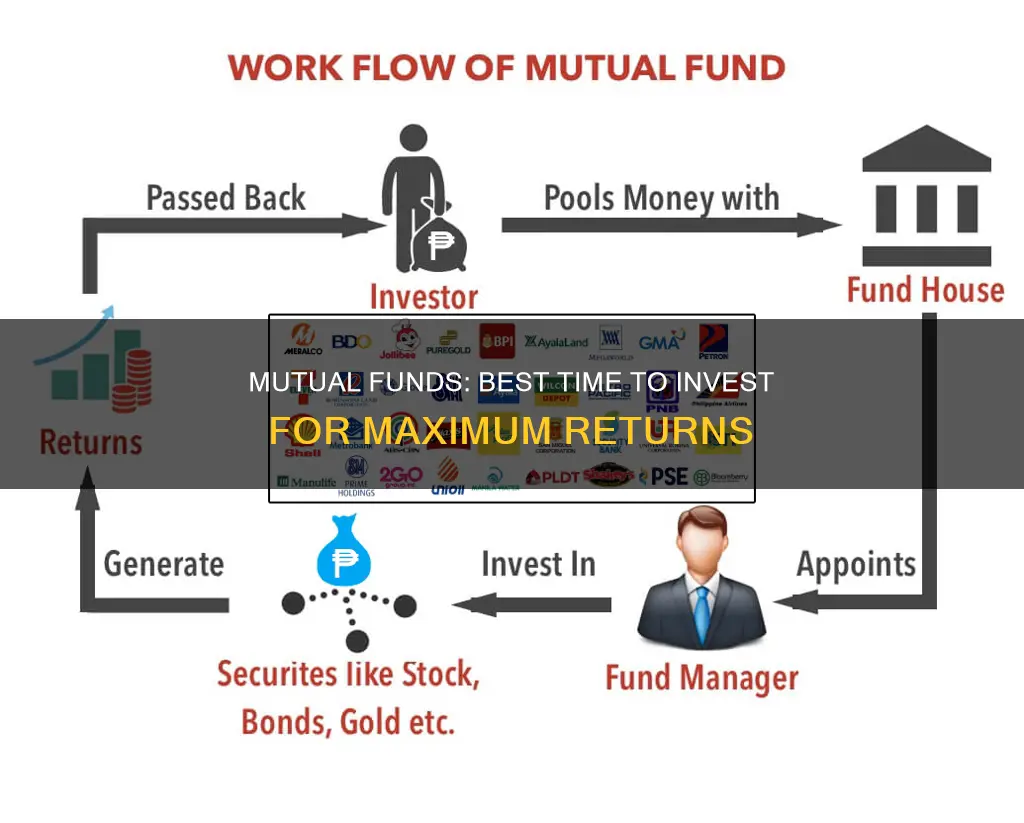

Investing in mutual funds is a powerful tool for wealth creation. However, many individuals struggle with the question of when to start investing. The simple answer is that the best time to invest in mutual funds is now. The sooner you start, the more you can take advantage of compounding, which allows you to earn returns not just on your initial investment but also on the returns generated over time.

While there is no fixed rule for the best time to invest in mutual funds, it is generally advisable to invest when markets are low to maximise returns and accumulate more units of the fund. This can be achieved through Systematic Investment Plans (SIPs), which allow you to invest a fixed amount at regular intervals, eliminating the need to time the market.

It is important to remember that investing in mutual funds should be aligned with your financial goals and risk tolerance. By investing consistently over time and maintaining a diversified portfolio, you can achieve your financial objectives.

| Characteristics | Values |

|---|---|

| Best time to invest | As soon as possible; there is no "best time" |

| Investment approach | Focus on "time in the market" rather than "timing the market" |

| Investment horizon | Typically between 3 and 5 years, or a full market cycle |

| Risk appetite | Depends on the investor's goals and risk tolerance |

| Market positioning | Risk-averse investors should consider investing when the market is recovering |

| Return on investment | Equity investments are high-risk but can offer great returns over the long term |

| Tax benefits | Tax-saving options are available, e.g. ELSS scheme with a 3-year lock-in period |

| Investment options | Systematic Investment Plans (SIPs) or lump-sum investments |

| Investor profile | Suitable for young professionals, middle-aged investors, and those near retirement |

What You'll Learn

Start investing now, don't delay

When it comes to investing in mutual funds, time is of the essence. The age-old adage, "the best time to plant a tree was 20 years ago, the second-best time is now", rings true here. The longer your money is invested, the more time it has to grow and compound.

Compounding effects

Compounding refers to earning returns not just on your initial investment but also on the returns generated over time. The longer your money remains invested, the greater the compounding effect. The power of compounding is such that even a small amount invested early on can grow into a substantial sum over time.

Missing out on gains

By delaying your investment, you miss out on potential gains. For example, consider two investors, one who invests early and another who invests 5 or 15 years later. Even if the latter investor puts in more money annually to catch up, they will still end up with a smaller corpus than the early investor. This difference is the cost of delay.

Riding market volatility

Equity markets are volatile by nature, and it is challenging to time the market consistently. Instead, focus on "time in the market" rather than "timing the market". By investing a fixed amount regularly through Systematic Investment Plans (SIPs), you buy more units when prices are low and fewer units when prices are high. Over time, this strategy smooths out market volatility and enhances returns.

Long-term gains

Mutual funds are best suited for long-term investment horizons. Equity-oriented funds, in particular, offer higher growth potential over the long term. Historical data shows that despite sharp falls in the market, a well-diversified equity fund can outperform broader indices over 15 years.

Start now, stay disciplined

In conclusion, the best time to start investing in mutual funds is now. Don't wait for the perfect moment, as it may never come. Start investing systematically, stay disciplined, and let your investments grow over time. Remember, the power of compounding and time in the market are key to building wealth.

Congress Funding: Kennedy's Convincing Legacy

You may want to see also

Invest regularly to build wealth

Investing regularly is a great way to build wealth over time. By investing a fixed amount at regular intervals, you can take advantage of something called 'rupee cost averaging'. This means that when you invest through a Systematic Investment Plan (SIP), you buy more units of your chosen fund when markets are low, and fewer units when markets are high. This approach helps you manage market volatility and smooths out market highs and lows over time.

For example, if you invest INR 5,000 per month in a mutual fund SIP with an average annual return of 12%, your investment will grow to INR 4.13 lakh in 5 years, INR 11.55 lakh in 10 years, INR 49.16 lakh in 20 years, and a substantial INR 1.47 crore in 30 years.

Starting early and investing consistently are key to building wealth through mutual funds. The power of compounding means that the longer your money remains invested, the greater the effect. For instance, consider two investors, Ajay and Vijay. Ajay starts investing INR 2,000 per month at age 25 for his retirement at 60. Vijay, who begins investing 5 years later, tries to catch up by investing an additional sum of INR 1.2 lakh per annum. Even with this higher investment, Vijay's corpus at retirement is INR 1.11 crore, less than Ajay's future value of INR 1.33 crore.

Therefore, the best time to start investing in mutual funds is now. Don't delay your investment journey. By investing regularly, you can harness the power of compounding and build significant wealth over the long term.

Understanding Giant Investment Funds: What Are They Called?

You may want to see also

Choose the right asset to manage volatility and risk

When it comes to investing in mutual funds, there is no one-size-fits-all answer to the question of timing. However, by choosing the right assets, investors can effectively manage volatility and risk. Here are some strategies to consider:

Diversification

Diversifying your investments across different asset classes, sectors, and geographic regions can help reduce the overall risk of your portfolio. Mutual funds themselves offer diversification by pooling money from multiple investors to purchase a variety of securities. However, it is important to note that diversification does not guarantee profits or protect against losses.

Systematic Investment Plans (SIPs)

SIPs allow you to invest a fixed amount of money in your chosen fund at regular intervals (monthly, quarterly, or annually). By investing a set amount regardless of market conditions, you can reduce the risk of trying to time the market. SIPs are a great way to invest in mutual funds without worrying about market volatility.

Long-Term Investment Horizon

Investing in mutual funds is typically recommended for long-term financial goals. The longer your investment horizon, the more time your investments have to grow and the better you can manage market volatility. Compounding returns over time can significantly increase your overall returns.

Risk Assessment and Tolerance

Understanding your risk tolerance is crucial when choosing mutual funds. Assess your financial situation, investment goals, and how much risk you are comfortable taking. If you have a low-risk tolerance, opt for low-risk investment options like debt mutual funds, which offer greater stability. If you are comfortable with higher risk, consider equity mutual funds, which aim for higher returns but come with greater volatility.

Research and Due Diligence

Conduct thorough research on the mutual funds you are considering. Evaluate the fund's performance over time, the fund manager's track record, and the fees associated with the fund. Compare different funds to find those that align with your investment goals and risk tolerance.

Volatility Measurements

When assessing the volatility of a mutual fund, consider using statistical measures such as standard deviation, beta, R-squared, and alpha. These tools help you understand the fund's volatility in relation to its returns and benchmark indices. This information can guide your investment decisions and risk management strategies.

Remember, investing in mutual funds carries inherent risks, and there is no guaranteed formula for success. It is important to do your own research, consult experts, and make informed decisions based on your financial situation and goals.

Understanding Investment Trust Funds: A Beginner's Guide

You may want to see also

Understand the difference between active and passive funds

When it comes to investing in mutual funds, there is no one "best time" to do so. The best time to invest in mutual funds is as soon as possible. The longer your money remains invested, the greater the compounding effect. However, it is always better to invest in mutual funds at a lower NAV rather than a higher price to maximise returns and lead to higher wealth accumulation.

Now, let's understand the difference between active and passive funds:

Active Funds:

Investing in actively managed funds involves a fund manager or a management team making decisions about how to invest the fund's money. The job of an active fund manager is to choose which investments to hold within the fund, actively buying and selling stocks to achieve the fund's goal of outperforming its stated benchmark or index. For example, if the FTSE 100 goes up by 5% over 12 months, the fund would aim to provide returns of above 5%.

The pros of active funds include:

- The possibility of beating the market index.

- Fund managers build diversified portfolios to manage the balance between risk and potential reward for investors.

- They may be able to spot opportunities or react to market downturns by selling poor-performing investments.

The cons of active funds include:

- There is no guarantee that an active fund will perform better than the index. In fact, relatively few active funds do.

- Active funds have to beat the index by enough to cover their expenses, such as transaction fees, which tend to be higher.

- There is no flexibility to avoid overvalued sectors or stocks.

Passive Funds:

Passive investing means investing in funds that aim to match the returns of a specific market or index without trying to beat it. They simply replicate the movement of the market they're tracking. For example, a fund tracking the FTSE 100 will buy shares in all 100 companies in the same proportions as their market value.

The pros of passive funds include:

- They can be an easy way to diversify within asset classes and markets.

- With no managers to pay, they generally have very low fees, which can enhance returns over time.

The cons of passive funds include:

- Your return depends entirely on the performance of the index being tracked, so if the market falls, so will the value of your investment.

- You may be overly exposed to one asset class or market.

Both active and passive funds have their advantages and disadvantages. It is not easy to decide which category is "good" or "bad" as it depends on the investor's profile. If an investor is looking for active management, can afford the higher fees, and is comfortable with the associated risks, then active funds could be considered. On the other hand, if an investor wants the fund to simply track the benchmark, does not want the fund manager to make too many decisions, and prefers lower fees, then passively managed funds could be a better choice.

Lump Sum Mutual Fund Investments: Good Idea or Not?

You may want to see also

Pick a fund with lower fees

When it comes to investing in mutual funds, there is no one-size-fits-all answer as to when is the best time to invest. However, a common piece of advice is to start as early as possible to take advantage of compound interest.

Now, let's focus on why you should pick a fund with lower fees:

When selecting a mutual fund for your investment, it is essential to consider the fees associated with the fund. Mutual funds typically have various fees, such as management fees, distribution fees, and other operating expenses. These fees are charged to investors to cover the costs of managing the fund and can vary significantly between different funds.

Lower fees are advantageous for investors because they directly impact the returns on their investment. The more fees that are charged, the lower the investor's overall profit. By choosing a fund with lower fees, you can maximize your returns and accumulate wealth more effectively.

Additionally, lower fees can also indicate a more efficient fund. Mutual funds with excessive fees may be spending more on marketing or administrative costs, which may not directly benefit the investors. By opting for a fund with lower fees, you can ensure that a larger portion of your investment is going towards the actual investment strategy rather than overhead costs.

Furthermore, it is worth noting that the performance of a mutual fund does not always correlate with the fees charged. Just because a fund has higher fees does not necessarily mean it will generate higher returns. In some cases, lower-fee funds may even outperform their higher-fee counterparts. Therefore, it is crucial to assess the fund's overall value and not solely rely on fees as an indicator of quality.

When considering which mutual fund to invest in, it is beneficial to compare the fees of different funds and choose those with lower expenses. By selecting a fund with lower fees, you can increase your potential returns, promote efficient fund management, and make a more informed investment decision.

In summary, picking a mutual fund with lower fees is advisable because it maximizes your returns, promotes efficient fund management, and allows you to better achieve your financial goals. Remember to consider your investment goals, risk tolerance, and perform thorough research before making any investment decisions.

Market Downturn: Mutual Funds, Invest or Avoid?

You may want to see also

Frequently asked questions

The best time to invest in mutual funds is now. The sooner you begin your investment journey, the more time your money has to grow. Trying to time the market is not the right way to invest.

There is no best time as such for investing in mutual funds. Individuals can make investments whenever they wish. However, it is always better to invest when fund prices are low rather than high.

Here are some things to keep in mind when determining the best time to invest in mutual funds:

- Investment Objective: It is advisable to invest with a goal in mind and have a financial target. This will help you identify the right funds.

- Risk Tolerance: Analyse your risk tolerance levels before investing. With a high-risk tolerance, you can invest in assets with higher growth rates but greater risks.

- Investment Horizon: The investment horizon is vital in picking the right funds. For instance, if your investment horizon is short-term, avoid high-risk schemes.

- Mode of Investing: You can invest in mutual funds through a lump sum or Systematic Investment Plans (SIPs). SIPs allow you to invest a fixed amount at regular intervals, eliminating the need to time the market.

Mutual funds offer several benefits, including:

- Diversification: Mutual funds invest in a diversified portfolio of stocks, bonds, or other securities, reducing risk.

- Professional Management: Mutual funds are managed by professional fund managers who make investment decisions on behalf of investors.

- Compounding: Starting early allows more time for your money to grow exponentially through the power of compounding.